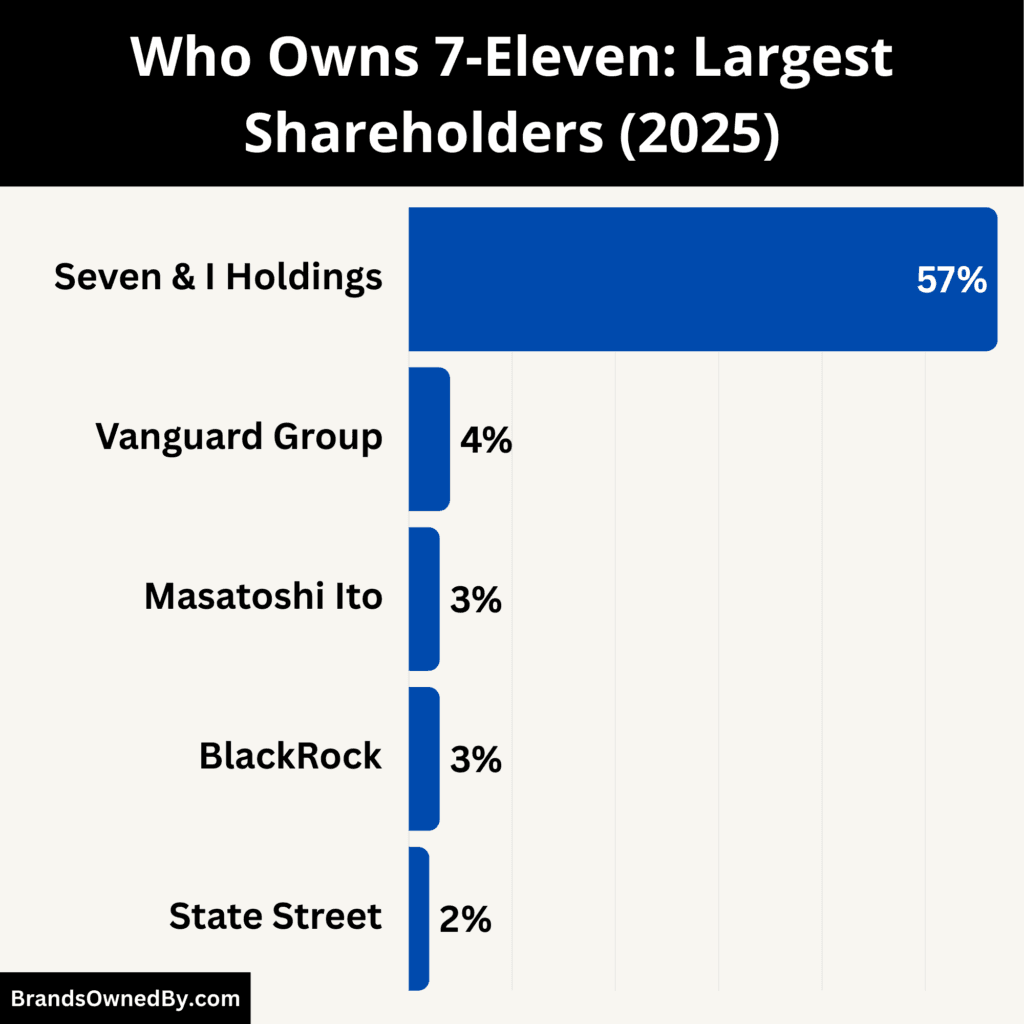

- 7‑Eleven, Inc. is majority-owned by Seven & i Holdings (57%), which directs global strategy, oversees North American operations, and controls major corporate decisions.

- Masatoshi Ito, the founding family member, retains a 3% stake, preserving the company’s historical legacy, corporate culture, and brand principles.

- Institutional investors including Vanguard Group (4%), BlackRock (3%), and State Street (2%) collectively hold around 9–10%, influencing governance, strategic initiatives, and long-term growth while ensuring accountability.

- Other individual and minor shareholders account for approximately 28–30%, contributing to a diversified ownership structure and participating in shareholder voting and corporate oversight.

7-Eleven is the largest global convenience store chain. It operates tens of thousands of stores across Asia, North America, Europe, and other regions. The brand is known for quick service, extended operating hours, and a broad range of ready-to-eat products and essentials. 7-Eleven has become a symbol of convenience retail around the world.

The company began as a small retail experiment in 1927. It transformed over the decades into a leading network of franchised and company-owned convenience stores. Today, it operates under the ownership of a Japanese retail conglomerate.

