- Family Dollar is privately owned as of 2026 and operates independently after being sold in 2025. The company is no longer part of Dollar Tree and is controlled by a private equity ownership group.

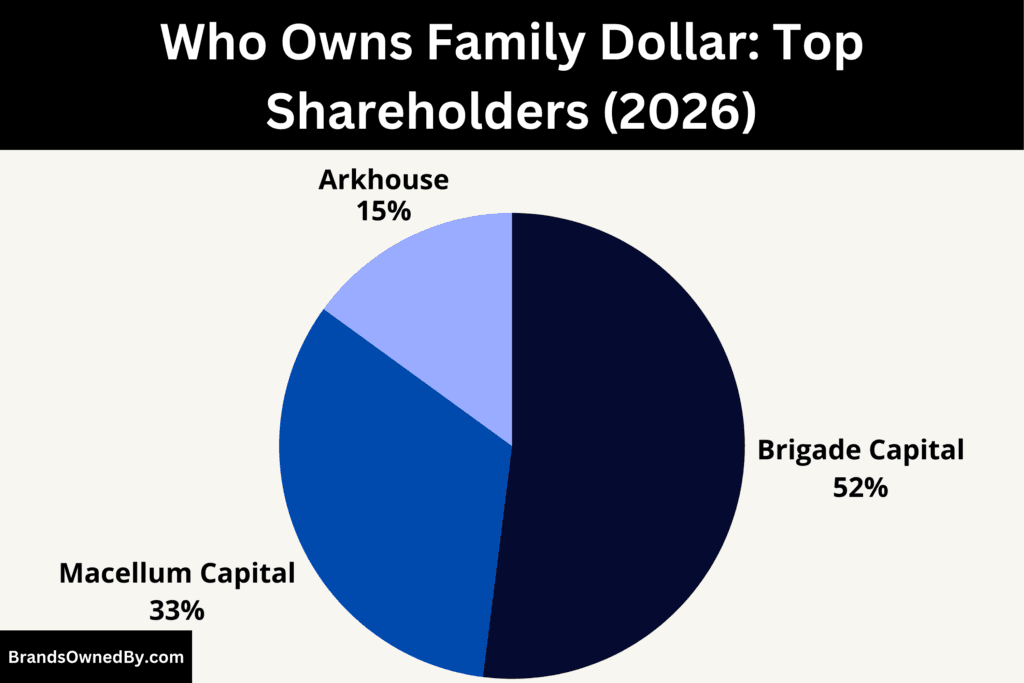

- The three main shareholders are Brigade Capital Management (52% majority stake), Macellum Capital Management (33% strategic ownership), and Arkhouse Management (15% minority stake), together holding 100% of the company.

- Brigade Capital Management is the controlling owner with majority voting power and directs corporate strategy, restructuring, and board governance, while Macellum and Arkhouse support operational turnaround and long-term business positioning.

- Ownership control rests with the private equity investors, while daily operations are handled by the CEO and executive leadership under board oversight.

Family Dollar is a neighborhood-focused discount retail chain in the United States. The company operates small-format stores that provide essential everyday goods at affordable prices. Its core product mix includes groceries, cleaning supplies, household items, health and beauty products, and seasonal merchandise. The brand targets value-conscious consumers, especially in working-class urban and rural communities.

As of 2026, Family Dollar operates as an independent private company after separating from Dollar Tree in 2025. The retailer continues to focus on convenience-based shopping.

Most stores are located close to residential areas rather than large commercial centers. This allows customers to make quick, frequent purchases. The company emphasizes affordability, private label brands, and essential goods rather than premium or luxury products.

Family Dollar remains one of the largest small-box discount retail chains in the United States. The brand plays a key role in serving underserved communities with accessible and low-cost retail options.

