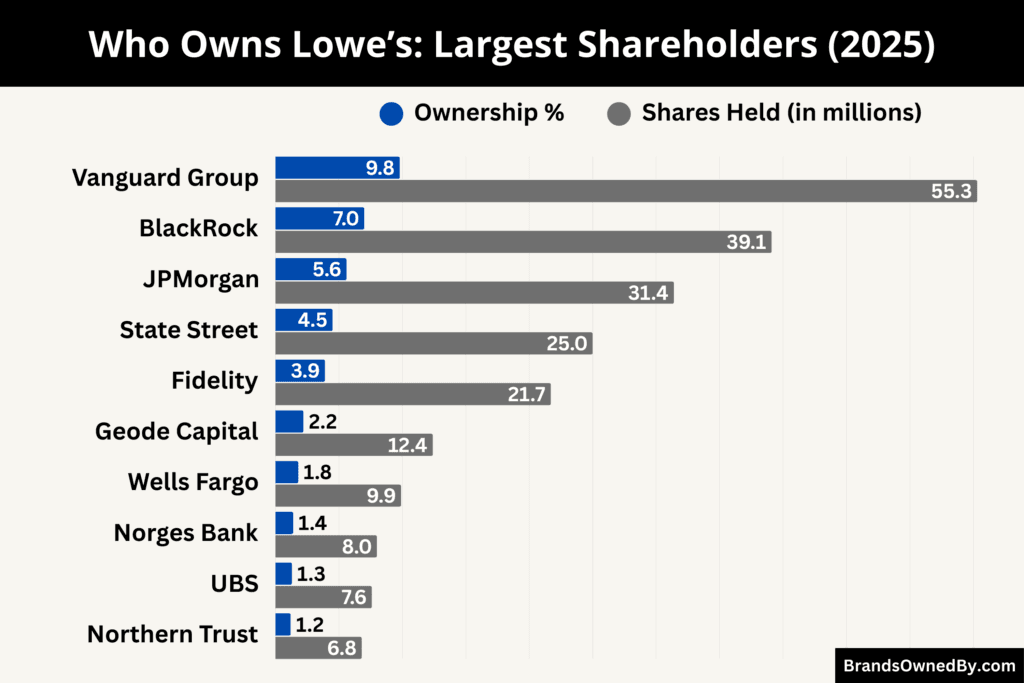

- Lowe’s Companies, Inc. is a publicly traded company with no controlling founder or family. Ownership is institutionally driven, with the largest shareholders collectively holding a decisive share of voting power.

- Vanguard Group is the largest shareholder, owning approximately 9.8% of Lowe’s outstanding shares, giving it the strongest single voting influence.

- BlackRock holds about 7.0%, JPMorgan Asset Management owns roughly 5.6%, and State Street Global Advisors controls around 4.5%, together forming a powerful institutional bloc.

- Company insiders and retail investors each hold relatively small, fragmented stakes, meaning Lowe’s governance and strategic direction are primarily shaped by institutional shareholders holding over 30% of total shares combined.

Lowe’s Companies, Inc. is a leading American home improvement retailer. The company operates a large chain of stores that sell building materials, tools, appliances, décor, and gardening supplies. Lowe’s serves both everyday homeowners and professional contractors.

Its network of stores spans the United States. The company is known for its wide product selection and customer service aimed at helping customers complete projects of all sizes. Lowe’s has grown into one of the most recognized names in home improvement retail, with a national presence and a strong brand reputation.

Lowe’s Founders

Lowe’s began nearly a century ago with a small hardware store. Lucius Smith Lowe founded the business in 1921 in North Wilkesboro, North Carolina.

The original store was named North Wilkesboro Hardware and sold a mix of hardware, farm supplies, dry goods, and other everyday items. Lucius Lowe ran the store until his death in 1940.

After his death, his daughter, Ruth Buchan, inherited the business. Within the same year, she sold the company to her brother, James Lowe.

In 1943, James took on his brother-in-law, H. Carl Buchan, as a partner. Carl Buchan later became the driving force behind Lowe’s transformation into a retail chain focused on building supplies and home improvement products.

H. Carl Buchan is often credited as a co-founder in the modern sense because he was instrumental in reshaping the company. He refocused the business on core categories and expanded the number of store locations throughout the 1940s and 1950s.

