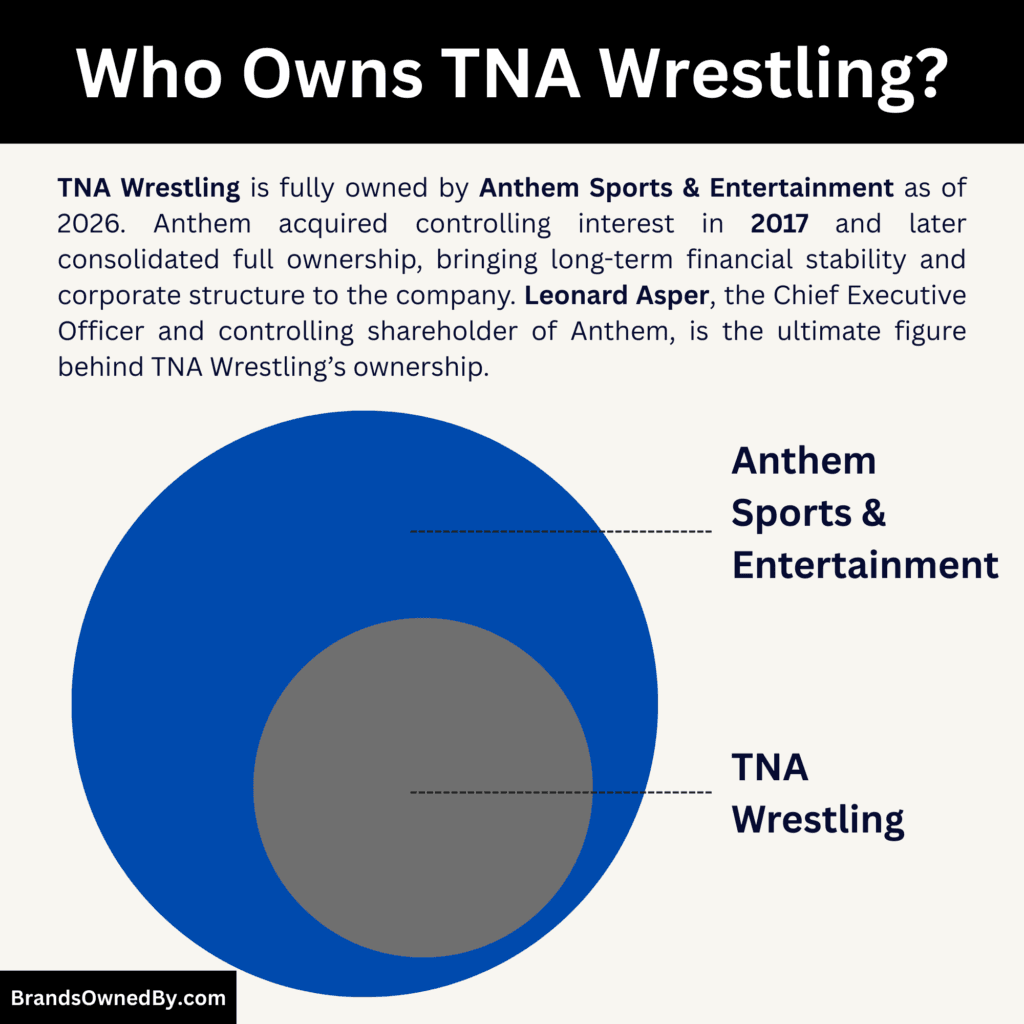

- TNA Wrestling is fully owned by Anthem Sports & Entertainment as of 2026, making it a privately controlled wrestling promotion with no public shareholders and centralized corporate ownership.

- Leonard Asper is the ultimate controlling figure behind TNA through his majority ownership and leadership of Anthem, which provides financial backing, strategic direction, and long-term stability to the promotion.

- The broader Asper family holds significant combined influence within Anthem, reinforcing private control and ensuring consistent governance without external investor pressure or public market involvement.

- TNA operates as a wholly owned subsidiary under Anthem’s sports and media structure, with corporate strategy directed by the parent company and daily operations managed by TNA’s internal executive leadership.

TNA Wrestling, officially known as Total Nonstop Action Wrestling, is a global professional wrestling promotion headquartered in Nashville, Tennessee. The company produces weekly television programming, premium live events, and digital content.

It features male and female wrestlers from around the world. The promotion is known for fast-paced matches, long-term storytelling, and strong international partnerships.

