- Manchester United remains publicly traded on the NYSE (ticker: MANU), but effective control rests privately with the Glazer family and Sir Jim Ratcliffe’s INEOS Group.

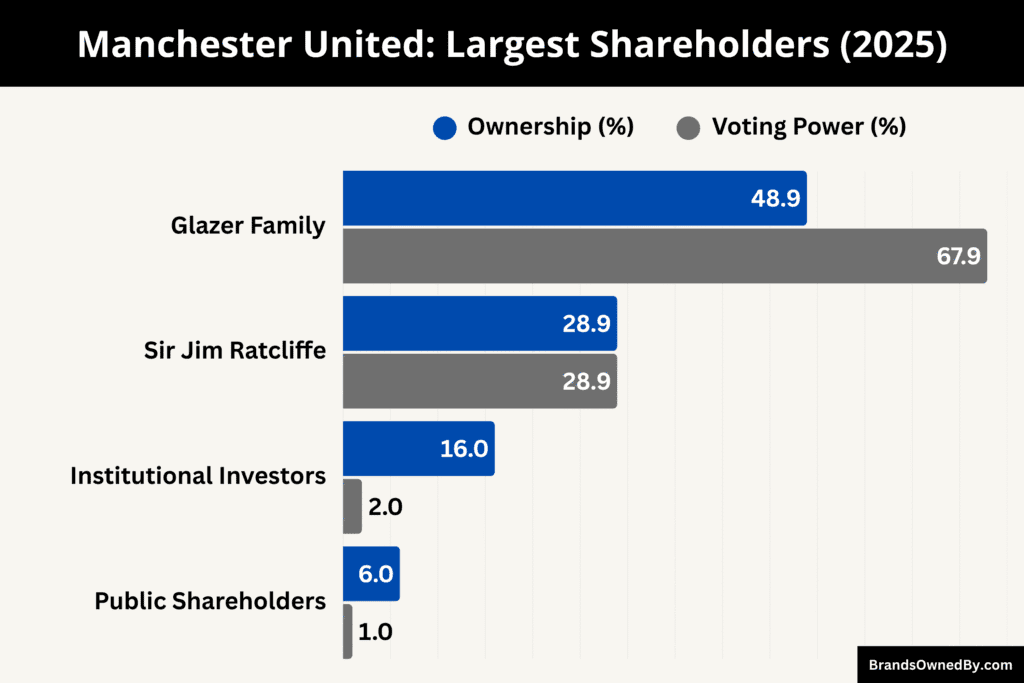

- The Glazers hold around 48.9% of total shares and 67.9% of voting power, while Ratcliffe owns 28.9% and controls all football operations.

- The Glazers maintain corporate and financial control through Class B super-voting shares, overseeing governance, strategic planning, and commercial growth as the club’s majority shareholders.

- Sir Jim Ratcliffe leads the sporting and infrastructure side, managing recruitment, performance, and redevelopment projects like the planned $1–2 billion Old Trafford modernization.

Manchester United is one of the most iconic and commercially powerful football clubs in the world. Based in Old Trafford, Greater Manchester, the club has evolved from a small industrial-era team into a global sports and entertainment empire. As of 2025, Manchester United competes in the English Premier League and remains one of the most valuable football brands globally.

United’s identity is built on three pillars — tradition, resilience, and global reach. The club’s history is marked by triumphs on the pitch, tragedies that shaped its character, and a relentless drive for excellence that resonates far beyond football. With a fan base exceeding 650 million people, Manchester United is not only a sporting institution but also a cultural and commercial phenomenon.

The club’s success has been fueled by legendary managers, world-class players, and a consistent focus on youth development through its renowned academy. Its motto, “Youth, Courage, Greatness,” reflects both its footballing philosophy and its broader influence as a global brand.

Manchester United Founders and Origin

Manchester United traces its roots back to 1878, when it was founded as Newton Heath LYR Football Club by employees of the Lancashire and Yorkshire Railway (LYR) depot in Newton Heath, Manchester. The team originally played in green and gold colors, representing the railway company. Its early matches were mostly against other railway departments and local clubs, reflecting the working-class spirit of industrial Manchester at the time.

By the early 1900s, Newton Heath was in severe financial trouble. The team’s debts nearly led to its collapse, but salvation came in 1902, when local brewery owner John Henry Davies intervened. He invested in the club, cleared its debts, and changed its name to Manchester United Football Club. This rebranding signified a new beginning — both in ambition and identity — aiming to represent the entire city rather than just a workplace team.

Davies also funded the construction of new facilities and attracted better players, setting the stage for United’s first major successes. Under his guidance, the club won its first First Division title in 1908 and its first FA Cup in 1909. In 1910, Manchester United moved into its permanent home — Old Trafford Stadium, which remains the club’s iconic base today.

Major Milestones in Manchester United History

- 1878: Founded as Newton Heath LYR Football Club by railway workers from the Lancashire and Yorkshire Railway depot in Manchester.

- 1880: Played the first recorded match against Bolton Wanderers’ reserves, marking the club’s earliest competitive activity.

- 1885: Became a fully professional football club, joining regional competitions in Northern England.

- 1892: Joined the newly formed Football League First Division, making its debut in organized national competition.

- 1902: Saved from financial collapse by brewery owner John Henry Davies, who renamed the club Manchester United Football Club and injected fresh capital.

- 1908: Won its first First Division title, establishing itself as one of England’s leading football teams.