In 1952, Buchan became the sole owner and incorporated the business as Lowe’s North Wilkesboro Hardware. This incorporation laid the groundwork for the company’s future growth as a national retailer.

Major Milestones

- 1921: Lucius Smith Lowe opened the first store, North Wilkesboro Hardware, in North Wilkesboro, North Carolina. This marked the beginning of what would later become Lowe’s Companies, Inc.

- 1940: Lucius Smith Lowe passed away. Ownership and management of the business transferred to his family, beginning a new phase in the company’s history.

- 1943: H. Carl Buchan joined the company as a partner. He shifted the business focus toward hardware and building materials to align with growing construction demand.

- 1949: The second Lowe’s store opened in Sparta, North Carolina. This was the company’s first step toward operating multiple locations.

- 1952: Carl Buchan became the sole owner and incorporated the company as Lowe’s North Wilkesboro Hardware, giving it a formal corporate structure.

- 1954: James Lowe, the founder’s son, established Lowes Foods as a separate grocery business, which later became independent from the hardware chain.

- 1961: Lowe’s became a publicly traded company and adopted the name Lowe’s Companies, Inc., opening the door to broader expansion.

- 1962: The company expanded beyond its original region and began operating across multiple states in the southeastern United States.

- 1970: Lowe’s surpassed 50 store locations, reflecting sustained regional growth and increasing brand recognition.

- 1979: Lowe’s strengthened its national presence and became more widely traded on the New York Stock Exchange, reinforcing its public-company status.

- 1980: The company began transitioning to larger store formats, moving toward the modern big-box home improvement model.

- 1984: Lowe’s expanded its product mix to serve both do-it-yourself customers and professional contractors more effectively.

- 1989: The store network grew past 300 locations, establishing Lowe’s as a major national retailer.

- 1994: Lowe’s surpassed 400 stores, continuing its rapid expansion across new U.S. markets.

- 1999: The company crossed 700 store locations, intensifying competition with other national home improvement chains.

- 2001: Lowe’s exceeded 1,000 stores, becoming one of the largest home improvement retailers in the United States.

- 2007: Lowe’s entered the Canadian market, marking its first major international expansion.

- 2010: The company expanded into Mexico, further extending its North American footprint.

- 2012: Lowe’s increased its focus on online retail and supply-chain modernization to support omni-channel shopping.

- 2018: Marvin Ellison was appointed CEO, initiating operational restructuring and renewed emphasis on professional customers.

- 2020: Lowe’s launched its Total Home strategy, focusing on customer experience, pro services, digital integration, and operational efficiency.

- 2023: The company streamlined international operations to concentrate on core North American markets.

- 2025: Lowe’s strengthened its professional contractor ecosystem through strategic acquisitions, supporting long-term growth and service expansion.

Who Owns Lowe’s: Major Shareholders

Lowe’s Companies, Inc. is a publicly traded company with a highly institutionalized ownership structure. More than three-quarters of the outstanding shares are held by large institutional investors. These include index fund managers, mutual fund providers, pension managers, and sovereign wealth funds.

Governance influence is exercised collectively through shareholder voting, board elections, and executive oversight. Retail investors and company insiders together account for a relatively small portion of total ownership, making institutions the primary power center within Lowe’s ownership structure.

Below is a list of the largest shareholders of Lowe’s as of December 2025:

Vanguard Group

Vanguard is the largest shareholder of Lowe’s, holding approximately 9.8% (55.3 million shares). This position is spread across multiple Vanguard index funds and ETFs, including large-cap and total market funds.

Vanguard’s ownership is considered highly stable because its funds are designed to track indices rather than trade actively. As a result, Vanguard rarely reduces its position unless Lowe’s exits major indices.

Its influence is most visible in proxy voting, where it plays a key role in approving board members, governance policies, and executive pay structures. Vanguard does not intervene in daily operations, but its long-term voting power makes it one of the most influential voices in Lowe’s corporate governance.

BlackRock

BlackRock owns about 7.0% (39.1 million shares) of Lowe’s, making it the second-largest shareholder. Its holdings are split between passive products such as iShares ETFs and actively managed institutional portfolios. BlackRock is known for active engagement with portfolio companies, including Lowe’s, particularly on governance standards, leadership accountability, and operational resilience.

