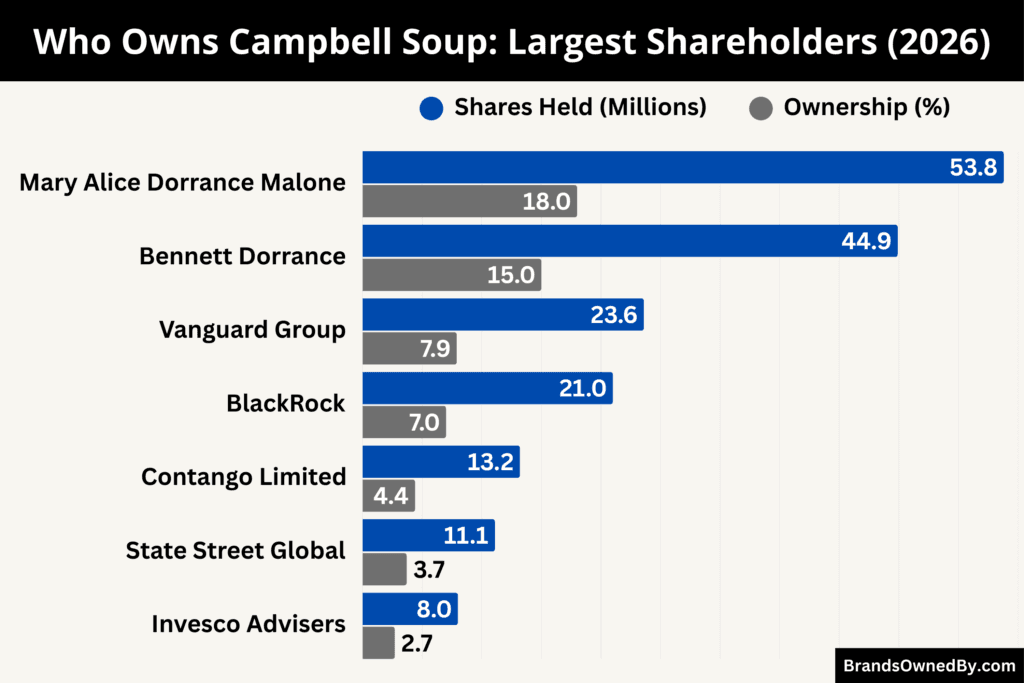

- Campbell Soup is a publicly traded company, with ownership dominated by a mix of legacy family shareholders and large institutional investors rather than a single controlling owner.

- The Dorrance family remains the most influential shareholder group, led by Mary Alice Dorrance Malone with about 18% ownership and Bennett Dorrance with roughly 15%, giving the family a combined stake of around one-third of the company.

- Major institutional investors collectively hold a significant portion of shares, including Vanguard (7.9%), BlackRock (7.0%), Contango Limited LP (4.4%), State Street (3.7%), and Invesco (2.7%), exercising influence through voting and governance.

- This ownership structure explains how Campbell Soup maintains long-term stability, with family shareholders shaping continuity while institutions provide market discipline and oversight.

Campbell Soup Company is a historic American food manufacturer. It produces soups, snacks, beverages, sauces, and prepared foods. The company is known for iconic products that have been sold in households for generations. Its operations span across North America, and its products are distributed through grocery retailers, foodservice channels, and international markets. Campbell Soup has built a reputation for brand recognition and innovation in the packaged foods industry.

Campbell Soup’s portfolio includes well-known brands such as Campbell’s condensed soups, Pepperidge Farm, Snyder’s-Lance, V8, Prego, and Swanson. The company has long been associated with convenience and quality in food products. Over the decades, it has adapted its portfolio through acquisitions, divestitures, and brand revitalization efforts.

Campbell Soup Company’s corporate headquarters remains in Camden, New Jersey. The company operates with a centralized executive leadership and a board of directors that provides governance and strategic oversight. Its long history reflects both traditional food heritage and responses to changing consumer preferences.

Campbell Soup Founders

Joseph A. Campbell was a successful Philadelphia fruit merchant before entering the food processing industry. In 1869, he partnered with Abraham Anderson to form a business focused on canned goods.

Campbell brought business acumen and capital to the partnership. He prioritized product preservation and distribution efficiency. Under his leadership, the company expanded beyond its initial offerings. Campbell’s focus on quality and scalability laid the foundation for what would become a major food manufacturer.

