- L’Oréal is a publicly traded company listed on the Paris stock exchange, with a stable and diversified ownership structure that balances family control, corporate partnership, institutional investment, and employee participation.

- The Bettencourt Meyers family is the largest shareholder, holding approximately 34.7% through holding companies, giving them significant influence over strategic decisions and board composition.

- Nestlé owns around 20.1% of L’Oréal, serving as a long-term strategic corporate partner without direct operational control.

- International and French institutional investors collectively hold about 37%, while individual shareholders own roughly 6% and employees hold around 2%, providing market discipline, liquidity, and alignment of internal incentives.

L’Oréal is a global leader in the beauty and cosmetics industry. It develops, manufactures, and markets a wide range of products for hair, skin, makeup, and fragrance. Its brands reach consumers in markets across the world. L’Oréal’s strategy combines scientific innovation, strong brand building, and market expansion to stay at the forefront of beauty trends. The company also invests in sustainability and inclusive beauty initiatives as part of its long-term purpose and corporate responsibility goals.

L’Oréal operates through multiple divisions that serve diverse consumer segments. These include mass-market beauty, luxury cosmetics, professional products for salons, and dermatological lines. The company maintains research centers in different regions to support product development and innovation.

L’Oréal Founder

L’Oréal was founded in 1909 by Eugène Schueller, a French chemist with a strong background in pharmaceutical and cosmetic chemistry. At the time, hair coloring was inconsistent and often damaging. Schueller developed a safe synthetic hair dye formula in his laboratory in Paris. This invention became the foundation of the company.

Schueller named his early business “Société Française de Teintures Inoffensives pour Cheveux,” which later evolved into L’Oréal. His vision went beyond a single product. He believed beauty products should be rooted in science, tested rigorously, and continuously improved.

One of Schueller’s most important contributions was embedding research into the company’s DNA. He hired chemists early on and treated innovation as a core business function, not a support role. This approach differentiated L’Oréal from competitors that relied mainly on fashion trends.

Schueller also understood the importance of education and professional relationships. He worked closely with hairdressers, offering training and technical guidance. This helped L’Oréal build trust within the professional beauty community and accelerate adoption of its products.

After Schueller’s death in 1957, leadership transitioned smoothly. His values of research excellence, brand building, and global ambition continued under professional management and family stewardship. These founding principles still guide L’Oréal’s strategy today.

Major Milestones

- 1909: Eugène Schueller founded L’Oréal in Paris after inventing a safe synthetic hair dye formula designed specifically for professional hairdressers.

- 1912: L’Oréal began selling products beyond Paris, expanding across France and establishing its first commercial distribution network.

- 1920: The company started exporting products internationally, marking its first steps toward becoming a global beauty brand.

- 1931: L’Oréal launched its first non-hair-dye products, including shampoos and haircare treatments, signaling early diversification.

- 1939: The brand officially adopted the name “L’Oréal,” simplifying its identity and strengthening brand recognition.

- 1950: L’Oréal invested heavily in scientific research and education for hair professionals, reinforcing its science-first positioning.

- 1957: Founder Eugène Schueller passed away, and leadership transitioned to professional management while preserving the company’s research-driven culture.

- 1963: L’Oréal became a publicly listed company on the Paris stock exchange, increasing transparency and supporting long-term global expansion.

- 1974: Nestlé acquired a strategic stake in L’Oréal, creating a stable shareholder structure that remains influential today.

- 1980: L’Oréal accelerated expansion into North America and Asia, establishing regional headquarters and local research capabilities.

- 1988: The company entered the luxury beauty segment more aggressively, laying the foundation for future prestige brand development.

- 1995: L’Oréal formalized its multi-division structure, separating mass market, luxury, professional, and dermatological beauty businesses.

- 2001: Dermatological and medical-grade skincare became a strategic focus, supported by deeper collaboration with dermatologists worldwide.

- 2006: Jean-Paul Agon became CEO, leading a period of strong globalization, brand discipline, and digital readiness.

- 2010: L’Oréal began integrating digital tools into marketing, consumer engagement, and product development.

- 2015: The company expanded its presence in e-commerce and social media, adapting to changing consumer behavior and influencer culture.