- 1909: Secured its first FA Cup victory, defeating Bristol City 1–0.

- 1910: Moved into Old Trafford, the club’s permanent home and one of the world’s most famous stadiums.

- 1945: Sir Matt Busby appointed manager; he reshapes the club, emphasizing youth development and attacking football.

- 1952: Manchester United wins the league title under Busby, marking the start of a new golden era.

- 1958: The Munich air disaster claims the lives of eight players and three staff members; the tragedy becomes a defining moment in club history.

- 1963: Wins the FA Cup, symbolizing recovery after the Munich tragedy.

- 1965: Regains the First Division title under Busby’s leadership, led by stars like George Best, Denis Law, and Bobby Charlton.

- 1968: Becomes the first English club to win the European Cup, defeating Benfica 4–1 at Wembley.

- 1974: Relegated to the Second Division but promoted again the following year, showing resilience after a difficult period.

- 1977: Wins the FA Cup, defeating Liverpool and preventing their treble bid.

- 1986: Sir Alex Ferguson appointed manager; begins rebuilding the club from the ground up.

- 1990: Wins the FA Cup, Ferguson’s first trophy, marking the beginning of his dominance.

- 1991: Wins the European Cup Winners’ Cup, beating Barcelona 2–1.

- 1992: Becomes a founding member of the Premier League, transforming the club’s commercial and global reach.

- 1993: Wins the inaugural Premier League title, ending a 26-year wait for top-flight success.

- 1999: Wins the historic Treble — Premier League, FA Cup, and UEFA Champions League — the first and only English club to achieve this feat.

- 2000: Wins the Intercontinental Cup, beating Palmeiras to become world champions.

- 2003: Cristiano Ronaldo signs for the club, ushering in a new era of attacking football and global marketing success.

- 2005: Acquired by the Glazer family through a leveraged buyout worth approximately £790 million.

- 2008: Wins the Champions League again in Moscow, defeating Chelsea on penalties.

- 2009: Cristiano Ronaldo sold to Real Madrid for a then world-record fee of £80 million.

- 2012: Club listed on the New York Stock Exchange (NYSE) under ticker symbol “MANU.”

- 2013: Sir Alex Ferguson retires after winning 38 trophies in 26 years, leaving as the most successful manager in British football history.

- 2016: Wins the FA Cup under Louis van Gaal, marking the club’s first major trophy post-Ferguson.

- 2017: Wins the Europa League and EFL Cup under José Mourinho, completing the set of all major European trophies.

- 2021: The European Super League controversy sees Manchester United withdraw after massive fan protests, signaling supporter influence.

- 2022: Erik ten Hag appointed manager, beginning a rebuilding phase centered on youth and modern tactics.

- 2024: Sir Jim Ratcliffe and INEOS acquire a 25% stake in Manchester United, gaining control over football operations and infrastructure projects.

- 2025: Manchester United valued at approximately $6.6 billion, with Old Trafford renovation plans underway and renewed focus on footballing success.

Who Owns Manchester United: Top Shareholders

Manchester United Football Club operates as a publicly traded company with a dual-share ownership structure. The club is officially listed on the New York Stock Exchange (NYSE) under the ticker symbol “MANU.” Despite its public listing, Manchester United is effectively controlled privately due to its dual-class share system, which gives majority voting power to the Glazer family through their Class B shares.

As of November 2025, Manchester United has a hybrid ownership model combining American financial control and British football operations leadership. The Glazer family holds the majority of voting rights (48.9%) and remains the controlling shareholder group. In contrast, Sir Jim Ratcliffe, through his company INEOS, owns a significant minority stake (around 28.9%) and has been granted operational control over football activities.

This structure means Manchester United is publicly owned in terms of share trading access, yet privately controlled in practice. The Class A shares, available to institutional and retail investors, offer limited voting rights. The Class B shares, held by the Glazers and INEOS, carry ten times the voting power of Class A shares, ensuring control remains concentrated among the primary owners.

In essence, Manchester United functions as a public-private hybrid organization — financially accountable to its shareholders through market regulations but strategically directed by a small group of major owners. This setup allows the club to access global capital while maintaining stability in leadership and long-term strategic planning.

| Shareholder / Group | Type of Owner | Shareholding (Approx.) | Voting Power (Approx.) | Share Class Held | Role / Control |

|---|---|---|---|---|---|

| Glazer Family (Avram, Joel, Bryan, Kevin, Darcie, Edward) | Majority Controlling Shareholder | 48.9% | 67.9% | Class B (Super-voting) | Strategic & Financial Control |

| Sir Jim Ratcliffe / INEOS Limited | Strategic Investor / Football Operations Lead | 28.9% | 28.9% | Mix of Class A & Class B | Football Operations & Infrastructure Control |

| Public Shareholders (Retail Investors) | Public Investors | ~6% | ~2% | Class A | Economic Stakeholders |

| Institutional Investors (Funds & Asset Managers) | Institutional Shareholders | ~16–17% | ~1–2% | Class A | Minority Influence via Market Participation |

| Board & Executive Management (Non-Owner Directors) | Governance & Management (Not Shareholders) | N/A | N/A | N/A | Operational Governance |

| Other Class A Shareholders (Free Float) | Mixed Institutional & Private Investors | ~5% | <1% | Class A | Passive Investors |

Glazer Family

The Glazer family remains the club’s principal shareholders. They own roughly 48.9% of the total outstanding shares. Their Class B shares carry super-voting rights, giving the family about 67.9% of the voting power. That voting majority lets the Glazers control key governance matters. They decide major corporate moves. They approve large financial transactions. They also retain rights tied to the club’s Class B share block, such as certain pre-emption and governance protections.

