When asking who owns Chelsea, you are referring to the ownership structure of Chelsea F.C., the London-based football club. This article details who owns Chelsea, how ownership is distributed, and the financial standing as of 2025.

Key Takeaways

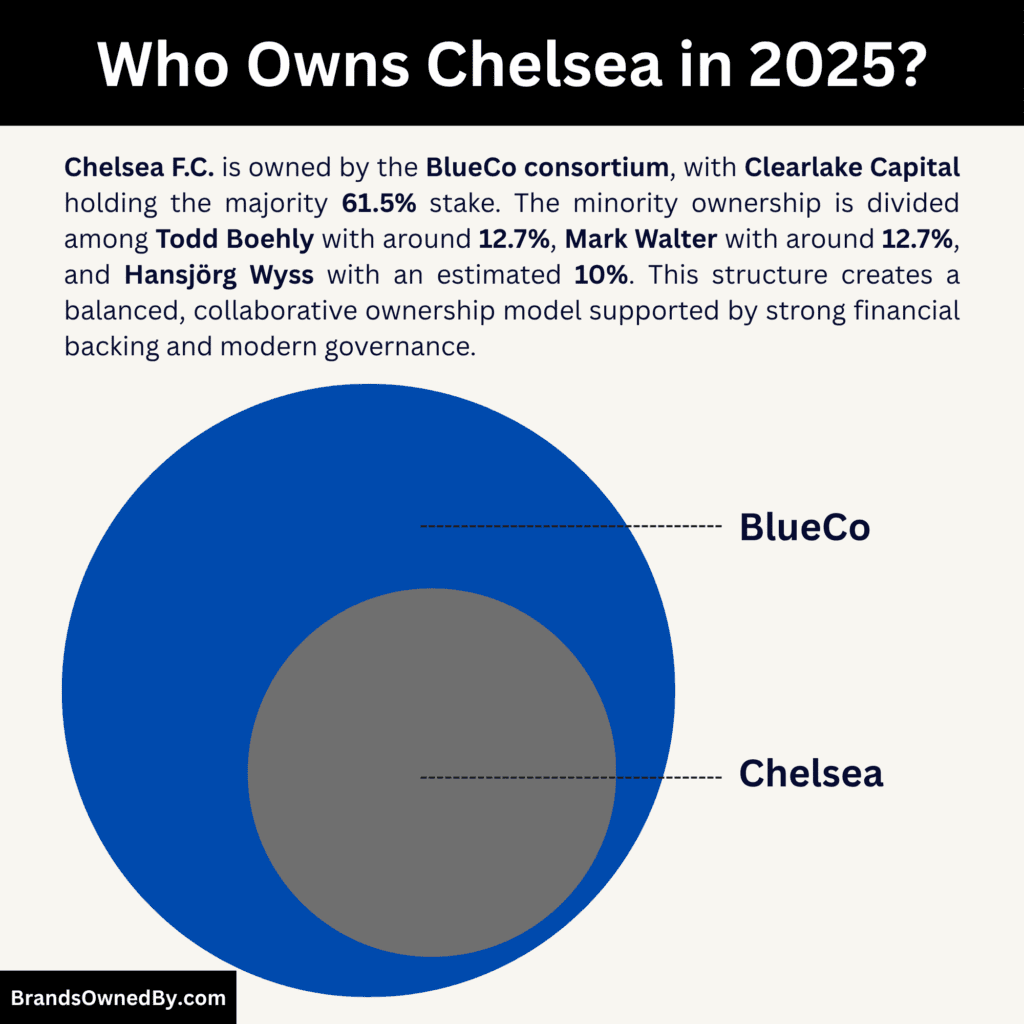

- Chelsea F.C. is fully owned by BlueCo, the consortium that took over in 2022 and controls all strategic, commercial, and football operations.

- Clearlake Capital is the majority owner with 61.5%, giving it the strongest authority in long-term financial and governance decisions.

- Todd Boehly and Mark Walter each hold around 12.7%, while Hansjörg Wyss holds an estimated 10–13%, forming the minority ownership block within BlueCo.

- Chelsea’s ownership model is collaborative and structured, combining majority investment power with active leadership from minority owners to drive sustainable growth and modern football management.

Chelsea F.C. Overview

Chelsea Football Club is a major English football club based in west London. The club was founded in 1905 and has grown into one of the world’s most recognised sports brands. Chelsea plays its home matches at Stamford Bridge, a stadium that has shaped the club’s identity for more than a century. The club has built success through strong ownership eras, major investment, world-class managers, and consistent competition at the highest level.