In 2024, the company revived the TNA name after years under the Impact Wrestling brand, signaling a return to its original identity and legacy.

TNA Wrestling operates as a professional wrestling and sports entertainment company. It produces weekly shows, pay-per-view events, and exclusive digital content. Its flagship program is Impact, supported by major events such as Bound for Glory and Slammiversary.

It promotes championships across multiple divisions including world, tag team, X-Division, and Knockouts.

TNA maintains a global footprint. Its content is distributed through television networks, streaming platforms, and international partners. The promotion works with talent from North America, Mexico, Japan, and Europe.

Cross-promotional partnerships have played an important role in expanding its reach. The company focuses heavily on in-ring performance, character-driven storylines, and fan engagement through live events and digital media.

Total Nonstop Action Wrestling Founders

TNA Wrestling was founded in 2002 by Jeff Jarrett and his father, Jerry Jarrett. Both were experienced wrestling promoters with deep industry knowledge. Their combined vision helped create a new national wrestling promotion after the collapse of WCW left a major gap in the market.

Jeff Jarrett was already a well-known professional wrestler before launching TNA. He had built a long career performing in major promotions such as WWE and WCW. After WCW shut down in 2001, Jarrett wanted to create a new platform for wrestlers and fans.

He became the driving force behind TNA’s early identity. Jeff worked both behind the scenes and in the ring. He helped develop storylines, recruit talent, and promote the brand globally. His leadership played a major role in keeping the company alive during its toughest years. Jeff Jarrett later returned multiple times in executive and advisory roles, influencing the company’s long-term direction.

Jerry Jarrett brought decades of promotional experience to the company. He had been one of the most respected figures in the wrestling territory era. Jerry previously co-founded and operated successful regional promotions, including the Memphis wrestling territory.

His business strategy, booking knowledge, and understanding of television wrestling were critical in building TNA’s foundation. Jerry focused on operational structure, talent relationships, and long-term sustainability. His mentorship helped guide the company through its startup phase and early expansion.

Together, Jeff and Jerry Jarrett created TNA from scratch with limited resources. They introduced a weekly pay-per-view model, which was unique at the time. Their combined wrestling and business expertise allowed TNA to grow from a small startup into a recognized international wrestling promotion. Their legacy remains central to the history and identity of TNA Wrestling.

Ownership History

TNA Wrestling has experienced one of the most complex ownership journeys in professional wrestling. The company moved through several leadership and investment phases before reaching stability. Each ownership era shaped the company’s direction, identity, and survival.

Founding Era and Early Private Ownership (2002–2005)

TNA Wrestling began in 2002 under the ownership of Jeff Jarrett and Jerry Jarrett. The company was launched as a privately controlled startup. During this period, the founders handled both creative and business operations. The promotion used a weekly pay-per-view model instead of traditional television. This allowed TNA to operate without a major broadcaster in its early stage.

Despite limited resources, the company gained attention for its in-ring style and new talent. However, running a wrestling promotion required significant funding. The founders soon looked for external investors to sustain growth and expand television distribution.

Panda Energy Investment and Dixie Carter Era (2005–2016)

A major turning point came when Panda Energy invested in TNA Wrestling. The investment was made through Dixie Carter, who became the company’s President and later its public face. Panda Energy became the majority financial backer. This era is often referred to as the Carter era.

Under Dixie Carter, TNA expanded significantly. The company secured national television deals, signed major wrestling stars, and increased production scale. The promotion competed more directly with larger wrestling companies during this period. However, financial and management challenges continued. Internal leadership changes and declining momentum created instability. By the mid-2010s, TNA faced serious operational difficulties and required new ownership support.

Transition and Debt Crisis Period (2016–2017)

By 2016, TNA Wrestling entered one of the most uncertain periods in its history. Ownership and financial control became complicated. Several investors and partners were involved in funding operations. The company struggled to maintain television distribution and consistent leadership.

During this time, Anthem Sports & Entertainment began providing financial and strategic support. Anthem initially acted as a minority investor and distribution partner through its media network. This involvement gradually increased as the company moved toward a full ownership transition.

Anthem Sports & Entertainment Acquisition (2017)

In 2017, Anthem Sports & Entertainment acquired a controlling stake in TNA Wrestling. This marked the most important ownership shift in company history. Anthem took over financial operations, corporate structure, and strategic direction. The acquisition ended years of instability and prevented the promotion from shutting down.

After gaining control, Anthem restructured the company. Leadership changes were implemented. Operational systems were rebuilt. The promotion focused on long-term sustainability rather than rapid expansion. This period stabilized the brand and restored business confidence.