- 2018: Sustainability commitments were embedded into L’Oréal’s core strategy, influencing packaging, sourcing, and product design.

- 2020: L’Oréal strengthened its focus on diversity, inclusion, and responsible beauty, making inclusivity a central brand value.

- 2021: Nicolas Hieronimus was appointed CEO, continuing the decentralized brand-led management model with a strong innovation focus.

- 2023: L’Oréal deepened investments in beauty technology, artificial intelligence, and personalized skincare solutions.

- 2025: L’Oréal stands as a global, science-driven beauty leader, recognized for innovation, sustainability, and long-term brand stewardship.

Who Owns L’Oréal: Major Shareholders

L’Oréal is a publicly traded company listed on Euronext Paris. Ownership is concentrated among three main groups. The Bettencourt Meyers family is the largest shareholder. Nestlé is the second-largest. The remaining shares are held by institutional and retail investors.

L’Oréal’s ownership is a blend of long-term strategic holders, family control, and broad public investors. The company is publicly traded on the Paris stock exchange, but its share structure reflects a stable and committed group of shareholders rather than a fragmented retail base.

This ownership mix shapes the company’s governance, board composition, and strategic direction in 2025. Key investors include the founding family via holding companies, a major multinational corporate partner, institutional asset managers, individual investors, and company employees.

Below is a list of the largest shareholders of L’Oréal as of December 2025:

| Shareholder | Ownership Stake (Approx.) | Type of Shareholder | Role in the Company | Level of Control and Influence |

|---|---|---|---|---|

| Bettencourt Meyers Family (via Téthys SAS and related holdings) | ~34.7% | Founding family | Largest and controlling shareholder | Holds the most voting power as a single bloc. Influences long-term strategy, board composition, and governance. Maintains decisive influence despite not owning an absolute majority. |

| Nestlé | ~20.1% | Strategic corporate investor | Second-largest shareholder | Has board representation and voting influence. Acts as a long-term strategic partner. Does not control daily operations or management decisions. |

| International Institutional Investors | ~30.2% | Institutional investors | Portfolio investors | Collective influence through voting at AGMs. Focus on governance, sustainability, and long-term value. No unified control due to fragmented ownership. |

| French Institutional Investors | ~6.8% | Domestic institutional investors | National financial stakeholders | Support governance stability and strategic resolutions. Influence board and policy decisions through shareholder votes. |

| Individual (Retail) Shareholders | ~6.1% | Public investors | Minority shareholders | Limited individual control. Provide liquidity and market confidence. Participate mainly through shareholder meetings. |

| Employee Shareholders | ~2.0% | Internal stakeholders | Employees and former employees | Align employee interests with company performance. Limited governance power but strong cultural and motivational impact. |

Bettencourt Meyers Family: Largest Shareholder and Strategic Controller

The Bettencourt Meyers family is the largest shareholder of L’Oréal, owning approximately 34.76% of the company’s share capital through holding entities such as Téthys SAS and Financière L’Arcouest SAS.

This significant stake gives the family considerable influence over corporate decisions and strategic direction. The family’s representation on the board has traditionally included key positions, and although Françoise Bettencourt Meyers stepped down from the board in 2025 in favor of a Téthys representative, she continues to serve as president of Téthys, maintaining indirect influence over L’Oréal’s governance.

The family’s control is both economic and symbolic. Their long-standing association with L’Oréal’s heritage supports continuity in long-term planning and research-focused investments. The family also plays a central role in appointing directors aligned with its vision for sustainable growth.

Nestlé: Major Strategic Corporate Investor

Nestlé holds approximately 20.14% of L’Oréal’s share capital as of late 2024, making it the second-largest shareholder after the Bettencourt Meyers family.

Although not a controlling shareholder, Nestlé’s stake gives it board representation and an ongoing strategic partnership role. Historically, the relationship has included cooperation on global expansion and operational insights. Nestlé’s participation contributes to a stable shareholder structure rather than a hostile influence.

The company’s presence as a large minority investor means it can influence major corporate decisions through board seats and voting power, but it does not control daily operations or strategic outcomes independently.

International Institutional Investors: Diversified Global Ownership

International institutional investors collectively hold approximately 30.18% of the share capital.

This group includes global asset managers, pension funds, and mutual funds. Their investment reflects confidence in L’Oréal’s growth prospects, global footprint, and resilience across economic cycles.

