- Frontier Airlines is publicly traded, but ownership influence is concentrated. The largest shareholder is William A. Franke, who controls about 30% of outstanding shares, giving him substantial influence over board decisions and long-term strategy.

- Indigo-affiliated entities, including Indigo Partners and related holding structures, collectively hold roughly 15% of shares, reinforcing continuity in Frontier’s ultra-low-cost operating model.

- Major institutional investors also play a role, with Wildcat Capital Management owning around 12%, while large asset managers like Vanguard hold smaller passive stakes of about 3.4%. Public and retail shareholders make up the remaining portion, providing liquidity but limited control.

Frontier Airlines is an American ultra-low-cost carrier based in Denver, Colorado. The airline operates a modern fleet focused on fuel efficiency and cost reduction. Frontier’s business model emphasizes very low base fares with optional paid add-ons for baggage, seat assignments, and other services.

The airline serves destinations across the contiguous United States, the Caribbean, Mexico, and select Central American markets using a point-to-point network. Its brand identity is often associated with the animal graphics on aircraft tails and a strong focus on sustainable operations.

The carrier has grown steadily since the mid-1990s, adapting to competitive pressures and evolving travel demand while maintaining its low-fare ethos.

Founders and Early Leadership

Frontier Airlines in its current form was launched in 1994 by a group of industry veterans and executives with prior ties to the original Frontier that operated from 1950 until 1986. The key figures in this founding team include:

- Frederick W. “Rick” Brown: Rick Brown was a founding executive who brought leadership experience to the startup. He played a central role in conceptualizing and establishing the new carrier after the original Frontier ceased operations.

- Janice Brown: Janice Brown, who had worked with the original Frontier Airlines, contributed industry insight and helped shape early operations.

- Bob Schulman: Bob Schulman also served as a founder with prior experience from the original Frontier. His involvement provided operational and strategic continuity from the legacy carrier.

- Sam Addoms: Sam Addoms joined the founding team as executive vice-president and treasurer. He later assumed the role of CEO, guiding early growth and corporate development.

In its formation, Frontier drew heavily on talent from the earlier airline, with roughly three-quarters of its initial workforce having experience with the original Frontier. This heritage helped establish the new airline’s operational capabilities and regional market focus.

Ownership History

The ownership history of Frontier Airlines reflects the broader evolution of the U.S. airline industry. The company has transitioned from founder-led ownership to corporate control, private equity stewardship, and finally public market participation. Each phase reshaped Frontier’s strategy, culture, and operating model.

Founder-Led and Public Shareholder Era (1994–2008)

Frontier Airlines began operations in 1994 as an independently run airline. Ownership was initially held by its founders, early executives, employees, and public shareholders. The company went public relatively early in its life, which was common for airlines during that period.

During this phase, Frontier operated as a hybrid carrier. It combined elements of low-cost pricing with full-service features. Ownership was widely dispersed, with no single controlling shareholder. Strategic decisions were driven by management and the board, with pressure from public markets to grow routes and market share.

This structure left Frontier vulnerable during economic downturns. Rising fuel costs and intense competition weakened its financial stability. By 2008, the airline could no longer sustain its cost structure under public ownership.

Bankruptcy and Republic Airways Ownership (2008–2013)

In 2008, Frontier Airlines filed for Chapter 11 bankruptcy protection. This marked a major ownership reset. Public shareholders were effectively wiped out as part of the restructuring process.

In 2009, Frontier was acquired out of bankruptcy by Republic Airways Holdings. Under the Republic, Frontier became a wholly owned subsidiary. Ownership was centralized under a corporate parent rather than public investors.

Republic Airways initially aimed to operate Frontier as a low-cost branded airline within a broader portfolio. However, strategic misalignment soon emerged. Republic’s core business focused on regional flying under capacity purchase agreements, not independent low-cost operations. Frontier struggled to compete effectively during this period, and its long-term position remained uncertain.

