- Marriott International owns and controls one of the world’s largest hotel brand portfolios, spanning luxury (The Ritz-Carlton, St. Regis, JW Marriott), premium and full-service (Marriott Hotels, Sheraton, Westin), and lifestyle brands (W Hotels, Renaissance, Le Méridien), allowing it to capture demand across all traveler segments.

- Select-service and extended-stay brands drive scale and stability, with Courtyard by Marriott, Fairfield by Marriott, Residence Inn, TownePlace Suites, and Element generating high recurring franchise and management fees through standardized, asset-light operations.

- Soft brands and collections expand reach without heavy capital risk, as Autograph Collection, Tribute Portfolio, and Design Hotels let independent hotels join Marriott’s system while preserving individuality and feeding the Marriott Bonvoy loyalty ecosystem.

- Luxury and lifestyle brands provide pricing power and brand halo, with Ritz-Carlton, St. Regis, JW Marriott, W Hotels, and EDITION strengthening global prestige, supporting premium fees, and boosting long-term value across hotels owned by Marriott.

Marriott International is the world’s largest hotel company by room count. It operates across luxury, premium, select-service, and long-stay segments. The company owns hotel brands rather than hotel real estate. Most properties operate under management or franchise agreements.

Marriott’s asset-light strategy allows rapid global expansion with lower capital risk. The company focuses on brand ownership, operational standards, loyalty programs, and global distribution systems. Its portfolio spans thousands of hotels across more than 130 countries and territories.

Marriott International is headquartered in Bethesda, Maryland. The company is listed on the NASDAQ stock exchange under the ticker symbol MAR.

The company’s reporting structure is organized by brand segments rather than geographic subsidiaries. Brand oversight, revenue management systems, and loyalty infrastructure are centrally controlled.

Marriott International separated its hotel ownership and real estate exposure in 1993. This separation established the modern asset-light structure that defines the company today.

List of Hotels Owned by Marriott

Marriott International owns and operates 37 hotel and accommodation brands as of 2026. Ownership refers to brand intellectual property, development rights, operating systems, loyalty integration, and global brand governance. Marriott does not primarily own hotel real estate. Individual properties are operated under management, franchise, soft-brand, or structured partnership agreements.

Below is a list of the hotels directly owned and operated at the brand level by Marriott International as of February 2026:

The Ritz-Carlton

The Ritz-Carlton is Marriott’s highest-profile ultra-luxury brand. It operates in the top tier of global hospitality, competing directly with Four Seasons and Mandarin Oriental.

Marriott controls the brand’s service philosophy, operating standards, and global development pipeline. Properties are almost exclusively managed hotels with strict performance metrics. The brand also extends into Ritz-Carlton Residences and destination-driven resort developments, which generate long-term management and licensing revenue.

Ritz-Carlton Reserve

Ritz-Carlton Reserve is a sub-brand positioned above traditional Ritz-Carlton hotels.

It focuses on remote, low-density resorts with high nightly rates and limited room counts. Marriott uses this brand selectively in high-yield destinations where exclusivity and experiential travel drive margins. Development approvals are tightly controlled to preserve scarcity.

St. Regis Hotels & Resorts

St. Regis is a heritage luxury brand defined by formal service rituals and butler service.

Marriott owns all brand rights and oversees development, design, and service frameworks. Properties are typically landmark city hotels or prestige resorts. The brand plays a strategic role in markets where heritage, tradition, and high-touch service command premium pricing.

JW Marriott

JW Marriott is Marriott’s modern luxury flagship.

It serves affluent business travelers and upscale leisure guests seeking luxury without formality. Properties are often large-scale hotels or resorts with extensive wellness, spa, and meeting facilities. Marriott uses JW Marriott as a scalable luxury platform in global gateway cities.

W Hotels

W Hotels is Marriott’s lifestyle luxury brand focused on experiential travel.

The brand emphasizes design, nightlife, music, and social spaces. Marriott owns and governs the brand globally, while properties operate under management or franchise agreements. W Hotels are strategically deployed in urban centers where lifestyle positioning drives higher food, beverage, and event revenue.

EDITION

EDITION is a boutique luxury brand positioned at the intersection of hospitality, design, and culinary excellence.

