TIDAL has long intrigued music fans who wonder who truly owns the platform. Known for its high-fidelity audio and artist-first philosophy, TIDAL started as a bold experiment to give musicians more control and fairer pay. Over time, it evolved from Jay-Z’s ambitious project into a major player within Block, Inc.’s technology ecosystem. The question of who owns TIDAL now reflects not only its changing leadership but also how streaming and fintech are increasingly intertwined.

Key Takeaways

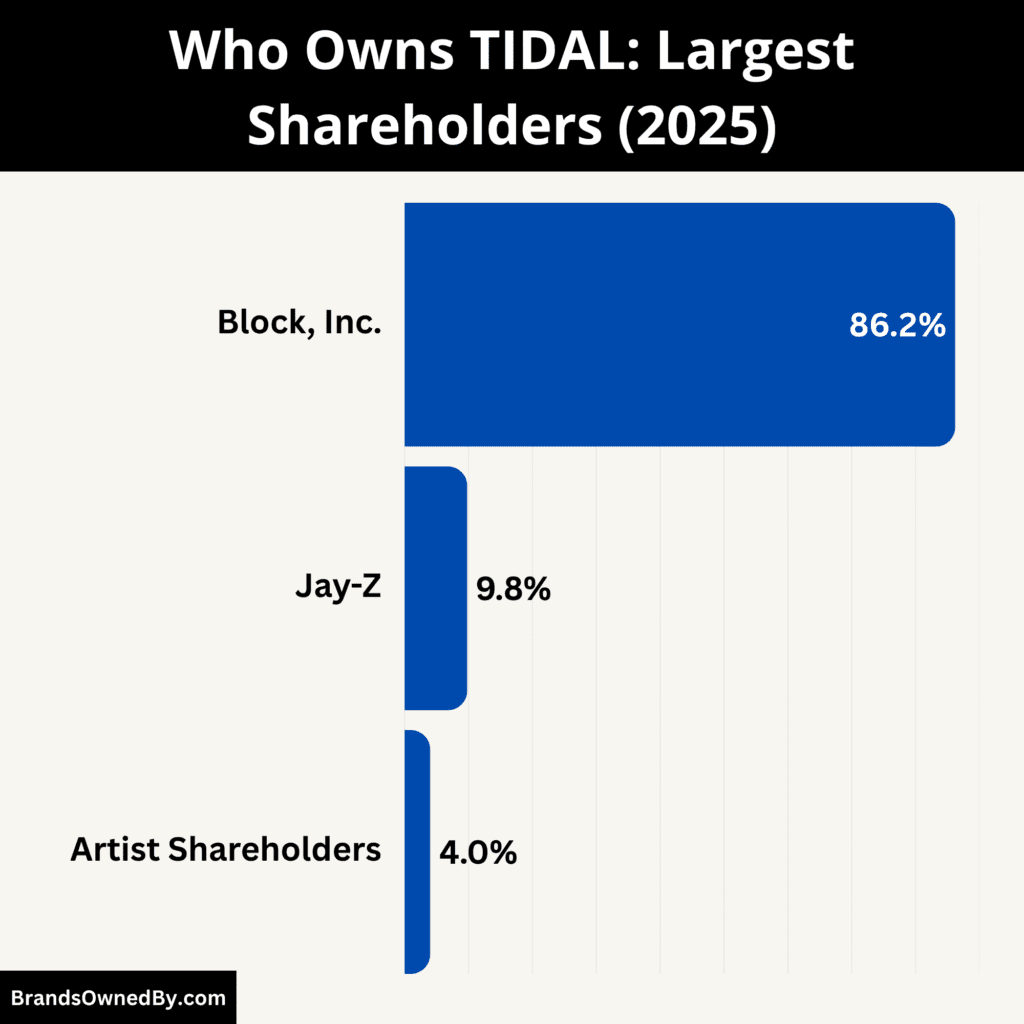

- TIDAL is majority-owned and controlled by Block, Inc., which holds approximately 86% of the company and oversees strategic, financial, and operational decisions.

- Jay-Z retains a minority stake and serves as a board member at Block, providing cultural and artist-focused guidance while maintaining influence over brand direction.