Impact Wrestling Rebrand and Corporate Integration (2017–2023)

Following the acquisition, Anthem fully integrated the promotion into its sports and media portfolio. The company rebranded as Impact Wrestling. The new identity reflected a fresh start and a shift in strategy. The focus moved toward consistent storytelling, international partnerships, and digital growth.

During this period, Anthem increased its involvement in decision-making. New executives were appointed. Production quality improved. Global distribution expanded. The promotion regained stability and rebuilt its fanbase.

Return to TNA Brand and Modern Ownership Structure (2024–Present)

In 2024, the company officially returned to the TNA Wrestling name. This move was both symbolic and strategic. It restored the original brand identity while keeping the modern corporate structure under Anthem.

As of 2026, TNA Wrestling operates as a fully owned subsidiary of Anthem Sports & Entertainment. The promotion now functions under a stable ownership model with centralized corporate leadership. Anthem provides long-term financial backing, media distribution, and strategic planning. This modern era represents the most stable ownership period in TNA Wrestling’s history.

Who Owns TNA Wrestling?

TNA Wrestling is fully owned by Anthem Sports & Entertainment as of 2026. Ownership is concentrated within Anthem, which controls 100% of TNA Wrestling. The largest controlling figure behind Anthem is media executive Leonard Asper, who holds majority influence through his leadership and ownership stake. This centralized ownership structure gives TNA long-term financial backing, corporate stability, and unified strategic control.

Parent Company: Anthem Sports & Entertainment

Anthem Sports & Entertainment owns 100% of TNA Wrestling. The company first acquired a controlling stake in 2017 during TNA’s financial crisis and later consolidated full ownership. Since then, TNA has operated as a wholly owned subsidiary within Anthem’s sports and media division.

Anthem is a privately held Canadian media and entertainment company. It specializes in broadcasting, combat sports, and television distribution. Through its ownership, Anthem provides financial resources, corporate management, and global distribution support to TNA. The promotion benefits from Anthem’s television networks, streaming infrastructure, and cross-promotional ecosystem. This ownership has been the key factor behind TNA’s financial stability and brand revival in recent years.

Leonard Asper – Majority Controlling Stake in Anthem (Estimated 60–65%)

Leonard Asper is the Chief Executive Officer and controlling shareholder of Anthem Sports & Entertainment. He is the most influential figure behind TNA Wrestling. Asper holds an estimated 60% to 65% controlling stake in Anthem through direct and family-linked ownership. This gives him effective decision-making authority over the company and its subsidiaries, including TNA.

Asper has a long background in media and broadcasting. Under his leadership, Anthem expanded into sports media and combat sports entertainment. He played a central role in acquiring and stabilizing TNA during its most difficult period. His influence focuses on long-term corporate strategy, financial oversight, and growth planning rather than daily wrestling operations.

The Asper Family – Combined Strategic Ownership Influence (Estimated 20–25%)

The broader Asper family holds an additional estimated 20% to 25% ownership influence in Anthem Sports & Entertainment. The family has deep roots in the North American media industry and has historically controlled major broadcasting assets. Their combined stake reinforces private ownership control and prevents outside corporate takeover or shareholder dilution.

The family’s role is primarily strategic and financial. They influence corporate governance, long-term investment direction, and expansion strategy. Through Anthem, this ownership indirectly supports TNA Wrestling’s long-term stability, media positioning, and operational continuity.

Internal Executives and Minority Stakeholders – Small Non-Controlling Equity (Estimated 10–15%)

A small portion of Anthem’s equity is believed to be distributed among internal executives, senior leadership, and early corporate stakeholders. These combined minority stakes are estimated to represent around 10% to 15% of the company. These holdings are private and not publicly traded.

These stakeholders do not hold controlling power. Strategic authority remains centralized under Leonard Asper and the Asper family. Their minority participation mainly aligns leadership incentives with long-term company performance and growth.