Over the years, Chelsea transformed from a promising early-20th-century club into a modern football powerhouse. The team now has a global fanbase, elite training facilities, and a strong presence in both men’s and women’s football. As of 2025, Chelsea remains one of the most valuable clubs in Europe with ambitions for long-term growth and continued success.

Founders and Early Origins

Chelsea was founded by Henry Augustus “Gus” Mears, a businessman who envisioned turning Stamford Bridge into a major football venue. His brother, Joseph Mears, supported the project and helped secure the site. The Mears brothers initially wanted an established club to use the ground. When negotiations failed, they decided to form their own team.

The club was officially established on 10 March 1905 at The Rising Sun pub, located near Stamford Bridge. Chelsea adopted blue as its primary colour and quickly gained entry into the Football League. The early direction of the club focused on creating a competitive team with the potential to draw large crowds, thanks to the size and location of the stadium.

The Mears family continued to guide the club for several decades. Their legacy can still be seen in the club’s foundations, stadium identity, and early culture that helped Chelsea grow into a London football institution.

Major Milestones

- 1905 — Chelsea F.C. is founded by Gus Mears after the formation meeting at The Rising Sun pub. The club joins the Football League later that year.

- 1915 — Chelsea reaches its first FA Cup final, boosting the club’s national profile even during wartime football.

- 1955 — Chelsea wins the First Division title for the first time, marking a major achievement in the club’s early history.

- 1965 — The club lifts the League Cup, its first major domestic trophy of the modern era.

- 1970 — Chelsea wins the FA Cup after a famous replay against Leeds United, solidifying the team’s status among elite English clubs.

- 1971 — The club wins the UEFA Cup Winners’ Cup, earning its first European trophy.

- 1997 — Chelsea wins the FA Cup under manager Ruud Gullit, beginning a run of trophy-winning seasons in the late 1990s.

- 2000 — The club claims the FA Cup again and secures the UEFA Super Cup, reinforcing its European pedigree.

- 2003 — A major ownership change takes place, introducing a period of heavy investment and a new ambition for global success.

- 2005 — Chelsea wins the Premier League under José Mourinho, ending a 50-year wait for a league title.

- 2009 — The club wins the FA Cup once more, showcasing its strength in knockout competitions.

- 2010 — Chelsea wins its first domestic double by capturing both the Premier League and FA Cup in the same season.

- 2012 — Chelsea wins the UEFA Champions League for the first time after a dramatic campaign filled with comebacks and historic moments.

- 2013 — The club wins the UEFA Europa League, completing back-to-back European triumphs.

- 2015 — Chelsea secures another Premier League title, continuing its dominance in English football.

- 2021 — The club wins its second UEFA Champions League, beating Manchester City in the final and marking another peak in European success.

- 2022 — Ownership shifts to the BlueCo consortium after a high-profile sale. This begins a new era focused on multi-club strategy, data-driven investment, and youth development.

- 2025 — Chelsea becomes the first men’s club to win all five major UEFA competitions after lifting the UEFA Conference League, completing a unique European trophy collection.

Who Owns Chelsea FC: Major Shareholders

Chelsea F.C. is owned in full by BlueCo, the holding company that acquired the club in 2022. BlueCo controls 100% of Chelsea and manages the club’s strategic, financial, and operational direction.

Inside BlueCo, ownership is shared between a majority investor and several minority partners. Each shareholder holds a defined percentage, giving them influence based on their stake and governance role. While Clearlake Capital is the majority shareholder, Todd Boehly acts as the main public and operational leader through his role as chairman.

This structure creates a balance of investment power, business leadership, and football-focused governance.

Parent Company: BlueCo Consortium Composition

Chelsea does not have a traditional parent company above BlueCo. BlueCo itself is the top-level holding company, meaning all ownership authority stops at BlueCo.

It directly owns 100% of Chelsea F.C., its assets, operations, and subsidiaries, including the women’s team and academy setups.

BlueCo is made up of four main shareholders: Clearlake Capital, Todd Boehly, Mark Walter, and Hansjörg Wyss. Each investor contributes capital, structure, and leadership influence.

Clearlake Capital (61.5% Ownership)

Clearlake Capital is the majority shareholder of BlueCo, holding about 61.5% of the ownership. This makes Clearlake the most powerful entity in Chelsea’s ownership structure. Its majority position gives it decisive influence over strategic decisions, large financial commitments, and long-term planning.