The stores are located in major cities and rural areas in more than 20 countries. 7-Eleven sells snacks, beverages, prepared foods, basic groceries, and services such as ATM access and bill payment options. The brand has also expanded into loyalty programs, digital ordering, and other modern retail features.

Founders

7-Eleven’s roots trace back to a small ice house storefront founded in Dallas, Texas, in 1927. Joe C. Thompson Sr. led the Southland Ice Company, which owned the property and saw an opportunity to improve customer service by selling basic goods directly to patrons.

An employee named John Jefferson Green began selling essentials like milk and bread from the ice house. This practical initiative met customer demand and set the stage for a new retail concept. Over the next decade, the business expanded across Texas. Between 1928 and 1946, the stores were called Tote’m Stores, a name chosen to reflect customers “toting” away goods, and sometimes featured totem-pole imagery as a fun marketing touch.

In 1946, the company renamed the stores 7-Eleven to reflect new extended operating hours—from 7 a.m. to 11 p.m.—which were uncommon at the time and signaled a new level of convenience to customers.

While the Southern U.S. expansion continued in the mid-20th century, a significant shift occurred when the Japanese retailer Ito-Yokado entered the picture. In 1973, Ito-Yokado signed a licensing and area service agreement with the American parent to develop 7-Eleven stores in Japan.

The first Japanese store opened in May 1974 in Toyosu, Tokyo, under a local corporate entity named York Seven, later renamed Seven-Eleven Japan Co., Ltd. Ito-Yokado’s leadership, including Masatoshi Ito and later executives like Toshifumi Suzuki, drove rapid adoption of the convenience store model in Japan.

The Japanese variant of the business emphasized fresh foods, integrated services, and 24-hour operations, shaping what many now recognize as the modern convenience store format. Seven-Eleven Japan’s success later allowed it not only to thrive domestically but also to influence the global brand’s strategy and ownership direction.

Major Milestones

- 1927: The Southland Ice Company begins selling everyday essentials from an ice house in Dallas, Texas, laying the foundation for the modern convenience store concept.

- 1928: The first Tote’m Store officially opens, marking the early branding phase of what would later become 7-Eleven.

- 1936: Tote’m Stores expand across multiple U.S. states, establishing a regional retail footprint in the southern United States.

- 1946: The brand is renamed 7-Eleven to reflect extended operating hours from 7 a.m. to 11 p.m., seven days a week.

- 1953: 7-Eleven begins standardizing store layouts and product offerings, creating a recognizable national brand identity.

- 1961: The company launches its franchising model, enabling rapid domestic expansion across the United States.

- 1969: The first international 7-Eleven store opens in Canada, marking the brand’s entry into global markets.

- 1973: Japanese retailer Ito-Yokado signs a licensing agreement to develop 7-Eleven stores in Japan.

- 1974: The first Japanese 7-Eleven store opens in Tokyo, beginning what would become the brand’s most influential market.

- 1975: Seven-Eleven Japan introduces 24-hour operations, setting a new industry standard later adopted worldwide.

- 1979: Seven-Eleven Japan is listed on the Tokyo Stock Exchange, strengthening its corporate independence and growth capacity.

- 1982: Advanced point-of-sale systems are rolled out in Japan, enabling data-driven inventory and product decisions.

- 1991: Ito-Yokado acquires a controlling stake in the Southland Corporation, shifting strategic control of 7-Eleven to Japan.

- 1999: Seven-Eleven Japan increases its ownership position, further consolidating long-term control over the global brand.

- 2005: Seven & i Holdings Co., Ltd. is formed, placing 7-Eleven at the center of its global retail strategy.

- 2010: The global store network surpasses 40,000 locations, with Asia emerging as the strongest operating region.

- 2013: Digital loyalty programs and mobile services are expanded across key markets.

- 2017: The company increases its focus on fresh food, private-label products, and localized store offerings.

- 2018: 7-Eleven becomes the world’s largest convenience store chain by surpassing 70,000 locations globally.

- 2021: The acquisition of Speedway significantly expands 7-Eleven’s footprint in the United States.

- 2022: Sustainability initiatives are rolled out, including energy-efficient stores and reduced packaging efforts.

- 2023: Activist investors push for structural reforms, placing 7-Eleven at the center of strategic discussions.

- 2024: Seven & i Holdings announces operational streamlining and a renewed focus on its convenience store business.