Beyond business operations, Joseph A. Campbell was active in civic affairs. He sought to improve industrial practices and supported organizational development within the company. His leadership established a culture that valued both innovation and steadiness.

Abraham Anderson

Abraham Anderson was a tinsmith by trade. His expertise in metalworking was essential in the early days of the company’s canned food production. Anderson’s technical knowledge helped ensure that the company could manufacture safe and durable cans, which were critical for preserving food in the 19th century.

While Anderson’s role was more technical than managerial, his contribution was indispensable. The partnership between a business strategist (Campbell) and a craftsperson (Anderson) allowed the company to scale production and address early operational challenges effectively.

John T. Dorrance

John T. Dorrance was not a founder in the original sense, but he became a pivotal figure in Campbell’s history. A chemist by training, Dorrance joined the company in the early 20th century. In 1897, he invented condensed soup. This innovation reduced shipping weight and cost while maintaining flavor and quality. Condensed soup transformed the company’s business model and set Campbell on a path to national prominence.

Dorrance later became President of the company. Under his leadership, the business grew rapidly. He also helped professionalize operations and expand distribution networks across the United States.

Major Milestones

- 1869: Joseph A. Campbell and Abraham Anderson establish the original canned food business.

- 1876: The company relocates operations to Camden, New Jersey, strengthening manufacturing capacity.

- 1897: John T. Dorrance invents condensed soup, changing the company’s product model.

- 1904: Campbell’s soup gains national distribution across the United States.

- 1922: The company officially adopts the name Campbell Soup Company.

- 1931: The iconic red-and-white soup can design becomes standardized.

- 1940s: Campbell supports large-scale food production during World War II.

- 1950s: Product lines expand beyond soup into sauces and prepared foods.

- 1961: Campbell acquires V8, entering the beverage category.

- 1970s: International expansion accelerates across Europe and other markets.

- 1980s: The company increases focus on brand marketing and packaged food innovation.

- 1990s: Campbell broadens its portfolio through acquisitions outside core soup products.

- 2006: Campbell acquires Pepperidge Farm, strengthening its premium snack presence.

- 2018: Major portfolio restructuring begins, including divestitures and refocusing efforts.

- 2019: Leadership transition signals a renewed emphasis on meals and snacking categories.

- 2021: Supply chain and operational modernization initiatives expand.

- 2023: Campbell simplifies its brand portfolio and organizational structure.

- 2024: Greater focus is placed on convenience foods and core household brands.

- 2025: Integration of snack and meal brands continues across distribution channels.

- 2026: Campbell Soup operates as a streamlined packaged food company centered on meals and snacks.

Who Owns Campbell Soup: Major Shareholders

The Campbell’s Company began life in 1869 as Anderson & Campbell, a small canned goods business founded by Joseph A. Campbell and Abraham Anderson in Camden, New Jersey. Over the decades, it became known as Campbell Soup Company and in late 2024 rebranded to The Campbell’s Company, reflecting its broader portfolio beyond soups.

The company is publicly listed on the NASDAQ under the ticker symbol CPB, and its shares trade broadly in U.S. financial markets.

As of January 2026, the company has approximately 298 million shares outstanding, which represent ownership stakes held by institutional investors, individual shareholders, and legacy family interests.

Below is a list of the largest shareholders of The Campbell’s Company as of January 2026:

Mary Alice Dorrance Malone

Mary Alice Dorrance Malone is one of the most prominent individual shareholders of The Campbell’s Company. She descends from John T. Dorrance, a pivotal figure in company history who invented condensed soup.

As of the latest filings, she holds around 53.8 million shares, equal to roughly 18% of total outstanding stock. Her holdings make her the largest individual stakeholder. Malone has also served on the company’s board, giving her direct influence on corporate governance and strategic direction. Her stake reflects the enduring legacy of the Dorrance family within the company’s ownership structure, bridging historic roots with current investor dynamics.

Bennett Dorrance

Bennett Dorrance is another key Dorrance family member with a significant ownership position. He holds approximately 44.9 million shares, representing about 15% of the company’s outstanding stock.

Like other family stakeholders, Bennett Dorrance does not manage daily operations but remains influential through voting rights and participation in major corporate decisions. His combined ownership with other family shareholders represents a collective block that continues to impact board-level governance and strategic discussions.