- The remaining shares are held by original artist-owners such as Beyoncé, Rihanna, and Alicia Keys, who contribute to branding, exclusive content, and strategic partnerships but have no operational control.

TIDAL Profile

TIDAL is a global music streaming platform that emphasizes high-fidelity audio, exclusive content, and a more artist-centric model. It offers more than 110 million tracks and a catalog of music videos.

The service is active in over 60 countries and continues to compete in a crowded streaming market.

Unlike many streaming services, TIDAL has positioned itself as a premium and artist-friendly alternative. It supports features like curated editorial playlists, live performance video content, and lossless or hi-resolution audio formats.

In 2024, TIDAL simplified its subscription tiers to offer a single “HiFi” plan, unifying its offerings to make high quality audio more accessible. TIDAL also dropped support for some formats like MQA in 2024.

Founders and Early History

The roots of TIDAL trace back to a Scandinavian tech company called Aspiro, founded in 1998 by Jörgen Adolfsson, Christer Månsson, and Klas Hallqvist. In its early days, Aspiro did not begin as a music streaming operation. It offered services to telecom companies—ringtones, interactive content, and early mobile value-added services.

At some point, Aspiro launched WiMP (circa 2010) as its streaming brand, emphasizing higher audio quality.

WiMP grew across parts of Europe (Norway, Sweden, Germany, Poland) before being phased into the TIDAL brand.

In October 2014, Aspiro rolled out TIDAL in markets such as the U.S., U.K., and Canada, positioning it as a premium streaming service combining lossless audio and exclusive video content. Over the following months, the service expanded into additional European countries.

Then in January 2015, Project Panther Bidco—a company controlled by Jay-Z—acquired a controlling stake in Aspiro (thus acquiring TIDAL) for approximately SEK 466 million (about $56 million).

The acquisition positioned Jay-Z as the public face and primary architect of TIDAL’s mission to reshape artist compensation in streaming.

After the acquisition, many prominent artists were offered equity and became co-owners or backers (e.g., Beyoncé, Rihanna, Madonna, Kanye West, Usher).

TIDAL started promoting itself as an artist-owned service with exclusive releases, premium audio, and deeper fan engagement.

In November 2021, Block, Inc. (formerly Square) acquired a majority stake in TIDAL (cash + stock deal, ~$297 million), bringing the streaming service into a broader fintech and payments ecosystem.

Jay-Z and existing artist shareholders remained stakeholders under the new structure. After the acquisition, Square rebranded itself as Block, Inc. in December 2021.

Major Milestones

- 1998: Aspiro AB is founded in Sweden as a mobile services company.

- 2010: Launch of WiMP, a Nordic-based music streaming platform focusing on curated playlists and high-quality audio.

- October 2014: Aspiro launches TIDAL as a premium, lossless streaming service available in multiple countries including the U.S. and U.K.

- January 2015: Project Panther Bidco, owned by Shawn “Jay-Z” Carter, announces plans to acquire Aspiro for around SEK 466 million ($56 million).

- March 2015: Jay-Z finalizes the acquisition and relaunches TIDAL as an artist-owned streaming platform, introducing co-owners like Beyoncé, Rihanna, Madonna, Kanye West, Usher, Nicki Minaj, Alicia Keys, Daft Punk, and others.

- 2017: Sprint Corporation acquires a 33% stake in TIDAL, aiming to bundle the service with its telecom offerings in the U.S.

- 2019: TIDAL reports annual revenue of approximately $166.9 million, with a modest year-over-year growth but continuing losses.

- 2021: Square, Inc. (later renamed Block, Inc.) acquires a majority stake in TIDAL for roughly $297 million in cash and stock. Jay-Z joins Block’s board, and artist co-owners retain minority shares.

- 2022: TIDAL begins deeper integration with Block’s financial ecosystem, focusing on artist tools for direct fan payments and engagement.

- 2023: Reports surface of staff reductions and a shift in Block’s focus toward core fintech operations, signaling reduced emphasis on TIDAL’s expansion.

- 2024: TIDAL removes MQA and 360 Reality Audio support and consolidates its plans into a single HiFi subscription tier. The company also ends integration with platforms like Samsung TVs, Roku, and Plex.