- 2025: The group appoints its first non-Japanese CEO, signaling a shift toward more globally driven leadership.

Who Owns 7-Eleven: Major Shareholders

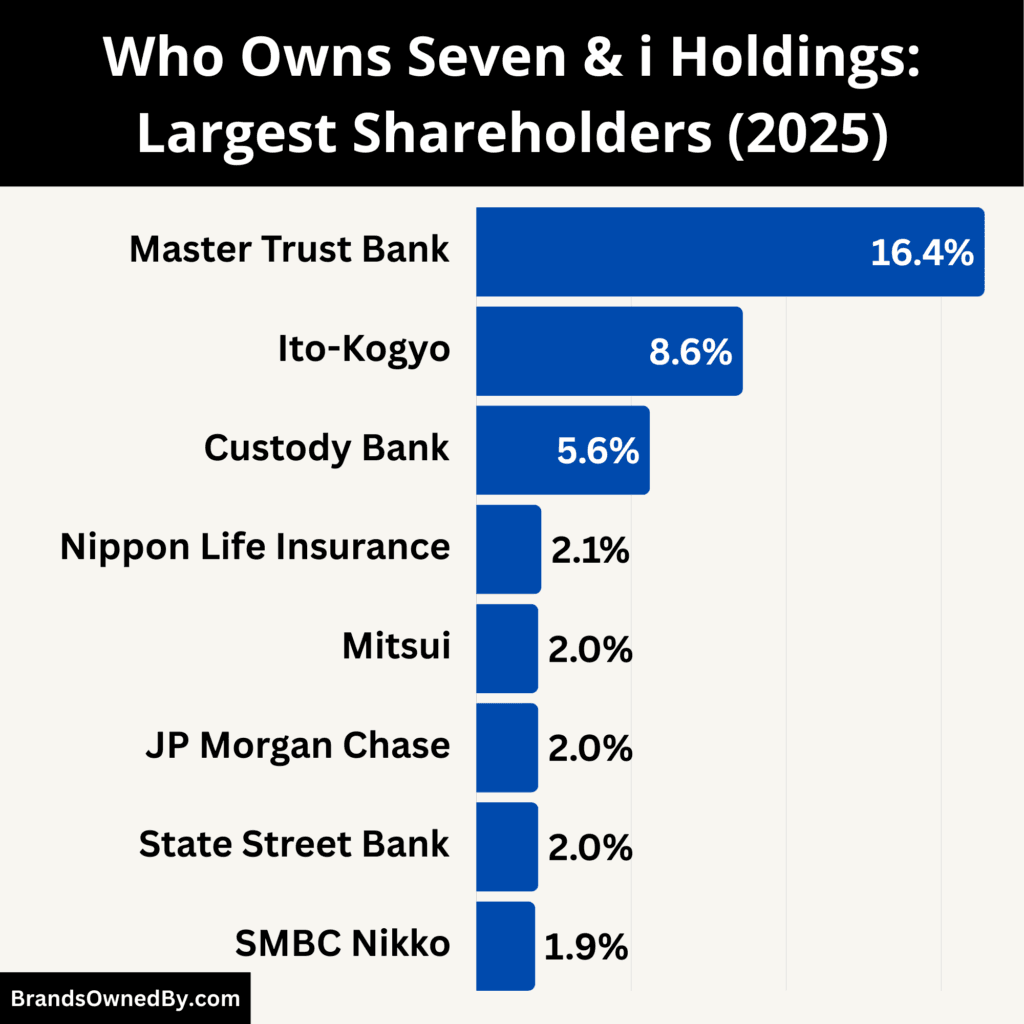

Seven & i Holdings Co., Ltd. is the parent company that ultimately owns and controls the global 7-Eleven convenience store business. Seven & I’s stock is publicly traded on the Tokyo Stock Exchange.

No single individual or entity holds a controlling majority of shares outright. Instead, ownership is a mix of large institutional investors, corporate proxy holders, financial institutions, and individual stakeholders.

This diversified shareholder base influences governance decisions and strategic direction, including responses to takeover proposals and leadership changes in 2025.

Below is a list of the major shareholders of 7-Eleven as of December 2025:

Seven & i Holdings: Majority Shareholder

Seven & i Holdings Co., Ltd. owns approximately 57% of 7‑Eleven, Inc., making it the primary controlling entity.