Although the Glazers have delegated football operations, they still influence board composition, long-term strategy, and capital allocation. Their holdings make them the ultimate legal stewards of the club’s corporate affairs. Any sale of a controlling block of Class B shares must follow the club’s governance procedures, which include rights of first offer between major parties.

Sir Jim Ratcliffe

Sir Jim Ratcliffe, through INEOS Limited, is the club’s operational partner for football. INEOS holds roughly 28.9% of the total outstanding shares and similar voting rights associated with that holding. Under the governance agreement, INEOS took control of football-related areas. This includes recruitment, sporting strategy, training infrastructure, and stadium modernization planning.

INEOS also committed a multi-hundred-million-dollar investment pledge aimed at infrastructure: training ground upgrades, stadium redevelopment planning, and long-term performance systems. In practice, Ratcliffe’s team has appointed senior sporting executives and reorganized the football department. They implemented cost rationalization in some non-playing areas to free up capital for long-term projects. INEOS’s role is operationally hands-on, even while it remains a minority shareholder by total shares outstanding.

Public and Institutional Shareholders

The remainder of shares are Class A ordinary shares traded on the New York Stock Exchange. These public and institutional investors together hold the balance of the equity (roughly 22% of total shares outstanding after the Glazer and INEOS holdings). They supply liquidity and capital market discipline. Their voting power is limited relative to Class B holders because each Class A share carries one vote versus ten votes for Class B.

Institutional holders can influence corporate governance through proposals and engagement. But in practice, they do not control the club’s strategic direction because of the Glazers’ super-voting position and the governance agreement with INEOS.

Share Classes and Voting Mechanics

Manchester United uses a two-class share structure: Class A (public) and Class B (super-voting). Class B shares are convertible into Class A on a one-for-one basis, but conversion is rare because it would dilute voting power. The governance arrangements set out how Class B shares may be sold or transferred. They also include rights of first offer between the Glazers and INEOS for certain Class B disposals.

A formal Governance Agreement defines who runs what. It delegates football operations to INEOS while preserving strategic financial control for the Glazers. The agreement also created a board and executive framework that blends both owners’ representatives and independent directors. This hybrid model is designed to combine long-term capital stewardship with specialist sporting expertise.

Practical Effect on Decision-Making

In daily terms, INEOS decides recruitment, coaches, sports science, and training infrastructure upgrades. The Glazers sign off on capital raises, major commercial deals, and any transaction that would change control of the club. Public investors monitor performance and push for transparency through shareholder meetings and filings. Together, this creates a two-track system: one track for football and another for finance. Each track has its own leaders and accountabilities.

INEOS is focused on rebuilding sporting performance and delivering infrastructure projects. That includes plans for training-ground modernisation and phases of Old Trafford renovation. The Glazers continue to prioritise long-term value creation and corporate governance. Public investors are watching profitability, broadcast income, and commercial growth. All three groups must coordinate for major capital projects and for any future change in the controlling share block.

Manchester United Ownership History

Manchester United’s ownership history reflects the evolution of English football itself — from a humble, locally funded railway team in the 19th century to one of the most valuable and commercially powerful sports organizations in the world.

Over nearly 150 years, the club’s control has shifted from community ownership and local businessmen to corporate families and global investors. Each transition marks a defining chapter in United’s identity — resilience, modernization, and global ambition.

As of 2025, the club is jointly controlled by the Glazer family and Sir Jim Ratcliffe’s INEOS Group, marking a new era that blends American business management with British sporting leadership.

| Ownership Era / Period | Owner / Group | Type of Ownership | Approx. Ownership Period | Key Figures | Main Role / Control |

|---|---|---|---|---|---|

| Founding Era | Newton Heath LYR Workers | Community-Owned Football Club | 1878–1902 | Local railway workers from the Lancashire and Yorkshire Railway depot | Founding and management of Newton Heath LYR FC |

| Rescue & Rebranding Era | John Henry Davies | Private Local Ownership | 1902–1927 | John Henry Davies (local brewery magnate) | Owner and chief financial backer |

| Interwar & Post-War Period | James W. Gibson Family | Private Ownership | 1931–1948 | James W. Gibson | Owner and investor |

| Commercial Growth Era | Louis Edwards & Family | Private Family Ownership | 1950s–1980 | Louis Edwards | Majority owner and chairman |

| Public Company Era | Martin Edwards & Public Investors | Publicly Listed (LSE) | 1980–2005 | Martin Edwards | Majority shareholder and chairman |

| Glazer Family Takeover | Malcolm Glazer & Family | Private American Ownership (Leveraged Buyout) | 2005–2023 | Malcolm Glazer, Avram Glazer, Joel Glazer, and family | Majority shareholders via Class B shares |

| Second Generation Glazers | Avram & Joel Glazer | Family-Controlled (Post-Malcolm Glazer) | 2014–2023 | Avram and Joel Glazer | Co-chairmen and executive leaders |

| Joint Ownership Era | Glazer Family + Sir Jim Ratcliffe / INEOS Group | Hybrid (Public-Private, Dual Ownership) | 2024–Present (as of 2025) | Avram Glazer, Joel Glazer, Sir Jim Ratcliffe | Glazers: Financial control; INEOS: Football operations control |

| Public & Institutional Investors | NYSE Shareholders | Public Institutional Ownership | 2012–Present | Institutional funds (Lindsell Train, Vanguard, Ariel Investments, etc.) | Public shareholders (minority stake) |

The Founding Era (1878–1902): From Railway Workers to Rebirth

Manchester United began in 1878 as Newton Heath LYR Football Club, formed by workers from the Lancashire and Yorkshire Railway (LYR) depot in Newton Heath, Manchester. The club initially played against other railway departments and local teams. Its ownership and funding were entirely community-based — managed by the workers and small local sponsors.