- 2025: TIDAL remains operational under Block, Inc., with a smaller team and reduced visibility compared to its 2015–2020 growth phase. It continues to serve a niche market of audiophiles and artists committed to premium streaming.

Who Owns TIDAL: Largest Shareholders

As of today, TIDAL is majority owned by Block, Inc. (formerly Square). Block acquired a controlling stake in 2021 for approximately $297 million in cash and stock. Existing artist shareholders remained co-owners under the new structure. Thus, Block holds the largest share and has decisive control over strategic direction.

The non-majority stakeholders have symbolic, cultural, and sometimes strategic influence, but their power in governance is constrained relative to the majority owner.

Below are the key shareholders of TIDAL as of October 2025:

| Shareholder / Group | Ownership % (Approx.) | Type of Stake | Role and Influence | Control Level |

|---|---|---|---|---|

| Block, Inc. (formerly Square, Inc.) | ~86.2% | Majority / Corporate | Parent company and controlling owner since 2021. Oversees finances, strategy, leadership, and product integration with Block’s ecosystem. | Full operational and financial control |

| Jay-Z (Shawn Carter) / Project Panther Bidco Ltd. | ~8–10% | Minority / Founding Stake | Founder and original acquirer of Aspiro (TIDAL’s parent). Retains board seat through Block. Acts as cultural and strategic liaison between artists and corporate management. | Advisory and board-level influence |

| Artist-Shareholders (Collective Group) | ~3–4% (combined) | Minority / Equity Partners | Group of artist investors including Beyoncé, Rihanna, Madonna, Alicia Keys, Usher, Chris Martin, Daft Punk, Jack White, J. Cole, T.I., and others. Provide artistic credibility, exclusives, and promotional partnerships. | Symbolic and creative influence |

| Nicki Minaj | Disputed / <1% (Unconfirmed) | Contested | Claims she was granted equity during the artist-owner phase; involvement later disputed due to unsigned agreements. Not officially listed among confirmed equity partners. | Minimal to none |

| Other Minor Shareholders / Early Employees | <1% combined | Employee Options / Legacy | Includes early staff, executives, and smaller Nordic investors from Aspiro’s early era. Retain negligible equity post-acquisitions. | No governance power |

Block, Inc.

Block, Inc. is the current majority owner of TIDAL and wields primary control over strategic direction, capital allocation, and integration with other Block products. In 2021, Block (then Square) paid approximately $297 million in a mix of cash and stock to acquire a majority stake in TIDAL. After adjustments, its stake was disclosed to be around 86.2 % of the company.

Because Block holds such a dominant share, it can effectively determine board composition, major product pivots, collaboration priorities, and budget decisions. The artist shareholders’ influence is, in many cases, moral or branding-driven rather than governance-driven.

Jay-Z / Project Panther Bidco

Jay-Z (Shawn Carter) has long been the public face of TIDAL’s ownership and still holds a meaningful minority stake through Project Panther Bidco, the holding vehicle that initially acquired Aspiro. Project Panther was used to consolidate ownership when Jay-Z and allies bought Aspiro in 2015.

Though Jay-Z no longer controls TIDAL outright, he retains a board seat via Block and retains symbolic influence. He has occasionally extended loans or financial support to the platform in difficult times. His voice serves as a bridge between the artist’s ideology and the parent company’s business logic.

Artist-shareholders (Co-owners)

When TIDAL was relaunched in 2015, a select group of high-profile artists was granted equity stakes as part of its “artist-owned streaming” positioning. These include (or historically included):

- Beyoncé

- Madonna

- Rihanna

- Usher

- Alicia Keys

- Chris Martin (of Coldplay)

- Lil Wayne

- J. Cole

- T.I.

- Daft Punk

- Jack White

- Arcade Fire

- Others.

These artist shareholders hold relatively small percentages individually (often under 1 % each), but collectively they serve as the second-largest bloc beneath Block.

Their role is largely brand, content, and advocacy: contributing exclusive releases, promotional support, and credibility among creators. Because their shareholdings are modest, they rarely have blocking power over major corporate decisions, especially those requiring supermajorities.