Family Dollar Founder

Family Dollar was founded by Leon Levine in 1959 in Charlotte, North Carolina. He was just 22 years old when he launched the first store. Levine grew up in a retail-oriented family. His parents operated a small variety store, which gave him early exposure to pricing strategy, merchandising, and customer demand.

Levine’s business vision was simple but powerful. He aimed to sell everyday essentials at very low fixed prices in neighborhood locations. His first stores focused on affordability, accessibility, and fast-moving consumer goods. This concept resonated strongly with budget-conscious households.

Under Levine’s leadership, Family Dollar expanded rapidly across the southeastern United States and later nationwide. He built the company into one of the most recognizable discount retail brands in America.

Levine remained actively involved in the business for decades and shaped the company’s culture, pricing philosophy, and community-focused retail model. He is widely regarded as a pioneer in modern discount retailing.

Ownership History

Family Dollar ownership has changed multiple times since its founding in 1959. The company moved from founder ownership to public shareholders, then became a subsidiary of Dollar Tree, and finally returned to independent private ownership in 2025.

Founder Ownership Era (1959–1970)

Family Dollar was founded and fully owned by Leon Levine in 1959. He started the business with a single store in Charlotte, North Carolina. During this period, Levine exercised complete control over the company’s strategy, pricing, and expansion decisions. The business operated as a privately held company with centralized decision-making.

Levine focused on a simple discount retail model. He targeted working-class neighborhoods and offered essential goods at very low prices. His hands-on leadership helped the company expand rapidly across the southeastern United States. By the late 1960s, Family Dollar had grown from a single store into a multi-location regional retailer. However, continued expansion required access to larger capital, which led to the next ownership transition.

Public Company Phase (1970–2015)

In 1970, Family Dollar became a publicly traded company. The initial public offering shifted ownership from Leon Levine alone to a broad base of public shareholders. Institutional investors, pension funds, and retail investors began holding shares in the company. While Levine and his family retained influence, control became shared through the board of directors.

This period marked Family Dollar’s transformation into a national discount retail chain. The company expanded aggressively across the United States. It opened thousands of stores and built a strong presence in underserved markets. Ownership during this era remained widely distributed among shareholders rather than concentrated in one entity.

Corporate governance followed a standard public company structure. Strategic decisions were made by executives and approved by the board, which represented shareholder interests. Family Dollar operated independently and competed directly with Dollar General, Walmart, and other value retailers for decades.

Dollar Tree Acquisition and Subsidiary Period (2015–2025)

A major ownership shift occurred in 2015 when Dollar Tree acquired Family Dollar after a prolonged bidding battle with Dollar General. This acquisition ended Family Dollar’s independence as a public company. Dollar Tree became the sole owner, holding 100% of the business.

Under Dollar Tree ownership, Family Dollar operated as a subsidiary rather than a separate corporation. Strategic and financial control moved to Dollar Tree headquarters. The parent company attempted to improve Family Dollar’s performance through restructuring, supply chain changes, and store optimization programs.

During this decade, Dollar Tree introduced combo stores that merged Dollar Tree and Family Dollar formats. It also closed underperforming locations and adjusted pricing and product strategies. Although the Family Dollar brand continued to exist, all major decisions were directed by Dollar Tree leadership.

Private Equity Buyout and Return to Independence (2025–Present)

In 2025, Dollar Tree decided to divest Family Dollar and sold the entire business to a private equity investor group. This marked the company’s return to independent ownership after ten years as a subsidiary.

The acquiring consortium included Brigade Capital Management, Macellum Capital Management, and Arkhouse Management. Following the transaction, Family Dollar became a privately held company with no public shareholders. Ownership is now concentrated among these investment firms.

The new owners control Family Dollar through equity stakes and board-level governance. Their focus is on operational turnaround, store modernization, and strengthening the company’s position in the discount retail sector. Unlike the Dollar Tree era, Family Dollar now operates with its own corporate structure and strategic direction.