However, financial instability plagued the club. By the turn of the century, Newton Heath was deeply in debt and faced dissolution. In 1902, a local brewery owner, John Henry Davies, stepped in with financial backing. He cleared the club’s debts, reorganized its finances, and renamed it Manchester United Football Club. This rescue laid the foundation for professional management and the club’s modern commercial identity.

The Davies and Edwards Family Era (1902–2005): Local Businessmen to Corporate Ownership

John Henry Davies (1902–1927)

Davies became the club’s first major private owner, funding facilities and professional recruitment. Under his stewardship, Manchester United won its first First Division title in 1908 and its first FA Cup in 1909. Davies also oversaw the move to Old Trafford in 1910, cementing the club’s permanent home. His death in 1927 left United without strong financial leadership, leading to several turbulent decades.

Post-War Reconstruction and Louis Edwards (1940s–1960s)

Following financial difficulties through the interwar years, the club’s structure evolved again. In 1945, the appointment of Sir Matt Busby as manager coincided with new ownership stability under James W. Gibson, who financed the club during the Great Depression. After Gibson’s death, Louis Edwards, a local meat magnate, gradually took control.

Louis Edwards turned Manchester United into a business-oriented organization, expanding its brand and commercial reach. When he passed away in 1980, his son Martin Edwards inherited the controlling stake.

Martin Edwards and the Stock Market Era (1980s–2005)

Under Martin Edwards, Manchester United modernized its management and expanded revenue streams. In 1991, Edwards floated the club on the London Stock Exchange, turning it into a publicly traded company for the first time. The move brought significant capital, but also opened the door for external takeovers.

During the 1990s, United became a global sports brand under Sir Alex Ferguson, but its public status meant shares could be freely bought and sold. This led to growing interest from corporate investors — setting the stage for a new kind of ownership.

The Glazer Takeover (2005–2023): Private American Control

In 2005, the Glazer family, led by American businessman Malcolm Glazer, acquired full control of Manchester United through a £790 million leveraged buyout (LBO). This deal turned the club from public to private, removing it from the London Stock Exchange.

The takeover was financed largely by borrowed money, secured against the club’s assets, sparking fan protests that continue to this day. The Glazers’ structure split the shares into two classes — Class A (public) and Class B (super-voting) — allowing them to retain control even if they sold part of their stake.

After Malcolm Glazer’s death in 2014, ownership passed equally to his six children: Avram, Joel, Kevin, Bryan, Darcie, and Edward Glazer. Avram and Joel took on leading executive roles, acting as the club’s co-chairmen.

Despite controversy, the Glazers expanded United’s commercial empire, growing sponsorship deals, media rights, and global fan engagement. However, sporting results began to decline post-2013 after Sir Alex Ferguson’s retirement, leading to mounting fan dissatisfaction.

The Ratcliffe / INEOS Era (2024–Present): Shared Ownership and Operational Reform

In early 2024, British billionaire Sir Jim Ratcliffe, founder of INEOS, acquired a 25% stake in Manchester United for approximately $1.5 billion. Later in 2024, his stake increased to 28.9%, giving INEOS significant influence in club management.

Under the terms of the agreement, Ratcliffe’s INEOS team assumed full control of football operations, including recruitment, training facilities, and stadium redevelopment plans. The Glazers, meanwhile, retained financial control and majority voting rights.

This arrangement effectively created a dual-ownership model:

- The Glazers manage corporate and financial aspects.

- Sir Jim Ratcliffe and INEOS oversee football performance and infrastructure.

Ratcliffe’s investment marked a major turning point — the first significant dilution of the Glazers’ absolute control since 2005. His leadership also represents a symbolic “British re-entry” into United’s management after nearly two decades of American control.

The Present Day (2025): Hybrid Control and the Future

As of November 2025, Manchester United operates as a public-private hybrid club. It is listed on the NYSE but privately controlled through dual-class shares. The Glazer family retains around 48.9% of total shares and 67.9% of voting rights, while Sir Jim Ratcliffe and INEOS hold 28.9% and manage football operations.

This structure gives the club two centers of power — business control in the U.S. through the Glazers and sporting leadership from the U.K. under Ratcliffe.

The modern ownership reflects a globalized football industry — one where financial capital, fan passion, and sporting strategy intersect. The Glazers’ financial expertise and Ratcliffe’s football focus form an unusual partnership, one that may define Manchester United’s next era of success — or struggle — as it aims to reclaim its dominance in world football.