While BlackRock does not seek control, its size allows it to materially influence shareholder outcomes, especially when voting aligns with other large institutions like Vanguard and State Street.

JPMorgan Asset Management

JPMorgan Asset Management holds approximately 5.6% (31.4 million shares) of Lowe’s. These shares are managed across pension funds, sovereign mandates, institutional portfolios, and mutual funds. JPMorgan’s stake reflects confidence in Lowe’s long-term business fundamentals and competitive positioning.

As a shareholder, JPMorgan participates in governance votes related to board structure, executive leadership, and strategic initiatives. Its ownership does not translate into operational authority, but its vote carries meaningful weight due to the size of its position.

State Street Global Advisors

State Street Global Advisors owns around 4.5% (25.0 million shares) of Lowe’s. Much of this stake is held through index-tracking investment vehicles that mirror major U.S. equity benchmarks.

Despite its passive investment style, State Street is an active participant in corporate governance. It regularly votes on issues related to board diversity, independence, and shareholder rights.

Its ownership contributes to the institutional stability of Lowe’s shareholder base and reinforces long-term governance continuity.

Fidelity Management & Research

Fidelity, through FMR LLC, holds roughly 3.9% (21.7 million shares) of Lowe’s. These shares are distributed across Fidelity’s actively managed mutual funds and long-term investment accounts. Fidelity’s investment approach tends to emphasize operational performance, management execution, and risk discipline.

While Fidelity does not seek a controlling role, its ownership gives it influence in key shareholder votes, particularly those involving executive compensation and strategic oversight.

Geode Capital Management

Geode Capital Management owns about 2.2% (12.4 million shares) of Lowe’s. Geode primarily manages passive strategies and often operates behind the scenes in index-related investment structures.

Although it does not actively engage in public governance debates, its voting rights contribute to the broader institutional consensus that shapes corporate decisions. Geode’s stake reinforces the dominance of long-term institutional ownership in Lowe’s.

Wells Fargo

Wells Fargo holds approximately 1.8% (9.9 million shares) of Lowe’s through its asset management and wealth advisory divisions. These shares are owned on behalf of retail and institutional clients rather than the bank itself. Wells Fargo participates in proxy voting and governance matters in line with fiduciary responsibilities.

While its ownership does not provide independent influence, it strengthens the institutional voting bloc that supports governance continuity.

Norges Bank Investment Management

Norges Bank Investment Management owns about 1.4% (8.0 million shares) of Lowe’s. This stake represents the Norwegian sovereign wealth fund’s exposure to the U.S. home improvement and infrastructure-related retail sector.

Norges Bank is known for a long-term investment horizon and strong emphasis on governance, sustainability, and risk management. Its ownership adds an international institutional dimension to Lowe’s shareholder base.

UBS Asset Management

UBS Asset Management holds roughly 1.3% (7.6 million shares) of Lowe’s. These shares are part of global equity portfolios and wealth management products offered to institutional and high-net-worth clients. UBS exercises its influence primarily through proxy voting and engagement aligned with long-term shareholder value. It does not play an active role in company operations.

Northern Trust

Northern Trust owns approximately 1.2% (6.8 million shares) of Lowe’s. Its holdings are typically associated with custodial, fiduciary, and institutional investment mandates. Northern Trust votes on behalf of clients and supports governance frameworks that emphasize transparency and accountability. Its role reinforces the institutional nature of Lowe’s ownership structure.

Other Institutional Shareholders

Beyond the largest holders, a broad group of institutional investors collectively owns millions of additional shares. These include firms such as T. Rowe Price, Wellington Management, Legal & General Investment Management, Massachusetts Financial Services, Morgan Stanley Investment Management, and BNY Mellon.

Individually, each holds less than 1%, but together they represent a meaningful portion of the share register. Their combined voting power further limits the possibility of concentrated control.

Insider and Retail Shareholders

Company insiders, including senior executives and board members, collectively own well below 1% of Lowe’s outstanding shares. Insider ownership is primarily linked to equity-based compensation rather than long-term controlling stakes.

Retail investors make up the remaining ownership through brokerage accounts, retirement plans, and mutual funds. While retail shareholders are numerous, their holdings are highly fragmented, leaving effective governance influence concentrated among institutional investors.