Who Owns Family Dollar: List of Shareholders

Family Dollar ownership changed significantly in recent years. As of 2026, Family Dollar is a privately owned company. It is no longer owned by Dollar Tree. In 2025, Dollar Tree sold the entire business to a private equity investor group. Today, ownership is concentrated among a small group of investment firms that control the company through equity stakes and board influence. The investor group directs strategy, restructuring, and long-term business decisions.

2025 Acquisition of Family Dollar

The current ownership structure was created after Dollar Tree divested Family Dollar in 2025. Dollar Tree originally acquired Family Dollar in 2015 for approximately $8.5 billion. However, after years of operational challenges, underperforming stores, and restructuring costs, Dollar Tree decided to sell the business.

In mid-2025, a private equity consortium led by Brigade Capital Management and Macellum Capital Management, with participation from Arkhouse Management, acquired Family Dollar for approximately $1 billion. The transaction included the full transfer of operations, store network, supply chain infrastructure, and brand ownership.

The acquisition marked a major shift. Family Dollar separated completely from Dollar Tree and became an independent private company. The new owners implemented a turnaround strategy focused on operational efficiency, store improvement, and long-term value creation.

Brigade Capital Management — Majority Shareholder (52%)

Brigade Capital Management is the largest shareholder of Family Dollar. As of 2026, the firm holds an estimated majority stake of about 52%. This makes Brigade the controlling owner with the strongest influence over corporate decisions, board appointments, and long-term strategy.

Brigade is a global investment firm known for credit and special-situation investments. Its involvement in Family Dollar reflects a turnaround-focused strategy. The firm is leading efforts to improve operational performance, strengthen supply chain efficiency, and reposition the brand in the discount retail sector. Brigade’s majority ownership allows it to guide restructuring, capital allocation, and executive oversight.

Macellum Capital Management — Strategic Co-Owner (33%)

Macellum Capital Management is the second-largest shareholder in Family Dollar. The firm holds an estimated 33% ownership stake as of 2026. Macellum is a retail-focused investment firm with experience in corporate restructuring and operational improvement.

At Family Dollar, Macellum plays a key role in governance and strategic planning. The firm works alongside Brigade to improve merchandising strategy, store productivity, and cost structure. Macellum’s stake provides substantial voting power and board-level influence, making it a central partner in the company’s transformation and long-term positioning.

Arkhouse Management — Minority Strategic Investor (15%)

Arkhouse Management holds an estimated 15% ownership stake in Family Dollar. Although smaller than Brigade and Macellum, Arkhouse remains an important strategic investor within the ownership group.

Arkhouse specializes in real estate and retail investment. Its expertise is valuable for managing Family Dollar’s large physical store network. The firm contributes to decisions involving store portfolio optimization, lease strategy, location planning, and long-term asset value. Arkhouse participates in governance through minority board representation and strategic advisory involvement.

Competitor Ownership Comparison

Family Dollar operates in the highly competitive discount retail sector. Its ownership structure is now very different from many of its major competitors. As of 2026, Family Dollar is privately owned by a small group of investment firms, while most of its competitors are publicly traded corporations with dispersed institutional ownership.

Below is a detailed comparison of how ownership differs across the key competitors in the value retail industry:

| Company | Ownership Type | Major Shareholders / Owners | Control Structure | Key Ownership Characteristics |

|---|---|---|---|---|

| Family Dollar | Privately owned | Brigade Capital Management (52%), Macellum Capital Management (~33%), Arkhouse Management (~15%) | Concentrated private equity control | Small investor group holds majority ownership and directs strategy, restructuring, and governance |

| Dollar General | Publicly traded | Institutional investors such as Vanguard Group, BlackRock, State Street | Board-governed public company | No single controlling shareholder, ownership widely distributed among institutions and public investors |

| Walmart | Publicly traded with family control | Walton family (largest shareholder), Vanguard, BlackRock | Family-influenced governance | Walton family holds dominant voting power and strong influence over long-term corporate strategy |

| Target | Publicly traded | Institutional investors including Vanguard Group, BlackRock, State Street | Board and executive-led governance | Widely distributed ownership with no controlling shareholder |

| Dollar Tree | Publicly traded | Institutional investors and public shareholders | Standard public company structure | No majority owner, governance through shareholders and board, operates independently after Family Dollar divestiture |

Dollar General Ownership

Dollar General is one of the closest competitors to Family Dollar in the discount retail market. Unlike Family Dollar, Dollar General is an independent publicly traded company listed on the New York Stock Exchange.