Clearlake does not manage daily football operations. Instead, it provides capital stability, governance oversight, and structured investment discipline. Its presence ensures that Chelsea’s spending, growth plans, and infrastructure projects align with long-term financial sustainability.

Todd Boehly (12.7% Ownership)

Todd Boehly owns roughly 12.7% of BlueCo and serves as the chairman of Chelsea. Despite holding a minority stake, his role as chairman makes him the most visible and operationally active figure in the club’s leadership.

Boehly drives major football decisions, oversees executive appointments, and acts as the public face of the ownership group. His influence comes from his position, authority, and involvement rather than raw ownership percentage. His leadership shapes Chelsea’s sporting direction, commercial expansion, and future vision.

Mark Walter (12.7% Ownership)

Mark Walter also holds around 12.7% of BlueCo. His role is more strategic and governance-focused, with less public visibility compared to Boehly. Walter contributes his experience from owning other major sports franchises, helping guide Chelsea’s commercial operations and global partnerships.

His presence strengthens the depth of the ownership group and ensures that key decisions are reviewed from a long-term, multi-sport investment perspective. Walter’s involvement adds business maturity and balanced oversight to Chelsea’s leadership.

Hansjörg Wyss (Estimated 10% Ownership)

Hansjörg Wyss owns an estimated 10% share within BlueCo’s minority block. His exact figure is not publicly broken down, but he is recognised as a key investor within the consortium.

Wyss is not involved in daily club decisions. Instead, he contributes capital, supports major structural choices, and helps maintain financial stability within the group. His participation ensures shared decision-making and prevents control from concentrating in the hands of a single individual.

Chelsea Ownership History

Chelsea’s ownership history spans more than a century and reflects the club’s evolution from a family-founded team to a globally recognised football institution. Each ownership era shaped Chelsea’s identity, financial strength, and long-term vision. The journey moved from family control, to private businessmen, to a billionaire-backed era, and finally to a modern consortium structure that governs the club today.

| Ownership Era | Owner / Group | Years | Type of Ownership |

|---|---|---|---|

| Founding Era | Gus Mears & the Mears Family | 1905–1982 | Family Ownership |

| Rebuilding Era | Ken Bates | 1982–2003 | Private Individual Owner |

| Global Expansion Era | Roman Abramovich | 2003–2022 | Private Owner (Individual) |

| Modern Consortium Era | BlueCo Consortium (Clearlake Capital, Todd Boehly, Mark Walter, Hansjörg Wyss) | 2022–Present | Consortium / Investment Group |

The Mears Family Era (1905–1982)

Chelsea was founded in 1905 by Gus Mears and his brother Joseph after they acquired Stamford Bridge and decided to create their own football club.

For decades, the Mears family controlled Chelsea, guiding its early growth, developing the stadium, and establishing the club as a key part of London’s football landscape.

This era was defined by traditional, family-style ownership, where decisions were made privately and with a focus on keeping the club’s identity strong and its operations stable.

Ken Bates Era (1982–2003)

Ken Bates purchased Chelsea in 1982 during a time of financial struggle and uncertainty around the stadium’s ownership.

Under Bates, the club modernised parts of its structure, fought complex legal battles to protect Stamford Bridge, and improved commercial operations.

He later floated Chelsea on the stock market, transitioning the club into a more corporate ownership model and opening the door to larger investments.

Bates’ leadership stabilised the club and created the conditions that allowed Chelsea to be ready for its next major transformation.

Roman Abramovich Era (2003–2022)

Roman Abramovich acquired Chelsea in 2003, ushering in one of the most significant eras in modern football.

His investment transformed the club into a global powerhouse, bringing elite players, top managers, and a winning culture that reshaped European football.

During his ownership, Chelsea won several Premier League titles, domestic trophies, and two UEFA Champions League titles.

Abramovich’s era established Chelsea as one of the world’s most successful and recognisable football clubs.

The era ended in 2022 when Abramovich opted to sell the club following political sanctions and legal restrictions that affected his ownership rights.

BlueCo Consortium Era (2022–Present)

The BlueCo consortium, consisting of Clearlake Capital, Todd Boehly, Mark Walter, and Hansjörg Wyss, completed the takeover of Chelsea in 2022.

This ownership introduced a modern, shared-investment model with structured governance, data-driven football strategy, and long-term planning at its core.

The group invested in youth development, analytics, global scouting, commercial expansion, and the women’s team.