Acquisition by Indigo Partners and Strategic Transformation (2013–2021)

A decisive shift occurred in 2013 when Frontier Airlines was acquired by Indigo Partners. This acquisition fundamentally changed Frontier’s ownership philosophy.

Indigo Partners is known for specializing in ultra-low-cost carriers worldwide. Upon taking ownership, Indigo installed new leadership, restructured costs, and repositioned Frontier as a pure ultra-low-cost airline. Ownership was concentrated, with Indigo becoming the controlling shareholder.

Under private ownership, Frontier exited legacy service elements. It standardized its fleet, densified seating, and fully embraced ancillary revenue. This period marked Frontier’s most dramatic operational transformation. Decision-making became centralized and long-term, free from quarterly public market pressures.

Return to Public Markets with Anchor Ownership (2021–Present)

In 2021, Frontier Airlines returned to the public markets through an initial public offering. Shares were listed on NASDAQ, allowing institutional and retail investors to participate once again.

However, this IPO did not dilute control in the traditional sense. Indigo Partners retained a large ownership stake and significant voting influence. As of 2025, Indigo remained the single largest shareholder, holding roughly one-third of outstanding shares and exercising outsized control through board representation.

Today, Frontier operates under a hybrid ownership structure. It is publicly traded, but strategic control remains concentrated. Institutional investors hold minority positions, while Indigo Partners continues to guide long-term direction.

Who Owns Frontier Airlines: Top Shareholders

Frontier Airlines is a publicly traded American ultra-low-cost airline headquartered in Denver, Colorado. The airline operates under Frontier Group Holdings, Inc., which is listed on NASDAQ.

It has a mixed ownership structure made up of a dominant long-term aviation investor, private investment entities, major institutional shareholders, and public investors.

As of 2026, Frontier Airlines’ ownership is defined by strong influence from Indigo-affiliated stakeholders, particularly its chairman, alongside large hedge funds and index managers. While shares trade publicly, effective control remains concentrated among a small group of influential shareholders who shape strategy, governance, and leadership direction.