Institutional holders typically advocate for strong governance, sustainability practices, and long-term value creation. They participate actively in annual general meetings and may influence executive compensation, corporate responsibility policies, and strategic priorities.

Here are a few institutional investors that are known to hold L’Oréal shares through investment funds and equity portfolios:

- The Vanguard Group – through international and developed markets index funds such as Vanguard Total International Stock Index Fund (VGTSX) and Vanguard International Growth Fund (VWIGX).

- iShares (BlackRock) – via exchange‑traded funds (ETFs) such as iShares MSCI EAFE ETF (EFA) and iShares Core MSCI EAFE ETF (IEFA) which include L’Oréal in their international equity holdings.

- Harding Loevner International Equity Portfolio (HLMIX) – an active global equity institutional fund with international holdings.

- Six Circles International Unconstrained Equity Fund (CIUEX) – an international equity institutional investor that includes L’Oréal among its global equities.

- EUROPACIFIC Growth Fund (AEPGX) – a long‑term international growth fund with exposure to global consumer stocks including L’Oréal.

French Institutional Investors: National Financial Backers

French institutional investors own approximately 6.85% of L’Oréal’s shares.

This category includes French pension funds, insurance companies, and local investment funds. Their participation reinforces L’Oréal’s position as one of France’s flagship global businesses.

French institutional investors often support initiatives that align with national economic interests and corporate governance norms. Their votes at shareholder meetings contribute to decisions on board composition and strategic resolutions.

Here are some well‑known French institutional investors that are typically part of the group holding L’Oréal shares:

- Amundi Asset Management – One of Europe’s largest asset managers, holding L’Oréal shares through diversified institutional funds.

- Natixis Investment Managers (Natixis AM) – Manages equities and funds for institutional clients, including French blue-chip stocks like L’Oréal.

- La Banque Postale Asset Management – Participates in French institutional holdings via mutual funds and pension-related investment vehicles.

- AXA Investment Managers – Holds L’Oréal shares indirectly through large-cap and CAC 40-focused funds.

Individual Shareholders: Retail Participation

Individual investors hold around 6.07% of L’Oréal’s share capital.

This group consists of retail investors and smaller private holders who have chosen to invest in the company’s stock. Although they do not wield significant influence individually, their collective ownership adds liquidity to the market and helps maintain broad investor confidence.

Individual shareholders typically engage through annual meetings and may support governance measures focused on transparency and shareholder rights.

Employee Share Ownership: Internal Stakeholders

Company employees and former employees hold about 2% of L’Oréal’s shares through employee savings plans and performance share awards.

This ownership reflects L’Oréal’s commitment to employee alignment with corporate performance. Employee shareholders have a direct financial interest in company success, which can foster stronger internal engagement and accountability.

Employee share ownership also enhances corporate culture, as employees benefit from stock appreciation and may participate in governance through voting.

Shareholder Influence and Control Dynamics

Although the Bettencourt Meyers family does not own a majority stake outright, its largest single shareholding combined with allied governance influence makes it the primary controlling force in L’Oréal’s strategic decisions. Strategic long-term orientation, cultural legacy, and board representation support this control.

Nestlé, as the key corporate investor, plays a sustained minority role. Its involvement underscores long-term confidence but does not translate into operational control.

Institutional and individual investors provide market discipline and diversified perspectives, reinforcing governance standards and shareholder accountability.

Employee ownership adds an internal voice focused on performance alignment.

Together, these stakeholders ensure that L’Oréal’s ownership structure balances family continuity, strategic partnership, institutional oversight, and market participation. This balance supports steady growth and adaptability in a competitive global beauty industry.

Who is the CEO of L’Oréal?

Nicolas Hieronimus is the Chief Executive Officer (CEO) of L’Oréal. He assumed the role in May 2021, succeeding Jean-Paul Agon after decades of leadership at the company. Hieronimus stepped into the CEO position with extensive experience across L’Oréal’s business units, having previously served as Deputy CEO in charge of divisions and leading key global markets and brands.

His tenure as CEO has been marked by a strategic emphasis on brand diversification, global expansion, and technological integration. Hieronimus has guided L’Oréal through a competitive landscape that includes rapid shifts in consumer behavior, digital transformation, and sustainability expectations.