Marriott owns the brand but limits expansion to protect exclusivity. Each property is individually curated, with strong emphasis on restaurants, bars, and social programming. The brand generates high margins through differentiated experiences rather than scale.

Bulgari Hotels & Resorts

Bulgari Hotels & Resorts operates as an ultra-luxury hospitality brand within Marriott’s portfolio.

Marriott controls hotel operations, distribution, and loyalty integration, while Bulgari contributes brand identity and design direction. The portfolio remains intentionally small, focused on global luxury capitals. These properties target ultra-high-net-worth travelers.

The Luxury Collection

The Luxury Collection is a soft-brand portfolio of independently owned luxury hotels.

Marriott owns the brand and governs inclusion criteria. Properties retain their individual identities while gaining access to Marriott’s reservation systems, revenue management, and loyalty program. This model allows Marriott to grow luxury inventory without standardizing design.

Marriott Hotels

Marriott Hotels is the company’s namesake full-service brand.

It focuses on large business hotels, convention properties, and premium urban locations. Marriott uses this brand to anchor group travel, corporate contracts, and meetings revenue. Properties operate under standardized brand frameworks that emphasize reliability and scale.

Sheraton Hotels & Resorts

Sheraton is one of Marriott’s most globally recognized full-service brands.

It serves corporate travelers, airline crews, and convention demand. Marriott owns the brand outright and has invested heavily in repositioning older properties. Sheraton remains a cornerstone for global business travel.

Westin Hotels & Resorts

Westin is positioned around wellness, sleep quality, and health-oriented travel.

Marriott owns proprietary programs such as the Heavenly Bed and wellness initiatives that differentiate the brand. Westin properties appeal to business travelers and upscale leisure guests seeking a balance between work and well-being.

Le Méridien

Le Méridien is an upscale lifestyle brand with European roots.

The brand emphasizes art, culture, and design-led hospitality. Marriott deploys Le Méridien primarily in cultural capitals and resort markets where experiential travel drives premium rates.

Renaissance Hotels

Renaissance is an upper-upscale lifestyle brand built around local discovery.

Each property reflects its surrounding neighborhood through design and programming. Marriott uses this brand to compete with boutique hotels while maintaining brand consistency and operational control.

Autograph Collection Hotels

Autograph Collection is a soft-brand for independent upper-upscale and luxury hotels.

Marriott owns the brand but allows properties to retain individual character. Hotels join primarily to access Marriott Bonvoy, global distribution, and revenue systems. This model delivers high-margin growth without asset ownership.

Tribute Portfolio

Tribute Portfolio targets independent boutique hotels.

It operates similarly to Autograph Collection but with a stronger emphasis on design-forward and experiential properties. Marriott governs brand standards while preserving hotel individuality.

Design Hotels

Design Hotels is a curated portfolio of architecturally significant hotels.

Marriott owns the platform and integrates selected hotels into its distribution ecosystem. The brand focuses on aesthetics, innovation, and creative hospitality concepts rather than scale.

Delta Hotels by Marriott

Delta Hotels is an upscale brand originally developed in Canada.

Marriott acquired and expanded it globally as a streamlined full-service offering. The brand focuses on consistency, efficiency, and modern design, targeting business travelers seeking predictability.

Gaylord Hotels

Gaylord Hotels is a specialized brand focused on large-scale convention resorts.

These properties feature expansive meeting space, entertainment zones, and enclosed atriums. Marriott uses Gaylord Hotels to dominate group and convention travel in destination markets.

Protea Hotels by Marriott

Protea Hotels is a regional brand focused on Africa.

Marriott owns the brand and uses it to serve local business and leisure demand. Properties are adapted to regional market conditions rather than global standardization.

Courtyard by Marriott

Courtyard is a select-service brand focused on business travelers.

It emphasizes functional design, efficient service, and flexible workspaces. Marriott uses Courtyard as a volume brand for steady, predictable fee income.

SpringHill Suites

SpringHill Suites is an all-suite select-service brand.

It offers larger rooms with separate living areas. The brand targets families and business travelers requiring more space without full extended-stay pricing.

Fairfield by Marriott

Fairfield is Marriott’s entry-level select-service brand.

It focuses on affordability, operational efficiency, and consistency. Marriott uses Fairfield to expand rapidly in price-sensitive and emerging markets.