Who is the CEO of Lowe’s?

The current Chief Executive Officer of Lowe’s is Marvin Ellison. He assumed the role in 2018 and has led the company through significant strategic shifts aimed at improving operational efficiency and customer experience. Ellison is widely credited with strengthening Lowe’s focus on professional contractors, enhancing supply chain capabilities, and expanding digital commerce operations.

Prior to joining Lowe’s, Ellison held leadership roles at major retail corporations. He served as President of Home Depot’s U.S. Division, where he managed thousands of stores and diverse business units. He also held executive positions at J.C. Penney and Target, building a track record in operations, merchandising, and customer service.

Leadership Style and Strategic Priorities

Marvin Ellison’s leadership style is characterized by hands-on operational focus and data-driven decision-making. Since becoming CEO of Lowe’s, he has prioritized:

- Improving store productivity and layout efficiency

- Enhancing the professional contractor business segment

- Accelerating digital and omni-channel retail capabilities

- Streamlining the supply chain and inventory systems

- Strengthening customer-centric services and loyalty programs.

Under Ellison’s direction, Lowe’s has pursued growth strategies that balance traditional retail footprint expansion with investments in technology and professional services.

Board Relationship and Decision Making

The CEO of Lowe’s reports directly to the Board of Directors. The board sets broad strategic goals, governance policies, and executive compensation frameworks. Ellison works closely with the board’s committees on risk management, audit oversight, and strategic planning.

Major corporate decisions, such as capital allocation, merger and acquisition opportunities, and long-range planning, are typically evaluated jointly by the executive team and the board. Shareholders, particularly large institutional holders, influence governance through annual meeting votes and advisory resolutions.

CEO Compensation (2025)

Marvin Ellison’s compensation reflects his role leading a large public company with annual revenues exceeding $80 billion. His compensation package typically includes base salary, performance-based annual incentives, long-term equity awards, and retirement or deferred compensation benefits.

For 2025, Ellison’s total annual compensation is structured as follows:

- Base salary: Approximately $1.6 million per year

- Annual performance bonus: Eligible for several million dollars based on corporate performance metrics such as revenue growth, profitability, and shareholder returns

- Long-term equity awards: A significant component of total compensation, often tied to multi-year performance goals and stock price appreciation

- Other benefits: Standard executive retirement plans, deferred compensation, and limited perquisites.

These combined elements position Ellison’s total pay well into the high single-digit millions, reflecting market competitive levels for CEOs of Fortune 100 retail corporations.

Personal Net Worth and Wealth Context

Marvin Ellison’s personal net worth is informed by his compensation over decades of executive leadership, equity holdings in Lowe’s and prior employers, and prudent financial management.

As of 2025, Ellison’s estimated personal net worth is in the range of $50–$70 million. This figure includes vested equity from earlier performance awards and long-term investment value. CEO net worth can fluctuate with stock price changes and realized compensation events.

Past CEOs and Leadership Continuity

Before Marvin Ellison, Lowe’s was led by several prominent executives:

- Robert A. Niblock (served through mid-2018): Niblock presided over significant national expansion and modernization efforts.

- Robert L. Tillman (late 1990s into the 2000s): Under his leadership Lowe’s expanded aggressively into new U.S. markets.

These transitions reflect evolving priorities at Lowe’s, from geographic growth and category expansion to operations-centric and customer-focused leadership under Ellison.

The CEO of Lowe’s plays a critical role in shaping company culture, which emphasizes operational excellence, customer focus, and continuous improvement. Ellison has reinforced a culture of accountability, performance measurement, and strategic clarity, aligning teams around measurable goals tied to financial performance and customer satisfaction.