As of 2025, BlueCo remains the full owner of Chelsea, with Clearlake as the majority shareholder and Todd Boehly serving as the club’s chairman.

How Ownership Transitioned Over Time

Chelsea’s shift from the Mears family to Ken Bates marked the move from traditional family ownership to a more commercial approach.

The sale to Roman Abramovich transitioned the club into a period of global investment, professionalisation, and major competitive success.

The move from Abramovich to BlueCo introduced collective decision-making, diversified investment, and modern governance standards.

Each ownership era built on the achievements of the previous one, turning Chelsea from a local London club into an internationally respected football institution.

Todd Boehly Net Worth

Todd Boehly’s net worth is estimated at $9.3 billion as of November 2025. This places him among the wealthiest sports investors in the world. His financial position reflects decades of strategic deal-making, diversified holdings, and long-term investment growth across multiple industries.

How Boehly Built His Fortune

Todd Boehly accumulated his wealth through a blended investment strategy. His financial foundation comes from Eldridge Industries, the private investment firm he co-founded. Eldridge holds hundreds of assets across insurance, credit, sports, real estate, and media.

Before founding Eldridge, Boehly spent many years at Guggenheim Partners, where he helped expand the firm’s credit and investment operations. His background in private credit and structured finance gave him the ability to build a diversified, resilient investment portfolio.

Key Business Interests

Boehly’s wealth is also tied to his holdings in major sports franchises and entertainment companies. He has ownership involvement in the Los Angeles Dodgers and several US sports ventures, along with significant stakes in entertainment platforms, live-event companies, and media production entities.

He also invests heavily in real estate and technology-focused businesses, which provide long-term asset appreciation. These holdings have continued to grow in value, contributing to his $9.3 billion net worth by late 2025.

Influence of Chelsea Ownership on His Wealth

Owning roughly 12.7% of BlueCo adds a powerful global football asset to Boehly’s portfolio. Chelsea’s commercial growth, global fanbase expansion, and sponsorship potential enhance the value of his stake.

Although Chelsea is not his most valuable asset, its international visibility strengthens his position in global sports ownership. The long-term value of the club, especially through media rights and brand development, is likely to contribute to his overall financial rise in the coming years.

Market Factors Affecting His Net Worth

Todd Boehly’s wealth is influenced by market performance because a large portion of his assets are tied to private companies and long-term investments. Shifts in interest rates, credit markets, real estate demand, and media valuations can affect how his portfolio is valued at any point in time.

Despite these market fluctuations, his portfolio has shown strong resilience due to its diversity. His strategic investments help balance growth assets with stable, income-producing holdings.

Long-Term Financial Outlook

Boehly’s financial outlook remains strong heading into 2026. His investment focus continues to expand into global sports, streaming, digital entertainment, and next-generation technology.

With Chelsea’s value increasing, continued global expansion of US sports investments, and ongoing growth from Eldridge Industries, his net worth is projected to rise further. His role in football and international sports markets is expected to strengthen as commercial opportunities continue to expand.

Chelsea F.C. Net Worth

Chelsea F.C. has an estimated franchise value of $3.25 billion as of November 2025, placing it among the world’s most valuable football clubs. This valuation reflects the club’s global brand presence, commercial partnerships, broadcast income, and long-term revenue potential.

Revenue Profile and Financial Health

For the 2024–2025 period, Chelsea generated roughly $592 million in revenue, placing it among the highest-earning clubs in European football.

This revenue is built on several pillars. Matchday income remains strong due to the London market, despite Stamford Bridge’s limited capacity. Broadcasting revenue forms a major part of Chelsea’s financial foundation thanks to the Premier League’s global media rights. Commercial partnerships and international sponsorships continue to expand, with the club maintaining strong visibility in Asia, the Middle East, Africa, Europe, and North America.

Although revenue is strong, Chelsea also carries high operating costs. Wage commitments, transfer amortisation, youth development, and infrastructure spending all contribute to financial pressure. As a result, the club has worked to balance investment with increased emphasis on long-term planning and commercially sustainable growth.

Key Drivers of Chelsea’s Valuation

Chelsea’s value is supported by a combination of sporting history, commercial strength, and strategic potential.

The club enjoys a global reputation built over decades of top-flight football and European success. This global presence fuels merchandise sales, digital growth, and worldwide sponsorship interest.

The Premier League remains a major driver of value. Its global appeal ensures reliable broadcasting income regardless of Chelsea’s league position, giving the club a stable financial base.