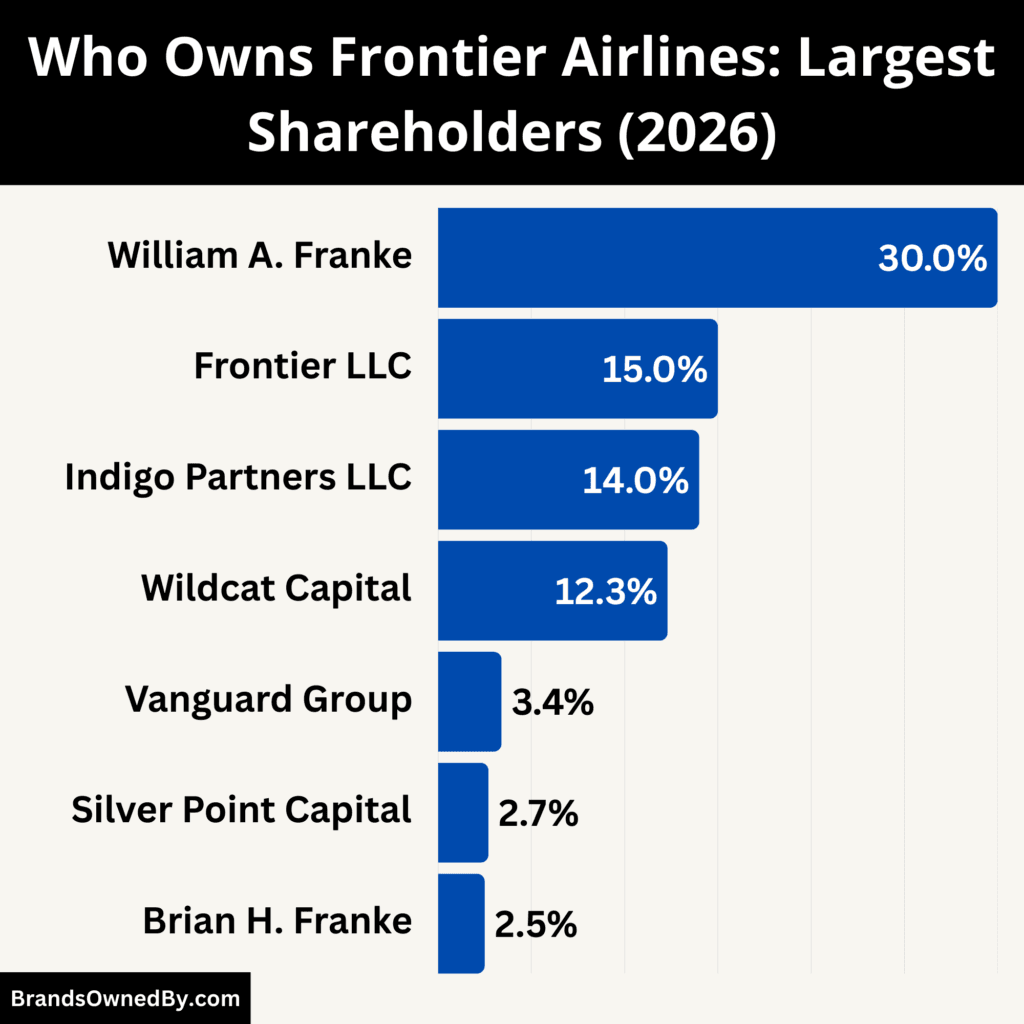

Below is a list of the major shareholders of Frontier Airlines as of February 2026:

William A. Franke – Largest Individual Shareholder

Bill Franke is the airline’s largest individual shareholder. As of late 2025 data, he owns close to 30% of Frontier Group Holdings’ outstanding shares. His stake is held either directly or through affiliated entities connected to his long-term investment in the airline.

Franke’s influence extends beyond ownership percentage. He is the Chairman of the Board of Frontier Group. His role gives him significant say in strategic decisions, governance, and executive appointments. Franke is also a co-founder and managing partner of Indigo Partners, the firm that originally acquired Frontier in 2013 and ushered the airline into its ultra-low-cost era.

Group Holdings – Frontier LLC

Group Holdings – Frontier LLC is a private holding company with a significant block of Frontier’s shares. It holds roughly 15% of the company’s outstanding stock.

This entity functions as a consolidated vehicle for related investors and sometimes reflects coordinated positions aligned with strategic leadership. Its stake supports stability in ownership and board representation.

Indigo Partners LLC – Private Equity Stake

Indigo Partners itself retains a notable ownership position of about 14% of Frontier Group’s shares after recent restructurings and share distributions.

Indigo Partners is best known for investing in low-cost carriers globally, including carriers like JetSMART, Volaris, and others in its portfolio. Its stake in Frontier aligns with its broader strategy to shape low-cost airline growth.

While Indigo’s direct share percentage is lower than in earlier years due to distributions of stock to individual investors and partners, its influence remains meaningful through board seats and historical leadership of the airline.

Wildcat Capital Management, LLC – Institutional Holder

Wildcat Capital Management, LLC is a significant institutional investor in Frontier Group Holdings, owning about 12.3% of outstanding stock.

This hedge fund’s involvement reflects its broader strategy of concentrated positions in select companies. Its stake is large enough to merit attention during governance discussions and can influence shareholder voting on key issues.

The Vanguard Group, Inc. – Index and Passive Ownership

The Vanguard Group, Inc. is a major global asset manager that often holds shares on behalf of indexed and mutual funds. It owns roughly 3.4% of Frontier’s shares.

Though its stake is relatively modest compared with the largest individual holders, Vanguard’s position reflects the airline’s inclusion in broader market indices and passive investment portfolios.

Silver Point Capital, L.P. – Specialized Investment Position

Silver Point Capital, L.P. is a credit- and special situations-focused investment firm that holds around 2.7% of Frontier Group’s shares.

This type of investor often seeks value through specialized strategies and may have influence in contexts like debt structure decisions or during times of market stress.