The Vanguard Group, Inc.

The Vanguard Group, Inc. is one of the largest institutional investors in The Campbell’s Company. Through its various mutual funds and index product portfolios, Vanguard owns about 23.6 million shares, equal to roughly 7.9% of total outstanding stock.

Institutional holdings like Vanguard’s are important because they bring professional governance expectations and proxy voting power. Although Vanguard does not manage the company’s operations, it can influence key decisions by voting at shareholder meetings and engaging with the board on governance practices.

BlackRock, Inc.

BlackRock, Inc. is another major institutional shareholder, holding roughly 21.0 million shares, approximately 7.0% of the company’s stock.

Like Vanguard, BlackRock holds shares on behalf of a wide array of funds and investors. Its position makes it one of the top institutional holders. BlackRock’s governance approach often emphasizes long-term shareholder value, board accountability, and sustainable strategy execution. Its voting power in shareholder meetings is significant due to the size of its stake.

State Street Global Advisors

State Street Global Advisors is a well-known institutional investor with a stake of about 11.1 million shares, representing approximately 3.7% of outstanding stock.

Institutional investors such as State Street contribute to the governance ecosystem by voting on key corporate matters including director elections and executive compensation. They may also engage management on issues such as strategic priorities and risk oversight.

Invesco Advisers, Inc.

Invesco Advisers, Inc. holds roughly 8.0 million shares, or about 2.7% of total shares outstanding.

Though smaller than some other institutional holders, Invesco’s stake still gives it a formal role in governance through proxy voting. Its presence in the ownership register reflects broader institutional interest in The Campbell’s Company from diversified asset management firms.

Contango Limited LP

Contango Limited LP appears on certain institutional ownership lists with approximately 13.2 million shares, or around 4.4% of outstanding shares. This position places Contango among the notable institutional investors in the company, though not as large as Vanguard or BlackRock. Such positions may be driven by specific investment strategies focused on value, dividends, or sector exposure.

Other Notable Institutional Holders

Beyond the named shareholders above, several other institutional holders appear in ownership filings. For example, additional asset managers and mutual funds own smaller blocks that nonetheless contribute to the company’s institutional ownership base.

Collectively, institutional investors own a majority share of the company’s stock, indicating that large investment firms together hold significant governance influence.

Insider and Retail Ownership Notes

In addition to major individual and institutional holders, a portion of the company’s shares are held by insiders and retail investors. Insider ownership typically includes executives and directors holding shares in their own names, which aligns management interests with shareholders.

Retail investors represent individual stockholders who trade shares on public exchanges. As of early 2026, insiders and institutions together shape the governance landscape of The Campbell’s Company.

Who is the CEO of Campbell Soup?

Mark Clouse is the President and Chief Executive Officer of The Campbell’s Company as of 2026. He has led the company since 2019 and is responsible for setting its long-term strategy, overseeing daily operations, and guiding major portfolio and leadership decisions.

As CEO, he works closely with the board of directors and senior executives to manage the company’s food and snack brands, drive operational performance, and adapt the business to changing consumer trends.

Mark Clouse: Background and Role

Mark Clouse is a seasoned consumer goods executive with decades of experience in food and beverage businesses. Before joining Campbell’s Company, he held senior leadership roles at global companies, where he managed major brands, led turnaround strategies, and guided long-term growth initiatives.

Clouse became CEO of Campbell’s Company in 2019. Since then, he has focused on transforming the company’s portfolio, strengthening operational performance, and enhancing product innovation.

Under his leadership, Campbell’s has streamlined its brand mix, invested in supply chain efficiencies, and expanded its presence in high-growth segments such as snacks and prepared meals.

As CEO, Clouse reports to the board of directors. He works closely with the executive leadership team to set annual performance goals, allocate capital, and evaluate mergers, acquisitions, or divestitures.

Leadership Style and Strategic Priorities

Mark Clouse is known for a collaborative leadership approach. He emphasizes accountability, performance metrics, and consumer insights. He balances long-term strategic vision with the practical demands of a highly competitive food industry.

During his tenure, Clouse has:

- Prioritized portfolio realignment to focus on core, high-margin brands.

- Advanced sustainability initiatives across packaging and sourcing.

- Strengthened direct relationships with retail partners.

