- Vitaminwater is fully owned by The Coca-Cola Company, following Coca-Cola’s acquisition of Glacéau in 2007 for $4.1 billion. This acquisition brought Vitaminwater, along with other Glacéau brands, under Coca-Cola’s global beverage portfolio.

- Strategic decisions, including brand direction and product management, are overseen by Coca-Cola’s executive team and board of directors, ensuring alignment with the parent company’s global objectives.

- The acquisition allowed Coca-Cola to expand into the enhanced water and functional beverage market, leveraging Vitaminwater’s existing brand recognition, distribution networks, and consumer base.

- Vitaminwater’s ownership structure reflects a single-parent model, with no independent subsidiaries, acquisitions, or mergers conducted by Vitaminwater itself since the acquisition.

Vitaminwater is a flavored, vitamin-enhanced water brand positioned between plain bottled water and traditional soft drinks. The brand focuses on hydration combined with functional benefits such as added vitamins and minerals. Its identity is built around colorful packaging, distinct flavor names, and lifestyle-driven marketing.

It has been marketed toward active, health-conscious consumers who want more flavor than water but fewer compromises than sugary sodas.

As of 2025, Vitaminwater continues to operate as a core enhanced water brand within The Coca-Cola Company’s global beverage portfolio. It remains especially strong in the United States, with a selective international presence.

Vitaminwater Founders

Vitaminwater was founded by J. Darius Bikoff, a New York–based entrepreneur known for his unconventional approach to beverage innovation. He established Energy Brands, later branded as Glacéau, in 1996. Bikoff did not come from a traditional beverage manufacturing background. Instead, his early career included work in finance and marketing, which shaped how he approached product positioning and branding.

The original idea behind Vitaminwater emerged from Bikoff’s personal lifestyle. He began mixing vitamins and electrolytes into water at home after workouts. He believed plain water lacked appeal for many consumers, while soft drinks were overloaded with sugar. This gap in the market became the foundation of Vitaminwater.

Bikoff focused heavily on branding from the start. He treated Vitaminwater as a lifestyle product rather than a functional supplement. Flavor names, bottle labels, and marketing language were designed to be playful, irreverent, and memorable. This strategy helped the brand connect with younger and fitness-oriented audiences.

Another defining aspect of Bikoff’s leadership was his emphasis on direct relationships with retailers and distributors. Instead of relying solely on traditional advertising, he leveraged word-of-mouth marketing and high-visibility product placement. This approach accelerated early growth and set Vitaminwater apart from competing beverage startups.

Bikoff remained closely involved with Glacéau until its acquisition by The Coca-Cola Company. His role in building Vitaminwater from a niche concept into a nationally recognized brand is often cited as one of the most successful beverage entrepreneurship stories of the modern era.

Major Milestones

- 1996: J. Darius Bikoff founded Energy Brands, later known as Glacéau, in New York with a focus on enhanced hydration products.

- 1998: Glacéau began experimenting with electrolyte- and vitamin-infused water concepts, setting the foundation for future branded products.

- 2000: Vitaminwater was officially launched, introducing flavored water with added vitamins and minerals to a broader consumer market.

- 2001: Early regional distribution expanded beyond New York, with Vitaminwater entering health food stores and specialty retailers across the U.S.

- 2003: The brand gained traction in gyms, fitness centers, and urban retail locations, strengthening its association with active lifestyles.

- 2004: National retail expansion accelerated, placing Vitaminwater in major grocery chains and convenience stores.

- 2005: Celebrity and athlete endorsements helped push Vitaminwater into mainstream pop culture and increased brand visibility.

- 2006: Vitaminwater became one of the fastest-growing enhanced water brands in the United States.

- 2007: The Coca-Cola Company acquired Glacéau, bringing Vitaminwater under Coca-Cola’s ownership and global distribution system.

- 2008: Vitaminwater began expanding into select international markets using Coca-Cola’s bottling network.

- 2011: New flavor profiles and functional variations were introduced to diversify the product lineup.

- 2013: The brand adjusted formulations to respond to growing consumer awareness around sugar intake.

- 2016: Vitaminwater strengthened its focus on lifestyle branding, digital marketing, and experiential campaigns.

- 2018: Zero-sugar and lower-calorie Vitaminwater variants gained increased prominence in the product portfolio.