Seven & i Holdings Co., Ltd. is a leading Japanese retail conglomerate and the parent company of 7-Eleven. The company was established in 2005 through a corporate restructuring of Ito-Yokado, Seven-Eleven Japan, and other affiliated retail businesses. This holding structure was designed to centralize strategic decision-making, streamline operations, and create a platform for global growth.

The company operates a diverse retail portfolio, which includes supermarkets, department stores, specialty stores, and, most importantly, convenience stores under the 7-Eleven brand. Seven & i Holdings focuses on integrating advanced technology, data-driven logistics, and supply chain efficiency to enhance customer experience and operational performance. Its business model emphasizes franchising, private-label products, and international expansion.

Seven & i Holdings is publicly traded on the Tokyo Stock Exchange and has a broad shareholder base, including Japanese trust banks, institutional investors, family-linked entities, and global asset managers.

As the parent company, Seven & I is responsible for setting the strategic direction, overseeing global expansion, and approving major operational initiatives. Beyond governance, it influences decisions related to mergers, acquisitions, and international market entries.

Its majority stake allows Seven & I to appoint key executives, guide investment priorities, and ensure that North American operations align with the overall corporate vision.

Additionally, Seven & I integrates financial, technological, and logistical support for 7‑Eleven, providing economies of scale, centralized procurement, and global marketing strategies. This close oversight ensures that the brand maintains consistency in service, quality, and customer experience across all markets.

Masatoshi Ito: Founding Family Shareholder

Masatoshi Ito, founder of Ito-Yokado and the original visionary behind 7‑Eleven, retains a 3% ownership stake. Though relatively modest in size, this stake carries historical and symbolic importance. Ito’s presence in the shareholder structure serves as a link to the company’s origins and ensures that the founding principles, such as customer convenience, store innovation, and community engagement, remain central to corporate decisions.

Over the decades, Ito has influenced store formats, product innovation, and operational efficiency. His continued stake reflects a long-term commitment to brand integrity and helps maintain a corporate culture that balances innovation with traditional values, fostering continuity across generations of leadership.

Vanguard Group

Vanguard Group holds approximately 4% of 7‑Eleven, Inc. As a leading institutional investor, Vanguard provides professional oversight and exerts influence through shareholder voting rather than operational control.

Its stake is significant because it represents the perspective of large-scale, diversified investment portfolios. Vanguard monitors the company’s financial performance, governance practices, and strategic initiatives, ensuring that executive decisions maximize shareholder value.

Additionally, Vanguard may influence policies on executive compensation, sustainability reporting, and long-term growth strategies. Its involvement ensures accountability, mitigates risk for minority shareholders, and aligns corporate actions with market expectations.

BlackRock

BlackRock owns roughly 3% of 7‑Eleven, Inc., making it a key institutional stakeholder. Known for its active engagement in corporate governance, BlackRock participates in voting on executive appointments, board structure, and major corporate initiatives.

Its stake provides oversight on strategic decisions such as market expansions, store portfolio optimization, and new service offerings like 7NOW delivery. BlackRock also promotes transparency in financial reporting and risk management.

While it does not involve itself in daily operations, its voting influence can shape long-term priorities, ensuring the company maintains strong governance practices and sustainable growth.

State Street

State Street holds approximately 2% of 7‑Eleven, Inc., representing another critical institutional perspective. State Street focuses on corporate governance, sustainability, and risk oversight.

Its engagement includes voting on shareholder resolutions, monitoring executive performance, and ensuring alignment with industry best practices. By bringing financial market expertise to the table, State Street helps maintain shareholder confidence and encourages decisions that maximize profitability while mitigating risk.

Its presence strengthens corporate transparency, accountability, and long-term planning across operational and strategic initiatives.

Other Individual Shareholders

Other minor and individual shareholders collectively own about 28–30% of 7‑Eleven, Inc. This group includes private investors, former executives, and smaller stakeholders.

While each holds a minor stake, collectively they form a significant portion of the ownership structure. These shareholders participate in annual meetings, vote on corporate resolutions, and provide diverse perspectives on company strategy.

Their involvement contributes to a more democratic ownership structure and helps balance the influence of major shareholders. In addition, minor shareholders often advocate for transparency, ethical governance, and policies that protect long-term shareholder value, indirectly shaping 7‑Eleven’s strategic direction.

Acquisition of 7-Eleven by Seven & i Holdings

7-Eleven was not always owned by Seven & i Holdings. The brand originated in the United States and was historically controlled by an American company called The Southland Corporation. Financial distress in the late 1980s created the opportunity for a gradual takeover by its Japanese partner.