- Promoted innovation in product development to meet evolving consumer tastes.

His leadership style blends operational discipline with strategic flexibility.

Compensation and Net Worth

As of the 2025 fiscal disclosures, Mark Clouse’s total compensation as CEO of Campbell’s Company was approximately $12.4 million. This figure includes:

- Base salary: $1.2 million

- Annual performance bonus: $2.3 million

- Long-term equity awards: $8.9 million.

Equity awards form a significant portion of executive pay, aligning his interests with long-term shareholder value.

Past CEOs and Leadership Transition

Prior to Mark Clouse, Campbell’s Company underwent several leadership changes:

- Denise Morrison (2011–2018): Focused on modernizing the portfolio and expanding the international footprint.

- Keith McLoughlin (Interim, 2018–2019): Guided the company through a transitional period.

- Mark Clouse (2019–Present): Leading current portfolio transformation and growth strategy.

These transitions illustrate how the CEO role has evolved in response to changing market dynamics, strategic priorities, and consumer preferences.

Decision-Making Structure

At Campbell’s Company, the CEO is supported by a board of directors and a leadership team that includes heads of major operating units such as Meals & Beverages, Snacks, Finance, and Supply Chain. The board sets governance policies and key strategic oversight, while the CEO executes operational plans and reports performance.

Key decisions—including long-term strategy, executive compensation frameworks, major investments, and acquisitions—require board approval. The CEO plays a central role in shaping proposals and leading discussions that influence final outcomes.

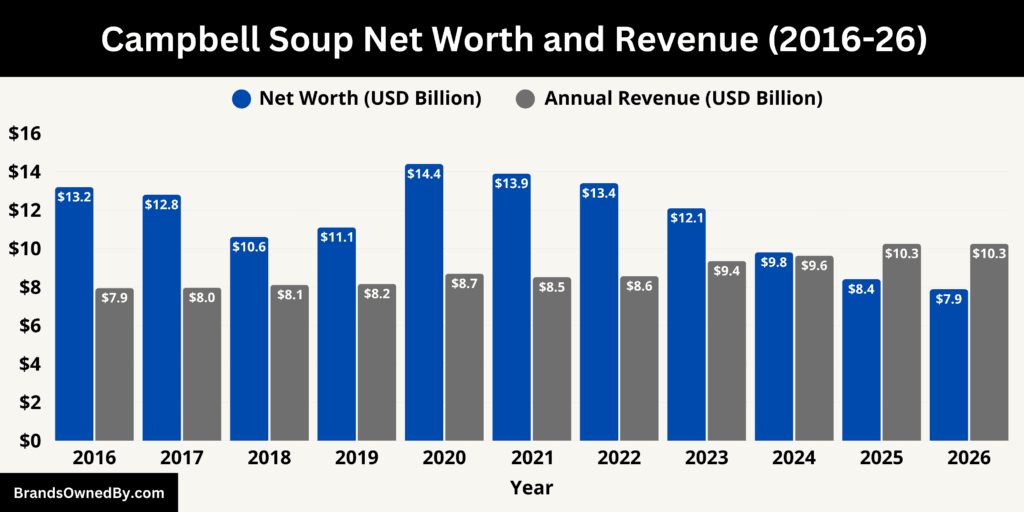

Campbell Soup Annual Revenue and Net Worth

In the fiscal year ending August 3, 2025, the company reported annual revenue of approximately $10.25 billion, marking consistent growth from prior years as product demand remains strong across meals, beverages, and snacks. As of January 2026, Campbell’s Company’s net worth is approximately $7.88 billion, representing the value investors place on all outstanding shares based on current market pricing and reflecting broader stock market dynamics affecting investor sentiment.

Revenue Breakdown by Business Segment

Campbell’s Company generates revenue through two clearly defined operating segments.

The Meals & Beverages segment accounts for approximately 54% of total revenue, or about $5.5 billion. This segment includes canned soups, ready-to-serve soups, broths, stocks, pasta sauces, and vegetable-based beverages. Soup alone represents the single largest product category within this segment, driven by high household penetration and repeat purchasing. Broths and cooking liquids contribute a growing share due to at-home meal preparation trends.