- 2020: Packaging updates were rolled out to modernize the brand while maintaining its recognizable identity.

- 2023: Vitaminwater aligned more closely with wellness and hydration trends, emphasizing clean labeling and refreshed messaging.

- 2025: Vitaminwater remains a well-established Coca-Cola brand, continuing to evolve through product innovation, updated branding, and alignment with modern consumer preferences.

Who Owns Vitaminwater?

Vitaminwater is owned by The Coca-Cola Company. Coca-Cola acquired Glacéau in 2007 for approximately $4.1 billion. Since then, Vitaminwater has operated as a Coca-Cola brand rather than a standalone company.

The Coca-Cola Company holds full ownership and control. Strategic decisions, product expansion, pricing, and global distribution are handled within Coca-Cola’s corporate structure. Vitaminwater benefits from Coca-Cola’s bottling network, marketing power, and international reach.

- Brand Name: Vitaminwater

- Parent Company: The Coca-Cola Company

- Ownership Type: 100% wholly owned by Coca-Cola

- Acquisition Year: 2007

- Original Founder: J. Darius Bikoff (Glacéau/Energy Brands)

- Ownership Structure: Fully consolidated under Coca-Cola; no minority owners or joint ventures

- Decision-Making: Controlled by Coca-Cola’s corporate leadership and brand governance

- Manufacturing & Distribution: Through Coca-Cola’s franchised bottling system

- Financial Reporting: Included in Coca-Cola’s consolidated results; no standalone financials

- Ownership Changes: None since the 2007 acquisition.

Parent Company: The Coca-Cola Company

Vitaminwater is owned outright by The Coca-Cola Company and operates as a brand within Coca-Cola’s North America Operating Unit. It is not a subsidiary with its own corporate structure, board, or financial reporting. All legal ownership, trademark rights, formulas, and brand assets are held directly by Coca-Cola.

From an operational standpoint, Vitaminwater is produced and distributed through Coca-Cola’s franchised bottling system, primarily Coca-Cola Consolidated, Coca-Cola UNITED, and other authorized bottlers in the U.S.

These bottlers handle manufacturing, packaging, and physical distribution, while Coca-Cola retains control over brand standards, product specifications, and concentrate formulation.

Strategic control of Vitaminwater sits at the corporate brand and category level, not at an independent brand office. Decisions related to product line extensions, flavor discontinuations, sugar-content adjustments, and packaging redesigns are approved within Coca-Cola’s hydration and sports beverage leadership.

This includes alignment with Coca-Cola’s broader shift toward lower-sugar and zero-sugar beverages across its portfolio.

Pricing architecture for Vitaminwater is determined centrally by Coca-Cola in coordination with bottling partners. Retail pricing execution varies by market, but margin targets, promotional calendars, and channel strategies are set at the corporate level. Vitaminwater is positioned as a premium enhanced water, typically priced above standard bottled water brands like Dasani.

Marketing control is also centralized. While Vitaminwater maintains a distinct tone and visual identity, national campaigns, influencer partnerships, and packaging updates are approved by Coca-Cola’s brand governance teams. The brand no longer operates with the autonomy it had under Glacéau prior to 2007.

Legally and financially, Vitaminwater is fully consolidated into The Coca-Cola Company’s results. It does not disclose standalone revenue, profit, or market share figures. All regulatory compliance, labeling standards, and litigation risk are borne by Coca-Cola as the parent company.

Acquisition of Vitaminwater by The Coca-Cola Company

Vitaminwater became part of The Coca-Cola Company through Coca-Cola’s acquisition of Energy Brands (Glacéau) in May 2007. The transaction was structured as a cash-and-stock deal valued at approximately $4.1 billion, making it one of the largest beverage brand acquisitions of that decade.

Under the terms of the deal, Coca-Cola paid a significant cash component and issued Coca-Cola shares to Glacéau shareholders. The structure allowed Coca-Cola to immediately gain 100% ownership of Vitaminwater, Smartwater, and all associated intellectual property, formulas, and brand rights.

A notable aspect of the acquisition was the earn-out and equity upside for Glacéau’s founder and early investors. J. Darius Bikoff, who retained a substantial ownership stake prior to the sale, became a billionaire as a result of the transaction. The deal also rewarded early institutional backers and senior executives with equity-based payouts tied to Glacéau’s growth trajectory.