Physical assets also play a significant role. Stamford Bridge and Chelsea’s training complex add long-term value and provide a foundation for future development opportunities. Player assets further elevate valuation, as the squad and youth academy contribute sizable resale potential and commercial visibility.

Financial Pressures and Challenges

Despite its strong valuation, Chelsea faces financial challenges that can impact long-term value. Operating costs remain among the highest in the league, and periods of rebuilding often require significant spending.

Regulatory frameworks such as Premier League Profit & Sustainability Rules have added pressure to achieve financial balance while maintaining competitive ambition. On-field performance also affects prize money, sponsorship confidence, and commercial momentum.

These factors mean that maintaining a high franchise value requires careful planning, performance stability, and continued expansion of global commercial opportunities.

Growth Outlook and Future Potential

Chelsea’s net worth is expected to grow in the coming years if the club successfully executes its long-term strategy. The redevelopment or reconstruction of Stamford Bridge is one of the most important opportunities. A larger modern stadium would dramatically increase matchday revenue and improve the club’s commercial footprint.

Continued investment in the women’s team, youth development, global partnerships, and international fan engagement also positions Chelsea for future financial expansion.

If sporting performance stabilises and international growth continues, Chelsea’s valuation has the potential to surpass several European rivals and move toward the top tier of global sports franchises.

Chelsea F.C. Leadership

Chelsea’s leadership structure in 2025 combines board-level oversight, executive management, and sporting directors who work together under the BlueCo ownership group. The club operates with a modern, multi-layered hierarchy designed to separate business operations from sporting decision-making.

Below is a complete breakdown of who leads Chelsea:

Chairman – Todd Boehly

Todd Boehly serves as the Chairman of Chelsea and is the most visible individual within the ownership group. His role extends beyond ceremonial duties. He oversees board-level decisions, long-term strategic planning, commercial direction, and major footballing matters that require ownership approval.

As chairman, Boehly maintains close involvement in manager appointments, executive hiring, large-scale transfer decisions, and stadium development strategy. He is also responsible for ensuring that Chelsea’s growth aligns with BlueCo’s global vision, especially in commercial expansion, brand development, and international investments.

Majority Ownership Oversight – Clearlake Capital

Clearlake Capital, with a 61.5% stake, controls the majority of board influence at Chelsea. Clearlake’s leadership does not manage the day-to-day operation of the club, but it exercises structured oversight over major financial decisions, long-term investments, regulatory compliance, and risk management.

Clearlake’s representatives work closely with the executive leadership to implement multi-year plans involving analytics investment, infrastructure planning, academy expansion, and cost discipline.

Their involvement ensures that the club grows in a financially sustainable way while remaining competitive in the transfer market.

Minority Owners – Mark Walter and Hansjörg Wyss

Mark Walter and Hansjörg Wyss serve as major minority shareholders in the BlueCo consortium. While they do not hold operational positions within the club, they contribute to ownership-level decision-making through strategic reviews, capital planning, and investment oversight.

Both owners bring extensive experience from global business, sports management, and large-scale investment ventures. Their presence creates a diversified governance model where decisions are reviewed from multiple financial and executive perspectives, reducing risks and encouraging long-term stability.

Chief Executive Officer – Chris Jurasek

Chris Jurasek leads the business operations of Chelsea as CEO. His role covers the full scope of non-football departments including commercial partnerships, digital growth, legal and compliance operations, marketing, human resources, matchday operations, and global strategy.

Jurasek ensures that Chelsea’s financial health and commercial performance support the club’s footballing ambitions. His leadership also involves managing sponsorship deals, enhancing global brand exposure, and aligning executive departments with BlueCo’s investment requirements.

President of Business Operations – Todd Kline

Todd Kline serves as the President of Business Operations and is a key figure behind Chelsea’s commercial growth. He manages sponsorship negotiations, partnership strategy, and hospitality development at Stamford Bridge.

Kline plays a crucial role in revenue expansion, international brand positioning, and identifying new commercial markets for Chelsea. His work focuses on long-term commercial sustainability and improving the club’s global financial footprint.

Sporting Leadership – Co-Sporting Directors

Chelsea operates under two Co-Sporting Directors, Laurence Stewart and Paul Winstanley.

They oversee all football-related departments including recruitment, squad planning, player contracts, loan strategy, performance analysis, and coordination between the first team, academy, and women’s team.

Their responsibilities are central to Chelsea’s data-driven approach to football operations. They ensure that all player decisions align with long-term planning and financial sustainability, reducing reliance on short-term transfer spending.