Four Points by Sheraton

Four Points is a practical mid-scale brand.

It emphasizes comfort, local food and beverage, and simplified service. The brand plays a role in secondary markets and conversion projects.

AC Hotels by Marriott

AC Hotels is a design-driven select-service brand.

It emphasizes minimalist European design and urban locations. Marriott uses AC Hotels to attract style-conscious business travelers.

Aloft Hotels

Aloft targets younger, tech-savvy travelers.

The brand features social lobbies, technology integration, and casual service. Marriott positions Aloft in urban and suburban growth markets.

Moxy Hotels

Moxy is Marriott’s affordable lifestyle brand.

It combines compact rooms with vibrant social spaces. The brand is optimized for high-density urban markets and franchise expansion.

Residence Inn by Marriott

Residence Inn is an extended-stay brand.

It offers apartment-style suites with kitchens. Marriott uses this brand to serve long-term business travel and relocations.

TownePlace Suites

TownePlace Suites is a value-oriented extended-stay brand.

It targets cost-conscious long-term guests. Properties focus on functionality rather than amenities.

Element by Westin

Element is an eco-focused extended-stay brand.

It emphasizes sustainability, natural light, and wellness. Marriott positions Element for environmentally conscious travelers.

Marriott Executive Apartments

Marriott Executive Apartments serve corporate expatriates.

They offer long-term residential accommodation with hotel services. The brand operates primarily in global business hubs.

Marriott Vacation Club

Marriott Vacation Club is a timeshare and vacation ownership brand.

It operates under a different financial structure than transient hotels. Marriott owns and manages vacation ownership inventory and memberships.

Homes & Villas by Marriott Bonvoy

Homes & Villas is Marriott’s premium home-rental platform.

It offers professionally managed luxury homes. The brand integrates non-hotel inventory into Marriott’s loyalty ecosystem.

Apartments by Marriott Bonvoy

Apartments by Marriott Bonvoy serves medium-term stays.

It integrates serviced apartments into Marriott’s systems. The platform expands Marriott’s reach beyond traditional hotels.

Top 10 Marriott Brands Ranked by Importance and Revenue (as of 2026)

Marriott International generates the majority of its revenue from management fees, franchise fees, and loyalty-driven ancillary income. The brands below are ranked by their direct and indirect impact on those revenue streams, not by prestige alone.

Legend (Revenue Contribution Intensity)

🟥 Very High 🟧 High 🟨 Medium ⬜ Medium–Low

| Rank | Brand | Segment | Revenue Contribution | Strategic Importance | Portfolio Role |

|---|---|---|---|---|---|

| 1 | Marriott Hotels | Full-service premium | 🟥🟥🟥🟥🟥 | 🟥🟥🟥🟥🟥 | Core corporate, meetings, and convention revenue anchor |

| 2 | Courtyard by Marriott | Select-service | 🟥🟥🟥🟥🟥 | 🟥🟥🟥🟥🟧 | Highest-volume franchise fee engine and Bonvoy feeder |

| 3 | Sheraton Hotels & Resorts | Full-service global | 🟧🟧🟧🟧⬜ | 🟥🟥🟥🟥⬜ | International corporate footprint and group travel backbone |

| 4 | Westin Hotels & Resorts | Premium wellness | 🟧🟧🟧🟧⬜ | 🟧🟧🟧🟧⬜ | High-margin premium brand with repeat business travelers |

| 5 | Residence Inn by Marriott | Extended-stay | 🟧🟧🟧🟧⬜ | 🟧🟧🟧🟧⬜ | Earnings stabilizer with long-stay occupancy |

| 6 | Fairfield by Marriott | Entry-level select-service | 🟨🟨🟨🟨⬜ | 🟧🟧🟧⬜⬜ | Rapid expansion and conversion growth engine |

| 7 | The Ritz-Carlton | Ultra-luxury | 🟨🟨🟨⬜⬜ | 🟥🟥🟥⬜⬜ | Brand halo, luxury pricing power, and residences income |

| 8 | JW Marriott | Scalable luxury | 🟨🟨🟨⬜⬜ | 🟧🟧🟧⬜⬜ | Primary global luxury growth platform |

| 9 | Autograph Collection Hotels | Soft luxury / upper-upscale | 🟨🟨🟨⬜⬜ | 🟧🟧🟧⬜⬜ | High-margin soft-brand expansion without standardization |

| 10 | Aloft Hotels | Lifestyle select-service | ⬜⬜⬜⬜⬜ | 🟨🟨🟨⬜⬜ | Future demand capture and loyalty lifecycle entry |

1. Marriott Hotels

Rank: #1 – Core revenue anchor

Marriott Hotels is the single most important brand in the portfolio. It anchors corporate contracts, global meetings business, and long-term management agreements.