The acquisition process began in 1991, when Ito-Yokado, a Japanese supermarket operator and long-time licensee of 7-Eleven in Japan, acquired a controlling stake of approximately 70% in The Southland Corporation. The deal was valued at around $430 million. At the time, Southland was burdened by heavy debt following aggressive leveraged buyouts and expansion strategies. Ito-Yokado stepped in as a strategic rescuer rather than a hostile acquirer.

Throughout the 1990s, Ito-Yokado continued increasing its ownership through additional share purchases and restructuring efforts. Operational control, board influence, and long-term strategic planning steadily shifted from the U.S. to Japan. During this period, the Southland Corporation was renamed 7-Eleven, Inc., reflecting the dominance of the convenience store business within the company.

In 2005, the acquisition was fully consolidated through a corporate restructuring. Ito-Yokado formed Seven & i Holdings Co., Ltd. as a new holding company. Under this structure, 7-Eleven, Inc. became a wholly owned subsidiary of Seven-Eleven Japan, which itself was placed under Seven & i Holdings. While no single cash transaction occurred in 2005, the restructuring finalized ownership and formally placed the global 7-Eleven brand under Japanese control.

Following the acquisition, Seven & i Holdings repositioned 7-Eleven as its core business. Capital allocation, international expansion, technology investment, and franchising strategy have since been directed from Japan. Non-core retail assets were gradually deprioritized.

As of 2025, 7-Eleven operates as the flagship brand of Seven & i Holdings. Although the parent company is publicly traded with diversified ownership, strategic and operational control of 7-Eleven remains firmly centralized within the Seven & I group. This acquisition marked one of the most significant cross-border takeovers in global retail history and permanently reshaped the convenience store industry.

Who is the CEO of 7-Eleven?

Joseph M. DePinto serves as the President and Chief Executive Officer of 7‑Eleven Inc., the North American operating company that manages and franchises stores across the U.S. and Canada.

DePinto has led the company as CEO for many years, bringing deep operational and strategic experience in convenience retail. He oversees all aspects of the business in the North American market, including merchandising, store operations, franchising partnerships, customer experience, and growth initiatives. His role is central to adapting global strategies to local market dynamics in the U.S. and Canada.

DePinto’s leadership spans both strategic planning and day‑to‑day execution. He reports to the board of 7‑Eleven International LLC and aligns North American operations with the broader direction set by Seven & i Holdings and Seven‑Eleven Japan.

Under his tenure, 7‑Eleven Inc. has focused on expanding fresh food offerings, enhancing digital services, and improving franchisee support.

Previous 7‑Eleven Inc. CEOs

Over the years, several executives have led 7‑Eleven Inc. before DePinto. Notable past CEOs include:

- James W. Keyes – Served as CEO of 7‑Eleven in the early 2000s, bringing extensive retail leadership experience to the company.

- Jim Keyes – DePinto succeeded Jim Keyes, who retired from the role. Keyes’ leadership focused on consolidating operations and strengthening core retail fundamentals before handing over to DePinto.

These leaders helped shape 7‑Eleven Inc.’s North American strategy and prepared the groundwork for the company’s performance in later years.

CEO Compensation and Salary

As of 2024 reporting, Joseph M. DePinto’s compensation as CEO of 7‑Eleven Inc. was approximately 4.34 billion yen (about $29.6 million).

This total compensation figure includes base salary, performance‑based incentives, and equity‑linked awards. His base salary portion was reported to be around $2 million, with over 90% of his total earnings tied to performance incentives designed to align executive pay with company results.

Compensation for convenience store CEOs like DePinto typically consists of:

- Base salary — fixed annual pay

- Performance incentives — bonuses tied to annual and multi‑year performance goals

- Stock and equity awards — long‑term incentives linked to shareholder value.

These components are intended to motivate executives to achieve growth, profitability, and operational excellence.

Organizational Decision‑Making

Within 7‑Eleven Inc., the CEO drives North American strategic decisions, including merchandising innovation, store operations optimization, franchise growth, and customer engagement strategies. DePinto collaborates with senior executives such as the Chief Financial Officer, Chief Operating Officer, and Chief Marketing Officer to align operational goals with market conditions and corporate governance set by the parent company’s leadership.

Despite the parent company leadership transition at Seven & i Holdings, 7‑Eleven Inc.’s CEO role remains a distinct and operationally focused position responsible for executing on North American market objectives, directly influencing performance in one of the company’s most important regional markets.

