Afterpay changed the way people shop by making “buy now, pay later” a mainstream option. Its fast rise turned it into a global brand, and naturally, many ask who owns Afterpay now. The answer reveals not just a change in ownership, but also how the company became part of a bigger push in digital finance.

Key Takeaways

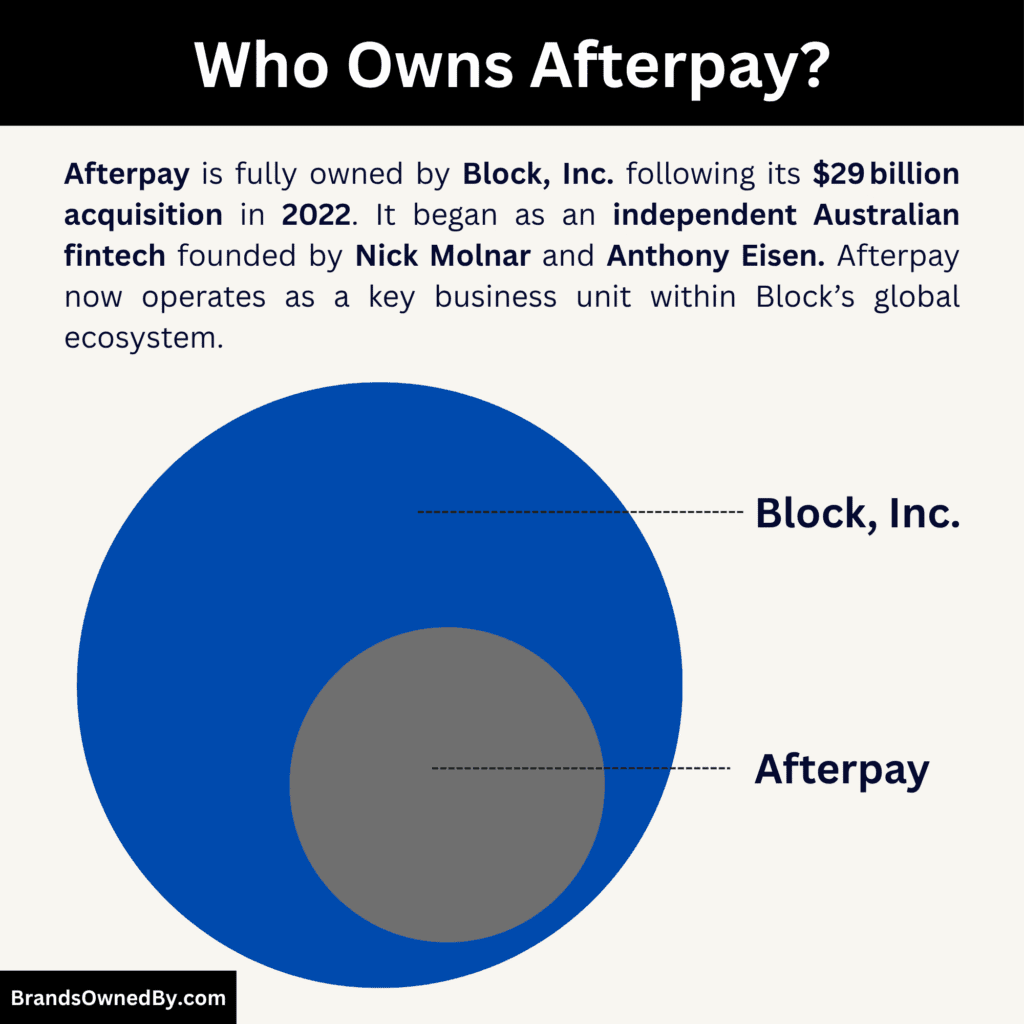

- Afterpay is fully owned by Block, Inc. following its $29 billion acquisition in 2022, making it a subsidiary rather than an independent public company.

- Nick Molnar, co-founder of Afterpay, leads the company’s operations within Block, overseeing consumer, merchant, and BNPL services globally.

- Anthony Eisen, the other co-founder, stepped back from day-to-day management in 2024 but remains involved at a governance level and on Block’s board.

- Ultimate control and strategic decisions rest with Block’s executive leadership and board, with insiders like Jack Dorsey holding significant influence over Afterpay’s direction.