Leadership and Decision-Making Structure

As CEO, Nicolas Hieronimus is responsible for executing the company’s strategic vision, aligning global operations, and driving performance. L’Oréal’s governance structure follows a decentralized model where key brand divisions and regional units have significant autonomy to innovate and tailor strategies to local markets.

However, overarching strategic decisions — such as major acquisitions, sustainability commitments, and global product platform strategies — are led by Hieronimus in coordination with the board of directors.

The board — which includes representatives from major shareholders and independent directors — works with the CEO to approve long-term plans, financial policies, and executive compensation frameworks.

Compensation and Salary

Nicolas Hieronimus’s compensation package reflects the complexity and scale of leading a global beauty giant. According to most current 2025 compensation analyses:

- His total annual compensation is approximately €9.78 million. This figure includes fixed salary, annual variable performance-linked bonuses, stock awards, and other long-term incentives. The breakdown shows that fixed salary typically makes up around 20% of total compensation, with the remaining portion comprised of performance-based and equity-linked elements.

- Based on remuneration disclosures for the 2024 financial year, his fixed salary was proposed to be raised to €2.3 million for 2025, reflecting increased responsibilities and multi-year performance. Variable compensation awarded for 2024 performance was approximately €2,048,500, aligned with financial and non-financial achievement metrics set by the board.

- In addition to cash components, Hieronimus receives performance share grants and long-term incentives tied to company performance over multiple years.

Past Leadership and Succession

Before Hieronimus became CEO, Jean-Paul Agon served as L’Oréal’s CEO from 2006 to 2021. Agon guided L’Oréal through major globalization, brand diversification, and digital transformation phases. Following his tenure as CEO, Agon continued to serve as Chairman of the board, providing continuity in leadership perspective.

Hieronimus’s appointment marked a planned and strategic leadership transition, emphasizing continuity while positioning the company for future challenges such as e-commerce acceleration, sustainability commitments, and emerging market growth.

Strategic Focus Under Nicolas Hieronimus

Under his leadership, L’Oréal has:

- Expanded its luxury and prestige portfolios, including high-end fragrance and skincare categories.

- Deepened investments in digital and data-driven marketing, analytics, and e-commerce platforms.

- Continued strategic acquisitions and partnerships to strengthen global reach and competitive positioning.

- Emphasized sustainability goals across product development, supply chain, and ESG reporting — integrating environmental, social, and governance priorities into corporate strategy.

L’Oréal’s CEO role in 2025, therefore, is not only about operational oversight but also about shaping long-term industry leadership, balancing heritage brands with future-oriented innovation, and aligning stakeholder expectations in a rapidly evolving market.

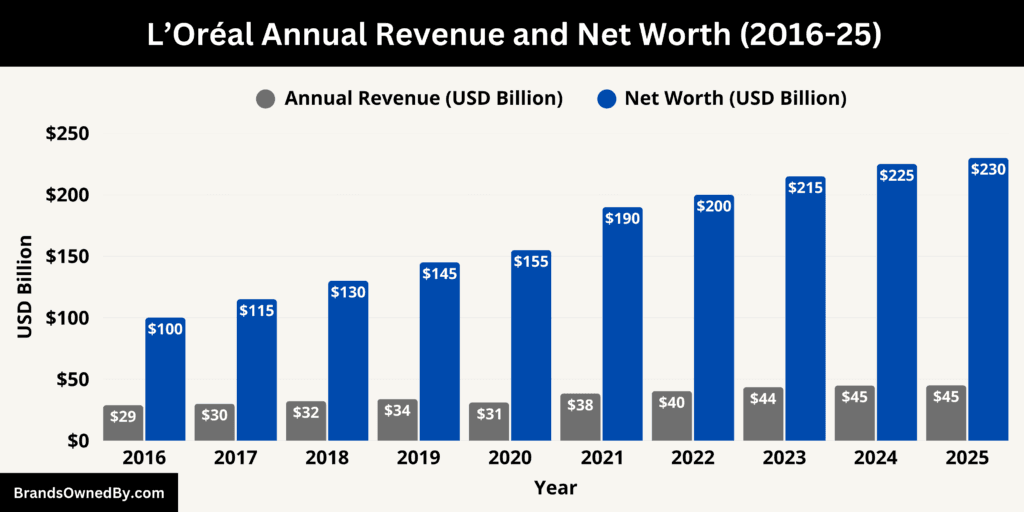

L’Oréal Annual Revenue and Net Worth

As of December 2025, L’Oréal reports annual revenue of over $45 billion and maintains a market net worth exceeding $230 billion. These figures reinforce its position as the world’s largest and most valuable beauty company. The scale reflects global brand strength, diversified product categories, and consistent demand across regions.