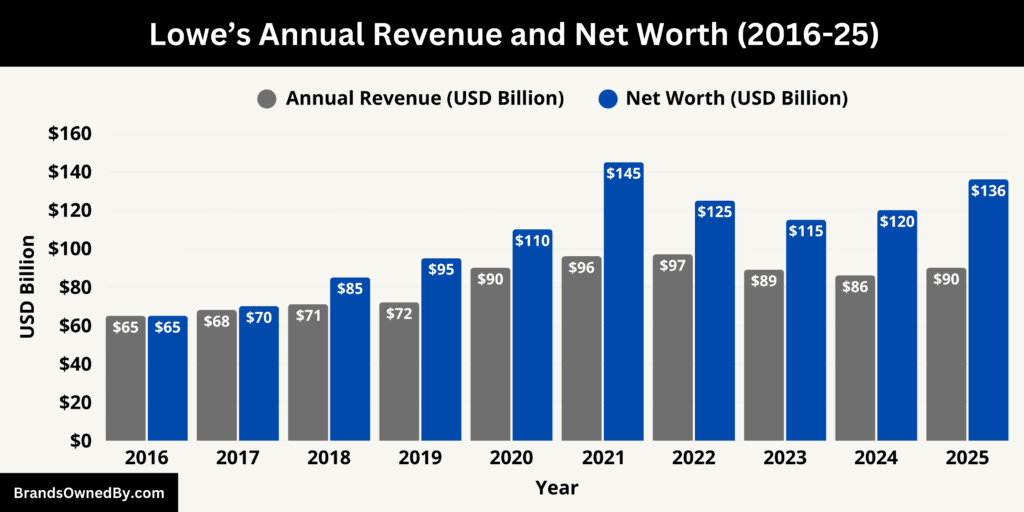

Lowe’s Annual Revenue and Net Worth

As of December 2025, Lowe’s Companies, Inc. generates over $90 billion in annual revenue and holds a net worth of approximately $136 billion, measured by its market capitalization. These figures reflect the company’s position as the second-largest home improvement retailer in the world, supported by a nationwide store network, a growing professional contractor business, and strong institutional investor backing.

2025 Revenue Breakdown and Operating Scale

In 2025, Lowe’s annual revenue exceeded $90 billion, with the vast majority generated from its U.S. operations. The company operates more than 1,700 home improvement stores, supported by a large distribution and fulfillment network designed to handle bulk materials, appliances, and job-site deliveries. Revenue is spread across thousands of SKUs, ranging from lumber and building materials to appliances, tools, décor, and seasonal outdoor products.

A defining feature of Lowe’s revenue structure in 2025 is the growing contribution from professional contractors. The Pro segment now accounts for roughly one-quarter of total revenue, driven by repeat purchasing, larger order sizes, and long-term customer relationships. These customers generate more predictable revenue than DIY shoppers and tend to be less sensitive to seasonal fluctuations. Lowe’s has invested heavily in Pro-only service desks, volume pricing, dedicated fulfillment, and credit offerings, all of which support higher average ticket values.

Digital commerce also plays a measurable role in revenue generation. Online sales represent a significant portion of total transactions, with many orders fulfilled through store pickup or local delivery rather than centralized warehouses. This omnichannel model allows Lowe’s to leverage its physical footprint while expanding digital revenue without duplicating inventory infrastructure.

Revenue Stability and Normalization After Peak Years

While Lowe’s experienced exceptional revenue growth during the 2020–2022 period, 2025 revenue reflects a more normalized but structurally higher baseline. Sales remain well above pre-2020 levels due to long-term shifts in homeowner spending, increased professional demand, and sustained investment in home maintenance and renovation.

Importantly, revenue consistency in 2025 is not dependent on a single category. Core building materials, appliances, and repair products provide steady demand, while discretionary categories such as décor and seasonal goods add upside during stronger consumer cycles. This diversification reduces volatility and supports predictable cash generation.

Net Worth and Market Capitalization as of December 2025

Lowe’s net worth reached approximately $136 billion as of December 2025, based on its market capitalization. Market capitalization reflects investor expectations about future earnings, cash flows, and competitive positioning, rather than just current revenue. Lowe’s valuation places it among the most valuable retail companies in the United States.

This valuation is supported by several structural factors. Lowe’s generates strong operating cash flow relative to revenue, allowing it to fund capital expenditures, dividends, and share repurchases without excessive balance sheet strain. The company’s long operating history, dominant market position, and defensive characteristics within the consumer discretionary sector also make it attractive to long-term institutional investors.

Another contributor to net worth growth is Lowe’s aggressive share repurchase strategy. Over the past decade, the company has materially reduced its share count. Fewer outstanding shares increase earnings per share and amplify market capitalization even when revenue growth is moderate.