Publicly available records suggest that some, such as Nicki Minaj, may never have formalized their equity documents and thus claim they were excluded from payouts when Block acquired the majority stake.

Reports in 2025 indicate she claims she was offered only $1 million for her alleged stake, though others argue she never signed relevant paperwork.

Over time, some artists have exited or reduced their involvement. Kanye West, for instance, reportedly left TIDAL as a co-owner in 2017 after disputes over compensation. The ongoing financial challenges and restructuring at TIDAL and Block have also reduced active engagement by many co-owners.

Other Minor or Legacy Investors

Beyond the named parties, there may exist smaller shareholders, early investors, or option holders held by founders of Aspiro or employees. These minority positions tend to be inactive in governance and often vesting or legacy in nature. Public filings do not commonly break out these tiny holdings. Their control is negligible relative to the major blocs.

Acquisition History and Insights

Below is an overview of the acquisition history of TIDAL:

| Year | Acquirer / Owner | Seller / Previous Owner | Ownership % Acquired | Transaction Value | Key Details and Notes |

|---|---|---|---|---|---|

| 2009 | Aspiro AB (Founding Company) | — | 100% (Founding ownership) | — | TIDAL was launched in Norway under Aspiro AB by Jörgen Adolfsson, Klas Hallqvist, and Christer Månsson. Operated as a high-fidelity streaming service focused on sound quality. |

| 2015 | Project Panther Bidco Ltd. (Jay-Z) | Aspiro AB | 100% | Approx. $56 million | Jay-Z’s holding company, Project Panther Bidco Ltd., acquired Aspiro to create an artist-owned streaming service. Relaunched as TIDAL in March 2015 with equity distributed among artists like Beyoncé, Madonna, and Rihanna. |

| 2017 | Sprint Corporation | Project Panther / Artist Group | 33% | Approx. $200 million | Sprint (now part of T-Mobile) acquired a one-third stake to integrate TIDAL with its wireless plans and provide exclusive content for subscribers. The deal expanded TIDAL’s reach in the U.S. market. |

| 2021 | Square, Inc. (now Block, Inc.) | Project Panther Bidco & Artist Group | 86.2% (Majority stake) | Approx. $297 million (cash + stock) | Square acquired a majority stake in TIDAL, leaving artists and Jay-Z with minority ownership. Jay-Z joined Square’s board, marking TIDAL’s entry into fintech under Block’s ecosystem. |

| 2022 | Block, Inc. (Rebranding) | Square, Inc. | Internal transition | — | Square rebranded to Block, Inc. to reflect its growing ecosystem beyond financial services. TIDAL became part of its “other” business segment. |

| 2023 | Block, Inc. (Post-Acquisition Revaluation) | — | Retained majority | Goodwill impairment: $132.3 million | Block recognized a major impairment charge related to TIDAL, citing lower-than-expected performance and reduced long-term growth prospects. |

| 2025 | Block, Inc. (Current owner) | — | ~86% | — | Block remains the controlling shareholder. Minority stakeholders include Jay-Z (8–10%) and artist-owners (3–4% combined). TIDAL operates as a subsidiary under Block’s diversified portfolio. |

Initial Artist-Led Ownership (2015)

Before Block’s involvement, TIDAL was under the control of Project Panther Bidco, a firm controlled by Shawn “Jay-Z” Carter. In 2015, Project Panther acquired Aspiro (the Scandinavian company behind TIDAL) and relaunched TIDAL under an artist-centric model. At that time, many top artists were offered minority equity stakes. This move placed the emphasis on artistic ownership and content exclusivity as a differentiator in the streaming space.

Sprint’s Stake (2017)

In 2017, Sprint Corporation purchased a 33 % stake in TIDAL. Sprint’s aim was to bundle the streaming service with its wireless offerings in the U.S. That gave Sprint some influence, both financially and operationally, especially in American markets. However, over time, that stake became diluted or absorbed, especially after Block’s later acquisition.