L’Oréal Revenue in 2025

L’Oréal’s 2025 revenue stands at approximately $45 billion, driven by balanced growth across mass market, luxury, professional, and dermatological beauty segments. Skincare remains the largest contributor, supported by strong demand for science-backed and premium products.

Geographically, growth is spread across North America, Europe, and the Asia-Pacific. Emerging markets continue to play an important role, while mature markets provide stability and high-margin sales. Digital channels contribute a growing share of revenue, reflecting L’Oréal’s long-term investment in e-commerce, data, and consumer engagement platforms.

The company’s revenue resilience is also supported by brand diversification. No single brand or category dominates overall sales. This reduces dependency risk and allows L’Oréal to adapt quickly to shifting beauty trends.

L’Oréal Net Worth and Market Valuation

L’Oréal’s net worth, measured through market capitalization, exceeds $230 billion as of December 2025. This valuation places it among the most valuable consumer goods companies globally and the most valuable pure-play beauty group.

The company’s high valuation is driven by strong operating margins, brand equity, and long-term growth visibility. Investors value L’Oréal not only for current performance but also for its innovation pipeline, pricing power, and global reach.

Its ownership stability, led by the founding family and long-term strategic shareholders, further supports investor confidence. This structure reduces volatility and encourages long-term value creation rather than short-term financial engineering.

What Drives L’Oréal’s Financial Strength

L’Oréal’s revenue and net worth are supported by several structural advantages. Its investment in research and development strengthens product differentiation. Its global brand portfolio allows premium pricing in luxury while maintaining volume leadership in mass markets.

Operational scale provides efficiencies in manufacturing, marketing, and distribution. At the same time, decentralized brand management enables local relevance and faster innovation cycles.

Together, these factors explain why L’Oréal continues to grow revenue steadily and sustain one of the highest valuations in the global beauty and consumer goods industry as of 2025.

Companies Owned by L’Oréal

L’Oréal owns and operates a diverse portfolio of beauty brands and professional products across mass-market, luxury, professional, and dermatological segments. Each brand is fully integrated into L’Oréal’s global operations, supported by centralized research and localized marketing strategies.

Below is a list of the companies and brands owned by L’Oréal as of December 2025:

| Brand / Company | Segment | Product Focus | Target Market | Global Presence | Notes / Key Highlights |

|---|---|---|---|---|---|

| L’Oréal Paris | Mass-Market | Skincare, Haircare, Makeup, Hair Color, Sun Care | General consumers | 130+ countries | Flagship brand; inclusive beauty campaigns; celebrity endorsements |

| Maybelline New York | Mass-Market | Makeup (Foundation, Lipstick, Mascara, Eyeshadow) | Young, trend-conscious consumers | 120+ countries | Trend-driven, social media-focused, influencer collaborations |

| Lancôme | Luxury | Skincare, Fragrances, Cosmetics | Premium consumers | 130+ countries | High-end, research-backed skincare; luxury retail and online channels |

| Yves Saint Laurent Beauty | Prestige / Luxury | Makeup, Fragrances | Fashion-forward, luxury consumers | Global | Couture-inspired branding; high-margin luxury segment |

| Kiehl’s | Premium Skincare | Skincare, Haircare, Bodycare | Urban, cosmopolitan consumers | Global | Apothecary heritage; sustainability focus; boutique stores |

| La Roche-Posay | Dermatological Skincare | Sensitive skin, Sun Protection, Therapeutic Skincare | Consumers with sensitive/medical skin needs | Global | Dermatologist-recommended; pharmacy distribution |

| Vichy | Dermatological Skincare | Anti-aging, Hydration, Skin Barrier Health | Premium skincare consumers | Global | Thermal spa water-based formulations; science-driven |