The Snacks segment contributes the remaining 46% of revenue, or roughly $4.7 billion. This revenue is generated primarily from baked snacks, crackers, cookies, and salty snacks sold under brands such as Pepperidge Farm and Snyder’s-Lance. Snack revenue is spread across pretzels, crackers, sandwich crackers, and cookies, with salty snacks representing the largest portion of this segment due to higher consumption frequency.

Revenue Breakdown by Geography

About 92% of total revenue, or approximately $9.4 billion, is generated in North America, primarily the United States. This reflects Campbell’s heavy concentration in U.S. grocery and mass retail channels.

The remaining 8% of revenue, or about $820 million, comes from international markets, including Canada and select global regions. International revenue is smaller due to a more limited brand footprint and fewer localized product lines outside North America.

Revenue Breakdown by Sales Channel

Roughly 78% of revenue is generated through retail grocery and mass merchandise stores, including supermarkets, club stores, and big-box retailers. These channels account for about $8.0 billion in annual sales.

Approximately 14% of revenue, or about $1.4 billion, comes from foodservice and institutional customers, including restaurants, schools, and healthcare facilities.

The remaining 8%, about $850 million, is generated through alternative channels, including convenience stores, e-commerce platforms, and specialty retailers.

Net Worth

Campbell’s Company’s net worth of $7.88 billion represents its market capitalization, not the value of its factories or brands alone. This figure is calculated using two exact components:

The company has approximately 298 million shares outstanding. As of January 2026, the average trading share price values the company’s equity at $7.88 billion in total.

Market capitalization reflects equity value only. It does not include company debt or cash. Investors use this figure to judge how the market values Campbell’s future earnings, brand durability, and dividend sustainability.

A net worth lower than annual revenue indicates that the market assigns a conservative valuation multiple to Campbell’s Company. This is typical for mature packaged-food businesses with stable demand but limited high-growth potential.

Investors value Campbell’s primarily as a cash-generating, dividend-paying company, not a growth stock. As a result, its valuation is driven more by earnings consistency and pricing power than by expansion expectations.

Relationship Between Revenue Scale and Market Value

Campbell’s Company generates over $10 billion annually from consumer food products that are purchased frequently and consistently. However, operating margins, retailer pricing pressure, and input cost sensitivity limit how aggressively the market values those sales.

This explains why the company’s revenue base is large, while its equity valuation remains moderate relative to total sales.

Companies Owned by The Campbell’s Company

As of 2026, The Campbell’s Company operates a diversified portfolio of food and beverage businesses that extend well beyond soup. The company owns and manages a mix of legacy brands, premium snack companies, and specialized foodservice operations.

Below is a list of the companies and brands owned by The Campbell’s Company as of January 2026:

| Company / Brand | Category | Primary Products | Market Position & Role |

|---|---|---|---|

| Campbell’s | Meals & Beverages | Condensed soups, ready-to-serve soups, cooking soups | Core and largest brand. Market leader in U.S. soup category with deep household penetration and nationwide distribution. |

| Campbell’s Chunky | Meals & Beverages | Hearty meal-style soups | Positioned as a filling, protein-rich meal replacement. Targets working adults and single-serve consumption. |

| Well Yes! | Meals & Beverages | Lower-sodium, clean-label soups | Health-focused line addressing wellness and ingredient transparency trends. |

| Swanson | Meals & Beverages | Broths, stocks, bone broths | Leading cooking liquid brand. High repeat usage tied to home-cooking and recipe preparation. |

| Prego | Meals & Beverages | Pasta sauces | Major shelf-stable pasta sauce brand competing in mainstream Italian sauce category. |

| Pace | Meals & Beverages | Salsas, Tex-Mex sauces | Strong brand recognition in salsa category. Used both as dip and cooking ingredient. |

| V8 | Beverages | Vegetable juice, juice blends, energy drinks | Nutrition-oriented beverage brand. Anchors Campbell’s presence in functional drinks. |

| Pepperidge Farm | Snacks & Bakery | Cookies, crackers, breads, frozen bakery | Premium snack and bakery brand. One of Campbell’s most profitable businesses. |

| Goldfish | Snacks | Snack crackers | Flagship snack brand under Pepperidge Farm. Category leader in children’s snack crackers. |

| Snyder’s of Hanover | Snacks | Pretzels, pretzel pieces | Major salty-snack brand with strong presence in pretzels and flavored snack pieces. |