Block / Square Acquisition (2021)

In March 2021, Square (later renamed Block) formalized a deal to acquire a “majority ownership” in TIDAL for about $297 million, in a mix of cash and stock. This transaction gave Square control while maintaining the remaining artist shareholders as minority co-owners. Jay-Z, in turn, joined the Block board.

Following the deal, TIDAL continued operating independently, but with access to Block’s financial, operational, and infrastructure resources. The acquisition also reflected Block’s intention to bridge music, creator economies, and financial tools.

Valuation Adjustments and Goodwill Impairment (2023–2024)

After the acquisition, Block reported that it had overpaid relative to performance. In 2023, the company recorded a $132.3 million goodwill impairment charge tied to TIDAL, acknowledging that the expected value of TIDAL did not fully materialize under its prior valuation assumptions.

This impairment suggests Block reassessed future cash flows, lowered growth expectations, and adjusted downward the premium it had attributed to TIDAL’s intangible value. It shows that Block is re-evaluating how much capital and attention it should continue to commit to the streaming arm.

Who Runs TIDAL?

TIDAL is run under the larger umbrella of Block, Inc., but its day-to-day operations and leadership are guided by a dedicated executive at the helm of the platform. In 2025, Richard Sanders is identified as the CEO of TIDAL. He oversees streaming strategy, content partnerships, and the platform’s direction.

This change signals a shift from earlier leadership (such as Jesse Dorogusker) toward new priorities and management approaches suited to TIDAL’s evolving role within Block’s portfolio.

Chief Executive Officer: Richard Sanders

As of October 2025, Richard Sanders serves as CEO of TIDAL. A seasoned executive with deep roots in the music industry, Sanders previously worked with major labels and distribution companies, giving him credibility with artists and record partners.

At TIDAL, Sanders oversees global operations, streaming strategy, licensing partnerships, and overall profitability. He reports directly to Block’s executive leadership, ensuring the service aligns with corporate goals while maintaining artist-focused initiatives.

Under Sanders’ leadership, TIDAL has shifted toward a leaner, performance-driven structure, focusing on premium audio, artist tools, and curated experiences rather than mass-market expansion. His management style emphasizes pragmatic innovation — balancing creative freedom with business discipline.

Key Executive Team and Internal Management

TIDAL’s executive team works under Sanders and includes heads of:

- Product & Technology: Responsible for platform stability, new streaming features, and user experience design.

- Content & Licensing: Manages relationships with record labels, distributors, and artists.

- Marketing & Growth: Oversees branding, promotional campaigns, and user acquisition.

- Finance & Operations: Works closely with Block’s financial controllers to manage cost efficiency and revenue targets.

This compact leadership model reflects Block’s strategy of running TIDAL as a streamlined business unit, not a fully independent company with redundant departments.