Ownership of Dollar General is widely distributed among institutional investors, mutual funds, and public shareholders. The largest shareholders typically include major asset managers such as Vanguard Group, BlackRock, and State Street. No single investor holds majority control. Instead, governance is exercised through the board of directors and executive leadership.

This dispersed ownership structure allows Dollar General to operate independently without influence from a parent company or private equity owner. Strategic decisions are driven by management and shareholder voting rather than a controlling investor group.

Walmart Ownership

Walmart is the largest retail competitor in the broader value and discount segment. Its ownership structure differs significantly from both Family Dollar and Dollar General.

Walmart is a publicly traded company, but the Walton family remains the dominant shareholder. Through family holdings and trusts, the Waltons collectively control a large portion of voting power. This gives the family strong influence over corporate governance, leadership appointments, and long-term strategy.

While institutional investors such as Vanguard and BlackRock hold significant stakes, the Walton family remains the most powerful controlling group. This makes Walmart a family-influenced public corporation rather than a widely dispersed ownership company like Dollar General.

Target Ownership

Target competes with Family Dollar in the affordable retail and household essentials market, though it operates at a slightly higher price point. Target is also a publicly traded company with no single controlling shareholder.

Ownership is largely concentrated among institutional investors. The largest shareholders typically include Vanguard Group, BlackRock, and State Street. These firms hold substantial voting power collectively but do not directly manage daily operations.

Target’s governance structure is similar to Dollar General. Strategic direction is guided by the board of directors and executive leadership rather than a dominant owner. This contrasts with Family Dollar’s private equity-controlled structure.

Dollar Tree Ownership

Dollar Tree was the former parent company of Family Dollar and remains a major competitor in the discount retail space. Dollar Tree is a publicly traded corporation owned by institutional investors and public shareholders.

Before 2025, Dollar Tree fully owned Family Dollar and controlled its operations. However, after divesting the business, Dollar Tree now operates independently again. Ownership is widely distributed among large institutional investors, with no single majority shareholder.

Unlike Family Dollar’s concentrated private ownership, Dollar Tree follows a traditional public company model where governance is shared among shareholders through voting and board oversight.

Key Ownership Differences

The biggest difference lies in control concentration. Family Dollar is privately owned by a small group of investment firms that hold majority control and directly influence strategy. In contrast, Dollar General, Target, and Dollar Tree are publicly traded with dispersed institutional ownership. Walmart stands apart due to strong family control by the Walton family.

Family Dollar’s private equity ownership allows faster restructuring and centralized decision-making. Public competitors operate with broader shareholder accountability and long-term market-driven governance. These ownership differences shape how each company approaches expansion, pricing, restructuring, and competitive strategy.

Who Controls Family Dollar?

Control of Family Dollar is defined by its private equity owners, board governance, and executive leadership. As of February 2026, the company operates as a standalone private retailer after separating from Dollar Tree in July 2025. Strategic authority sits with the ownership group, while operational execution is led by the CEO and management team. Below is a factual and current breakdown of who actually controls Family Dollar.

Ownership Control and Strategic Authority

Family Dollar is controlled at the highest level by its private equity owners. The company was sold by Dollar Tree in July 2025 to Brigade Capital Management and Macellum Capital Management for about $1.01 billion.