| Lance | Snacks | Sandwich crackers, snack packs | Focused on convenience and on-the-go consumption. Strong in vending and convenience channels. |

| Cape Cod | Snacks | Kettle-cooked potato chips | Premium chip brand emphasizing small-batch cooking and bold flavors. |

| Late July | Snacks | Organic tortilla chips, snacks | Better-for-you and organic snack brand targeting health-conscious consumers. |

| Snack Factory | Snacks | Pretzel Crisps | Flat pretzel snack positioned for dipping and adult snacking occasions. |

| Kettle Brand | Snacks | Kettle-cooked potato chips | Premium potato chip brand with strong flavor innovation and higher price positioning. |

| Campbell’s Foodservice | Foodservice | Soups, sauces, customized food solutions | Supplies restaurants, schools, hospitals, and institutions with bulk and customized products. |

| Campbell’s Manufacturing Operations | Operations | Food production and logistics | Integrated manufacturing and supply chain network supporting retail and foodservice businesses across North America. |

Campbell’s

Campbell’s is the core operating brand and the company’s largest business unit. It includes condensed soups, ready-to-serve soups, Chunky, Homestyle, and cooking soups. Campbell’s products are produced at scale and distributed nationwide. The brand benefits from decades of consumer recognition and remains a dominant force in the U.S. soup aisle. It also serves as the foundation for innovation in flavor extensions, portion formats, and sodium-reduced recipes.

Campbell’s Chunky

Campbell’s Chunky operates as a distinct line within the soup portfolio. It is positioned as a meal replacement rather than a side dish. Chunky soups are thicker, protein-focused, and sold primarily in single-serve cans. The brand targets working adults and active consumers seeking convenience and satiety. Its marketing and packaging clearly differentiate it from traditional condensed soups.

Well Yes!

Well Yes! represents Campbell’s response to ingredient transparency and wellness trends. The line focuses on recognizable ingredients, lower sodium content, and nutritional labeling clarity. It allows the company to compete in the better-for-you soup category without diluting its flagship brand. Well Yes! products are sold alongside mainstream soups but appeal to health-conscious shoppers.

Swanson

Swanson is a cornerstone of Campbell’s cooking and meal-prep business. The brand specializes in broths, stocks, and bone broths used as recipe bases. Swanson benefits from frequent household usage and repeat purchases. It also plays a strategic role in cross-selling, as its products are commonly used alongside soups, sauces, and rice dishes.

Prego

Prego is Campbell’s primary pasta sauce business. It competes in the shelf-stable Italian sauce market and offers traditional, chunky, lower-sugar, and specialty varieties. Prego’s positioning emphasizes thickness and flavor consistency. The brand gives Campbell’s a strong presence in center-aisle meal solutions beyond soup.

Pace

Pace operates in the salsa and Tex-Mex category. It is known for bold flavors and wide availability. Pace products are used both as dips and cooking ingredients, allowing the brand to participate in multiple consumption occasions. It complements Campbell’s broader meal-enhancement strategy.

V8

V8 is Campbell’s beverage platform. It includes vegetable juices, fruit-vegetable blends, and V8 Energy drinks. The brand is positioned around nutrition and functionality rather than refreshment alone. V8 extends Campbell’s reach beyond food into beverages while maintaining alignment with health and wellness messaging.

Pepperidge Farm

Pepperidge Farm operates as a premium bakery and snack company within Campbell’s portfolio. It produces cookies, crackers, breads, frozen bakery items, and snack products. Pepperidge Farm maintains a higher price point and emphasizes quality ingredients and baking heritage. It is one of Campbell’s most profitable and strategically important businesses.

Goldfish

Goldfish is a flagship snack brand under Pepperidge Farm. It dominates the children’s snack cracker category and has expanded into adult-oriented flavors and formats. Goldfish benefits from strong brand loyalty, high consumption frequency, and wide distribution across retail channels.

Snyder’s of Hanover

Snyder’s of Hanover is a major salty-snack brand specializing in pretzels and pretzel pieces. The brand offers traditional, flavored, and specialty pretzels. It strengthens Campbell’s position in savory snacks and contributes significantly to the Snacks segment.

Lance

Lance focuses on sandwich crackers and convenience-oriented snack packs. The brand performs well in vending, convenience stores, and multipack formats. Lance supports Campbell’s strategy of serving on-the-go consumption occasions.