Brian H. Franke – Director and Smaller Stakeholder

Brian H. Franke, a board member and relative of William A. Franke, also holds a smaller stake in Frontier (about 2.5%).

Even though his percentage is modest, his dual role as both shareholder and corporate insider adds to the concentration of influence among key strategic leadership.

Other Institutional and Retail Holders

Beyond the major named holders, Frontier shares are held by dozens of other institutional investors, smaller funds, and individual retail investors. These positions collectively make up the remaining portion of publicly traded stock. Some of these include diversified financial institutions, index fund vehicles, and regional investment managers that participate through standard investment channels.

Competitor Ownership Comparison

Comparing how Frontier Airlines is owned against its major competitors helps reveal strategic differences. Ownership structure influences long-term decisions, financial flexibility, and operational priorities. Some airlines are widely held by public investors. Others have concentrated ownership or private equity influence. Below, ownership is compared across key U.S. carriers for context.

| Airline | Ownership Type | Largest Shareholder Profile | Ownership Concentration | Control Characteristics |

|---|---|---|---|---|

| Frontier Airlines | Public company with concentrated ownership | Aviation-focused private investor (Indigo-affiliated leadership) | High | Strategic control influenced by a dominant long-term shareholder with board authority |

| Spirit Airlines | Public company | Institutional investors (no controlling owner) | Low | Decisions driven by board consensus and public market expectations |

| Southwest Airlines | Public company | Large asset managers and index funds | Very low | Broad shareholder base with traditional corporate governance |

| United Airlines | Public company | Diversified institutional investors | Very low | Management accountable to a wide range of public shareholders |

| Delta Air Lines | Public company | Institutional and retail investors | Very low | Strong management autonomy within dispersed ownership model |

| American Airlines | Public company | Institutional investors and retail holders | Very low | Ownership widely spread, subject to market and activist pressures |

| European Low-Cost Peers (general model) | Public or mixed | Varies by carrier | Medium to low | Some private equity history, but limited long-term control after IPOs |

Frontier vs Spirit Airlines

Frontier and Spirit are both ultra-low-cost carriers (ULCCs), but their ownership structures differ.

Spirit Airlines is publicly traded on the NYSE. Its ownership is broadly dispersed among institutional and retail investors. No single shareholder exerts controlling influence like Indigo Partners does at Frontier.

Institutional investors such as large asset managers own the largest blocks of Spirit’s shares, but none hold a dominant seat on the board. As a result, strategic decisions at Spirit are shaped more by public market expectations and consensus among diverse shareholders. Frontier’s ownership, by contrast, remains concentrated with long-term aviation investors through Indigo-affiliated positions, which provides stability but less broad shareholder oversight.

Frontier vs Southwest Airlines

Southwest Airlines also operates as a publicly traded company, with widely held shares through index funds, mutual funds, and institutional managers. No private equity firm or single individual controls a majority position.

Southwest’s ownership is more typical of legacy U.S. carriers. Large institutional holders like pension funds and diversified asset management firms comprise the biggest stakes. Decision-making at Southwest is driven by a traditional board of directors accountable to many large public owners. Frontline strategic shifts must align with broad investor expectations and governance norms. Frontier’s ownership concentrated among a few investors gives it different decision dynamics.

Frontier vs Major Legacy Carriers

Major U.S. legacy airlines like United Airlines, American Airlines, and Delta Air Lines also have widely dispersed ownership.

These carriers are included in major stock indices. Their shares are held by a diverse mix of institutional and retail holders, with no dominant private equity owner. Large index managers and diversified funds hold meaningful positions, but they do not typically exert outsized influence compared to a structured controlling stakeholder.

Because of this dispersion, strategic decisions at legacy carriers must balance the interests of many large institutional investors. Public scrutiny, quarterly earnings expectations, and activist investor pressures play significant roles. Frontier’s position, where a dominant owner maintains strategic direction while still being public, is less common among these peers.

Frontier vs Airlines with Private Equity Backing

Some airlines outside the U.S. have private equity influence similar to Frontier’s, but few U.S. competitors share this trait.