Afterpay Company Profile

Afterpay is a fintech company specializing in buy now, pay later (BNPL) services. It enables consumers to break purchases into interest-free instalments, typically four payments over six weeks, or longer monthly plans for higher order amounts. The service is offered both online and in physical retail stores via integrations or digital wallet setups. Afterpay does not charge interest to consumers — though it may charge late fees if payments are missed.

Originally founded in Australia, Afterpay now operates across multiple markets including Australia, New Zealand, the U.S., the U.K., Canada, and parts of Europe (in the U.K. and EU, it operates under the Clearpay brand). It serves millions of users and hundreds of thousands of merchants worldwide.

Founders

Afterpay was founded in 2014 by Nick Molnar and Anthony Eisen. The idea emerged from a conversation between neighbors. Molnar was a young entrepreneur; Eisen brought experience from finance and investing.

Together, they built a platform to let shoppers pay over time, without interest. Over the years, they bootstrapped partnerships with merchants and grew the risk-assessment model behind consumer approvals.

Afterpay often cites its early lessons and incremental scaling as critical to its success. The founders stayed deeply involved in operations, merchant relations, growth strategy, and risk systems.

After the acquisition by Block, the founders transitioned into leadership roles within the larger company. Anthony Eisen currently sits on Block’s board of directors (as of 2025). Molnar took on a leadership role in sales across Block.

Major Milestones

- 2014: Afterpay is founded by Molnar and Eisen in Australia.

- 2015–2016: The company gains initial traction, secures merchant partnerships, and builds its technological and risk foundation.

- 2016: Afterpay lists on the Australian Securities Exchange (ASX), allowing public investors to buy shares.

- 2018: Afterpay enters the U.S. market. It also acquires or aligns with Clearpay (UK) to expand in Europe.

- 2019: Rapid international growth. The company raises additional capital, scales merchant count, and solidifies operations in multiple markets.

- 2021: Block (then Square) agrees to acquire Afterpay in a deal valued at around $29 billion (AUD equivalent higher).

- January 2022: The acquisition is completed. Afterpay is officially integrated as a subsidiary of Block, and its shares are delisted from ASX.

- 2023: Under Block, Afterpay processes more than $27.3 billion in payments and contributes about $1.04 billion in revenue.

- 2024–2025: Afterpay continues expansion and integration into Block’s ecosystem. It also launches extended “pay monthly” plans (3, 6, 12, 24 months) for larger purchases.

- 2025: Afterpay hosts its biannual “Afterpay Day” sales events (e.g., March and August), generating strong consumer engagement and merchant deals.

- 2025 (mid-year): New regulation in Australia mandates BNPL services to perform credit checks, tightening oversight of firms like Afterpay.

Who Owns Afterpay in 2025?

Afterpay is no longer a standalone public company. Since early 2022, it has been an indirect, wholly owned subsidiary of Block, Inc. (formerly Square). A court-approved scheme of arrangement transferred all issued shares of Afterpay into Block’s control.

Under that arrangement, former Afterpay shareholders received Block stock (Class A common shares or equivalents) in exchange for their Afterpay shares.

After the acquisition, Afterpay does not have independent public shareholders. Instead, governance and control flow from Block’s corporate structure.

Afterpay also had issued convertible notes (SGX zero-coupon convertible notes) before the acquisition. These notes were triggered by a change of control and required treatment under the acquisition terms.

Parent Company: Block, Inc.

Block, Inc. is a global payments and financial services company, best known for Square, Cash App, and other fintech innovations. Block rebranded from Square in December 2021 to reflect its broader ambitions beyond payments.

Afterpay plays a strategic role inside Block: integrating BNPL into the seller and consumer ecosystems, and contributing to Block’s push into seamless commerce finance.

Block has sought to integrate Afterpay features into Cash App, allow Afterpay payments via Block’s merchant platforms, and build unified consumer and merchant workflows.

Acquisition Timeline & Structure

- In August 2021, Square (soon to become Block) announced it would acquire Afterpay via an all-stock deal valued at around $29 billion (A$39 billion).

- The transaction was structured as a scheme of arrangement under Australia’s Corporations Act.