Competitor Ownership Comparison

Ownership structures in professional wrestling vary widely. Some promotions are part of global public corporations. Others are privately owned by individuals or media groups. TNA Wrestling follows a different model compared to its biggest competitors. Below is a detailed comparison of how major wrestling promotions are owned and controlled:

| Promotion | Parent Owner | Ownership Type | Key Controlling Figures | Control Structure | Strategic Influence |

|---|---|---|---|---|---|

| TNA Wrestling | Anthem Sports & Entertainment | Private media ownership | Leonard Asper and the Asper family | Centralized corporate control under private parent company | Long-term stability, media-backed growth, no public shareholder pressure |

| WWE | TKO Group Holdings (Endeavor-controlled) | Publicly traded corporate ownership | Endeavor Group leadership and institutional investors | Corporate board governance with shareholder accountability | Global expansion, investor-driven performance, large-scale media strategy |

| AEW | Khan Family | Private billionaire ownership | Tony Khan and Shahid Khan | Centralized family control with unified creative and business leadership | Flexible decision-making, strong financial backing, independent operations |

| NJPW | Bushiroad | Corporate media ownership | Bushiroad executive leadership | Parent-company guided corporate structure | Brand-focused growth, cross-media integration, international expansion |

WWE – Owned by TKO Group Holdings (Public Corporate Structure)

WWE operates under TKO Group Holdings, a publicly traded sports and entertainment company. TKO was formed after the merger of WWE and UFC under Endeavor’s ownership structure. This makes WWE part of a large global corporate entity rather than an independent wrestling company.

Because TKO is publicly traded, WWE ownership is spread across institutional investors, shareholders, and corporate insiders. No single individual owns WWE outright. However, Endeavor Group remains the largest controlling stakeholder within TKO. WWE operates with a corporate board, structured governance, and shareholder accountability. Strategic decisions are made at the corporate level rather than solely within the wrestling division.

This model provides massive financial backing, global media reach, and strong investor confidence. However, it also means WWE must meet shareholder expectations and corporate performance targets.

AEW – Privately Owned by the Khan Family (Billionaire Ownership Model)

All Elite Wrestling operates under private ownership led by Tony Khan. The promotion is financially backed by his father, Shahid Khan, a billionaire businessman and owner of major sports franchises. This makes AEW a privately funded wrestling company with centralized family control.

Tony Khan serves as the CEO, President, and Head of Creative. This gives him direct control over both business and creative operations. Unlike WWE, AEW does not answer to public shareholders. Decisions are made internally within the Khan family structure.

This ownership model allows flexibility and fast decision-making. It also provides strong financial security due to the Khan family’s wealth. However, the company relies heavily on a single ownership group rather than a diversified corporate structure.

NJPW – Owned by Bushiroad (Corporate Media Ownership)

New Japan Pro-Wrestling operates under Bushiroad, a Japanese entertainment and media company. Bushiroad acquired NJPW to strengthen its sports and content portfolio. This structure is similar to TNA in some ways, as both operate under a parent media company rather than individual ownership.

Bushiroad provides financial support, marketing infrastructure, and cross-promotion across its entertainment properties. NJPW benefits from corporate backing while maintaining its wrestling identity. Strategic decisions are influenced by the parent company’s long-term media strategy.

This model focuses on steady growth, brand consistency, and international expansion rather than aggressive competition with larger global promotions.

TNA Wrestling – Owned by Anthem Sports & Entertainment (Media-Backed Private Ownership)

TNA Wrestling operates under Anthem Sports & Entertainment, a privately held media company. Unlike WWE, TNA is not publicly traded. Unlike AEW, it is not controlled by a single billionaire owner. Instead, it functions as a subsidiary within a mid-sized media group.

Anthem provides financial stability, television distribution, and corporate governance. Strategic decisions are made at the parent company level, while daily wrestling operations are handled by TNA leadership. This structure offers stability without public market pressure. It also ensures long-term operational continuity.

Compared to competitors, TNA’s ownership sits between two extremes. It is more structured than AEW’s individual ownership model but less corporate-heavy than WWE’s public shareholder system. This balanced structure allows TNA to operate efficiently while maintaining independence in creative and brand direction.

Who Controls TNA Wrestling?

Control of TNA Wrestling follows a structured corporate hierarchy. The promotion is owned by Anthem Sports & Entertainment. Strategic authority sits at the parent company level. Daily operations are handled by TNA’s executive leadership. This layered structure separates corporate governance from wrestling operations. It ensures financial oversight, stable management, and consistent decision-making.

Leonard Asper – Chief Executive Officer of Anthem Sports & Entertainment

Leonard Asper is the Chief Executive Officer of Anthem Sports & Entertainment. As the top executive of the parent company, he is the ultimate authority behind TNA Wrestling. He oversees corporate strategy, financial direction, and long-term planning. His role focuses on high-level governance rather than day-to-day wrestling operations.