These properties are typically large, full-service hotels with extensive meeting and conference facilities. That structure generates high base management fees plus incentive fees tied to group and corporate demand. The brand is also critical for negotiating multinational corporate travel agreements.

Strategically, Marriott Hotels stabilizes earnings during economic cycles. Even when leisure demand softens, corporate and group travel tied to this brand provides predictable cash flow.

2. Courtyard by Marriott

Rank: #2 – Highest-volume fee engine

Courtyard is one of Marriott’s largest brands by property count and a cornerstone of franchise revenue.

The brand’s importance lies in standardization. Courtyard hotels are inexpensive to build, easy to operate, and highly franchise-friendly. This allows Marriott to scale quickly while earning recurring franchise and system fees with minimal capital exposure.

Courtyard also feeds Marriott Bonvoy at scale. High room-night volume translates into loyalty engagement, credit card revenue, and repeat bookings across higher-end brands.

3. Sheraton Hotels & Resorts

Rank: #3 – Global corporate footprint

Sheraton remains one of Marriott’s most valuable legacy brands despite repositioning challenges.

It plays a critical role in international markets, especially Asia, the Middle East, and airport-adjacent business hubs. Sheraton properties generate strong group, airline crew, and corporate travel revenue.

From a strategic standpoint, Sheraton gives Marriott instant brand recognition in markets where newer brands lack awareness. That recognition directly supports franchise growth and long-term management contracts.

4. Westin Hotels & Resorts

Rank: #4 – Premium-margin business travel brand

Westin is one of Marriott’s most profitable premium brands on a per-property basis.

Its importance comes from proprietary wellness assets such as the Heavenly Bed and integrated wellness programs. These create pricing power and brand differentiation without increasing operational complexity.

Westin also performs exceptionally well with business travelers who travel frequently, making it a high-value contributor to Marriott Bonvoy engagement and premium credit card partnerships.

5. Residence Inn by Marriott

Rank: #5 – Margin stability through long stays

Residence Inn is strategically vital due to its extended-stay economics.

Guests stay longer. Operating costs are lower. Occupancy is more stable. That combination produces consistent management and franchise fees even during downturns.

From a portfolio perspective, Residence Inn reduces earnings volatility. It also strengthens Marriott’s relationship with corporate clients handling relocations and long-term assignments.

6. Fairfield by Marriott

Rank: #6 – Expansion and conversion engine

Fairfield is critical for geographic expansion and franchise conversions.

Its standardized, cost-controlled model allows Marriott to enter secondary and tertiary markets rapidly. While individual properties generate lower fees than premium brands, the sheer volume makes Fairfield a major contributor to systemwide fee income.

Fairfield is also essential for defending market share against Hilton and IHG in the entry-level segment.

7. Ritz-Carlton

Rank: #7 – Brand halo and pricing power

Ritz-Carlton is not Marriott’s largest revenue generator by volume, but it is strategically indispensable.

The brand creates a halo effect that elevates the entire Marriott portfolio. It strengthens relationships with ultra-high-net-worth travelers and luxury property owners.

Ritz-Carlton properties also command high incentive fees and support branded residences, which generate long-term, high-margin licensing and management income.

8. JW Marriott

Rank: #8 – Scalable luxury platform

JW Marriott is Marriott’s most scalable luxury brand.

It bridges the gap between ultra-luxury and premium business travel. Properties are large, globally deployable, and capable of generating strong meeting, resort, and leisure revenue.

Strategically, JW Marriott allows Marriott to grow luxury exposure without the development constraints of Ritz-Carlton or St. Regis.

9. Autograph Collection Hotels

Rank: #9 – High-margin growth without standardization

Autograph Collection is one of Marriott’s most profitable brand models.