7-Eleven Annual Revenue and Net Worth

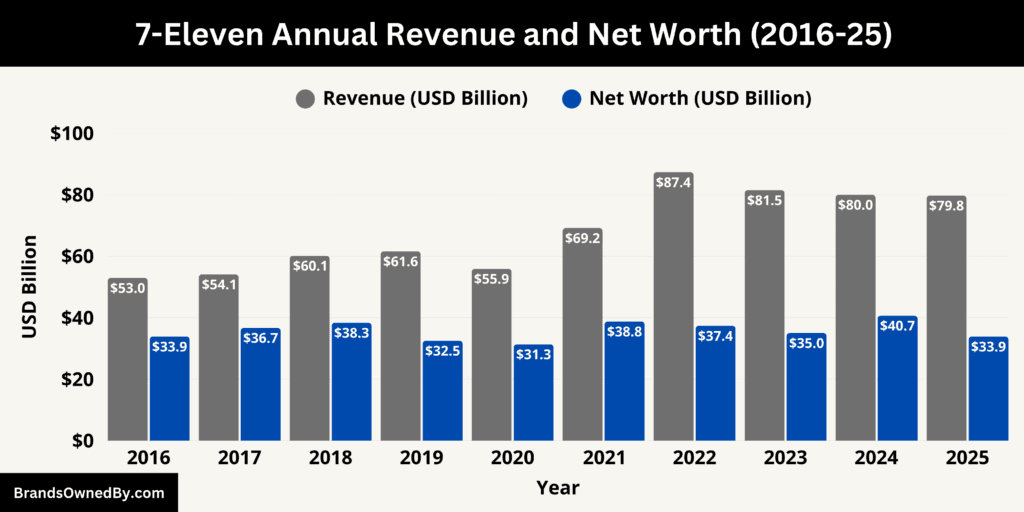

As of December 2025, 7-Eleven’s annual revenue stands at approximately $79.76 billion, representing the total value of goods and services sold through its global store network over the past year.

At the same time, 7‑Eleven’s net worth is about $33.85 billion, capturing how financial markets value the company’s outstanding shares. These figures illustrate both the current scale of 7‑Eleven’s operations and how the market perceives its long‑term earnings potential and competitive position.

Revenue of 7‑Eleven in 2025

As of December 2025, 7‑Eleven’s trailing twelve‑month (TTM) revenue — the sum of its most recent annualized sales — is estimated at approximately $79.76 billion.

It reflects the total income generated from the sale of goods and services across its global store network, including franchise and directly operated units in North America, Japan, Asia, and other regions. The company’s convenience retail model, which includes foodservice, beverages, packaged goods, and services, remains the core driver of revenue.

7‑Eleven’s revenue trends in 2025 show some moderation compared with prior years, as the company adapts to shifting consumer spending patterns, macroeconomic headwinds, and strategic store optimization efforts in key markets such as the United States and Canada.

Still, at close to $80 billion in annual sales, 7‑Eleven stands among the largest convenience retailers in the world, underscoring its operational scale and sustained demand for convenience retail offerings across diverse markets.

Net Worth and Market Valuation

As of December 2025, 7‑Eleven’s estimated market capitalization — a proxy for its overall net worth in the public markets — stands at approximately $33.85 billion. This valuation reflects investor perception of the company’s future earnings potential, competitive position, and strategic direction.

Market capitalization can fluctuate with share price movements, investor sentiment, and broader economic conditions.

In 2025, 7‑Eleven’s valuation sits in a range that reflects ongoing operational adjustments, earnings performance, and the competitive dynamics of global convenience retail.

At roughly $34 billion in market value, 7‑Eleven remains one of the most valuable retail brands globally, with a solid footprint and strong recurring revenue streams.

Financial Position and Performance Context

The combination of strong revenue and a substantial market valuation illustrates how 7‑Eleven performs as a large‑scale retail enterprise in 2025. Revenue near $80 billion shows continued consumer demand across its global store network, while a market value above $30 billion emphasizes investors’ long‑term confidence in the business. These figures account for the company’s multi‑region operations, franchise royalty streams, and brand strength.

The net worth and revenue of 7‑Eleven should be seen in the context of its global expansion and strategic recalibration in key regions. Shifts in store formats, product mix, and operational focus — such as a growing emphasis on prepared foods and digital services — influence how the company earns revenue and how investors value the enterprise. Together, these financial metrics highlight the scale and economic footprint of 7‑Eleven as it enters the latter part of 2025 as a leading convenience retailer.