Technical Director – Dave Fallows

Dave Fallows plays an expanded role in recruitment strategy, advanced analytics, and squad planning. He leads technical development, scouting systems, and performance evaluation across the club.

Fallows works closely with the sporting directors to streamline Chelsea’s recruitment model and align it with the club’s strategic goals, ensuring that the club builds a squad that can compete for years rather than relying on short-term fixes.

Head Coach – Enzo Maresca

Enzo Maresca is the head coach of Chelsea’s men’s first team. His responsibilities include tactical planning, training management, player development, and matchday decision-making.

Maresca works within the club’s modern sporting structure, collaborating with the sporting directors on recruitment, youth integration, and long-term squad identity. His coaching philosophy emphasizes possession-based football, structured build-up play, and a strong reliance on youth and tactical discipline.

Performance, Coaching, and Medical Departments

Chelsea’s first-team operations are supported by large specialist departments including assistant coaches, fitness and conditioning experts, goalkeeping coaches, performance analysts, and a world-class medical team.

These departments ensure that players receive elite preparation, injury management, and performance monitoring throughout the season. Together, they form a crucial layer of Chelsea’s modern leadership infrastructure.

Women’s Team Leadership – Sonia Bompastor

Chelsea Women are led by Sonia Bompastor, one of the most respected coaches in women’s football. Her leadership includes tactical management, player development, and long-term squad planning.

Bompastor oversees a staff dedicated specifically to the women’s side, including analysts, fitness coaches, technical coaches, and operations managers. Her arrival signaled Chelsea’s commitment to maintaining dominance in women’s football while expanding the global reach of the women’s brand.

Leadership Philosophy and Cultural Direction

Chelsea’s leadership culture in 2025 is built on collaboration, data-driven decision-making, and sustainable long-term planning. Ownership, executives, and sporting directors work within a defined hierarchy that balances ambition with financial responsibility.

This structure supports clear communication across the club, avoids impulsive decision-making, and builds a foundation for competitive consistency. The leadership team prioritizes youth development, commercial expansion, global fan engagement, and modern infrastructure growth.

Conclusion

Understanding who owns Chelsea offers a clear picture of how the club has evolved from its early family roots to a modern, globally driven football powerhouse. Today, Chelsea operates under the BlueCo consortium led by Clearlake Capital with Todd Boehly as chairman, supported by Mark Walter and Hansjörg Wyss, forming a leadership model built on shared investment, strong governance, and long-term planning.

After decades of ownership transitions—from the Mears family to Ken Bates, then Roman Abramovich—the club now functions with a balanced structure that blends financial strength, commercial ambition, and modern sporting strategy. As of 2025, Chelsea stands as one of the world’s most valuable clubs, and its current ownership continues to shape a future focused on sustainability, global expansion, and consistent on-field success.

FAQs

Who owns Chelsea F.C.?

Chelsea F.C. is owned by BlueCo, a consortium led by majority shareholder Clearlake Capital (61.5%) and minority shareholders Todd Boehly, Mark Walter, and Hansjörg Wyss.

What is Chelsea’s owner’s net worth?

Chelsea’s most active owner and chairman, Todd Boehly, has an estimated net worth of $9.3 billion as of November 2025. Clearlake Capital, the majority owner, manages tens of billions in assets, giving the ownership group significant financial strength.

Does Abramovich still own Chelsea?

No. Roman Abramovich no longer owns Chelsea. His ownership officially ended in 2022 when the club was sold to the BlueCo consortium.

How rich is BlueCo?

BlueCo does not publish a single combined net worth, but as a consortium it is backed by Clearlake Capital, which manages over $70 billion in assets, along with billionaire investors Todd Boehly, Mark Walter, and Hansjörg Wyss. This makes BlueCo one of the financially strongest ownership groups in world football.

How many clubs does Todd Boehly own?

Todd Boehly is part-owner of several major sports franchises, including Chelsea F.C., the Los Angeles Dodgers (MLB), and a minority stake in the Los Angeles Lakers (NBA) through the ownership group he is linked with. Chelsea is currently the only football club he co-owns under BlueCo.

Who sold Chelsea for 1 pound?

Ken Bates bought Chelsea for £1 in 1982, taking over the club during a period of financial instability.

Why was Abramovich forced to sell Chelsea?

Roman Abramovich was forced to sell Chelsea in 2022 after the UK government imposed sanctions related to geopolitical tensions and his reported connections to the Russian state, which prevented him from operating or financially benefiting from the club.