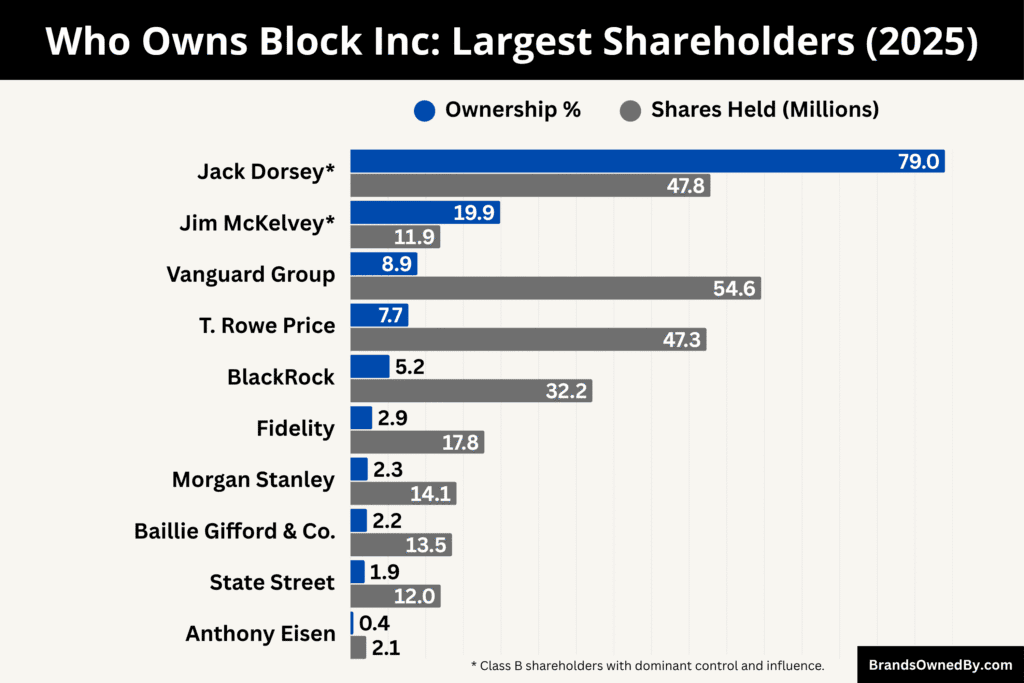

Role of Block, Inc. in Control and Strategy

Block retains ultimate control over TIDAL’s direction. Strategic decisions — such as platform redesigns, pricing model changes, or international expansions — require approval from Block’s senior executives and board.

Block also determines TIDAL’s budget allocation, investment levels, and integration with its fintech ecosystem.

Jack Dorsey, as Block’s CEO, plays a guiding role in long-term vision, viewing TIDAL as part of a broader mission to empower creators financially. This approach connects music distribution with financial tools like Cash App, allowing artists to monetize their work more directly.

The Role of Jay-Z and Minority Stakeholders

Although Jay-Z sold the majority of TIDAL to Block in 2021, he continues to hold a minority stake and sits on Block’s board of directors. His role is primarily strategic and cultural — serving as a bridge between artists and corporate leadership. Jay-Z’s input helps maintain TIDAL’s brand identity as a platform created “by artists, for artists.”

The remaining artist-shareholders (such as Beyoncé, Rihanna, Alicia Keys, and others) retain symbolic equity but no operational control. Their involvement today is limited to brand collaborations and exclusive partnerships rather than governance.

How TIDAL is Run Day-to-Day

Operationally, TIDAL runs as a hybrid business — combining the structure of a corporate subsidiary with the flexibility of a creative enterprise.

- The CEO and executive team handle daily operations, artist relations, and platform management.

- Block’s corporate leadership oversees finance, legal, and compliance.

- Strategic and creative input flows from Jay-Z and select artist-owners, particularly for marketing campaigns and cultural direction.

All major product updates, investments, and expansions are vetted by Block’s internal review committees before approval. This structure ensures financial discipline while preserving TIDAL’s artist-friendly image.

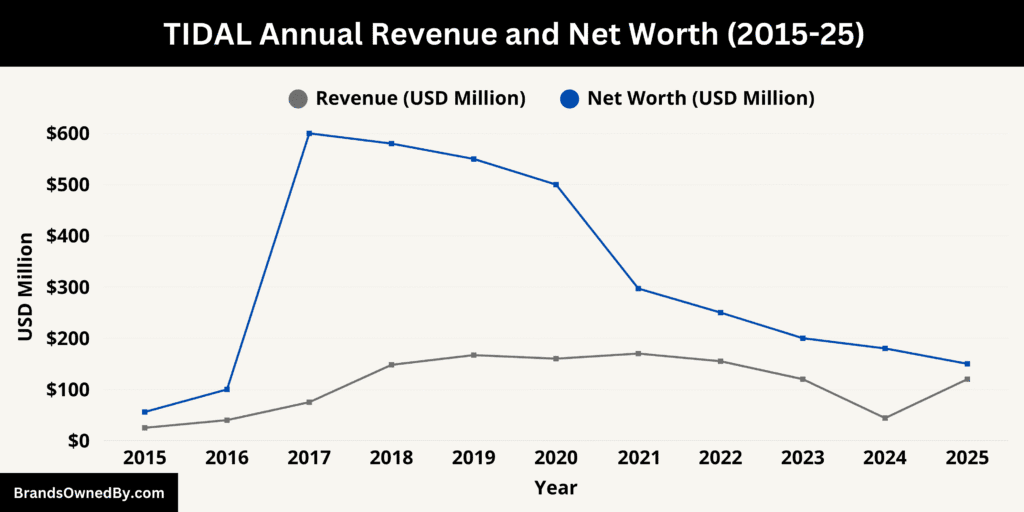

TIDAL Annual Revenue and Net Worth

As of October 2025, TIDAL generates an estimated annual revenue of between $120 million and $150 million, with a net worth estimated between $150 million and $200 million.