As a soft brand, it allows independent hotels to join Marriott’s system while retaining their identity. Marriott earns franchise and system fees without the cost of enforcing rigid brand standards.

This model is especially important in Europe and historic city centers, where standardized hotels are difficult to develop.

10. Aloft Hotels

Rank: #10 – Demographic and future-demand capture

Aloft earns its place due to strategic relevance rather than raw revenue.

It attracts younger, tech-savvy travelers early in their travel lifecycle. This feeds long-term loyalty value as these guests move up into premium and luxury brands over time.

Aloft also performs well in mixed-use and conversion developments, supporting Marriott’s future pipeline in urban growth markets.

Who Owns Marriott?

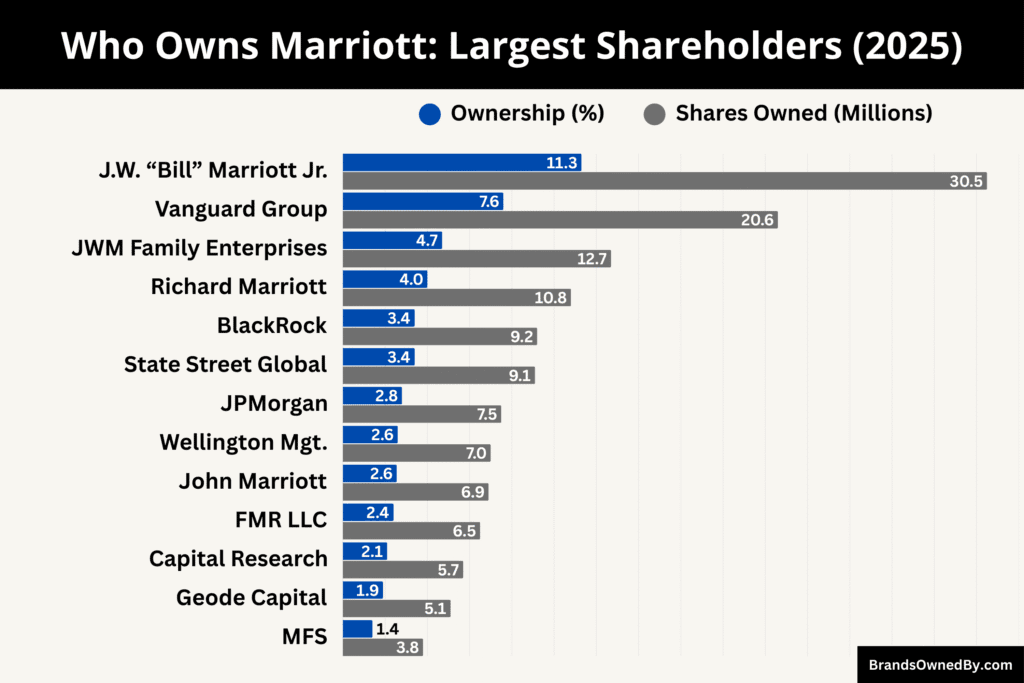

Marriott International is a publicly traded company listed on the NASDAQ under the ticker symbol MAR. Ownership is distributed primarily among large institutional investors, with the founding Marriott family retaining long-term influence through equity holdings, board representation, and legacy governance.

Marriott’s shareholder base is dominated by asset managers and index fund providers. These investors hold shares on behalf of pension funds, ETFs, mutual funds, and retirement accounts.

The Marriott family does not hold a majority stake. However, it remains one of the most influential ownership groups due to historical involvement, long-term alignment, and continued presence in corporate governance.

The Vanguard Group

The Vanguard Group is the largest shareholder in Marriott International as of 2026.

Vanguard holds approximately 9% of Marriott’s outstanding shares. Its ownership is largely passive and spread across index funds and long-term institutional portfolios.

Despite being a passive investor, Vanguard plays a significant role in corporate governance. It votes on major shareholder resolutions, executive compensation policies, and board appointments. Vanguard’s influence is exercised through stewardship rather than day-to-day operational involvement.

BlackRock

BlackRock is the second-largest shareholder in Marriott.

BlackRock owns roughly 7% of the company’s shares as of 2026. Like Vanguard, its stake is primarily held through ETFs and institutional investment products.