Coca-Cola did not dismantle Glacéau after the acquisition. Instead, it retained Glacéau as a distinct operating unit within Coca-Cola’s North America business, at least in the initial years. This decision was deliberate. Coca-Cola wanted to preserve Glacéau’s brand voice, marketing style, and product innovation culture, which were seen as core drivers of Vitaminwater’s success.

From an operational standpoint, Coca-Cola integrated Vitaminwater into its bottling, manufacturing, and distribution system almost immediately. This gave the brand nationwide and later international reach that Glacéau could not have achieved independently. At the same time, Coca-Cola assumed control over regulatory compliance, ingredient sourcing standards, and quality assurance.

The acquisition also came with regulatory and legal implications. In the years following the deal, Vitaminwater faced scrutiny over marketing and labeling claims related to health benefits. These issues were managed at the Coca-Cola corporate level, reinforcing that full legal and reputational responsibility for the brand had transferred to Coca-Cola.

Strategically, the acquisition allowed Coca-Cola to buy market leadership rather than build it. At the time of purchase, Vitaminwater was already one of the fastest-growing enhanced water brands in the U.S., with strong urban penetration and premium shelf positioning. Coca-Cola used the acquisition to accelerate its shift away from reliance on carbonated soft drinks and deepen its presence in functional and wellness-oriented beverages.

Vitaminwater Leadership

As of 2025, the lead executive responsible for Vitaminwater at the brand level is Amanda Harkins, who serves as Brand Director, Vitaminwater within The Coca‑Cola Company’s North America Operating Unit.

Harkins is the primary leader shaping the brand’s strategy, positioning, and creative direction in the current market. She oversees key aspects such as packaging innovation, flavor portfolio decisions, consumer engagement, and alignment with broader category trends.

Her leadership is reflected in the brand’s refreshed packaging identity and expanded flavor offerings that emphasize modern relevance and functional benefits.

Brand-Level Functional Leadership

Under the Brand Director, several key roles support execution of marketing, design, and product development:

Matt Cooper – Design Director, Vitaminwater: Cooper leads the visual and design strategy for the brand, including the execution of its refreshed packaging system launched in 2025. This role includes translating high‑level brand direction into tangible creative assets that resonate with contemporary consumers.

Reporting Structure and Oversight

The Brand Director reports into Coca‑Cola’s senior leadership responsible for the hydration and enhanced water category, which includes brands like Vitaminwater and smartwater. Within this operating unit, leadership is structured to ensure that category strategy, brand growth, and market execution are coordinated across regional teams and corporate functions.

While the Brand Director makes most decisions specific to Vitaminwater’s positioning and consumer interface, corporate oversight from The Coca‑Cola Company’s broader leadership ensures alignment with enterprise goals, global marketing standards, and financial targets established for the enhanced water segment.

Leadership Focus Areas

Under the current leadership structure, key priorities for Vitaminwater include:

- Refreshing the brand identity to remain relevant to evolving consumer tastes, particularly among younger demographics.

- Expanding distribution of both full‑sugar and zero‑sugar varieties with updated packaging to enhance shelf visibility.

- Emphasizing functional beverage benefits (e.g., electrolytes, immune‑focused nutrients) in product development and campaign messaging.