- Shareholder meetings, court approval, and regulatory clearances (including foreign investment and banking authorities) were required.

- The scheme became legally effective in mid-December 2021, even before all foreign regulatory approvals (notably Bank of Spain) were fully in hand; some approvals were shifted to be “conditions subsequent” rather than absolute precedents, a structuring tactic to reduce deal risk.

- On January 31, 2022 (Pacific Time) / February 1, 2022 (Australian time), Block completed the acquisition.

- On that date, all Afterpay shares were transferred to a Block acquirer entity (Lanai (AU) 2 Pty Ltd, a wholly owned subsidiary of Block).

- Shareholders of Afterpay were entitled to 0.375 shares of Block Class A stock (or equivalents) for each Afterpay share.

- Outstanding Afterpay equity awards (options, restricted shares) underwent vesting or forfeiture and were replaced or converted into Block awards in many cases.

Treatment of Debt and Convertible Notes

Before the acquisition, Afterpay had issued zero-coupon convertible notes (SGX Notes) totalling about A$1.5 billion.

Those notes included change-of-control provisions. Upon the acquisition, noteholders had the right to either require redemption at face value or convert into APT shares (depending on timing) under the terms of the notes.

Because the acquisition triggered the change of control, the notes’ valuation and redemption obligations had to be accounted for in Block’s financial planning and in the scheme mechanics.

Also, in relation to Clearpay (Afterpay’s European arm), Afterpay had held about 90 % of Clearpay since 2018 and had an option to acquire the remaining shares. That option became exercisable in connection with a change of control. After the acquisition, Afterpay agreed to acquire the remaining 6.5 % interest in Clearpay held by ThinkSmart in exchange for issued APT shares.

Governance & Structural Control

Afterpay is governed under Block’s corporate framework. Major decisions, budgeting, integrations, and strategic direction are subject to Block’s board oversight and executive processes.

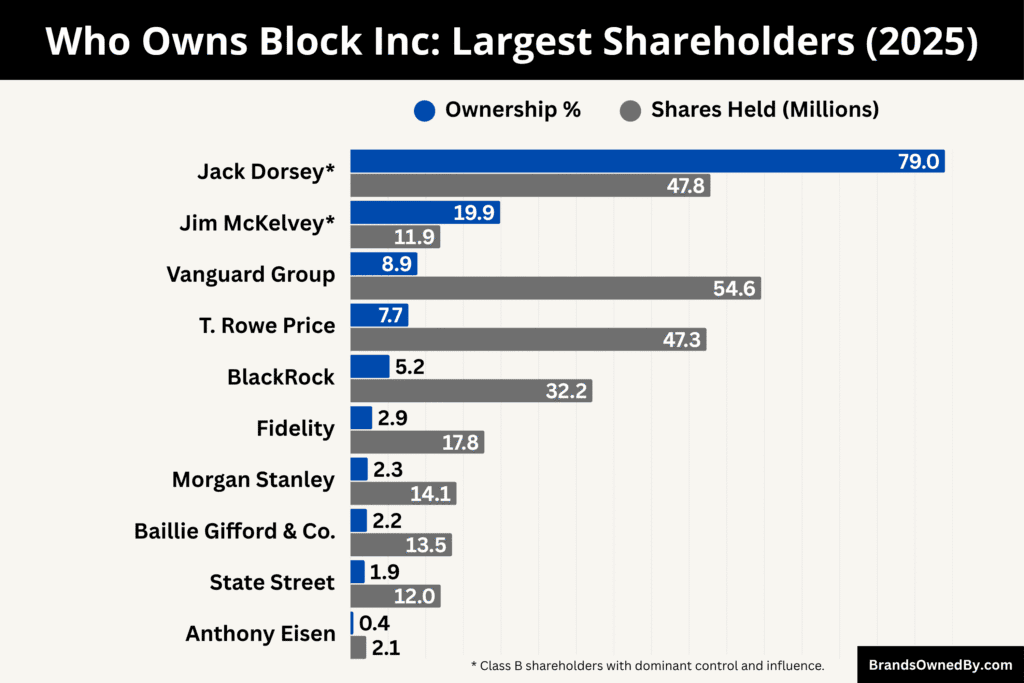

Inside Block, control is influenced by a dual-class share structure: Class B shares carry a higher voting weight relative to Class A, enabling foundational executives and insiders to maintain control.