| Biotherm | Luxury Skincare | Anti-aging, Hydration | Men & Women, Premium consumers | 60+ countries | Aquatic ingredient focus; sustainability in product development |

| Redken | Professional Haircare | Hair Color, Treatments, Styling Products | Salons, Hair Professionals | Global | Professional training programs; salon-exclusive products |

| Matrix | Professional Haircare | Hair Color, Styling, Treatments | Salons, Hair Professionals | Global | Technical innovation; professional education programs |

| Kérastase | Premium Professional Haircare | Hair Treatments, Shampoos, Styling | High-end salon clients | Europe, North America, Asia-Pacific | Personalized, premium salon experiences; high-margin |

| Garnier | Mass-Market | Haircare, Skincare, Bodycare | General consumers | Global | Affordable, innovative, natural formulations; sustainability focus |

| Vichy Laboratories | Dermatological | Medical-grade skincare | Pharmacy & professional channels | Global | Supports research-backed skincare; integration with dermatology |

| CeraVe | Dermatological | Ceramide-based Skincare | Sensitive/Dry skin consumers | Global | Clinically validated formulas; pharmacy and retail expansion |

| SkinCeuticals | Clinical Skincare | Antioxidants, Anti-aging, Skin Protection | High-end, dermatologist-aligned | Global | Sold through dermatologists, medical spas, premium retail |

| Essie | Nail Care | Nail Polishes, Treatments, Accessories | Consumers & Salons | Global | Trend-driven color palettes; salon and consumer reach |

| Urban Decay | Premium Makeup | Eyeshadow, Lipstick, Cosmetics | Fashion-forward, young consumers | Global | Bold, edgy branding; trend-focused collections |

| IT Cosmetics | Skincare + Makeup | Corrective Makeup, Dermatologist-Tested Products | Premium consumers | Global | Science-backed formulations; bridges skincare and cosmetics |

L’Oréal Paris

L’Oréal Paris is the flagship brand and represents the company’s mass-market leadership. Founded in 1909 alongside the company itself, it offers skincare, haircare, hair color, makeup, and sun protection products.

The brand is widely recognized for combining innovation, accessibility, and quality, targeting everyday consumers seeking reliable, affordable beauty solutions. L’Oréal Paris has a strong global presence in over 130 countries, and its campaigns often feature international celebrities and social media influencers to maintain relevance across age groups. The brand also emphasizes inclusive beauty, offering wide ranges of shades in foundations and concealers, and promoting sustainability in packaging and ingredient sourcing.

Maybelline New York

Maybelline New York is a trend-driven makeup brand that caters primarily to younger consumers. Known for its mascara, foundations, lipsticks, and eye products, Maybelline combines affordable pricing with fashion-forward innovations. Its global marketing leverages social media platforms, influencer collaborations, and viral campaigns to appeal to tech-savvy, trend-conscious buyers. The brand operates in over 120 countries and is considered a pillar of L’Oréal’s mass-market cosmetics growth, particularly in emerging markets where makeup trends are rapidly expanding.

Lancôme

Lancôme is a luxury beauty brand specializing in skincare, fragrances, and high-end cosmetics. Founded in 1935, Lancôme is synonymous with elegance, innovation, and premium quality. The brand invests heavily in research and development, offering clinically tested anti-aging, hydration, and brightening skincare solutions. Lancôme has a strong presence in global duty-free, luxury retail, and online channels. Its high-profile celebrity endorsements and luxury-focused marketing campaigns reinforce its status as a prestige beauty leader.

Yves Saint Laurent Beauty

Yves Saint Laurent Beauty (YSL Beauty) is positioned as a prestige makeup and fragrance brand with a bold, fashion-forward identity. It offers iconic lipsticks, eyeshadows, foundations, and high-end perfumes. YSL Beauty aligns closely with high-fashion aesthetics, often featuring runway-inspired collections and limited-edition collaborations. The brand operates globally, emphasizing luxury retail experiences and selective e-commerce distribution, contributing significantly to L’Oréal’s high-margin luxury portfolio.