BlackRock’s importance lies in voting power and governance oversight. It actively engages with management on issues such as capital allocation, risk management, executive pay, and long-term strategy. While it does not control operations, its position gives it leverage on strategic decisions.

State Street Corporation

State Street Corporation ranks among Marriott’s top shareholders.

State Street controls close to 4% of Marriott International’s outstanding shares. Most of these holdings are tied to index-tracking funds and custodial assets.

State Street’s role is similar to other large institutional holders. It influences governance outcomes through proxy voting and shareholder engagement rather than direct management involvement.

The Marriott Family

Marriott family remains a key long-term shareholder group.

Although the family’s collective ownership percentage is significantly lower than that of institutional investors, its influence is disproportionate to its stake. This influence comes from decades of leadership continuity, board participation, and deep familiarity with the company’s culture and strategy.

Family members have historically held executive and board positions. Even as professional management now runs day-to-day operations, the family’s presence reinforces long-term strategic thinking over short-term market pressure.

Other Institutional Investors

Beyond the top three asset managers, Marriott’s shareholder base includes pension funds, insurance companies, sovereign investment funds, and actively managed mutual funds.

These investors typically hold smaller individual stakes. Collectively, however, they represent a substantial portion of voting power. Their interests generally align around stable fee growth, disciplined capital allocation, and preservation of the asset-light business model.

Retail and Individual Shareholders

Individual investors own a smaller portion of Marriott International shares.

These shareholders include employees, executives, and retail investors. While they do not materially influence corporate decisions, they benefit from dividends, share price appreciation, and loyalty-driven growth tied to Marriott’s global scale.

Who Controls Marriott Hotels?

Control of Marriott Hotels is exercised through a multi-layered governance and operating structure rather than through property ownership. Marriott International controls Marriott Hotels through brand ownership, contractual authority, executive leadership, and board governance. Individual hotel buildings are usually owned by third parties, but operational and brand control remains centralized.

Corporate-Level Control: Marriott International

Marriott International holds ultimate control over the Marriott Hotels brand. This includes ownership of trademarks, brand standards, operating systems, pricing frameworks, and global distribution.

No hotel can operate under the Marriott Hotels name without a binding legal agreement with Marriott International. These agreements grant Marriott the authority to dictate how hotels are branded, marketed, staffed, and operated at a strategic level.

This corporate control is the foundation of Marriott’s asset-light model. It allows Marriott to scale globally without owning real estate while retaining decisive authority over hotel operations.

Board of Directors: Strategic and Fiduciary Control

The board of directors is responsible for strategic oversight and long-term control of Marriott International.

The board approves major decisions that directly affect Marriott Hotels, including brand expansion, capital allocation, acquisitions, divestitures, executive compensation, and long-term corporate strategy. While the board does not manage daily hotel operations, it controls the direction in which the Marriott Hotels brand evolves.

Board members are elected by shareholders, giving large institutional investors indirect influence over control through voting power.

Executive Leadership: Day-to-Day Operational Control

Operational control of Marriott Hotels is exercised by the executive leadership team.

The President and Chief Executive Officer, along with senior executives overseeing operations, brand management, finance, and development, make decisions that directly impact hotel performance. This includes approving new Marriott Hotels locations, negotiating management and franchise contracts, and setting global operating standards.

Executives also control pricing strategies, revenue management systems, technology platforms, and loyalty integration that individual hotels must follow.

Brand Governance and Standards Enforcement

Marriott Hotels operates under a centralized brand governance system.

Marriott International sets mandatory brand standards covering room design, service levels, staffing ratios, technology systems, food and beverage concepts, and guest experience benchmarks. Compliance is enforced through audits, inspections, and performance reviews.

Hotel owners who fail to meet brand standards can face penalties, mandatory renovations, or termination of branding rights. This gives Marriott strong leverage over properties it does not own.

Hotel Owners: Property Ownership Without Brand Control

Most Marriott Hotels are owned by real estate investors, hotel developers, or institutional property owners.

These owners control the physical asset and are responsible for capital expenditures, maintenance, and local regulatory compliance. However, ownership of the building does not equate to control of the brand or guest experience.

Owners cannot independently change branding, operating procedures, or service models. Any significant changes must be approved by Marriott International under the terms of the management or franchise agreement.