Some of the former Afterpay leadership was integrated into Block’s executive ranks. The co-founders (Molnar and Eisen) were given roles overseeing merchant and consumer operations. Eisen joined Block’s board.

Over time, leadership roles were reshuffled: Eisen stepped back from active executive work (though still retaining a board or oversight role), while Molnar was promoted to lead broader sales functions across Block.

In practice, Afterpay’s autonomy is reduced; many critical functions—product development, marketing, integration, compliance—are coordinated with or subsumed within Block’s teams. The degree of autonomy varies by market.

Who Runs Afterpay?

Afterpay is no longer an independent company, so its leadership is integrated into the structure of Block, Inc. While Afterpay still operates as a recognizable brand, it is treated as a division within Block’s ecosystem. This means that strategic oversight, resource allocation, and high-level decision-making are ultimately directed by Block’s executive leadership and board.

Nick Molnar: Operational Lead and Sales Head

Nick Molnar continues to be the central executive running Afterpay. As co-founder, he has long been intimately involved in product, merchant relationships, and risk systems. In 2025, Molnar’s responsibilities stretch across Afterpay, and also into Block’s broader sales functions, including oversight of merchant acquisition, integration of Afterpay features with Square and Cash App, and aligning sales strategy across all units.

Molnar is publicly identified as Co-Founder and Co-Lead for Afterpay under Block’s structure. His role is not just internal — he often represents Afterpay to merchants, regulators, and industry forums.

Anthony Eisen: Board Member & Former Executive

Anthony Eisen, the other founder, stepped away from day-to-day leadership of Afterpay in 2024. However, he retains significant involvement through governance. In 2025, Eisen was appointed to Block’s board of directors. He brings expertise in fintech, buy now, pay later, and the history of Afterpay’s growth.

Before stepping back, Eisen co-led Afterpay’s merchant and consumer businesses post-acquisition. His departure from management marked a shift toward centralized control within Block’s organizational framework.

Block’s Top Leadership and Oversight

Although Molnar directs Afterpay’s business operations, real control lies with Block’s senior leadership, including its CEO (or “Head”) and executive team. Block’s leaders — such as Jack Dorsey and other C-suite executives — decide on long horizon strategy, integration priorities, budget allocation, acquisitions, and compliance matters that affect Afterpay. Block’s board holds oversight over these decisions. Block’s dual-class share structure ensures insiders wield significant control over company direction, including for its subsidiaries.

Key Leadership from Official Sources

From Block’s publicly listed leadership pages and announcements:

- Anthony Eisen is officially recognized as a Co-Founder of Afterpay and serves on Block’s board.

- Nick Molnar is described in leadership profiles as Co-Lead for Afterpay under Block, with responsibility over the Afterpay unit.

These are the prominent names officially associated with Afterpay’s leadership within Block’s structure.

Regional & Functional Leaders

Beyond Molnar and Eisen, Afterpay’s operations depend on regional and functional executives. In markets like the U.S., U.K. (Clearpay), Australia, and Europe, local general managers, compliance officers, merchant growth leads, product heads, and marketing heads run the localized operations. These regional leads report upward to Molnar and liaise with Block’s centralized teams to maintain consistency and adherence to global strategy, regulatory standards, and technology integration.