Brands Owned by 7-Eleven

7‑Eleven, Inc. operates a diverse portfolio of convenience store brands, proprietary products, and customer‑focused services beyond its flagship stores. Below is a list of the major brands owned by 7-Eleven as of December 2025:

| Brand / Entity | Description | Year Acquired / Launched | Key Features / Operations |

|---|---|---|---|

| 7‑Eleven (Flagship Stores) | Core convenience store brand | Founded 1927 (original), operated under 7‑Eleven, Inc. in U.S. | Offers snacks, beverages, ready‑to‑eat meals, private‑label products, services like ATMs and bill payment; mix of franchise and company‑operated stores |

| Speedway | Convenience and fuel retail chain | Acquired 2021 | ~3,800 stores across 36 U.S. states; adds fuel retail operations; expanded geographic presence and customer base |

| Stripes Convenience Stores | Regional convenience store chain | Acquired 2018 | Located mainly in TX, LA, NM, OK; includes fuel partnerships and proprietary food offerings; strengthens presence in West South Central U.S. |

| Laredo Taco Company | Quick‑serve Mexican food brand | Launched within Stripes stores; expanded to 7‑Eleven | Fresh tacos, burritos, and specialty items; part of 7‑Eleven’s prepared food expansion |

| Raise the Roost Chicken and Biscuits | Quick‑serve comfort food brand | Introduced within select stores | Focus on fried chicken, biscuits, and related menu items; supports prepared food strategy |

| 7‑Select Private Brand Products | Proprietary product line | Developed in‑house | Includes snacks, beverages, frozen foods, and ready‑to‑eat meals; exclusive to 7‑Eleven and related stores; builds customer loyalty |

| 7NOW Delivery Service | On‑demand delivery platform | Launched 2017 | Mobile app–based delivery of convenience items and prepared food; operates in select U.S. cities; adapts to consumer demand for delivery |

| 7Rewards Loyalty Program | Customer rewards and loyalty system | Launched 2017 | Enables point collection and redemption at stores; enhances customer engagement and repeat visits; provides valuable consumer data insights |

7‑Eleven

7‑Eleven is the core business and primary brand operated directly by 7‑Eleven, Inc. It comprises the majority of the company’s global footprint, with tens of thousands of convenience stores across North America and other regions.

These stores are company‑operated and franchised outlets offering a wide range of products, including snacks, beverages, ready‑to‑eat meals, everyday essentials, and services such as bill payment and ATMs.

The 7‑Eleven brand is known for its iconic offerings such as Slurpee, Big Gulp, and private‑label 7‑Select products, which drive high customer recognition and frequent store visits. Operational strategies focus on convenience, speed, and localized product assortments tailored to regional consumer preferences.

Speedway

Speedway is a major convenience store and fuel retail brand acquired by 7‑Eleven, Inc. in 2021 in a transaction valued at approximately $21 billion in cash, making it one of the largest acquisitions in the company’s history.

Under 7‑Eleven’s ownership, Speedway continues to operate its network of convenience and fuel sites across roughly 36 U.S. states, particularly in the Midwest and East Coast.

The acquisition significantly expanded 7‑Eleven’s North American presence and diversified its portfolio by adding fuel retail alongside traditional convenience store offerings. Speedway’s integration allows 7‑Eleven to leverage combined operational efficiencies, broaden geographic coverage, and introduce cross‑brand products while maintaining Speedway’s established customer base and identity.

Stripes Convenience Stores

Stripes is a convenience store chain predominantly located in Texas, Louisiana, New Mexico, and Oklahoma that operates under the 7‑Eleven corporate umbrella. Stripes stores are known for their regional popularity and for offering a range of foodservice items, fuel partnerships, and branded quick meals.

Acquired by 7‑Eleven in 2018, the brand helps strengthen the company’s presence in the West South Central United States and complements its traditional 7‑Eleven and Speedway operations. Many Stripes locations feature proprietary food concepts that enhance the customer experience and support local market positioning.

Laredo Taco Company

Laredo Taco Company is a food concept brand operated by 7‑Eleven, Inc., focused on authentic Mexican‑inspired meals such as tacos, burritos, and specialty offerings made with fresh ingredients. Originally developed within Stripes stores, Laredo Taco Company has been expanded into an additional 7‑Eleven locations as part of 7‑Eleven’s broader strategy to elevate prepared foods.

It exemplifies 7‑Eleven’s efforts to diversify beyond traditional convenience items, responding to consumer demand for higher‑quality, made‑to‑order food choices in its stores.