Asper played a key role in acquiring and stabilizing TNA during its most difficult period. Under his leadership, Anthem strengthened media distribution, improved its financial structure, and rebuilt the brand. All major strategic decisions related to TNA, including investment, restructuring, and expansion, ultimately fall under his corporate authority.

Anthony Cicione – President of TNA Wrestling

Anthony Cicione serves as President of TNA Wrestling. He manages the promotion’s day-to-day business operations. His responsibilities include brand direction, business strategy, partnerships, and operational execution. Cicione acts as the primary executive leader within the wrestling division.

He works closely with Anthem leadership to align corporate strategy with wrestling operations. His role ensures smooth management of events, talent operations, and long-term brand growth. Cicione represents the bridge between corporate ownership and the wrestling product.

Creative and Wrestling Operations Leadership

Creative direction and wrestling operations are handled by an internal leadership team. This includes producers, talent relations executives, and booking decision-makers. They shape storylines, roster development, and event planning.

While creative leaders manage the wrestling product, final authority still aligns with executive leadership. This ensures business strategy and creative direction remain coordinated. The structure allows operational flexibility while maintaining corporate oversight.

Corporate Decision-Making Structure

TNA operates under a centralized corporate governance model. Major decisions such as financial planning, large investments, distribution agreements, and long-term strategy are guided by Anthem Sports & Entertainment. The parent company provides financial backing and strategic control.

Operational decisions related to shows, talent, and events are handled within TNA leadership. This separation allows efficient daily management while keeping long-term control centralized. The structure prevents leadership instability, which affected the company in earlier years.

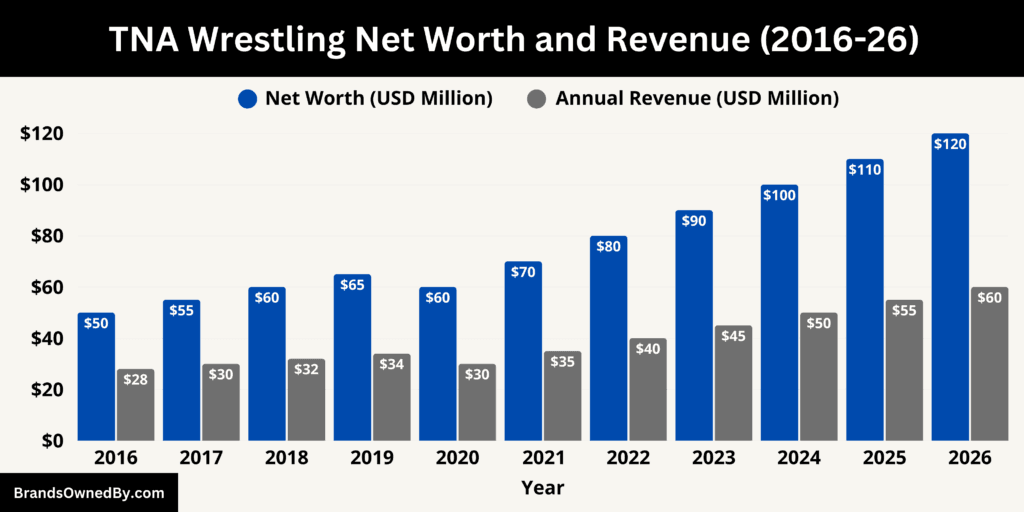

TNA Wrestling Annual Revenue and Net Worth

As of February 2026, TNA Wrestling generates approximately $60 million in annual revenue and holds an estimated enterprise value of about $120 million. It has maintained steady growth since Anthem stabilized operations, with increasing reliance on media, streaming, and recurring event income rather than volatile live-event dependency.

TNA Wrestling Revenue in 2026

In 2026, total revenue is estimated at $60 million. Media and broadcasting rights remain the largest contributor, generating roughly $25 million. This includes domestic television distribution, international syndication, and content licensing across Anthem-owned networks and partner platforms. TNA produces over 120 hours of annual original programming, which supports consistent media revenue.

Digital streaming through the TNA+ platform contributes approximately $13 million. This includes monthly subscriptions, premium live event purchases, and archive access. Subscriber growth has been driven by global distribution expansion and the monetization of TNA’s historical content library.

Live events and touring generate close to $9 million annually. The promotion runs multiple major events each year, including Bound for Glory and Slammiversary, along with television tapings and international shows. Attendance levels remain modest compared to larger competitors but stable enough to support predictable income.