Profitability and Its Impact on Valuation

Lowe’s net worth is closely tied to its ability to convert revenue into profit. In 2025, operating margins remained strong relative to historical norms, supported by supply chain efficiencies, improved inventory turnover, and disciplined cost controls. Store productivity has improved, with revenue per store and revenue per employee remaining key internal performance metrics.

The company’s pricing power in core categories, combined with private-label brands and vendor scale advantages, supports margin stability. Profitability allows Lowe’s to reinvest in store upgrades, distribution centers, and technology platforms while still returning substantial capital to shareholders. This balance between reinvestment and returns underpins investor confidence and valuation strength.

Balance Sheet Strength and Asset Base

Beyond market capitalization, Lowe’s financial position is reinforced by a substantial asset base. The company controls a large portfolio of owned and leased retail properties, regional distribution centers, and fulfillment facilities. Inventory levels are carefully managed to align with seasonal demand and contractor workflows, reducing excess working capital risk.

Lowe’s carries long-term debt as part of its capital structure, primarily used to finance share repurchases and strategic investments. However, debt is supported by consistent operating cash flows and manageable interest coverage. Retained earnings accumulated over decades of profitability further strengthen shareholder equity and financial flexibility.

Long-Term Financial Position

With $90+ billion in annual revenue and a $136 billion net worth, Lowe’s enters the post-2025 period from a position of scale and financial resilience. Its revenue base is diversified, its valuation is supported by institutional ownership, and its operating model is designed for long-term cash generation rather than short-term growth spikes.

This combination of revenue stability, margin discipline, and capital efficiency explains why Lowe’s continues to command a high market valuation and remains a core holding for global institutional investors.

Companies Owned by Lowe’s

Lowe’s Companies, Inc. owns and operates a broad portfolio of retail operations, professional service platforms, acquired businesses, private-label brands, and internal support entities as of 2025.

Below is a list of the major brands owned by Lowe’s as of December 2025:

| Company / Brand | Type | Year Established / Acquired | Primary Function | Strategic Role Within Lowe’s |

|---|---|---|---|---|

| Lowe’s | Core operating company | 1921 | Home improvement retail | Primary revenue-generating business operating 1,700+ stores, e-commerce platform, and nationwide fulfillment network |

| Lowe’s Pro | Business segment | Internal | Professional contractor sales & services | Drives higher-margin, repeat purchases from contractors, builders, and property managers |

| Lowe’s Installation Services | Service platform | Internal | Installation & project services | Expands revenue beyond product sales by managing installation projects and customer relationships |

| Lowe’s Canada | Regional subsidiary | 2007 (restructured) | Canadian retail operations | Maintains Lowe’s brand presence and localized retail operations in Canada |

| Artisan Design Group | Acquired company | 2025 | Interior design & installation | Expands Lowe’s reach into new-home construction, interior finishes, and professional installations |

| Foundation Building Materials | Acquired company | 2025 | Specialty building materials distribution | Adds wholesale-style distribution for drywall, steel framing, and job-site delivery to contractors |

| Kobalt | Private-label brand | 1998 | Tools & equipment | Exclusive mid-to-premium tools brand supporting margin expansion and brand differentiation |

| Project Source | Private-label brand | Internal | Value home improvement products | Price-competitive brand aimed at cost-conscious DIY customers |

| allen + roth | Private-label brand | Internal | Home décor & fixtures | Style-focused brand supporting higher-margin décor and design categories |

| Style Selections | Private-label brand | Internal | Flooring, blinds, décor | Affordable design-forward products for renovations and remodels |

| Blue Hawk | Private-label brand | Internal | Hardware & accessories | Everyday repair and installation products supporting volume sales |

| Reliabilt | Private-label brand | Internal | Structural building products | Doors, windows, ladders, and construction essentials for DIY and Pro customers |

| Portfolio | Private-label brand | Internal | Indoor & outdoor lighting | Exclusive lighting line competing with specialty retailers |

| Utilitech | Private-label brand | Internal | Electrical & seasonal products | Supports utility, emergency, and seasonal demand categories |

| Lowe’s Supply Chain Operations | Internal operating unit | Internal | Distribution & logistics | Powers store replenishment, bulk delivery, and job-site fulfillment |

| Lowe’s Digital Platforms | Internal operating unit | Internal | E-commerce & technology | Supports omnichannel sales, online ordering, Pro accounts, and fulfillment integration |

Lowe’s

Lowe’s is the core operating entity and primary brand of Lowe’s Companies, Inc. It operates more than 1,700 home improvement retail stores across the United States. These stores serve both DIY customers and professional contractors. The Lowe’s brand encompasses in-store retail, online commerce, professional services, installation offerings, and fulfillment operations. All strategic initiatives, including pricing, merchandising, supply chain, and customer experience, are centered around the Lowe’s brand.