Management Agreements: Direct Operational Authority

In managed Marriott Hotels, Marriott International exercises direct operational control.

Under management agreements, Marriott appoints the hotel’s general manager and senior leadership team. It oversees staffing policies, procurement systems, budgeting, and operational execution. Owners receive financial returns but do not run daily operations.

These agreements often last 20 to 40 years, giving Marriott long-term operational authority over the property.

Franchise Agreements: Indirect but Enforceable Control

In franchised Marriott Hotels, daily operations are handled by the owner or a third-party operator.

However, Marriott retains indirect control through franchise agreements. These contracts require strict adherence to brand standards, use of Marriott’s reservation systems, participation in Marriott Bonvoy, and compliance with pricing and marketing rules.

Failure to comply can result in fines, loss of brand affiliation, or termination of the franchise agreement. This enforcement power gives Marriott significant influence even without direct management.

Revenue Management and Pricing Control

Marriott International controls centralized revenue management systems used by Marriott Hotels worldwide.

These systems guide room pricing, demand forecasting, inventory allocation, and distribution strategy. While individual hotels may adjust rates within defined ranges, ultimate pricing logic is driven by Marriott’s centralized algorithms and policies.

This control over pricing and distribution directly impacts hotel profitability and market positioning.

Loyalty Program Control: Marriott Bonvoy

Marriott Hotels are fully integrated into the Marriott Bonvoy loyalty program.

Marriott International controls Bonvoy rules, point redemption rates, elite benefits, and co-branded credit card partnerships. Hotels must honor loyalty benefits even when it impacts short-term margins.

This gives Marriott leverage over hotels while also driving consistent demand across the portfolio.

Who Has the Final Say?

Final control over Marriott Hotels rests with Marriott International.

Shareholders influence governance through board elections. The board sets strategic direction. Executives control operations and brand execution. Hotel owners control real estate but operate within strict contractual boundaries.

This layered control structure is what allows Marriott to dominate global hospitality without owning most hotels.

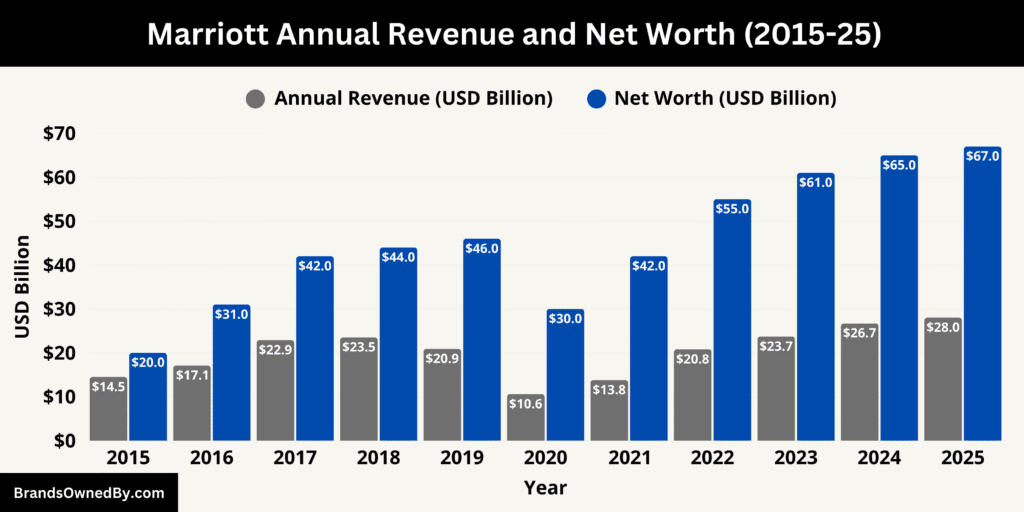

Marriott Annual Revenue and Net Worth

As of February 2026, Marriott International generates approximately $23.3 billion in annual revenue and carries a market capitalization (net worth) of about $70 billion. These figures reflect Marriott’s fee-based, asset-light business model rather than hotel real-estate ownership.

Marriott International Revenue in 2026

Marriott’s $23.3 billion revenue in 2026 is derived almost entirely from recurring contractual fees.

Around 55–60% of total revenue comes from base management and franchise fees paid by hotel owners operating under Marriott brands.