Merchandise and licensing account for about $7 million. This includes branded apparel, replica championships, collectibles, and online retail sales. Sponsorships, advertising, and brand partnerships generate roughly $6 million, supported by integrated promotion across Anthem’s media ecosystem.

Overall revenue reflects a balanced model driven primarily by media and digital monetization rather than live gate dependency.

TNA Wrestling Net Worth in 2026

TNA Wrestling’s estimated net worth as of February 2026 stands at $120 million. This valuation is based on intellectual property, brand equity, media rights value, and recurring revenue stability. One of the company’s largest assets is its historical video library, which spans more than two decades of wrestling content. This archive generates ongoing licensing and streaming value.

Brand value also contributes significantly to net worth. The return to the TNA name strengthened recognition and historical positioning within the wrestling industry. Operational infrastructure, production equipment, and long-term media agreements further support valuation.

The company’s value has increased steadily from approximately $50 million in 2016 to $120 million in 2026, reflecting improved financial management, stable ownership, and recurring revenue growth.

Revenue Composition and Segment Data

Media rights contribute approximately 42 percent of total revenue, making it the largest income stream. Digital streaming represents around 22 percent and continues to grow as subscription numbers increase globally. Live events contribute roughly 15 percent, reflecting a reduced dependence on ticket sales compared to earlier years.

Merchandise and licensing generate close to 12 percent of total revenue, supported by direct-to-consumer online sales. Sponsorship and advertising account for about 9 percent. This diversified structure reduces financial volatility and supports a predictable annual cash flow.

The shift toward media and digital monetization has been the most important financial change in the company’s modern era.

Financial Growth Trend

TNA Wrestling has shown consistent long-term improvement. Annual revenue increased from about $28 million in 2016 to $60 million in 2026, representing more than 110 percent growth over ten years. Net worth rose from roughly $50 million to $120 million during the same period.

This growth was driven by Anthem’s corporate restructuring, stronger distribution deals, expansion of digital streaming, and controlled operational costs. The company moved from financial instability to stable profitability with predictable recurring income.

Future Revenue Forecast

Projected revenue growth remains moderate but steady, supported by digital expansion and international media distribution.

- 2027: Estimated revenue $65 million, driven by growth in TNA+ subscriptions and expanded international syndication

- 2028: Estimated revenue $69 million, supported by higher premium event sales and stronger licensing income

- 2029: Estimated revenue $72 million, reflecting continued media rights growth and digital monetization expansion

- 2030: Estimated revenue $75 million, driven by long-term streaming scale and broader global distribution

TNA Wrestling is expected to maintain stable financial performance rather than rapid expansion. The company’s diversified revenue model, media-driven strategy, and consistent event calendar position it for sustainable growth through the end of the decade.

Brands Owned by TNA Wrestling

TNA Wrestling functions primarily as a content and intellectual-property driven wrestling promotion. Its core assets are internal brands, media properties, divisions, championships, and event franchises that directly generate revenue and audience engagement. These entities form the operational backbone of the company as of 2026.

| Entity / Brand | Type | Primary Function | Core Revenue Role | Strategic Importance |

|---|---|---|---|---|

| TNA Impact | Weekly Flagship TV Program | Main storytelling platform, championship programs, talent positioning, and event promotion | Broadcast licensing, advertising, and distribution income | Central content engine driving audience engagement and brand visibility |

| TNA Xplosion | Secondary / International Show | Extended matches, emerging talent exposure, and international content distribution | Supports overseas broadcast contracts and content volume monetization | Expands global reach and supports talent development pipeline |

| TNA+ Streaming Platform | Digital Streaming Service | Hosts weekly shows, premium live events, exclusive specials, and historical archive | Subscription revenue and premium event purchases | Direct-to-consumer distribution and recurring digital income |

| Bound for Glory | Flagship Annual Event | Year-end premier event featuring top championship matches and major storyline conclusions | Premium event sales, sponsorships, and merchandise surge | Most valuable event property and major annual revenue driver |

| Slammiversary | Anniversary Premium Event | Celebrates company history, milestone matches, and major storyline developments | Streaming purchases, ticket sales, and legacy-driven merchandise demand | Strengthens brand heritage and long-term audience loyalty |

| Hard to Kill | Annual Premium Event | Sets early-year storyline direction, major title matches, and roster positioning | Early-year premium event revenue and subscriber engagement | Stabilizes first-quarter revenue and drives yearly narrative reset |

| TNA Knockouts Division | Women’s Wrestling Brand | Dedicated women’s championship division with independent storylines and roster | Merchandise, branding partnerships, and viewership engagement | Major competitive differentiator and global reputation builder |