Afterpay Annual Revenue and Net Worth

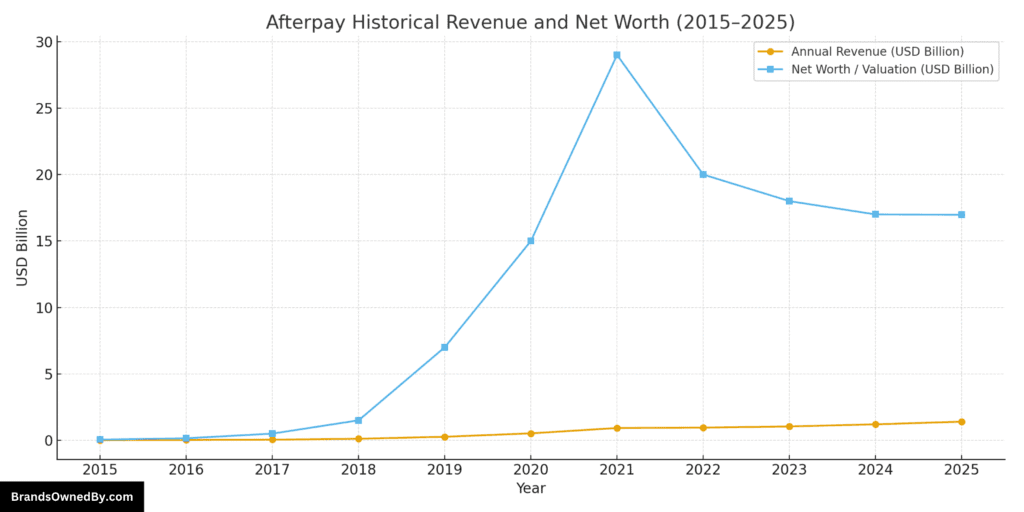

As of 2025, Afterpay remains one of the most significant business units within Block, Inc., generating an estimated revenue of $1.3–1.5 billion and carrying an implied net worth of around $16.97 billion. These figures reflect both its continued consumer and merchant adoption and its strategic role in Block’s broader fintech ecosystem.

| Year | Annual Revenue (Approx.) | Net Worth / Valuation (Approx.) | Notes |

|---|---|---|---|

| 2015 | < US$10 million | ~US$50 million | Founded by Nick Molnar & Anthony Eisen in Australia. |

| 2016 | US$23 million | ~US$150 million | Listed on Australian Stock Exchange (ASX). Early adoption by merchants. |

| 2017 | US$46 million | ~US$500 million | Rapid expansion in Australia and first moves overseas. |

| 2018 | US$113 million | ~US$1.5 billion | Entered the U.S. market, saw explosive growth. |

| 2019 | US$264 million | ~US$7 billion | Strong U.S. adoption; became one of the fastest-growing BNPL firms. |

| 2020 | US$519 million | ~US$15 billion | Pandemic boosted BNPL usage as online shopping surged. |

| 2021 | US$924 million | ~US$29 billion | Peak valuation when Block (then Square) announced US$29B acquisition. |

| 2022 | ~US$950 million | ~US$20 billion | Acquisition completed; integrated into Block’s ecosystem. |

| 2023 | US$1.04 billion | ~US$18 billion | Last clear standalone revenue disclosure; BNPL adoption faced regulatory headwinds. |

| 2024 | ~US$1.2 billion (est.) | ~US$17 billion | Revenue grew modestly; tighter regulations in UK/AU. Eisen stepped back from management. |

| 2025 | ~US$1.3–1.5 billion (est.) | ~US$16.97 billion | Estimated based on Q1 2025 segment reporting under Block; fully embedded in Cash App ecosystem. |

Revenue

Since Afterpay is consolidated into Block’s financials, there is no fully disclosed “standalone” revenue line for it in 2025. However, certain segment disclosures provide clues. In Q1 2025, Block reported that its BNPL platform (which is largely Afterpay) generated about $312.9 million in revenue for the quarter.

If that quarterly pace sustained (or grew modestly), a rough full-year estimate for Afterpay (as part of Block’s BNPL business) might lie between $1.2 billion and $1.4 billion.

Another clue comes from the annualized gross profit measure in Block’s Q1 investor presentation: the BNPL unit’s gross profit was annualized to about US$948 million.

Given that gross profit margins for BNPL are high relative to revenue, the bulk of the revenue is higher than that number.

Considering growth, merchant expansion, and deeper integration into Cash App, many analysts believe Afterpay’s effective 2025 revenue falls in the $1.3–1.5 billion range. This is speculative, but grounded in the observed quarterly numbers and trajectory.

Net Worth

At the time of its acquisition in 2022, Afterpay was valued at about $29 billion. However, market conditions and fintech valuations have shifted.

As of October 2025, analysts estimate Afterpay’s implied net worth at approximately $16.97 billion. This valuation reflects its current contribution to Block’s earnings, its position in the competitive BNPL market, and overall investor sentiment toward fintech businesses.