These investors hold controlling equity and influence the company through board representation, governance rights, and capital oversight. Major corporate decisions such as restructuring, store strategy, leadership appointments, and long-term direction require approval from the ownership group.

Unlike public retailers, this concentrated ownership allows faster and more centralized decision-making. The current strategic focus includes operational turnaround, improving store productivity, and repositioning the brand in the discount retail market.

CEO and Executive Leadership (2026)

As of early 2026, Family Dollar is led by Chairman and CEO Duncan MacNaughton. He assumed leadership following the company’s separation from Dollar Tree in 2025.

MacNaughton is a veteran retail executive and previously served in senior leadership roles at Family Dollar before returning to lead the company under its new ownership. His mandate focuses on stabilizing operations, strengthening merchandising, improving store performance, and rebuilding the company as an independent discount retailer.

Jason Nordin continues to serve as President, overseeing operational execution across the store network and corporate functions.

The executive team manages daily operations including supply chain, pricing, merchandising, and store management. However, major strategic moves still require approval from the board and ownership group.

Board of Directors and Governance Structure

Family Dollar operates under a private-company governance model. The board of directors represents the private equity owners and serves as the highest decision-making body. The board approves major investments, restructuring plans, leadership decisions, and long-term strategy.

Because Brigade and Macellum are the principal owners, they hold a strong influence over board composition and governance direction. The board works closely with the CEO to ensure execution aligns with turnaround objectives and performance targets.

Compared to public companies, this governance structure enables quicker execution and tighter strategic control.

Transition from Dollar Tree Control

From 2015 to mid-2025, Family Dollar was fully controlled by Dollar Tree after being acquired for about $8.5–$9 billion.

During that period, Family Dollar operated as a subsidiary. Strategic and financial decisions were made at Dollar Tree headquarters. The parent company implemented restructuring, closed underperforming stores, and attempted to integrate the brand into its broader retail system.

In July 2025, Dollar Tree completed the sale of Family Dollar to private equity investors, ending a decade of corporate control and making Family Dollar an independent company again.

This transition marked a shift from corporate ownership to private equity governance and began a new phase focused on turnaround and operational independence.

How Control Works Today

As of 2026, control of Family Dollar operates on two levels. Strategic control lies with the private equity owners and the board of directors. Operational control rests with CEO Duncan MacNaughton and the executive leadership team.

The owners define long-term direction and capital strategy. Management executes daily business operations. This centralized private ownership model enables faster restructuring, tighter oversight, and more direct control compared to publicly traded competitors.