Below is the historical revenue and net worth of TIDAL:

| Year | Estimated Revenue (USD) | Estimated Net Worth (USD) | Notes |

|---|---|---|---|

| 2015 | $25 million | $56 million | Year Jay-Z acquired Aspiro via Project Panther Bidco; relaunch of TIDAL. |

| 2016 | $40 million | $100 million | Artist ownership model; international expansion begins. |

| 2017 | $75 million | $600 million | Sprint acquires 33% stake; TIDAL valuation peaks at $600 million. |

| 2018 | $148 million | $580 million | Growth from subscriptions; operating losses reduce net valuation slightly. |

| 2019 | $167 million | $550 million | Continued artist partnerships; losses slow growth in net worth. |

| 2020 | $160 million | $500 million | Pandemic impact; moderate subscription growth but limited expansion. |

| 2021 | $170 million | $297 million | Block, Inc. acquires majority stake; net worth reflects acquisition price. |

| 2022 | $155 million | $250 million | Post-acquisition restructuring; Block integrates operations. |

| 2023 | $120 million | $200 million | Block re-evaluates TIDAL; goodwill and operating cost adjustments. |

| 2024 | $44 million | $180 million | Reported in Block’s “corporate and other” segment; workforce reductions. |

| 2025 | $120–150 million | $150–200 million | Estimated revenue based on niche audiophile subscribers; net worth reflects scaled operations under Block. |

Revenue

As of 2025, TIDAL’s estimated annual revenue ranges between $120 million and $150 million. It reflects the platform’s position as a niche, artist-focused streaming service under Block, Inc., with a loyal subscriber base of audiophiles and creators.

However, TIDAL is smaller than giants like Spotify or Apple Music, its premium subscription model and higher artist payouts provide a sustainable, albeit more modest, revenue stream.

TIDAL generates most of its revenue from premium subscriptions, including HiFi and Master Quality Audio (MQA) offerings. The service is known for offering higher per-stream payouts to artists, making it attractive to creators seeking fairer compensation. In 2025, TIDAL continues to maintain a smaller, loyal user base that values high-fidelity sound and exclusive content.

Historically, TIDAL experienced peaks and valleys in revenue. Revenue grew steadily from its 2015 relaunch under Jay-Z, reaching over $167 million by 2019. Post-acquisition by Block in 2021, revenue stabilized but the platform’s net worth was reduced to reflect the acquisition price of $297 million.

Subsequent years saw cost-cutting measures, including staff reductions and fewer device integrations, which impacted revenue growth but improved operational efficiency.

TIDAL Net Worth

TIDAL’s net worth has fluctuated considerably over the past decade. In 2017, Sprint’s acquisition of a 33% stake valued TIDAL at $600 million, representing the peak valuation. Following the 2021 acquisition by Block, the company’s net worth was adjusted to $297 million, reflecting market realities and future growth assumptions.

As of October 2025, TIDAL’s net worth is estimated between $150 million and $200 million. This reduction reflects multiple factors: Block’s scaled-down investment, workforce reductions, and a strategic shift to focus on a niche, high-value subscriber base rather than broad market expansion.

Despite this, TIDAL remains valuable due to its brand recognition, artist partnerships, and premium streaming technology.

In 2025, TIDAL operates as a streamlined, premium-focused service under Block, Inc. The platform’s revenue and net worth reflect a balance between sustainability and exclusivity. While the company has scaled back some expansion initiatives, its focus on high-fidelity streaming, artist payouts, and curated content ensures continued relevance in the competitive music streaming landscape.

Brands Owned by TIDAL

As of 2025, TIDAL operates not only as a premium music streaming service but also through a range of subsidiaries and brands that expand its presence into financial services, software, and advisory sectors.