The decline from its peak acquisition valuation is tied to the broader recalibration of technology company valuations after 2022. Rising interest rates, tighter regulatory scrutiny, and increased competition in the BNPL space all influenced market sentiment. Even so, Afterpay remains one of the most valuable consumer-facing assets within Block, not only for its revenue but for the way it strengthens customer loyalty and expands merchant services.

Why the Net Worth Matters

Afterpay’s net worth in 2025 is important because it helps investors and analysts gauge how much value the BNPL segment adds to Block. While no longer an independent stock, Afterpay continues to drive adoption of Block’s platforms.

Its integration with Cash App allows users to manage payments and BNPL installments in one ecosystem, while merchants using Square gain access to Afterpay’s global consumer base. This dual benefit underpins its valuation and ensures that it remains a key driver of Block’s financial strength.

Brands Owned by Afterpay

As of 2025, Afterpay operates a range of brands, products, and business units that extend its buy now, pay later services across multiple markets.

Below is a list of the major divisions and brands owned by Afterpay as of 2025:

| Company / Brand | Description | Key Markets / Focus | Notable Features / Operations |

|---|---|---|---|

| Afterpay | Core BNPL platform | Australia, U.S., Canada, U.K., EU, New Zealand | Four interest-free installment payments, merchant partnerships, consumer-focused payments |

| Clearpay | Afterpay’s UK brand | United Kingdom, Europe | BNPL tailored for UK regulations, online and in-store payments, strong merchant adoption |

| Afterpay Media Network (AMN) | Advertising and marketing platform | Global | Connects brands with consumers using Afterpay data, targeted campaigns, privacy-first infrastructure |

| Afterpay Business Solutions | Merchant tools and integration services | Global | POS and online checkout integration, analytics, insights for merchants, streamlined payment processes |

| Afterpay Installments | Consumer installment product | Global | Splits purchases into four interest-free payments, available online and in-store, widely adopted |

| Afterpay Pay Monthly | Extended payment plan product | Australia, U.S., EU | Pay for larger purchases over 3–24 months, higher-value item financing, expanded merchant partnerships |

| Afterpay for Business | SME-focused platform | Global | Helps SMEs integrate BNPL, provides onboarding support, marketing resources, and customer support |

| Afterpay Partnerships | Strategic merchant and brand collaborations | Global | Collaborations with brands like Caleres (Famous Footwear, Sam Edelman, Naturalizer), expanding reach and adoption |

Afterpay

Afterpay is a leading Australian financial technology company specializing in the “buy now, pay later” (BNPL) model. Founded in 2014 by Nick Molnar and Anthony Eisen, Afterpay allows consumers to make purchases and pay for them in four equal, interest-free installments. The company operates in several countries, including Australia, the United States, Canada, the United Kingdom, France, Italy, Spain, and New Zealand. It serves millions of active users and partners with a vast network of merchants across various industries.

Clearpay

Clearpay is the brand name under which Afterpay operates in the United Kingdom. The service offers the same BNPL functionality as Afterpay but is tailored to meet the regulatory and consumer preferences of the UK market. Clearpay enables UK consumers to shop online and in-store, paying for their purchases in four interest-free installments. The platform has gained significant traction among UK retailers and consumers, contributing to Afterpay’s international expansion.

Afterpay Media Network (AMN)

The Afterpay Media Network (AMN) is Afterpay’s advertising and marketing platform that connects brands with consumers through targeted campaigns. AMN leverages Afterpay’s extensive user data to deliver personalized and relevant advertisements to shoppers. The network allows brands to reach their desired audience effectively, enhancing customer engagement and driving sales. In 2025, Afterpay partnered with Narrative I/O to enhance AMN’s infrastructure, focusing on privacy-first data collaboration and identity orchestration.

Afterpay Business Solutions

Afterpay Business Solutions is a suite of tools and services designed to help merchants integrate Afterpay’s payment options into their sales channels. This includes point-of-sale (POS) systems, online checkout solutions, and analytics tools that provide insights into customer behavior and sales performance. The platform aims to streamline the payment process for retailers and offer a seamless shopping experience for consumers.

Afterpay Installments

Afterpay Installments is a core product that allows consumers to split their purchases into four equal, interest-free payments. This service is available both online and in-store, providing flexibility and affordability to shoppers. Afterpay Installments has become a popular payment option among consumers, particularly in markets like Australia and the United States, where it has been integrated into numerous retail platforms.