Net Worth of Manchester United’s Owners:Glazer Family & Sir Jim Ratcliffe

As of November 2025, the Glazer family’s collective net worth is estimated at around $10 billion, while Sir Jim Ratcliffe’s net worth stands at approximately $17 billion. These figures position both owners among the wealthiest in global sport. However, their wealth structures — one built on diversified family investments and the other on a massive industrial empire — play very different roles in Manchester United’s modern operations.

| Owner / Group | Estimated Net Worth (November 2025) | Primary Source of Wealth | Role at Manchester United |

|---|---|---|---|

| Sir Jim Ratcliffe | $17 billion (£13.4 billion) | INEOS Group (Chemicals, Manufacturing, Energy) | Minority shareholder with full football operations control |

| Glazer Family | $10 billion (collectively) | Real estate, Tampa Bay Buccaneers, First Allied Corporation | Majority shareholders with corporate and financial control |

Sir Jim Ratcliffe Net Worth

Sir Jim Ratcliffe is one of Britain’s richest industrialists and the founder of INEOS Group, a multinational chemicals, manufacturing, and energy conglomerate. As of November 2025, his estimated net worth is $17 billion, according to the Sunday Times Rich List and Forbes.

Ratcliffe’s wealth is primarily derived from his majority ownership in INEOS, which operates more than 30 manufacturing sites worldwide and produces petrochemicals, polymers, and synthetic oils. His fortune has been both vast and volatile, reflecting the cyclical nature of the energy and materials sector.

Sources of Wealth

INEOS remains Ratcliffe’s primary source of wealth. Founded in 1998, the company grew rapidly through acquisitions of underperforming chemical divisions from firms such as BP and BASF. Over the decades, Ratcliffe transformed INEOS into one of the world’s largest privately owned industrial companies.

The group’s annual revenues exceed $60 billion, though its profits are sensitive to energy markets and environmental regulations. Ratcliffe’s wealth has therefore experienced notable fluctuations — with 2025 marking a reported decline compared to previous years, driven by industrial slowdowns and debt exposure in INEOS’s energy division.

Investments and Diversification

Beyond his industrial holdings, Ratcliffe has built a diversified investment portfolio across sport and infrastructure. His company, INEOS Sport, owns or partners with several major sports organizations:

- INEOS Grenadiers cycling team (formerly Team Sky)

- OGC Nice football club in France

- INEOS Britannia America’s Cup sailing team

- Partial ownership in Mercedes-AMG Petronas F1 Team.

In 2024, Ratcliffe extended his sporting footprint by acquiring a 28.9% stake in Manchester United for about $1.5 billion. The deal granted him operational control of football matters, including recruitment, facilities, and infrastructure — a reflection of both his sporting passion and long-term investment strategy.

Current Standing

Despite a temporary dip in his wealth due to market conditions, Ratcliffe remains one of the wealthiest figures in British business and global sport. His fortune gives Manchester United access to substantial capital resources, especially for projects like the planned Old Trafford redevelopment, expected to exceed $1 billion in cost.

The Glazer Family Net Worth

The Glazer family, based in Florida, USA, has been the majority owner of Manchester United since 2005. Their collective net worth is estimated at around $10 billion as of November 2025. The family wealth stems from diversified business interests across sports, real estate, and finance, as well as long-term ownership of high-value sports franchises.

The Glazers control Manchester United through Class B shares, which carry ten times the voting rights of ordinary shares. This structure allows them to maintain boardroom control despite holding less than 50% of total equity.

Sources of Wealth

The Glazer fortune originated with Malcolm Glazer, who founded and led First Allied Corporation, a real estate investment company. Over the decades, the family expanded its holdings across multiple industries, including:

- Real Estate: Commercial and residential investments across the U.S.

- Sports: Ownership of the Tampa Bay Buccaneers (NFL), purchased in 1995 for $192 million and now valued at over $4 billion.

- Media and Financial Investments: Through various holding entities and private investments.

Manchester United Ownership and Financial Control

The Glazers’ 2005 leveraged buyout of Manchester United, valued at £790 million, remains one of the most talked-about takeovers in football history. The acquisition was largely debt-financed, and the club’s assets were used as collateral — a move that sparked years of fan protest.

Despite the backlash, the Glazers have significantly increased Manchester United’s commercial value, with the club’s valuation rising from $1 billion in 2005 to $6.6 billion in 2025. The family has also overseen the expansion of global sponsorship deals, broadcasting partnerships, and digital fan engagement, turning United into one of the world’s most profitable sports brands.

Current Financial Position

As of 2025, the Glazer family continues to derive substantial income from both Manchester United and the Tampa Bay Buccaneers. Their net worth remains stable due to diversified investments and steady revenue from U.S. sports. While individual Glazer siblings’ fortunes vary, Avram and Joel Glazer — the family’s co-chairmen of Manchester United — are each estimated to be worth around $1.5 billion personally.

However, unlike Ratcliffe, whose wealth is liquid and industrial, the Glazers’ wealth is tied up in long-term equity assets, meaning they are less likely to make large direct capital injections into the club.