Indigo Partners, through its early acquisition of Frontier, positioned the airline with a controlling stake and a consistent ultra-low-cost identity. Comparatively, other carriers have seen private equity interest at various points (e.g., acquisitions or takeovers), but few retain that influence in the public era.

For example, European low-cost carriers have had varying degrees of private equity ownership, but most transitioned to broader public participation over time. Frontier’s retention of strong influence by an aviation-focused private equity investor sets it apart in the U.S. market.

Implications of Ownership Differences

Ownership structure affects more than who holds shares. It determines:

- Strategic Direction: Concentrated ownership like Frontier’s enables long-term strategic continuity without pressure from a broad mix of quarterly-focused institutional investors.

- Leadership Stability: A dominant investor can promote stable leadership appointments that align with long-term goals.

- Market Perception: Public carriers with dispersed ownership can experience rapid stock price shifts due to broader market sentiment. Frontier’s concentrated base often tempers that effect.

Frontier’s ownership structure is unique among its U.S. ULCC and legacy peers. Its blend of public share trading with concentrated private equity influence creates a hybrid model. Other competitors rely more on broad institutional ownership and market discipline, giving them different strategic and governance dynamics.

Who Controls Frontier Airlines?

Control at Frontier Airlines is shaped by a combination of executive leadership, board oversight, and influential shareholders. While the airline is publicly traded, decision-making authority is not evenly distributed among all shareholders. Instead, control is concentrated through leadership roles and board influence tied to long-term aviation investors.

Role of Frontier Group Holdings, Inc.

Frontier Group Holdings is the publicly listed parent company of Frontier Airlines. All corporate governance, executive appointments, and strategic approvals flow through this holding company structure.

Shareholders elect the board of directors. The board then oversees management and approves major decisions. These include fleet orders, route expansion, leadership appointments, and long-term strategic shifts. Although shares trade publicly, this structure allows a small group of influential stakeholders to guide outcomes.

Chief Executive Officer and Executive Leadership

The day-to-day control of Frontier Airlines rests with its Chief Executive Officer and senior management team.

As of 2026, the CEO is Barry Biffle. He has led Frontier since 2016 and is one of the longest-serving airline CEOs in the U.S. ultra-low-cost sector. Under his leadership, Frontier is fully committed to the ULCC model. This included aggressive cost discipline, fleet standardization, and network experimentation.

The CEO oversees all operational functions. These include route planning, pricing strategy, labor relations, and brand positioning. Executive decisions are aligned closely with board expectations and shareholder priorities, particularly those of dominant long-term investors.

Other senior executives manage finance, operations, commercial strategy, and regulatory compliance. However, major strategic shifts require board approval.

Board of Directors and Governance Power

The board of directors plays a central role in controlling Frontier Airlines.

The board approves executive compensation, long-term aircraft orders, mergers, and leadership succession. Several board members have deep experience in low-cost aviation and private equity. This composition reflects Frontier’s ownership history and current shareholder makeup.

The Chairman of the Board holds particular influence. The chairman helps set board agendas, guides CEO evaluation, and shapes strategic priorities. This role has historically been aligned with Indigo-affiliated leadership, reinforcing continuity in Frontier’s operating philosophy.

Influence of Major Shareholders

While Frontier is not legally a controlled company, its ownership concentration creates de facto control.

Large shareholders, particularly those affiliated with Indigo Partners and its leadership, exert strong influence through board representation and voting power. Their long-term investment horizon allows Frontier to prioritize structural cost advantages over short-term market reactions.

Institutional investors such as hedge funds and asset managers also hold meaningful stakes. However, they generally do not participate directly in operational control. Their influence is exercised through proxy voting, governance proposals, and performance expectations rather than hands-on management.

How Control Differs from Other Airlines

Frontier’s control structure differs from most U.S. airlines.

At legacy carriers, authority is more dispersed. Boards answer to a broad mix of institutional investors. At Frontier, control is more centralized. Strategic decisions reflect the priorities of a smaller, aviation-focused ownership group working closely with management.