Raise the Roost Chicken and Biscuits

Raise the Roost Chicken and Biscuits is another quick‑serve food concept within 7‑Eleven’s portfolio, offering menu items centered around fried chicken, biscuits, and related comfort foods. This brand operates in select convenience store locations and supports 7‑Eleven’s strategic push into differentiated prepared meals.

The concept aims to attract customers looking for hearty food options beyond standard convenience products and aligns with broader efforts to compete with fast‑casual dining trends.

7‑Select Private Brand Products

7‑Select is the proprietary product brand developed and marketed by 7‑Eleven. It encompasses a wide variety of items sold exclusively in 7‑Eleven and related store banners, including snacks, beverages, frozen foods, and ready‑to‑eat meals.

The 7‑Select line is a core part of the company’s merchandising strategy, helping differentiate offerings from competitors while providing customers with value‑oriented and unique products that build loyalty. 7‑Select contributes meaningfully to overall sales and represents 7‑Eleven’s investment in branded goods that complement its convenience retail model.

7NOW Delivery Service

7NOW is 7‑Eleven’s on‑demand delivery platform, allowing customers to order food, drinks, and convenience items through a mobile app for delivery in select cities. The service has expanded rapidly and reflects the company’s adaptation to changing consumer preferences for convenience beyond physical store visits. 7NOW enhances customer engagement and creates incremental revenue streams by tapping into the growing demand for delivery services.

7Rewards Loyalty Program

7Rewards is the company’s customer loyalty program that enables users to earn and redeem points at participating 7‑Eleven and related stores. The program fosters repeat business and enhances customer data insights, allowing 7‑Eleven to tailor offers and promotions more effectively. With millions of members, 7Rewards plays a central role in strengthening brand affinity and encouraging frequent visits across the company’s varied store formats.

Final Thoughts

The details of who owns 7‑Eleven reveal a structured mix of majority control by Seven & i Holdings, historical influence from the founding family, and oversight from institutional and individual shareholders. This ownership framework enables the company to maintain strong governance, expand globally, and innovate in convenience retail. With such a balanced shareholder base, 7‑Eleven is well-positioned to continue growing and adapting to evolving market trends while remaining a leading and trusted brand worldwide.

FAQs

Who owns Seven Eleven?

7‑Eleven, Inc. is majority-owned by Seven & i Holdings Co., Ltd., a Japanese retail holding company, which holds approximately 57% of the company.

Is 7‑11 Japanese owned?

Yes, 7‑Eleven is Japanese-owned through its parent company, Seven & i Holdings, which oversees operations worldwide.

Who owns 7‑11 in the USA?

In the United States, 7‑Eleven is operated by 7‑Eleven, Inc., a subsidiary of Seven & i Holdings, which manages all North American operations.

Who owns 7 Eleven Australia?

7‑Eleven Australia is owned and operated by the Australian subsidiary of Seven & i Holdings, managing a network of convenience stores across the country.

When was 7 Eleven founded?

7‑Eleven was founded in 1927 in Dallas, Texas, originally named Tote’m Stores.

Is 7‑Eleven owned by Reliance?

No, 7‑Eleven is not owned by Reliance. Reliance operates a separate retail partnership in India but does not own the global 7‑Eleven brand.

What is the origin country of 7 Eleven?

7‑Eleven originated in the United States, specifically in Dallas, Texas, in 1927.

Who is Seven Eleven Japanese owner?

The Japanese owner of 7‑Eleven is Seven & i Holdings Co., Ltd., which is the parent company controlling global operations.

Is 7 11 owned by Ambani?

No, 7‑Eleven is not owned by Mukesh Ambani. While Reliance Retail operates 7‑Eleven stores in India under a licensing agreement, Ambani does not own the global brand.

What do Japanese people call 7‑11?

In Japan, 7‑Eleven is commonly called “Sebun Irebun” (セブン‐イレブン), a phonetic rendering of “Seven‑Eleven” in Japanese.

Is 7‑11 getting Japanese food in the US?

Yes, 7‑Eleven stores in the U.S. offer some Japanese-inspired food items, including sushi, onigiri, and ready-to-eat meals, reflecting global menu influences.

Who owns Seven & i Holdings?

Seven & i Holdings Co., Ltd. is a publicly traded Japanese holding company. Major shareholders include institutional investors, the founding Ito family, and other individual shareholders, with no single private owner controlling it entirely.