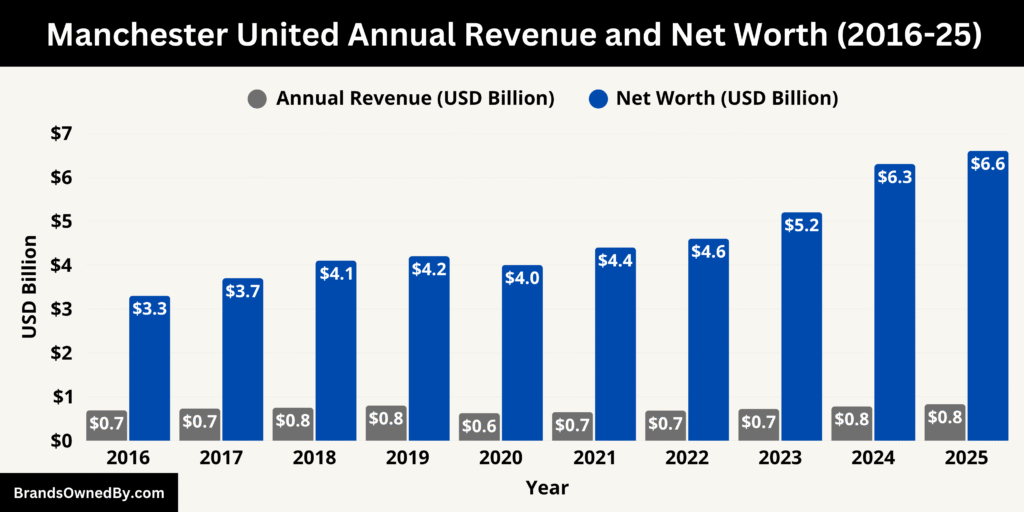

Manchester United Net Worth

As of November 2025, the net worth of Manchester United is estimated at approximately $6.6 billion, positioning it among the top three most valuable football franchises globally, alongside Real Madrid and FC Barcelona. This valuation reflects not only the team’s commercial dominance and historical legacy but also its ability to generate massive recurring revenues across multiple streams — broadcasting, matchday, sponsorships, and digital media.

Manchester United’s overall worth is determined by its enterprise value — a combination of market capitalization, brand valuation, physical assets, debt levels, and revenue potential. As of 2025, industry reports such as those from Football Benchmark and Brand Finance place the club’s enterprise valuation at $6.6 billion.

This valuation accounts for:

- Brand value and intellectual property

- Matchday and commercial revenues

- Stadium and training infrastructure

- Debt and long-term liabilities.

While United’s public stock market capitalization (NYSE: MANU) sits around $2.7 billion, the higher enterprise value includes physical assets, brand equity, and future cash flow potential — giving a fuller picture of what the franchise is truly worth.

Revenue Streams and Financial Performance

For the 2024–25 fiscal year, Manchester United reported record revenues of £666.5 million (approximately $830 million). This represents one of the highest revenue totals in European football.

- Commercial revenue: £372 million — boosted by global partnerships, kit deals, and sponsorships with brands like Adidas, TeamViewer, and Snapdragon.

- Matchday income: £153 million — reflecting increased ticket sales, stadium hospitality, and membership programs.

- Broadcasting income: £141 million — slightly lower than prior years due to inconsistent European qualification.

Despite this record turnover, the club posted a net loss of £33 million, primarily driven by restructuring costs, managerial changes, and ongoing interest payments on legacy debt.

Profitability and Debt

Manchester United continues to carry significant debt from its 2005 leveraged buyout under the Glazer family. As of 2025, gross debt remains around £535 million ($680 million). While the debt has been partially offset by strong cash reserves and refinancing, it remains a long-term factor in the club’s balance sheet.

Manchester United’s brand alone is valued at over $1.8 billion, according to 2025 Brand Finance Football 50 rankings. It consistently ranks among the top three most valuable sports brands worldwide — a testament to its century-long history, cultural impact, and global fan loyalty.

The club’s digital footprint — spanning over 200 million social media followers — continues to fuel sponsorship growth and international merchandising. The United brand carries emotional weight across generations, representing not just a football club, but a global lifestyle and identity.

Physical and Infrastructure Assets

Manchester United’s Old Trafford Stadium, nicknamed “The Theatre of Dreams,” remains one of the most iconic sporting venues globally.

- Estimated value of the property: $500 million–$700 million, including land and facilities.

- Current capacity: 74,310 seats, with expansion and redevelopment plans underway.

Under Sir Jim Ratcliffe’s direction through INEOS, discussions are ongoing to redevelop or rebuild Old Trafford into a modern 90,000–100,000 seat super-stadium. The proposed project, estimated to cost between $1 billion and $2 billion, would significantly increase the club’s long-term valuation through improved commercial and matchday returns.

In addition to Old Trafford, the Carrington Training Complex and youth academy contribute immense intangible value, having produced talents like Marcus Rashford and Alejandro Garnacho — ensuring continuity between sporting success and brand strength.

Key Factors Driving the $6.6 Billion Valuation

Below are the major factors that contribute collectively to the club’s valuation:

1. Commercial Dominance

Manchester United’s sponsorship portfolio spans technology, automotive, finance, and luxury sectors. Deals with Adidas ($1.2 billion over 10 years) and Qualcomm’s Snapdragon ($60 million per year) are among the most lucrative in sports history.

2. Global Fan Base

With over 650 million global supporters and millions of active subscribers on digital platforms, United’s fan base is the backbone of its brand value. This global reach allows the club to command premium rates for merchandise and digital content partnerships.

3. Media and Broadcasting Rights

Broadcasting remains one of the club’s biggest revenue drivers. Even during competitive downturns, Manchester United secures strong domestic and international TV rights due to its global following and historical prestige.