Cape Cod

Cape Cod operates in the premium kettle-cooked potato chip category. It emphasizes small-batch cooking and distinctive flavors. The brand allows Campbell’s to compete in higher-margin snack segments.

Late July

Late July is focused on organic and better-for-you snacks. It produces tortilla chips and snacks made with organic ingredients. Late July gives Campbell’s access to health-conscious consumers and natural food retail channels.

Snack Factory

Snack Factory produces Pretzel Crisps, a flat pretzel snack positioned for dipping and sharing. The brand appeals to adult snackers and social occasions. It expands Campbell’s footprint beyond traditional chip formats.

Kettle Brand

Kettle Brand is a well-known kettle-cooked potato chip company. It offers bold flavors and premium positioning. Kettle Brand adds depth to Campbell’s salty snack lineup and strengthens shelf presence in the premium chip category.

Campbell’s Foodservice

Campbell’s Foodservice supplies soups, sauces, and customized food solutions to restaurants, schools, hospitals, and institutions. This division operates separately from retail branding and focuses on bulk packaging, consistency, and cost efficiency. It allows Campbell’s to participate in non-retail consumption channels.

Campbell’s Manufacturing and Supply Chain Operations

Campbell’s Manufacturing Operations consist of production facilities and distribution centers across North America. These operations manufacture soups, snacks, beverages, and baked goods. Vertical integration allows the company to control quality, manage costs, and support national distribution at scale.

Final Thoughts

For anyone seeking clarity on who owns Campbell Soup, the answer lies in its publicly traded structure supported by a combination of major institutional investors and long-standing family shareholders tied to the company’s history. This ownership balance allows Campbell’s Company to maintain strategic stability while remaining accountable to the market.

Over time, the business has expanded far beyond soup into meals, beverages, and snacks, supported by a strong portfolio of established brands and nationwide distribution. Professional management oversees daily operations, while shareholders influence long-term direction through governance and voting power, making Campbell’s a steady, resilient food company built for long-term continuity rather than short-term disruption.

FAQs

Who owns Campbell Soup Company?

The Campbell’s Company is publicly owned. Its shares are held by a combination of institutional investors, individual shareholders, and members of the Dorrance family. No single entity owns the company outright, but a small group of major shareholders collectively holds significant influence through voting power.

Who owns the most shares of Campbell’s Soup?

The largest individual shareholder is Mary Alice Dorrance Malone, who owns about 18% of the company’s outstanding shares. She is followed by Bennett Dorrance, who holds roughly 15%. Together, the Dorrance family controls close to one-third of Campbell’s Company through direct and indirect holdings.

What are the companies owned by Campbell Soup?

Campbell Soup owns and operates a wide range of food and beverage businesses. These include Campbell’s, Pepperidge Farm, Goldfish, Snyder’s of Hanover, Lance, Swanson, Prego, Pace, V8, Cape Cod, Late July, Snack Factory, Kettle Brand, and Campbell’s Foodservice. All of these brands are operated directly by the company as of 2026.

How much is the Dorrance family worth?

The combined net worth of the Dorrance family is estimated to be over $17 billion. Most of this wealth is tied to their long-term ownership stake in Campbell’s Company and related investment holdings, rather than direct involvement in day-to-day business operations.

Does Campbell’s Soup still own Godiva?

No. Campbell’s Soup does not own Godiva. The company sold the Godiva chocolate brand in 2019, fully exiting the premium chocolate business to focus on its core meals and snacks portfolio.

What is the largest soup company in the world?

Campbell’s is widely regarded as the largest soup company in the world by brand recognition and category leadership, particularly in the U.S. market. Its soup products dominate shelf space and household penetration compared to global competitors.

Is Campbell’s owned by Nestlé?

No. Campbell’s is not owned by Nestlé. Nestlé is a separate global food company with no ownership stake or controlling interest in Campbell’s Company.

What brands does Campbell Soup own?

Campbell Soup owns a broad portfolio of brands across meals, beverages, and snacks. Key brands include Campbell’s, Campbell’s Chunky, Swanson, Prego, Pace, V8, Pepperidge Farm, Goldfish, Snyder’s of Hanover, Lance, Cape Cod, Late July, Snack Factory, Kettle Brand, and Campbell’s Foodservice. These brands form the backbone of the company’s operations as of 2026.