Vitaminwater Annual Revenue and Net Worth

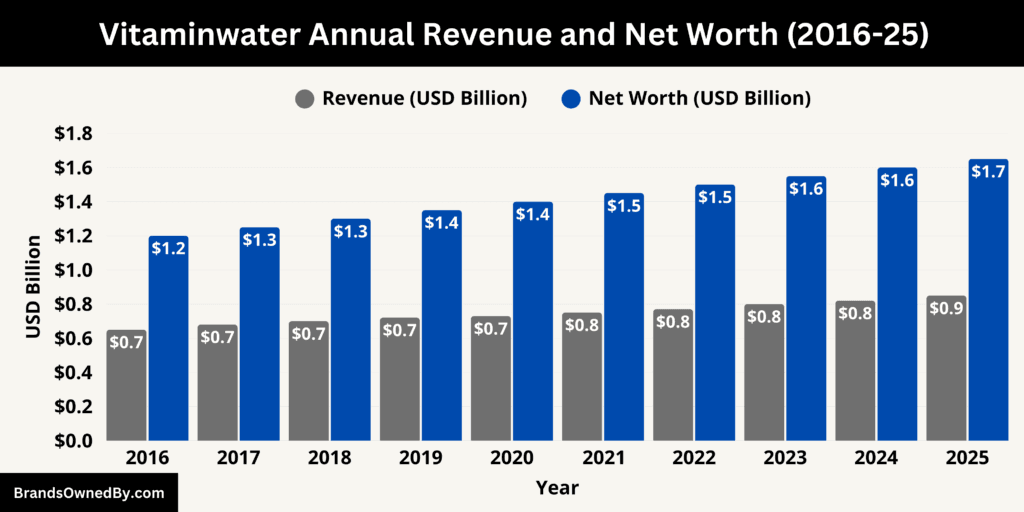

As of December 2025, Vitaminwater’s annual retail revenue at approximately $850 million, reflecting strong consumer demand for vitamin‑infused and flavored hydration products. The estimated brand net worth is around $1.65 billion, based on market share, consumer recognition, and category positioning within the global functional beverage market.

Revenue 2025

Vitaminwater has consistently been one of the largest products in the enhanced water segment. Prior market analyses put Vitaminwater’s annual sales above $700 million in earlier years, and more recent estimates suggest that its annual retail sales value in 2025 is approximately $830–$850 million.

This estimate is consistent with how leading market research reports categorize enhanced water products and their retail performance relative to category totals. The global vitamin water functional drinks market, which includes brands like Vitaminwater, generated around $2.7 billion in revenue in 2024, with continued growth expected into 2025.

This broader market context implies that Vitaminwater likely retains a significant share of category sales.

These revenue estimates reflect Vitaminwater’s performance across key retail channels such as supermarkets, convenience stores, mass merchants, and e‑commerce platforms. The continued introduction of new flavors and packaging refreshes, along with expanded distribution for both full‑sugar and zero‑sugar variants, contributes to the brand’s ability to sustain and modestly grow its sales year over year.

Net Worth

The estimated net worth of $1.65 billion as of December 2025 represents the brand value of Vitaminwater as a standalone entity within the enhanced water category.

This valuation accounts for consumer awareness, market share, brand equity, and competitive positioning. The figure is derived from comparative analysis with other leading functional water brands and reflects Vitaminwater’s contribution to the overall market for vitamin-enhanced beverages.

Vitaminwater’s net worth is bolstered by consistent consumer demand, strong retail presence, and a recognizable brand identity that differentiates it from competitors. Strategic investments in packaging innovation, flavor diversification, and marketing campaigns support both its current revenue and long-term brand valuation.

Brands Owned by Vitaminwater

Below is a list of the major brands owned by Vitaminwater as of December 2025:

| Brand / Product Line | Description | Key Features | Target Audience | Market Role |

|---|---|---|---|---|

| Vitaminwater Original | Flagship product line | Flavored water with added vitamins, electrolytes, and minerals | General consumers seeking functional hydration | Largest revenue contributor, establishes core brand identity |

| Vitaminwater Zero | Sugar-free variant of the Original line | Vitamins and electrolytes, no added sugar | Health-conscious and low-calorie seekers | Key growth driver in sugar-free beverage segment |

| Vitaminwater Immune Support | Focused on immune system benefits | Enriched with vitamins C, D, and minerals | Consumers interested in wellness and immune support | Supports seasonal demand and wellness positioning |

| Vitaminwater Energy | Mild energy-boosting beverage | Electrolytes, vitamins, moderate stimulation | Active consumers seeking functional energy | Differentiates from traditional energy drinks, complements functional hydration |

| Vitaminwater Hydration Series | Performance hydration line | Electrolytes and minerals for replenishment | Athletes and physically active individuals | Positions Vitaminwater in the sports and active lifestyle segment |

| Vitaminwater Limited Editions / Seasonal Flavors | Rotating special flavors | Unique ingredients, seasonal packaging | Trend-focused and experimental consumers | Creates brand visibility spikes and marketing engagement |

Vitaminwater Original

Vitaminwater Original is the flagship product line that established the brand’s identity in the enhanced water market. It includes a range of flavored waters with added vitamins, electrolytes, and minerals. Each flavor is designed to target specific wellness or lifestyle benefits, such as energy, immune support, or hydration. The Original line remains the largest contributor to Vitaminwater’s estimated revenue, supported by nationwide distribution in retail, convenience, and online channels.