4. Growth Potential and Modernization

Under Ratcliffe and INEOS’s new football leadership, Manchester United is restructuring its sporting operations. The club’s focus on long-term competitiveness, combined with infrastructure investment, enhances its future value projection.

Manchester United Leadership

As of 2025, Manchester United operates under a dual-power leadership model that merges financial governance from the Glazer family with football and operational management led by Sir Jim Ratcliffe’s INEOS team. This structure aims to restore the club’s footballing dominance while sustaining its global commercial leadership.

The leadership framework now integrates three dimensions:

- Ownership governance – controlled by the Glazer family and Sir Jim Ratcliffe.

- Executive management – led by CEO Omar Berrada and a strengthened corporate team.

- Football operations – run by INEOS with a renewed focus on sporting excellence, infrastructure, and data-driven management.

This system reflects Manchester United’s evolution into a modern global enterprise, balancing financial strength, sporting performance, and brand expansion.

Executive Governance: The Glazer Family

Joel and Avram Glazer – Executive Co-Chairmen

The Glazer brothers, Joel and Avram, continue to serve as Executive Co-Chairmen of Manchester United PLC, representing the family’s controlling Class B shares. Their primary responsibility is to set the club’s long-term corporate and financial strategy.

Key areas of oversight include:

- Approval of major investment decisions, including stadium redevelopment and financing.

- Oversight of revenue performance, media rights negotiations, and global sponsorships.

- Ensuring compliance with U.S. public company regulations as Manchester United remains listed on the NYSE.

Under their stewardship, United has transitioned into one of the most profitable sports brands in the world, with a valuation of $6.6 billion as of 2025. Despite controversy surrounding their leveraged buyout in 2005, the Glazers have retained majority voting control and continue to oversee business operations in coordination with the INEOS partnership.

Strategic Leadership: Sir Jim Ratcliffe and INEOS

Sir Jim Ratcliffe – Football Operations Lead

British billionaire Sir Jim Ratcliffe, through his company INEOS, holds approximately 28.9% of Manchester United and directs the club’s footballing and operational side. His influence has transformed the club’s structure since early 2024.

Ratcliffe’s leadership emphasizes modernization, merit-based management, and data analytics in football decision-making. His objectives include:

- Restructuring football operations — introducing a clear sporting hierarchy to improve player recruitment and performance analysis.

- Infrastructure development — leading plans for the Old Trafford redevelopment project, valued between $1–2 billion.

- Restoring football identity — implementing a long-term vision to rebuild the club’s competitive culture, academy pipeline, and sporting discipline.

Ratcliffe’s INEOS delegation has embedded professionals from its sporting network — including representatives from OGC Nice and the Mercedes-AMG F1 team — to enhance efficiency, technology integration, and strategic planning.

Executive Leadership

Below is an overview of the executive leadership positions of Manchester United as of November 2025:

Omar Berrada – Chief Executive Officer (CEO)

Appointed in 2024, Omar Berrada is widely seen as one of the most significant executive appointments in Manchester United’s modern era. Formerly an executive at Manchester City, Berrada brings extensive experience in commercial development, global brand growth, and football operations.

His responsibilities include:

- Overseeing daily operations across all departments (football, commercial, media, and corporate).

- Managing relationships between the Glazers, INEOS, and the board of directors.

- Implementing a five-year strategic plan to elevate sporting competitiveness and global profitability.

Under Berrada’s leadership, United has initiated a more transparent governance structure, introduced new commercial deals, and begun executing Ratcliffe’s football vision while maintaining financial accountability.

Roger Bell – Chief Financial Officer (CFO)

Roger Bell, Manchester United’s Chief Financial Officer, oversees the club’s financial stability, investor relations, and long-term fiscal planning. He ensures compliance with international accounting standards and the club’s NYSE obligations.

His key priorities in 2025 include:

- Managing the club’s £535 million debt portfolio through refinancing and reduced interest exposure.

- Supporting capital projects like Old Trafford redevelopment and Carrington training facility upgrades.

- Overseeing sustainability and cost efficiency across global operations.

Bell works closely with the commercial division to maximize profitability while maintaining Manchester United’s reputation as one of the most financially resilient clubs in the Premier League.

Ellie Norman – Chief Communications and Brand Officer

Ellie Norman, previously of Formula 1, joined the leadership team to strengthen brand communications, digital strategy, and fan engagement. Her focus includes global brand storytelling, sustainability initiatives, and digital transformation to expand fan monetization and reach.

Ben Hawkins – Chief Commercial Officer (CCO)

Under Ben Hawkins, Manchester United’s commercial department has continued to break revenue records. The club’s global partnerships now span over 100 brands, contributing nearly $370 million annually in commercial income. Hawkins’ strategy emphasizes premium brand alignment and digital sponsorship growth.

Jean-Claude Blanc – INEOS Sports CEO and Board Representative

Jean-Claude Blanc, one of Europe’s most experienced sports executives, serves as the INEOS representative on Manchester United’s board. He oversees the integration of sporting operations between INEOS and United, ensuring alignment between business efficiency and football performance.

Blanc brings a proven track record from Paris Saint-Germain, where he managed large-scale sporting and commercial projects. At United, he supervises football operations, infrastructure, and performance departments.

Football Performance and Technical Team

Manchester United’s technical division in 2025 includes:

- Director of Football: Responsible for player recruitment, scouting networks, and talent management.

- Head of Football Operations: Manages team logistics, training facilities, and data analytics systems.