Kiehl’s

Kiehl’s is a premium skincare brand with roots in apothecary formulations and natural ingredients. Founded in 1851 in New York City, it is now part of L’Oréal’s luxury and dermo-cosmetic segment. Kiehl’s focuses on high-quality, science-backed formulations and sustainable sourcing of ingredients. Its retail strategy includes standalone boutiques and personalized customer consultations. Kiehl’s also emphasizes corporate social responsibility, supporting community projects and environmentally conscious practices.

La Roche-Posay

La Roche-Posay is a dermatologically oriented skincare brand, widely recommended by dermatologists. It focuses on sensitive skin, sun protection, and therapeutic skincare solutions. Its products combine thermal spring water with advanced formulations. La Roche-Posay has a strong presence in pharmacies and professional skincare channels worldwide. Its credibility among medical professionals and consumers strengthens L’Oréal’s dermatology portfolio.

Vichy

Vichy is a science-driven skincare brand with a focus on anti-aging, hydration, and skin barrier health. Founded in 1931, it uses thermal spa water as a key ingredient in all formulations. Vichy’s product range includes serums, moisturizers, sunscreens, and corrective skincare. The brand is marketed globally through retail, pharmacy, and online channels, combining scientific research with consumer-friendly messaging.

Biotherm

Biotherm is a luxury skincare brand known for using aquatic and thermal ingredients in anti-aging and hydrating formulations. The brand emphasizes sustainability in sourcing and packaging and caters to both men and women. Biotherm has a strong presence in Europe, North America, and Asia and leverages high-end retail, department stores, and online platforms to reach premium consumers.

Redken

Redken is a professional haircare brand primarily sold through salons. It provides hair color, treatments, and styling products, along with extensive professional training programs for stylists. The brand’s scientific approach emphasizes innovation in haircare chemistry, and it is widely recognized among professionals globally, strengthening L’Oréal’s professional division.

Matrix

Matrix is another professional haircare brand focused on salon markets. It offers a complete range of hair color, styling, and treatment products. Matrix also provides education programs and digital resources for professional stylists, emphasizing product performance and innovation. Its global presence complements L’Oréal’s professional haircare portfolio.

Kérastase

Kérastase is a premium professional haircare brand serving salons and high-end consumers. Its products include hair treatments, shampoos, conditioners, and styling solutions. Kérastase focuses on personalized hair care and premium salon experiences. It is positioned as a high-margin, luxury haircare brand with strong influence in European and North American markets.

Garnier

Garnier is a mass-market skincare and haircare brand known for affordable, innovative, and natural formulations. Its portfolio includes shampoos, conditioners, hair colors, skincare products, and body care. Garnier emphasizes environmental sustainability, with eco-friendly packaging and responsibly sourced ingredients. It is a leading contributor to L’Oréal’s volume sales in emerging and mature markets alike.

Vichy Laboratories

Vichy Laboratories operates as a specialized dermatological entity supporting product research, development, and distribution of medical-grade skincare. It bridges consumer needs with scientific research, reinforcing L’Oréal’s dermatology and pharmacy-focused offerings.

CeraVe

CeraVe is a ceramide-based skincare brand acquired by L’Oréal in 2017. It specializes in clinically validated formulations for dry and sensitive skin. CeraVe has rapidly expanded internationally through retail, e-commerce, and pharmacy channels, strengthening L’Oréal’s position in dermatologist-recommended skincare.

SkinCeuticals

SkinCeuticals is a clinical skincare brand focusing on antioxidants, anti-aging, and skin protection. The brand is sold through dermatologists, medical spas, and premium retail channels. SkinCeuticals complements L’Oréal’s scientific skincare portfolio and caters to consumers seeking advanced, professional-grade formulations.

Essie

Essie is a global nail care brand offering nail polishes, treatments, and nail accessories. It serves both salon professionals and consumers, combining quality with trend-driven color palettes. Essie helps diversify L’Oréal’s beauty portfolio beyond hair and skincare.

Urban Decay

Urban Decay is a premium makeup brand targeting bold, fashion-forward consumers. It is known for vibrant eyeshadows, foundations, and cosmetics with edgy branding. Urban Decay appeals primarily to younger, trend-conscious consumers, enhancing L’Oréal’s prestige makeup presence.