This structure enables faster execution. It also reduces internal conflict between short-term shareholders and long-term strategy.

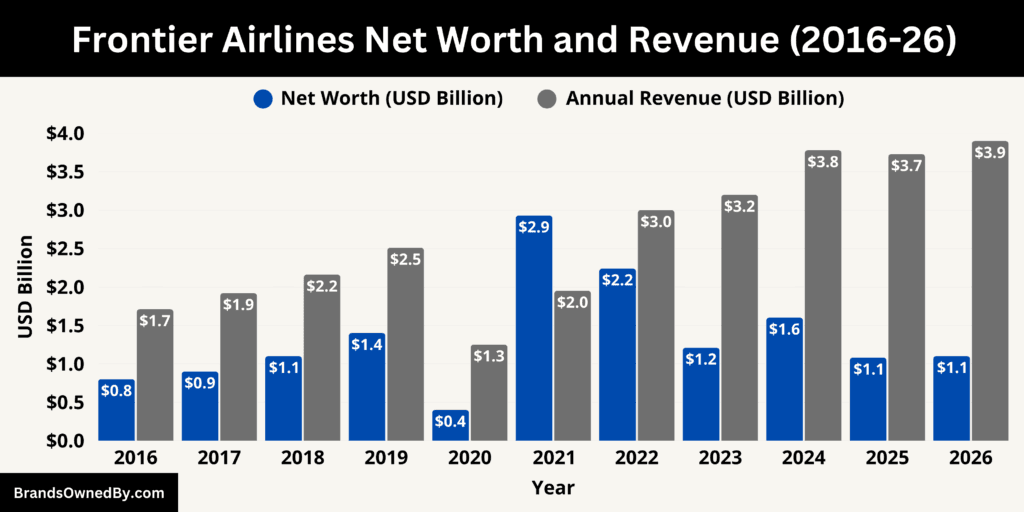

Frontier Airlines Annual Revenue and Net Worth

As of February 2026, Frontier Airlines generates approximately $3.9 billion in annual revenue and has an estimated net worth of about $1.1 billion. It places Frontier among the largest ultra-low-cost carriers in the United States by revenue, though its valuation remains constrained by industry cyclicality and intense fare competition.

2026 Revenue Breakdown

Frontier’s $3.9 billion revenue in 2026 is not evenly distributed across business lines. The airline’s model is heavily skewed toward fee-driven monetization rather than base fares alone.

Passenger ticket revenue contributes roughly $2.5–$2.6 billion, representing about 65–67% of total revenue. This comes primarily from domestic leisure routes, with limited exposure to corporate travel.

Ancillary revenue accounts for approximately $1.3–$1.4 billion, or 33–35% of total revenue. This includes carry-on and checked bag fees, seat selection, bundle products, change fees, and priority services. Frontier consistently ranks among the top two U.S. airlines in ancillary revenue per passenger, averaging well above $70 per traveler.

Other operating revenue, including loyalty program partnerships, charter flying, and miscellaneous services, contributes less than $100 million annually and remains non-core.

Revenue vs Scale

Frontier’s revenue growth over the last decade has been driven by capacity expansion, aircraft density, and route churn, not pricing power. The airline operates one of the youngest Airbus fleets in the U.S., allowing higher utilization rates. However, aggressive fare competition limits yield expansion, keeping revenue growth volume-dependent.

From 2016 to 2019, revenue grew from $1.7 billion to $2.5 billion. In 2020, revenue collapsed to $1.25 billion due to travel shutdowns. By 2024, revenue reached $3.78 billion, surpassing pre-pandemic levels by more than 50%. The 2026 figure reflects slower growth as the airline shifts from expansion to optimization.

Net Worth and Market Capitalization

Frontier’s estimated net worth of $1.1 billion, as of February 2026, reflects its public market valuation rather than its intrinsic asset value. The airline’s enterprise value is significantly higher when accounting for aircraft, leases, and route authority, but equity value remains compressed.