- Erik ten Hag (Manager): Retained as head coach, working under the INEOS-led structure with autonomy over first-team tactics and squad management.

This framework aims to create synergy between executive oversight and sporting execution — blending business discipline with football ambition.

Board of Directors and Corporate Oversight

The Manchester United Board of Directors comprises members from both ownership groups and independent figures who ensure transparency and accountability.

Current Composition (2025):

- Joel Glazer & Avram Glazer: Executive Co-Chairmen

- Sir Jim Ratcliffe: INEOS Lead & Board Member

- Jean-Claude Blanc: INEOS Sports CEO & Board Director

- Omar Berrada: Chief Executive Officer

- Independent Directors: Provide impartial oversight on audit, remuneration, and risk committees.

The board operates with distinct committees focusing on governance, ethics, and financial oversight — a requirement under U.S. corporate law.

Final Words

The evolving structure of who owns Manchester United in 2025 highlights a new era of collaboration between financial and football leadership. The Glazer family continues to hold majority control through their voting power, while Sir Jim Ratcliffe’s INEOS Group manages the club’s football operations, performance strategy, and infrastructure development.

This partnership blends American corporate governance with British sporting expertise, creating a balanced ownership model. Together, they aim to rebuild Manchester United’s legacy on and off the pitch, ensuring the club remains one of the world’s most valuable and influential football institutions.

FAQs

Who is the new owner of Manchester United?

The new owner of Manchester United, as of 2025, is Sir Jim Ratcliffe, who acquired a 28.9% stake in the club through his company INEOS Group. He now oversees all football operations, including recruitment, infrastructure, and performance management.

Who are the owners of Manchester United?

Manchester United is jointly owned by the Glazer family and Sir Jim Ratcliffe (INEOS Group). The Glazers remain the majority shareholders, while Ratcliffe is the minority shareholder with operational control of football activities.

Who owns Manchester United shares?

Ownership of Manchester United shares is divided among:

- The Glazer family – approximately 48.9% of total shares (majority voting control).

- Sir Jim Ratcliffe / INEOS Group – around 28.9%.

- Public and institutional investors – roughly 22%, via Class A shares listed on the New York Stock Exchange (ticker: MANU).

Who owned Manchester United before the Glazers?

Before the Glazers’ takeover in 2005, Martin Edwards was the primary shareholder and chairman. The Edwards family controlled Manchester United for several decades, having taken over from Louis Edwards, Martin’s father, in the mid-20th century.

How much of Manchester United do the Glazers own?

As of 2025, the Glazer family owns around 48.9% of Manchester United’s total shares but controls about 67.9% of the voting rights, thanks to their Class B super-voting shares, which carry ten times more voting power than the publicly traded Class A shares.

Do the Glazers still own Manchester United?

Yes, the Glazers still own Manchester United in 2025. They remain the majority shareholders with overall financial and governance control, despite Sir Jim Ratcliffe’s investment and operational role in football matters.

What is the list of Manchester United owners?

As of 2025, the ownership of Manchester United is as follows:

- The Glazer Family – Majority shareholders (48.9% ownership, 67.9% voting control).

- Sir Jim Ratcliffe / INEOS Group – Minority shareholder (28.9% ownership, full control of football operations).

- Public & Institutional Investors – Around 22% combined, through publicly traded Class A shares.

What is Glazer’s ownership of Manchester United?

The Glazer ownership of Manchester United began in 2005 when Malcolm Glazer completed a £790 million leveraged buyout of the club. The family’s six children now equally share control, with Avram and Joel Glazer acting as the club’s Executive Co-Chairmen.

Who does the Glazer family own?

The Glazer family owns:

- Manchester United Football Club (England) – Majority ownership and voting control.

- Tampa Bay Buccaneers (USA) – NFL franchise purchased in 1995, currently valued at around $4 billion.

- Additional assets through First Allied Corporation, including real estate and private investment ventures.

Does Sir Jim Ratcliffe own Manchester United?

Yes, Sir Jim Ratcliffe owns approximately 28.9% of Manchester United. While not a majority owner, he holds full operational control of the club’s football division, including management, recruitment, and infrastructure projects.

Who owns 25% of Manchester United?

The 25% stake in Manchester United belongs to Sir Jim Ratcliffe, who purchased his shares in 2024 through INEOS Group. The final figure increased to about 28.9% following additional investments and share restructuring in 2025.

Is Jim Ratcliffe richer than the Glazers?

Yes. As of November 2025, Sir Jim Ratcliffe’s net worth is estimated at $17 billion, while the Glazer family’s collective net worth is approximately $10 billion. Ratcliffe is significantly wealthier as an individual due to his industrial empire under INEOS.

Can I buy shares in Man United?

Yes, investors can buy Class A shares of Manchester United on the New York Stock Exchange (NYSE) under the ticker “MANU.” These shares offer limited voting rights compared to the Glazers’ Class B shares but provide public access to club ownership.

What does INEOS stand for?

INEOS does not stand for individual words but is derived from the Latin word “neos,” meaning “new.” It reflects innovation and rebirth. Founded in 1998 by Sir Jim Ratcliffe, INEOS is one of the world’s largest privately owned chemical and energy companies.

What else do the Glazers own?

Besides Manchester United, the Glazer family owns the Tampa Bay Buccaneers (NFL) and holds investments through their private company First Allied Corporation, which manages commercial real estate, financial assets, and other holdings across the United States.