| X-Division | High-Speed Wrestling Division | Fast-paced, innovative in-ring competition and international talent attraction | Digital replay value and fan engagement-driven monetization | Unique brand identity and global talent gateway |

| TNA World Championship Brand | Main Event Championship Structure | Top-tier championship, ranking hierarchy, and headline storyline focus | Drives main-event marketability and merchandise linked to top champions | Core storytelling axis and brand prestige driver |

| TNA Tag Team Division | Tag Team Competition Division | Dedicated tag team championship and long-term rivalry development | Merchandise tied to team branding and event match quality value | Supports roster depth and enhances match quality across events |

| TNA Production and Media Operations | Internal Production Unit | Handles filming, broadcasting, post-production, and content management | Content licensing, archive monetization, and production cost control | Ensures full control over content lifecycle and operational independence |

TNA Impact

TNA Impact is the company’s primary weekly television program and the central engine of its business. The show is produced in high-volume taping blocks, typically generating over 100 hours of original content annually. It drives television distribution agreements, advertising inventory, and storyline continuity across all company platforms. Most championship programs, talent pushes, and long-term rivalries originate on Impact. The show also functions as the main promotional vehicle for premium live events, which significantly influences pay-per-view sales and streaming subscriptions.

From a commercial perspective, Impact generates the largest share of media revenue through broadcast licensing, international syndication, and digital replay rights. The show also plays a key role in talent branding, merchandise demand, and audience retention across the TNA+ ecosystem.

TNA Xplosion

TNA Xplosion is produced as a supplementary wrestling program targeted mainly at international markets. Unlike Impact, Xplosion emphasizes full-length matches, emerging talent exposure, and extended in-ring performance rather than heavy storyline development. The show is often packaged for overseas television partners and digital distribution, helping TNA maintain a continuous global presence even outside its core domestic market.

Xplosion supports revenue indirectly by strengthening international distribution contracts and increasing content volume for broadcasters. It also acts as a developmental exposure platform, allowing newer talent to gain screen time before transitioning into major storylines on Impact or premium events.

TNA+ Streaming Platform

TNA+ is the company’s direct-to-consumer digital streaming platform and one of its most strategically important assets. The service hosts weekly programming, premium live events, exclusive specials, and the company’s historical archive. The archive includes thousands of matches, legacy pay-per-views, and classic episodes dating back to 2002. This long-tail content significantly increases subscriber retention and lifetime value.

The platform generates recurring monthly subscription income and additional event-based purchases. It also provides TNA with full control over digital distribution, eliminating reliance on third-party streaming services. TNA+ analytics are used to track viewer behavior, event popularity, and market demand, which directly informs programming and event strategy.

Bound for Glory

Bound for Glory is the company’s flagship annual event and its most valuable event property. It serves as the culmination of major storylines and often features the highest-stakes championship matches of the year. Historically, the event has delivered the promotion’s strongest annual buy rates, live attendance, and global viewership.

From a business standpoint, Bound for Glory drives a major portion of yearly premium event revenue. It also boosts merchandise sales, sponsorship integration, and international licensing value. The event strengthens brand prestige and often introduces long-term storyline resets that shape the following year’s programming cycle.

Slammiversary

Slammiversary commemorates the founding of TNA Wrestling and functions as both a legacy celebration and a major commercial event. It frequently includes milestone matches, title changes, and appearances by historically significant talent. The event leverages nostalgia and brand heritage to attract long-time viewers while promoting current roster strength.

Commercially, Slammiversary performs consistently across streaming purchases, ticket sales, and digital engagement. The event is also used strategically to introduce new talent, launch major rivalries, and test market response to evolving creative directions.

Hard to Kill

Hard to Kill is positioned as a pivotal early-year premium event that establishes narrative direction for the rest of the calendar year. It often features championship resets, faction developments, and long-term storyline triggers. The event typically performs strongly in digital purchases due to its placement early in the annual cycle when audience engagement resets.

From an operational perspective, Hard to Kill helps stabilize first-quarter revenue and maintains subscriber engagement following the post-holiday slowdown period. It also plays a role in talent repositioning and brand refresh initiatives.

TNA Knockouts Division

The Knockouts Division represents TNA’s women’s wrestling brand and has been a defining competitive advantage for the company. The division operates with its own championship structure, talent pipeline, and storyline continuity. It has historically contributed strong viewership and fan loyalty, particularly during periods when women’s wrestling gained global prominence.