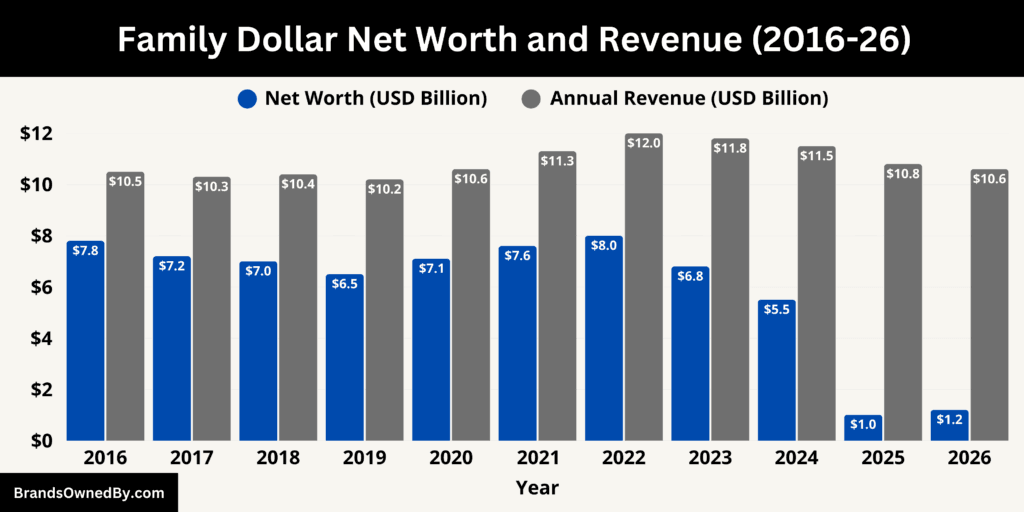

Family Dollar Annual Revenue and Net Worth

As of February 2026, the company generates an estimated $10.6 billion in annual revenue and holds an estimated net worth of about $1.2 billion following its post-divestiture stabilization and restructuring phase. The figures reflect the company’s transition from corporate ownership to a turnaround-focused private business model.

Family Dollar Revenue in 2026 (TTM)

In 2026 (TTM), Family Dollar generates approximately $10.6 billion in annual revenue. The company continues to earn most of its income from its nationwide network of small-format discount retail stores. Revenue is primarily driven by essential goods rather than discretionary spending.

A large portion of revenue comes from consumables and daily essentials. Groceries, packaged food, beverages, cleaning supplies, and household necessities contribute nearly 60% of total revenue. These categories provide stable and recurring sales because customers purchase them frequently.

General merchandise contributes around 25% of revenue. This includes home products, seasonal goods, apparel basics, and low-cost household items. These products generate higher margins compared to consumables but fluctuate depending on consumer demand and seasonal cycles.

Health, beauty, and personal care products account for roughly 10% of revenue. This category includes hygiene products, cosmetics, and pharmacy-adjacent goods. The remaining 5% comes from seasonal promotions, private label expansion, and miscellaneous retail items.

Although revenue has remained relatively stable compared to past years, growth in 2026 is modest. The company is prioritizing operational improvement over aggressive expansion. Store optimization, inventory control, and merchandising changes are currently the primary focus rather than revenue acceleration.

Net Worth and Company Valuation (2026)

As of February 2026, Family Dollar’s estimated net worth stands at approximately $1.2 billion. This valuation reflects the company’s current status as a privately held turnaround business rather than a high-growth retail chain.

The valuation is largely influenced by its 2025 sale price of about $1.01 billion, when Dollar Tree divested the business to private equity investors. Since then, modest operational stabilization and restructuring progress have slightly improved enterprise value.

Family Dollar’s valuation is supported by several key assets. Its nationwide store footprint remains one of its strongest value drivers. The company operates thousands of retail locations across the United States, giving it a large physical presence in the discount retail sector. The brand itself also holds strong recognition among value-focused consumers, contributing to its long-term business value.

However, valuation remains lower than historical levels due to prior operational inefficiencies, store underperformance, and restructuring costs. The company is currently in a rebuilding phase rather than a rapid growth stage.

Revenue Structure and Business Mix

Family Dollar’s revenue model is built around high-volume, low-margin retail. The company focuses heavily on essential goods, which provide consistent cash flow but limited margin expansion.

Consumables remain the dominant revenue driver because they generate repeat purchases. Customers typically visit Family Dollar frequently for everyday necessities rather than occasional bulk shopping. This creates steady revenue even during economic downturns.

Private label brands are increasingly important in improving profitability. These products generate higher margins compared to national brands. The company has expanded private label offerings to strengthen revenue quality rather than just volume.

Store productivity is another key factor influencing revenue. The company has been closing underperforming stores and improving inventory efficiency. This strategy focuses on profitability per store rather than total store count growth.

Net Worth Drivers and Financial Position

Family Dollar’s net worth in 2026 is shaped by operational restructuring and asset value rather than rapid growth. The company’s store network, inventory base, and brand equity form the core of its valuation.

Real estate and lease portfolio value remain important components. Although many locations are leased rather than owned, the scale of the store network contributes to enterprise stability. Improvements in store productivity and cost control are gradually strengthening valuation.