At roughly 0.28x–0.30x revenue, Frontier trades at a discount to broader transportation benchmarks. This is driven by thin margins, fuel price exposure, and investor skepticism toward the sustainability of ultra-low fares in a crowded domestic market.

Despite strong revenue, Frontier’s valuation has not expanded proportionally. This gap between revenue and net worth highlights the capital-intensive nature of aviation and the limited tolerance markets have for pricing volatility.

Forecasted Revenue

Frontier Airlines’ financial trajectory through 2030 reflects a shift from rapid post-pandemic expansion to disciplined, efficiency-driven growth. The airline is no longer in a phase of aggressive capacity additions. Instead, it is optimizing its existing network, aircraft utilization, and pricing structure to extract higher revenue per aircraft rather than simply adding routes.

As of 2026, Frontier Airlines generates approximately $3.9 billion in annual revenue with an estimated net worth of $1.1 billion. Future growth builds on this base rather than resetting it.

Revenue growth through 2030 is expected to average 4–5% annually, which is modest by airline standards but realistic for a mature ultra-low-cost carrier operating in a saturated U.S. leisure market.

Passenger revenue will continue to rise primarily through higher aircraft utilization and route optimization, not fare inflation. Frontier already operates among the densest Airbus configurations in the U.S., limiting further gains from seat additions. Growth, therefore, depends on flying aircraft for more hours per day and redeploying capacity to high-demand seasonal routes.

Ancillary revenue remains the most important growth lever. Frontier consistently generates over $70 per passenger in ancillary fees, among the highest in the industry. Incremental increases in baggage fees, bundled fare adoption, and seat-selection pricing are expected to push ancillary revenue growth slightly ahead of passenger growth. This allows total revenue to expand even when base fares remain flat.

Based on these drivers, projected revenue is as follows:

- 2027: $4.05 billion, reflecting full-year optimization of 2026 capacity additions

- 2028: $4.25 billion, driven by incremental international leisure routes and higher ancillary attachment rates

- 2029: $4.45 billion, assuming stable demand and limited economic disruption

- 2030: $4.70 billion, representing a mature, efficiency-maximized network

By 2030, Frontier’s revenue mix is expected to remain roughly 65% passenger revenue and 35% ancillary revenue, reinforcing its ultra-low-cost identity.

Brands Owned by Frontier Airlines

Frontier Airlines’ owned and operated entities reflect a single-brand, single-airline strategy. Every business unit exists to support the core airline operation rather than diversify away from it. This structure minimizes complexity, reduces fixed costs, and aligns directly with Frontier’s ultra-low-cost positioning.

Below is a list of the internal brands and entities owned by Frontier Airlines as of February 2026:

Frontier Airlines (Core Operating Airline)

Frontier Airlines itself is the primary and dominant operating entity. All commercial passenger services, route planning, aircraft operations, crew management, and customer-facing activities are conducted under this single airline brand.

The airline operates exclusively under the Frontier name. It does not run secondary airlines, regional feeders, or premium sub-brands. This allows Frontier to maintain a uniform cost structure, standardized service model, and consistent pricing strategy across its entire network.

Frontier Miles

Frontier Miles is Frontier Airlines’ in-house frequent flyer and loyalty program. It is fully owned and operated by the airline rather than outsourced or spun off into a separate business.

The program allows customers to earn miles based on spending rather than distance flown. Miles can be redeemed for flights, seat upgrades, and bundled fare products. Frontier Miles also functions as a revenue-generating platform through co-branded credit card partnerships and mileage sales to financial institutions.

While Frontier Miles is smaller than loyalty programs at legacy airlines, it plays an important role in customer retention and ancillary revenue generation.

Discount Den

Discount Den is a paid subscription product owned and operated directly by Frontier Airlines. It offers members access to lower fares, early access to promotions, and discounted pricing for children on select routes.

This program supports Frontier’s revenue strategy by generating recurring subscription income while encouraging repeat travel. Discount Den also helps smooth demand by locking customers into Frontier’s booking ecosystem.