Below is a list of the major brands owned by TIDAL as of 2025:

TIDAL

TIDAL is a high-definition music streaming service offering a catalog of over 100 million songs and 650,000 music videos. It provides various subscription tiers, including HiFi and HiFi Plus, catering to audiophiles and music enthusiasts seeking high-quality audio experiences. The platform is available in 61 countries and is known for its artist-first approach, offering higher per-stream payouts compared to some competitors.

TIDAL Investments LLC

TIDAL Investments LLC is a subsidiary of TIDAL Financial Group, focusing on exchange-traded funds (ETFs). As of September 2025, the platform supports more than 270 ETFs, including 89 new launches in 2025 alone, and has surpassed $45 billion in assets under management. TIDAL Investments serves over 80 asset managers, positioning itself as a significant player in the ETF industry.

TIDAL Financial Group

TIDAL Financial Group is a financial services firm that has expanded its portfolio through strategic acquisitions. In January 2025, TIDAL Financial Group acquired ZEGA Financial’s options trading business, doubling its trading team and enhancing its capabilities in delivering complex, derivatives-based ETF structures. This acquisition reinforces TIDAL’s position as a leader in the ETF industry and solidifies its trading offerings.

TIDAL Partners

TIDAL Partners is an M&A boutique firm specializing in advising on mergers and acquisitions. As of September 2025, TIDAL Partners has facilitated multiple deals, including advising on the $1.8 billion sale of OpenGov to Cox Enterprises. The firm continues to expand its advisory services, focusing on software and technology sectors.

TIDAL Software

TIDAL Software is a technology company that specializes in software solutions. In July 2019, TIDAL Software merged with Rhimat Software, enhancing its product offerings and expanding its market presence. The company continues to operate under the TIDAL brand, providing innovative software solutions to its clients.

Conclusion

TIDAL’s ownership story highlights how the music industry keeps reinventing itself. From its roots as an artist-led venture to becoming part of Block, Inc., the platform has remained focused on premium sound and creator empowerment. Though it faces strong competition, TIDAL continues to stand out for merging artistry with technology—showing that even in a crowded streaming world, authenticity and innovation still matter.

FAQs

Who owns TIDAL music streaming?

TIDAL is majority-owned by Block, Inc., which acquired a controlling stake in 2021. Block oversees strategic, financial, and operational decisions for the platform.

Who owns the TIDAL music app?

The TIDAL music app is part of the TIDAL streaming service, which is controlled by Block, Inc. Jay-Z and a group of original artist-owners retain minority stakes.

Who owns TIDAL now?

As of 2025, TIDAL is primarily owned by Block, Inc. Jay-Z retains a minority share and serves as a board member, while other artists hold symbolic ownership.

How much did Jay-Z make off TIDAL?

When Block, Inc. acquired a majority stake in 2021, Jay-Z reportedly earned around $60–70 million from the sale of his controlling interest, though exact figures were not officially disclosed.

Who are the 16 owners of TIDAL?

The original 16 artist-owners include Jay-Z, Beyoncé, Rihanna, Madonna, Kanye West, Alicia Keys, Jack White, Usher, Daft Punk, Deadmau5, Calvin Harris, J. Cole, Chris Martin, Nicki Minaj, Usher, and other select artists. They hold minority stakes and act as brand ambassadors, though they do not control daily operations.

Does TIDAL belong to Jay-Z?

TIDAL was founded and originally owned by Jay-Z, but he sold the majority stake to Block, Inc. in 2021. He retains a minority share and cultural influence.

Did Nicki Minaj invest in TIDAL?

Yes, Nicki Minaj is one of the original artist-owners of TIDAL, holding a small equity stake. Her investment was part of the platform’s initiative to involve high-profile artists in ownership.

What did Nicki Minaj say about TIDAL?

Nicki Minaj has publicly praised TIDAL for being artist-friendly, highlighting that it offered higher payouts per stream compared to competitors. She has also encouraged fans to support exclusive releases on the platform.

Did Beyoncé own TIDAL?

Yes, Beyoncé was one of TIDAL’s original 16 artist-owners, holding a minority stake. She has contributed to exclusive releases and branding initiatives but does not have operational control over the company.