Debt structure and operational costs continue to influence net worth. Private equity ownership typically involves restructuring debt and improving cash flow efficiency. The current focus is on strengthening operating margins and improving long-term enterprise value.

While the company’s valuation is lower than its peak years under Dollar Tree, stabilization in 2026 indicates a gradual recovery phase rather than continued decline.

Future Revenue Forecast

Family Dollar is expected to follow a gradual recovery path through 2030. The company’s strategy focuses on improving store productivity, strengthening private label margins, optimizing inventory, and stabilizing operations rather than aggressive expansion. Based on current performance trends and restructuring progress, the revenue outlook is projected as follows:

- 2027: Estimated revenue of $10.9 billion. Growth driven by improved store efficiency, better inventory management, and stabilization after restructuring.

- 2028: Estimated revenue of $11.2 billion. Continued operational improvements and expansion of higher-margin private label products support moderate growth.

- 2029: Estimated revenue of $11.6 billion. Stronger store productivity and merchandising optimization improve revenue quality and overall performance.

- 2030: Estimated revenue of $12.0 billion. Completion of the turnaround strategy, improved profitability, and stabilized operations support long-term revenue recovery and a sustainable growth trajectory.

Brands Owned by Family Dollar

As of 2026, Family Dollar operates as an independent private discount retailer. It controls a network of operating entities, retail formats, and private label brands that support its nationwide discount retail business. Below are the key companies, brands, and operating entities owned and run directly by Family Dollar:

| Entity / Brand | Type | Ownership | Core Function | Key Details |

|---|---|---|---|---|

| Family Dollar Stores | Retail Chain | Fully owned | Primary retail operations | Core business of the company operating thousands of small-format discount stores across the United States serving value-focused consumers |

| Family Dollar Distribution Network | Logistics & Supply Chain | Fully owned | Inventory distribution and supply chain management | Operates regional distribution centers handling procurement, storage, and delivery of goods to the nationwide store network |

| Kidgets | Private Label Brand | Fully owned | Baby and toddler care products | Includes diapers, wipes, and infant essentials positioned as affordable alternatives to national baby care brands |

| Smart & Simple | Private Label Brand | Fully owned | Household and cleaning products | One of the largest in-house brands offering paper goods, kitchen supplies, storage items, and everyday essentials |

| Family Gourmet | Private Label Brand | Fully owned | Grocery and packaged food products | Includes snacks, canned foods, beverages, and pantry staples supporting the company’s consumables-driven revenue model |

| Family Wellness | Private Label Brand | Fully owned | Health and personal care products | Offers hygiene products, wellness items, and pharmacy-adjacent goods targeted at value-conscious consumers |

| Homeline | Private Label Brand | Fully owned | Household and home utility products | Includes kitchenware, storage items, and home essentials supporting the general merchandise category |

| Seasonal Merchandise Lines | Retail Product Division | Fully owned | Seasonal and event-based retail goods | Includes holiday décor, back-to-school supplies, and limited-time merchandise driving seasonal store traffic |

| Family Dollar Real Estate & Store Operations | Internal Operating Entity | Fully owned | Store portfolio and real estate management | Oversees leasing, location strategy, store maintenance, and network optimization across thousands of locations |

| Family Dollar Digital & Retail Systems | Digital Operations | Fully owned | E-commerce and promotional infrastructure | Manages digital coupons, promotions, and online engagement to support in-store retail operations |

Family Dollar Stores

Family Dollar Stores are the core operating business of the company. This is the primary retail chain through which the company generates nearly all of its revenue. The stores operate in small-box neighborhood formats and focus on affordable everyday essentials such as groceries, cleaning supplies, personal care products, and household goods.

As of 2026, Family Dollar operates thousands of locations across the United States. The stores are primarily located in urban neighborhoods, small towns, and underserved communities where low-cost convenience retail is in high demand. These stores form the backbone of the company’s operations and brand identity.