The program is tightly integrated into Frontier’s pricing engine and does not operate as a standalone company.

Frontier Cargo

Frontier Cargo represents the airline’s limited cargo and belly-freight operations. It is not a separate airline or logistics company but an internal business unit.

Cargo capacity is offered on a space-available basis using existing passenger aircraft. Frontier does not operate dedicated freighters. Cargo revenue remains a minor contributor compared to passenger and ancillary revenue, but it provides incremental income without meaningful cost increases.

Aircraft Leasing and Special Purpose Entities

Frontier Airlines owns and controls several special purpose entities (SPEs) and aircraft-holding structures. These entities exist for leasing, financing, and regulatory purposes rather than branding or commercial operations.

Aircraft are often held in separate legal entities to manage risk, comply with international aviation regulations, and optimize tax and financing arrangements. These entities do not operate independently and have no public-facing presence.

Frontier Training and Operational Units

Frontier operates internal units responsible for pilot training, crew certification, safety compliance, and operational control. These functions are managed in-house rather than through external subsidiaries.

Training centers, maintenance oversight, and flight operations control remain centralized under Frontier Airlines to maintain consistency and regulatory compliance.

Final Thoughts

Frontier Airlines operates with a clear sense of direction shaped by its ownership and control structure. The airline prioritizes cost efficiency, simplicity, and scale over diversification or premium positioning. This focus explains its pricing approach, operating model, and competitive behavior. Examining who owns Frontier Airlines provides useful context, but it is the consistency of that ownership-driven strategy that continues to define how the airline competes and evolves.

FAQs

Who is Frontier Airlines owned by?

Frontier Airlines is a publicly traded company. Its largest shareholder is William A. Franke, who owns about 30% of the company. Other ownership comes from institutional investors and public shareholders.

Who owns Frontier Airways?

Frontier Airways, commonly referred to as Frontier Airlines, is owned by a mix of shareholders. Control is concentrated among Indigo-affiliated investors, led by William A. Franke, alongside hedge funds and asset managers.

Who is Frontier Airlines affiliated with?

Frontier Airlines is closely affiliated with Indigo Partners, a private equity firm specializing in ultra-low-cost airlines. While Frontier is public, Indigo-linked stakeholders exert significant influence through ownership and board roles.

Who merged with Frontier Airlines?

No airline has merged with Frontier Airlines. Frontier has grown organically through route expansion and fleet growth rather than airline mergers.

Who bought Frontier Airlines?

Frontier Airlines was acquired by Indigo Partners in 2013 after being sold by Republic Airways. That acquisition reshaped Frontier into a pure ultra-low-cost carrier.

What company owns Frontier Airlines?

No single company owns Frontier Airlines outright. It is owned by shareholders through Frontier Group Holdings, Inc., with William A. Franke and Indigo-affiliated entities holding the largest combined influence.

Did Spirit and Frontier merge?

No. Frontier Airlines and Spirit Airlines did not merge. Frontier proposed a merger in 2022, but the deal was abandoned after Spirit pursued a different transaction.

Is Frontier Airlines bankrupt?

No. Frontier Airlines is not bankrupt. It operates as an active, publicly traded airline and continues to expand routes and capacity.

Are Spirit and Frontier the same company?

No. Spirit Airlines and Frontier Airlines are separate companies with different ownership structures, management teams, and stock listings.

Who runs Frontier Airlines?

Frontier Airlines is run by its executive leadership team, led by Barry Biffle, who serves as Chief Executive Officer and oversees day-to-day operations.

Which is bigger, Spirit or Frontier?

Spirit Airlines is generally larger than Frontier Airlines in terms of fleet size, passenger volume, and overall market presence. Frontier remains one of the largest ultra-low-cost carriers but operates at a smaller scale than Spirit.

What airlines does Indigo Partners own?

Indigo Partners has invested in and controlled several ultra-low-cost airlines globally. These include Frontier Airlines, Wizz Air, Volaris, and JetSMART.