Lowe’s Pro

Lowe’s Pro is not a separate legal company but a dedicated business segment operated directly by Lowe’s. It focuses exclusively on professional contractors, builders, property managers, and tradespeople. Lowe’s Pro includes dedicated service desks, volume pricing programs, credit solutions, job-site delivery, and bulk purchasing infrastructure. This segment represents one of Lowe’s fastest-growing revenue drivers and is deeply integrated into store layouts, fulfillment centers, and digital platforms.

Lowe’s Installation Services

Lowe’s Installation Services is an internally operated service platform that connects customers with professional installers for products such as flooring, roofing, windows, appliances, cabinets, and fencing. While third-party installers perform the labor, Lowe’s owns and manages the customer relationship, project coordination, and service standards. This entity allows Lowe’s to capture additional value beyond product sales and strengthens customer retention.

Lowe’s Canada

Lowe’s Canada represents the company’s Canadian retail operations following the strategic restructuring of its international business. Lowe’s operates a smaller, more focused footprint in Canada compared to its U.S. presence. The Canadian business includes home improvement stores and localized fulfillment operations tailored to regional demand. Lowe’s maintains direct operational control over branding, merchandising, and supply chain strategy in this market.

Artisan Design Group

Artisan Design Group is a specialty design and installation company acquired by Lowe’s to strengthen its professional and interior finishing capabilities. The company provides flooring, countertops, cabinets, and related interior design services primarily to homebuilders, property developers, and professional clients. Artisan Design Group operates as a standalone business unit under Lowe’s ownership, expanding Lowe’s reach deeper into the professional construction and new-home installation ecosystem.

Foundation Building Materials

Foundation Building Materials is a large distributor of specialty building materials, including drywall, steel framing, insulation, and related products. Acquired by Lowe’s, this entity enhances the company’s ability to serve professional contractors and large-scale construction projects. Unlike retail stores, Foundation Building Materials operates through distribution centers and job-site delivery, giving Lowe’s vertical integration across retail and professional supply channels.

Kobalt

Kobalt is a private-label tools brand owned exclusively by Lowe’s. It includes hand tools, power tools, storage solutions, and outdoor equipment. Kobalt is positioned as a mid-to-premium brand competing with national tool brands. Lowe’s controls product design, pricing strategy, and merchandising, allowing for higher margins and brand differentiation.

Craftsman

Lowe’s holds retail distribution rights for Craftsman tools within its stores. While Craftsman as a brand is owned externally, Lowe’s operates Craftsman as a core in-store and online offering with dedicated merchandising and inventory control. Craftsman plays a major role in Lowe’s tools category strategy and contractor appeal.

Project Source

Project Source is a Lowe’s-owned private-label brand offering value-oriented home improvement products. These include lighting, faucets, storage, décor, and basic household fixtures. The brand targets price-sensitive customers while maintaining acceptable quality standards. Project Source supports Lowe’s competitive pricing strategy against other large retailers.

allen + roth

allen + roth is a Lowe’s-owned private brand focused on home décor and interior design products. It includes lighting, bathroom fixtures, cabinetry, and furniture. The brand is positioned toward style-conscious homeowners and offers exclusive designs unavailable through competitors. Lowe’s uses allen + roth to strengthen its private-brand portfolio in higher-margin categories.

Style Selections

Style Selections is a private-label brand owned by Lowe’s that focuses on flooring, tiles, blinds, and interior décor products. It is positioned as an affordable yet design-forward option for homeowners. Lowe’s controls sourcing, quality standards, and pricing, allowing flexibility across different customer segments.