IT Cosmetics

IT Cosmetics is a skincare-meets-makeup brand designed for corrective, high-performance beauty solutions. Its products are dermatologist-tested and sold through premium retail and online channels. IT Cosmetics strengthens L’Oréal’s high-growth, science-backed makeup portfolio.

Acquisitions and Strategic Expansions

L’Oréal strategically acquires brands to expand its reach in luxury, professional, and dermatology sectors. Recent acquisitions include CeraVe, SkinCeuticals, IT Cosmetics, and Urban Decay. Each acquisition is fully integrated, leveraging L’Oréal’s global distribution, R&D capabilities, and marketing power, while maintaining the brand’s original identity and niche positioning.

Professional and Specialty Divisions

Professional and specialty divisions include Redken, Matrix, and Kérastase for salons, and La Roche-Posay, Vichy, and CeraVe for pharmacies. These brands deliver higher margins, reinforce scientific credibility, and support training programs for professionals worldwide.

Final Words

Understanding who owns L’Oréal provides clear insight into the company’s governance, strategic direction, and long-term stability. With the Bettencourt Meyers family as the largest shareholder, alongside Nestlé, institutional investors, and a mix of individual and employee shareholders, L’Oréal benefits from a balanced and resilient ownership structure. This combination of family control, corporate partnership, and global investor participation enables the company to maintain leadership across innovation, luxury, mass-market, and professional beauty sectors while driving sustainable growth and value for all stakeholders.

FAQs

Who owns L’Oréal cosmetics?

L’Oréal cosmetics are owned by L’Oréal S.A., a publicly traded company listed on the Paris stock exchange. The largest controlling shareholder is the Bettencourt Meyers family, supported by Nestlé and other institutional and individual investors.

Who owns the L’Oréal brand?

The L’Oréal brand is owned by L’Oréal S.A. and managed as the company’s flagship mass-market brand. Its operations, marketing, and product development are fully controlled by L’Oréal.

Who is the largest shareholder of L’Oréal?

The Bettencourt Meyers family is the largest shareholder, holding approximately 34.7% of the company through holding entities like Téthys SAS and Financière L’Arcouest SAS.

Which country owns L’Oréal?

L’Oréal is a French company, founded and headquartered in France. It is publicly traded, so ownership is shared among private, institutional, and corporate investors globally.

Is L’Oréal owned by Nestlé?

No, Nestlé is a minority shareholder, owning around 20.1% of L’Oréal. While influential, Nestlé does not have controlling ownership of the company.

What are the major companies owned by L’Oréal?

L’Oréal owns a diverse portfolio of companies and brands, including L’Oréal Paris, Maybelline New York, Lancôme, Yves Saint Laurent Beauty, Kiehl’s, La Roche-Posay, Vichy, Biotherm, Redken, Matrix, Kérastase, Garnier, CeraVe, SkinCeuticals, Essie, Urban Decay, and IT Cosmetics.

Who makes L’Oréal products?

L’Oréal products are developed, manufactured, and marketed by L’Oréal S.A. and its subsidiaries. The company operates global research and manufacturing facilities to produce skincare, haircare, makeup, and fragrance products.

What brands does L’Oréal own?

L’Oréal owns over 30 global brands across mass-market, luxury, professional, and dermatological segments. Major brands include L’Oréal Paris, Maybelline, Lancôme, Kiehl’s, La Roche-Posay, Vichy, Garnier, Redken, Kérastase, CeraVe, SkinCeuticals, and IT Cosmetics.

How many brands are under L’Oréal?

As of 2025, L’Oréal owns more than 30 brands globally, spanning mass-market, professional, luxury, and dermatological segments.

How much did Kendall Jenner get paid for L’Oréal?

Kendall Jenner was reported to have been paid around $1.5 million per year as a global ambassador for L’Oréal, including campaigns, endorsements, and public appearances.

Is Prada under L’Oréal?

No, Prada is not owned by L’Oréal. Prada is an independent luxury fashion house headquartered in Italy.

How much is the owner of L’Oréal worth?

Françoise Bettencourt Meyers, representing the Bettencourt family, has an estimated net worth of around $98 billion as of December 2025, making her one of the wealthiest individuals in the world.

How much did L’Oréal pay for Maybelline?

L’Oréal acquired Maybelline in 1996 for approximately $500 million, integrating it into its mass-market cosmetics division.