Approximately 20–25% comes from incentive management fees, which are performance-based and tied directly to hotel profitability, especially in luxury and premium brands.

Roughly 15–20% of revenue is generated through Marriott Bonvoy–related income, including loyalty redemptions, co-branded credit card partnerships, and marketing contributions.

Less than 5% of revenue is tied to owned or leased hotels and ancillary business lines.

This mix explains why Marriott’s revenue scales with global travel demand while capital expenditure remains limited.

Revenue Concentration by Brand Type

Revenue contribution is uneven across the portfolio.

Full-service and premium brands such as Marriott Hotels, Sheraton, and Westin account for over 40% of total fee revenue, driven by large hotels, group business, and conventions.

Select-service brands including Courtyard and Fairfield contribute over 30% of recurring fee revenue due to high property count and franchise density.

Extended-stay brands such as Residence Inn and TownePlace Suites contribute around 15%, but with higher margin stability due to longer guest stays.

Luxury brands generate a smaller share of total revenue by volume, but they deliver disproportionately high incentive fees and branded-residence income.

Marriott International Net Worth 2026

Marriott International’s net worth, measured by market capitalization, stands at approximately $70 billion in February 2026.

This valuation is not asset-based. Marriott owns relatively little hotel real estate. Instead, its market value reflects:

- Brand intellectual property

- Long-term management and franchise contracts

- Global reservation and pricing systems

- Marriott Bonvoy loyalty infrastructure.

Intangible assets account for the majority of enterprise value.

Balance Sheet Reality vs Market Value

Marriott’s owned tangible assets represent well under 20% of its total market value.

More than 80% of investor valuation is tied to expected future cash flows from management fees, franchise fees, and loyalty monetization rather than property ownership.

This explains why Marriott’s net worth significantly exceeds what would be expected for a traditional hotel owner with similar revenue.

The ratio between $23.3 billion in revenue and $70+ billion in valuation reflects:

- Long-duration contracts, often 20–40 years

- High renewal rates across brands

- Low capital intensity

- Strong free-cash-flow conversion.

Investors price Marriott closer to a global brand and services platform than a lodging real-estate company.

Final Words

Hotels owned by Marriott reflect a business built on brand strength, scale, and long-term control rather than real estate ownership. From luxury flagships and lifestyle hotels to extended-stay and value-driven brands, Marriott International has created a diversified portfolio that generates stable revenue across economic cycles. Its asset-light strategy, strong loyalty ecosystem, and disciplined expansion continue to reinforce its position as the most influential hotel company in the world.

FAQs

Which hotels does Marriott own?

Marriott International owns and controls 38 hotel and accommodation brands. These include luxury brands like The Ritz-Carlton, St. Regis, and JW Marriott, premium and full-service brands such as Marriott Hotels, Sheraton, and Westin, lifestyle brands like W Hotels and Renaissance, and select-service and extended-stay brands including Courtyard, Fairfield, Residence Inn, and TownePlace Suites. Marriott owns the brands and operating systems, while most individual hotel buildings are owned by third-party investors.

Where are Marriott Hotels located?

Marriott Hotels are located worldwide, across North America, Europe, Asia-Pacific, the Middle East, Africa, and Latin America. Properties operate in major cities, resort destinations, business hubs, airports, and secondary markets, giving Marriott a truly global footprint across more than 130 countries and territories.

Who is the CEO of Marriott?

The CEO of Marriott International is Anthony Capuano. He has served as President and Chief Executive Officer since 2021 and leads the company’s global brand strategy, operations, and long-term growth.

Is Radisson part of Marriott?

No. Radisson is not part of Marriott. Radisson operates under a separate ownership and brand structure and is not affiliated with Marriott International.

Is Hilton Inn part of Marriott?

No. Hilton Inn is part of the Hilton brand family, not Marriott. It is owned and operated under Hilton, which is a direct competitor of Marriott.

Does Marriott own Hilton?

No. Marriott does not own Hilton. Marriott International and Hilton are separate publicly traded hospitality companies with distinct brand portfolios, leadership, and ownership structures.

Is Fairfield part of Marriott?

Yes. Fairfield by Marriott is a hotel brand owned and operated by Marriott International. It is a select-service brand focused on affordability, consistency, and efficiency, and is one of Marriott’s key growth brands globally.