Blue Hawk

Blue Hawk is a Lowe’s-owned brand offering hardware, fasteners, safety gear, and installation accessories. The brand is commonly used for everyday repair and maintenance products. It supports Lowe’s effort to provide low-cost alternatives to national brands while maintaining consistent availability across stores.

Reliabilt

Reliabilt is a private-label brand owned by Lowe’s that focuses on doors, windows, ladders, and structural building products. The brand is designed to serve both DIY and professional customers seeking dependable performance at competitive prices. Reliabilt products are widely used in renovation and construction projects.

Portfolio

Portfolio is Lowe’s exclusive lighting brand, offering indoor and outdoor lighting solutions. The brand includes ceiling lights, outdoor fixtures, and smart lighting options. Portfolio allows Lowe’s to compete directly with specialty lighting retailers while retaining margin control.

Utilitech

Utilitech is a Lowe’s-owned brand specializing in electrical, utility, and seasonal products. This includes extension cords, generators, fans, and heaters. Utilitech plays a key role in seasonal demand cycles and emergency preparedness categories.

Lowe’s Supply Chain Operations

Lowe’s operates its own supply chain and distribution network, which includes regional distribution centers, fulfillment hubs, and cross-dock facilities. These operations are owned and managed internally and support both retail and professional delivery needs. The supply chain entity is critical to inventory availability, speed of fulfillment, and cost efficiency.

Lowe’s Digital Platforms

Lowe’s owns and operates its digital commerce platforms, including its website, mobile applications, and backend technology infrastructure. These platforms support online ordering, in-store pickup, job-site delivery, and account management for professional customers. Digital operations are fully integrated with physical stores and fulfillment centers.

Final Thoughts

Lowe’s Companies, Inc. stands as one of the most established and institutionally owned retailers in the home improvement industry. For readers asking who owns Lowe’s, the answer is clear.

The company is publicly traded and primarily owned by large institutional investors, with governance shaped through board oversight and executive leadership rather than individual or family control. Its diversified ownership structure, strong leadership under its current CEO, solid financial position, and well-integrated portfolio of brands and operations have allowed Lowe’s to scale efficiently and remain competitive.

Together, these factors explain how Lowe’s continues to operate as a stable, shareholder-driven company with a long-term growth focus in the global home improvement market.

FAQs

Who owns Lowe’s stores?

Lowe’s stores are owned by Lowe’s Companies, Inc., a publicly traded corporation. The stores are not franchised. They are operated directly by the company, which is owned by a broad base of institutional and retail shareholders.

Who owns Lowe’s Home Improvement?

Lowe’s Home Improvement is the core retail business of Lowe’s Companies, Inc.. Because the company is publicly listed, ownership is shared among millions of shareholders rather than a single owner or private entity.

Who owns the majority of Lowe’s?

No individual or organization owns a majority of Lowe’s. The largest shareholder is Vanguard Group with about 9.8% of the company, followed by BlackRock at roughly 7.0%. Ownership is institutionally concentrated, but no shareholder controls more than 10%.

What companies does Lowe’s own?

Lowe’s owns and operates its core Lowe’s retail brand, Lowe’s Pro services, Lowe’s Installation Services, Lowe’s Canada, and acquired businesses such as Artisan Design Group and Foundation Building Materials. It also owns several private-label brands including Kobalt, allen + roth, Project Source, Style Selections, Reliabilt, Portfolio, Utilitech, and Blue Hawk.

Is Lowe’s owned by Walmart?

No, Lowe’s is not owned by Walmart. The two companies are completely separate, publicly traded retailers. Walmart has no ownership stake or control over Lowe’s.

Who owns Lowe’s Canada?

Lowe’s Canada is owned and operated directly by Lowe’s Companies, Inc.. It is not a separate or independently owned business. Strategic decisions, branding, and operations are controlled by Lowe’s U.S. headquarters.

Is Lowe’s an American-owned company?

Yes, Lowe’s is an American-owned company. It was founded in North Carolina, is headquartered in the United States, and is listed on the New York Stock Exchange. While it has international investors, the company itself is American.

Does Warren Buffett own Lowe’s stock?

There is no evidence that Berkshire Hathaway, led by Warren Buffett, holds a significant or disclosed ownership stake in Lowe’s. Lowe’s major shareholders are large asset managers such as Vanguard, BlackRock, and State Street, not Buffett-controlled entities.