The division generates measurable commercial value through dedicated merchandise, branding partnerships, and fan engagement. It also strengthens the company’s global positioning by maintaining a reputation for competitive women’s wrestling rather than treating it as a secondary product.

X-Division

The X-Division is a unique competitive format created and owned by TNA. It focuses on speed, innovation, and high-risk wrestling rather than traditional weight classifications. This division played a major role in shaping TNA’s early brand identity and continues to attract technically skilled and internationally recognized talent.

The X-Division Championship remains one of the company’s most historically significant titles. Matches within this division often generate high replay value on streaming platforms and contribute to digital engagement metrics. The division also supports international talent scouting and cross-promotional relationships.

TNA World Championship Brand

The TNA World Championship represents the top competitive tier and the central storytelling axis of the promotion. The championship brand includes title lineage, ranking hierarchy, and main-event positioning across all programming and events. Championship storylines directly influence pay-per-view performance, audience retention, and merchandise demand tied to top-tier wrestlers.

From a commercial perspective, the world title picture drives the company’s main-event marketability. Champions often serve as brand representatives in promotional campaigns, international marketing, and sponsorship integration.

TNA Tag Team Division

The Tag Team Division has historically been one of TNA’s strongest in-ring product segments. The division operates with its own championship titles, dedicated talent roster, and long-form rivalries. Tag team wrestling has consistently contributed to match quality and audience engagement across weekly programming and premium events.

The division supports mid-card depth while also producing headline matches during major events. Tag team branding also generates merchandise opportunities tied to popular team identities and catchphrases.

TNA Production and Media Operations

TNA Wrestling maintains an internal production and media unit responsible for television production, live broadcasting, post-production, and digital content management. This division produces weekly programming, premium live events, documentary-style specials, and archive remastering. The company controls its full content lifecycle from filming to distribution.

Operationally, this division ensures consistent content output and cost control. The company’s large video archive is actively monetized through streaming and licensing. Production infrastructure and broadcast capability form a key part of TNA’s long-term asset base and operational independence.

Final Words

TNA Wrestling has come a long way from its early struggles. The promotion is now fully owned by Anthem Sports & Entertainment, with Leonard Asper as the ultimate controlling figure. Stable ownership has allowed the brand to rebuild, grow internationally, and return to its original TNA identity. While smaller than WWE and AEW, TNA remains a significant player in global professional wrestling with a loyal fanbase and consistent operations.

FAQs

Is TNA owned by WWE?

No, TNA Wrestling is not owned by WWE. The two promotions are completely separate companies with different ownership, management, and business structures. TNA operates under Anthem Sports & Entertainment, while WWE functions as part of TKO Group Holdings. There is no ownership overlap, merger, or corporate control between the two organizations.

Who owns TNA Wrestling company?

TNA Wrestling is fully owned by Anthem Sports & Entertainment as of 2026. The promotion operates as a privately held subsidiary within Anthem’s sports and media division. Anthem provides financial backing, media distribution, and corporate governance, making it the sole controlling owner of the TNA Wrestling company.

Did Vince McMahon buy TNA?

No, Vince McMahon has never purchased TNA Wrestling. Throughout its history, TNA has been owned by different investors and later acquired by Anthem Sports & Entertainment in 2017. Vince McMahon was historically associated only with WWE and was never involved in the ownership or acquisition of TNA.

Who owns TNA Impact Wrestling?

TNA Impact Wrestling, now officially branded again as TNA Wrestling, is owned by Anthem Sports & Entertainment. The rebranding did not change ownership. The promotion continues to operate under Anthem’s corporate control with centralized financial and strategic management.

Are TNA and WWE owned by the same company?

No, TNA and WWE are not owned by the same company. TNA Wrestling is owned by Anthem Sports & Entertainment, a private media company. WWE, on the other hand, is owned by TKO Group Holdings, a publicly traded sports and entertainment corporation. The two promotions operate independently with no shared ownership or corporate governance.

Does Vince McMahon own TNA Impact Wrestling?

No, Vince McMahon does not own TNA Impact Wrestling. He has never held any ownership stake in the promotion. TNA has been under the ownership of Anthem Sports & Entertainment since 2017, and corporate control remains with Anthem’s leadership.

Is TNA owned by TKO?

No, TNA Wrestling is not owned by TKO Group Holdings. TKO owns WWE and UFC as part of its sports entertainment portfolio. TNA operates separately under Anthem Sports & Entertainment and has no corporate connection to TKO.