Vitaminwater Zero

Vitaminwater Zero is a sugar-free version of the flagship product line. It provides the same vitamin and electrolyte benefits without added calories, catering to health-conscious consumers seeking functional beverages without sugar intake. This line has grown in popularity alongside increased consumer focus on low-calorie beverages and continues to be a key part of Vitaminwater’s overall product strategy.

Vitaminwater Immune Support

This product line focuses specifically on enhanced formulations aimed at supporting the immune system. It includes flavors enriched with vitamins C, D, and other micronutrients. While smaller than the Original and Zero lines in terms of market share, the Immune Support line has positioned Vitaminwater as a functional beverage aligned with wellness trends, particularly during seasonal demand peaks for immune-boosting products.

Vitaminwater Energy

Vitaminwater Energy is formulated to provide a mild boost in energy through added electrolytes and vitamins. It targets consumers who seek functional hydration combined with enhanced alertness and vitality. This line differentiates itself from traditional energy drinks by providing moderate stimulation without the high caffeine or sugar content typical of conventional energy beverages.

Vitaminwater Hydration Series

This series focuses on high-performance hydration for active and athletic consumers. The Hydration Series is fortified with electrolytes and minerals to aid in replenishment during exercise or physical activity. It supports Vitaminwater’s positioning in the active lifestyle segment and complements its broader portfolio of functional hydration products.

Vitaminwater Limited Editions and Seasonal Flavors

Vitaminwater also periodically releases limited edition and seasonal flavors to maintain consumer interest and respond to trends. These offerings vary year to year and provide opportunities to experiment with new ingredients, flavor profiles, and packaging innovations. Limited editions often receive targeted marketing campaigns and social media promotion, creating short-term spikes in brand visibility and retail demand.

Final Thoughts

Vitaminwater has established itself as a leading brand in the enhanced and functional water market. Its diverse product lines, including Original, Zero, Immune Support, Energy, and Hydration Series, demonstrate the brand’s ability to meet consumer demand for wellness-focused and flavored hydration.

As of 2025, Vitaminwater continues to generate significant retail revenue and maintains a strong brand value, reflecting its market presence and consumer loyalty.

Understanding who owns Vitaminwater and how the brand operates provides insight into its sustained success and relevance in the competitive beverage industry. The brand’s focused leadership and strategic product offerings ensure that Vitaminwater remains a key player in the functional beverage segment.

FAQs

Is Vitaminwater owned by Coke or Pepsi?

Vitaminwater is owned by The Coca-Cola Company. It is not affiliated with PepsiCo. Coca-Cola acquired the brand in 2007 when it purchased Glacéau, the company that created Vitaminwater.

Does 50 Cent own Vitaminwater?

50 Cent does not own Vitaminwater as a company. He had an endorsement and partnership deal with the brand, which included marketing and profit-sharing components tied to specific product lines.

Is Vitaminwater owned by Coca-Cola?

Yes, Vitaminwater is owned by Coca-Cola. The brand became part of Coca-Cola’s portfolio after the 2007 acquisition of Glacéau.

Who is the original owner of Vitaminwater?

The original owner of Vitaminwater was Energy Brands, also known as Glacéau, founded by J. Darius Bikoff in 1996.

Who started Vitaminwater?

Vitaminwater was started by J. Darius Bikoff, who created the brand under the Glacéau company.

Who invented Vitaminwater?

J. Darius Bikoff is credited with inventing Vitaminwater. He developed the concept of flavored water enhanced with vitamins and minerals.

Does 50 Cent own a part of Vitaminwater?

50 Cent did not own an equity stake in Vitaminwater itself. His involvement was through a partnership deal with Glacéau before the Coca-Cola acquisition, which included promotion and royalties from sales of a co-branded flavor.

How much did 50 Cent make off his Vitaminwater deal?

50 Cent reportedly earned around $100 million from his partnership and endorsement deal with Vitaminwater, primarily from the sale of the company to Coca-Cola in 2007, which included his share of profits from the co-branded product line.