Family Dollar Distribution Network

Family Dollar owns and operates a large logistics and distribution infrastructure that supports its nationwide retail footprint. This includes multiple regional distribution centers, supply chain systems, and inventory management operations.

These distribution facilities handle the procurement, storage, and delivery of goods to thousands of retail stores. The network plays a critical role in maintaining low operating costs and ensuring consistent product availability. Supply chain efficiency remains a major focus under the company’s ongoing turnaround strategy.

Kidgets

Kidgets is Family Dollar’s in-house brand focused on baby and toddler products. The brand includes diapers, baby wipes, infant accessories, and child-care essentials. Kidgets is positioned as an affordable alternative to national baby care brands and is widely sold across Family Dollar stores.

Smart & Simple

Smart & Simple is one of Family Dollar’s largest private label brands. It focuses on household and cleaning products such as paper towels, tissues, aluminum foil, trash bags, food storage items, and kitchen supplies. The brand is known for offering low-cost everyday household essentials and is a key contributor to recurring store sales.

Family Gourmet

Family Gourmet is the company’s packaged food and grocery brand. It includes snacks, canned goods, dry foods, beverages, and pantry essentials. The brand supports the company’s consumables-driven revenue model by providing affordable grocery options for budget-conscious customers.

Family Wellness

Family Wellness is Family Dollar’s health and personal care brand. It includes hygiene products, over-the-counter wellness items, vitamins, and pharmacy-adjacent goods. The brand helps Family Dollar compete in the low-cost health and wellness segment while improving margin through private label pricing.

Homeline

Homeline is a home products and household essentials brand owned by Family Dollar. It includes kitchenware, storage items, basic home accessories, and utility products. The brand supports the company’s general merchandise category and is commonly sold in most store locations.

Seasonal and Value Merchandise Lines

Family Dollar also operates multiple seasonal merchandise lines under its own brand control. These include holiday decorations, back-to-school supplies, and event-based retail items. Seasonal goods are an important part of driving traffic and increasing store sales during peak shopping periods.

Family Dollar Real Estate and Store Operations Entity

Family Dollar manages its large store network through internal operating entities responsible for real estate, leasing, and store portfolio management. These internal divisions oversee site selection, lease negotiations, store maintenance, and network optimization.

Real estate management plays an important role in the company’s turnaround strategy, especially in optimizing underperforming locations and improving store productivity across the portfolio.

Family Dollar Digital and Retail Operations

Family Dollar operates its own digital retail infrastructure, including its e-commerce platform, mobile promotions, and digital coupon systems. While the company remains primarily a physical retail chain, digital operations support customer engagement, pricing strategy, and promotional campaigns.

These systems help Family Dollar maintain competitiveness in modern retail by integrating digital savings tools with in-store shopping.

Final Words

The story of who owns Family Dollar reflects the company’s long journey through different ownership structures and strategic shifts. Today, Family Dollar operates as a privately owned discount retailer focused on essential goods and neighborhood convenience. Its current ownership enables quicker decision-making and tighter operational control, which are important in a highly competitive value retail market. The brand remains centered on affordability and accessibility, serving millions of budget-conscious shoppers while continuing to refine its operations for long-term stability and growth.

FAQs

What company owns Family Dollar?

Family Dollar is privately owned as of 2026. It is controlled by a private equity investor group led by Brigade Capital Management, with Macellum Capital Management and Arkhouse Management as co-owners.

Who is the new owner of Family Dollar?

The new owners of Family Dollar are Brigade Capital Management (majority shareholder), Macellum Capital Management, and Arkhouse Management. They acquired the company in 2025 after it was divested by Dollar Tree.

Is Family Dollar publicly traded?

No, Family Dollar is not publicly traded. It operates as a privately held company and does not have shares listed on any stock exchange.

How many Family Dollar stores are there?

As of 2026, Family Dollar operates thousands of retail locations across the United States, with a store network of roughly over 7,000 locations serving urban, suburban, and rural communities.