Afterpay Pay Monthly

Afterpay Pay Monthly is an extension of the traditional BNPL model, offering consumers the option to pay for larger purchases over a longer period, typically ranging from three to 24 months. This service caters to customers making higher-value purchases, such as electronics and furniture, providing them with more manageable payment plans. In 2025, Afterpay expanded its Pay Monthly offerings, partnering with brands like Caleres to offer flexible payment options on a wider range of products.

Afterpay for Business

Afterpay for Business is a platform that enables small and medium-sized enterprises (SMEs) to offer BNPL services to their customers. This initiative aims to empower businesses by providing them with the tools and support needed to integrate Afterpay’s payment solutions into their operations. The platform offers resources such as onboarding assistance, marketing materials, and customer support to help businesses grow and thrive in the competitive retail landscape.

Afterpay Partnerships

In addition to its core services, Afterpay has formed strategic partnerships with various brands and retailers to enhance its offerings and expand its reach. Notable partnerships include collaborations with companies like Caleres, which owns brands such as Famous Footwear, Sam Edelman, and Naturalizer. These partnerships allow Afterpay to offer flexible payment options to a broader customer base and strengthen its position in the retail market.

Final Words

Today, the question of who owns Afterpay leads straight to Block, Inc. What began as an Australian startup has grown into a cornerstone of one of the world’s largest fintech groups. The brand continues to operate under its own name, but its future direction is guided by Block’s broader strategy to connect payments, commerce, and consumer finance.

FAQs

Who is Afterpay owned by?

Afterpay is fully owned by Block, Inc., the American financial technology company formerly known as Square. After its $29 billion acquisition in 2022, Afterpay became a subsidiary and is operated within Block’s broader payments and financial services ecosystem.

Who owns Afterpay Australia?

Afterpay Australia is also owned by Block, Inc. The Australian operations are part of the global Afterpay brand and are managed under Block’s governance, with Nick Molnar overseeing the company’s operational activities worldwide.

Where was Afterpay founded?

Afterpay was founded in Sydney, Australia, in 2014 by Nick Molnar and Anthony Eisen. The company started as a small fintech startup offering interest-free installment payments to Australian consumers.

Is Afterpay publicly traded?

No, Afterpay is not publicly traded as an independent company. It was listed on the Australian Stock Exchange before its acquisition but became a fully owned subsidiary of Block, Inc. in 2022.

How did Afterpay start?

Afterpay started as a solution to help consumers make purchases without paying interest upfront. Nick Molnar and Anthony Eisen developed a “buy now, pay later” (BNPL) model that split payments into four installments. The company quickly gained traction in Australia and expanded internationally.

How was Afterpay started?

The company was started by Nick Molnar, a university student at the time, who teamed up with Anthony Eisen. They designed a simple BNPL service to appeal to younger consumers who preferred flexible payment options over credit cards.

Is Afterpay owned by Cash App now?

No, Afterpay is not owned by Cash App. Afterpay is owned by Block, Inc., the same parent company that owns Cash App. While Afterpay’s services are integrated into Cash App, they remain distinct brands and products.

How much did Nick Molnar sell Afterpay for?

Nick Molnar and co-founder Anthony Eisen sold Afterpay for approximately $29 billion when it was acquired by Block, Inc. in 2022. This made it one of the largest fintech acquisitions in history.

Is Afterpay owned by Google?

No, Afterpay is not owned by Google. It is owned by Block, Inc., an independent financial technology company based in the United States.

Are Afterpay and PayPal the same?

No, Afterpay and PayPal are separate companies. Afterpay focuses on BNPL services, while PayPal is a digital payments platform with broader offerings, including peer-to-peer payments, merchant services, and credit products.

What country is Afterpay from?

Afterpay originates from Australia. It was founded in Sydney in 2014 and initially focused on the Australian market before expanding globally.

Who is Afterpay affiliated with?

Afterpay is affiliated with Block, Inc., its parent company. It also partners with thousands of merchants globally, including retailers in Australia, the U.S., the U.K., and Europe, and operates under the Clearpay brand in the UK and EU.