Breeze Airways is a new low-cost airline in the United States. Founded in 2018 and launched in 2021, it has quickly gained attention for affordable flights and underserved routes. Many people ask who owns Breeze Airways and what makes it different in the crowded aviation industry.

Breeze Airways Company Profile

Breeze Airways (legally Breeze Aviation Group, Inc.) is a U.S. low-cost airline headquartered in Cottonwood Heights, Utah. It aims to serve underserved city pairs within the U.S. with nontraditional route structures and minimal competition. Its tagline is “nice, new and nonstop,” reflecting its commitment to direct service between smaller markets.

As of 2025, Breeze operates over 300 year-round and seasonal routes connecting around 76 cities in 34 U.S. states. It often flies routes that other carriers avoid, giving it a niche in the domestic market. The airline’s fleet is composed mainly of Airbus A220-300 aircraft, supplemented by Embraer regional jets, allowing it to serve both short and mid-distance markets.

Ticketing at Breeze is structured into multiple fare tiers—ranging from more restrictive (No Flex) to premium (Nicest)—each offering varying levels of flexibility, baggage, seat choice, and amenities. Breeze also streams in-flight entertainment and progressively rolled out full Wi-Fi connectivity across its A220 fleet by 2024.

In September 2025, Breeze received certification from the U.S. Federal Aviation Administration (FAA) as a U.S. flag carrier. That status enables it to operate international routes under bilateral aviation treaties. Its first scheduled international services are slated for early 2026 to destinations in Mexico and the Caribbean (Cancún, Montego Bay, Punta Cana).

The airline emphasizes both organic growth and clever network design: as of 2025, about 87-90% of its nonstop routes are operated without direct competition. It continues expanding into new markets domestically while preparing for its first cross-border flights.

Founders

The driving force behind Breeze Airways is David Neeleman, a veteran airline entrepreneur. He previously cofounded or played leading roles in multiple airlines including JetBlue (U.S.), Azul (Brazil), WestJet (Canada), and Morris Air. After planning under the initial project name “Moxy,” he renamed the venture “Breeze Airways.”

His past track record gives him credibility in the industry. He remains deeply involved with Breeze’s operations, branding, route planning, and strategic direction. In Breeze’s executive team, he holds the role of Founder and Chief Executive Officer. Under his leadership, the airline has adopted unconventional route strategies, a lean cost structure, and a focus on underserved markets.

Breeze also employs experienced aviation executives in areas such as commercial strategy, operations, finance, and customer experience. These leaders help execute Neeleman’s vision and manage day-to-day operations.

Major Milestones

2018 – David Neeleman begins planning a new U.S. airline under the working name “Moxy.” The idea focuses on serving underserved city pairs with low-cost nonstop flights.

2019 – The airline rebrands from “Moxy” to Breeze Airways. Initial orders are placed for Airbus A220-300 aircraft, setting the stage for a modern and fuel-efficient fleet.

2021 – Breeze Airways officially launches operations in May. Its first routes connect smaller and mid-sized U.S. cities that lack nonstop service. Early operations rely on Embraer E190 and E195 regional jets.

2022 – Breeze introduces its three-tier fare structure: Nice, Nicer, and Nicest. The Nicest fare adds first-class style seating on the Airbus A220s, giving passengers a premium low-cost option.

2023 – Wi-Fi rollout begins on Airbus A220 aircraft. Breeze expands rapidly with dozens of new destinations and continues taking delivery of new A220s. The network grows to include more than 30 states.

2024 – A breakthrough year for growth. Breeze adds 29 new cities and 88 new routes in a single year. By year-end, it is flying around 220 nonstop routes. It reports its first full profitable quarter in Q4 2024, with revenue exceeding $200 million for the quarter and $680 million for the year. Fleet growth accelerates with 13 new A220-300s delivered, bringing the total A220 fleet to 33 aircraft.

2025 – Expansion continues aggressively. In spring, Breeze adds 19 new routes and three new cities: Rochester (NY), Albany (NY), and Memphis (TN). As of mid-2025, the airline operates over 300 routes serving 76 cities in 34 states. It begins nonstop and “BreezeThru” one-stop services out of Provo, Utah, to the western U.S. New service also launches from Bradley International Airport (Connecticut) to Greensboro/Winston-Salem, NC.

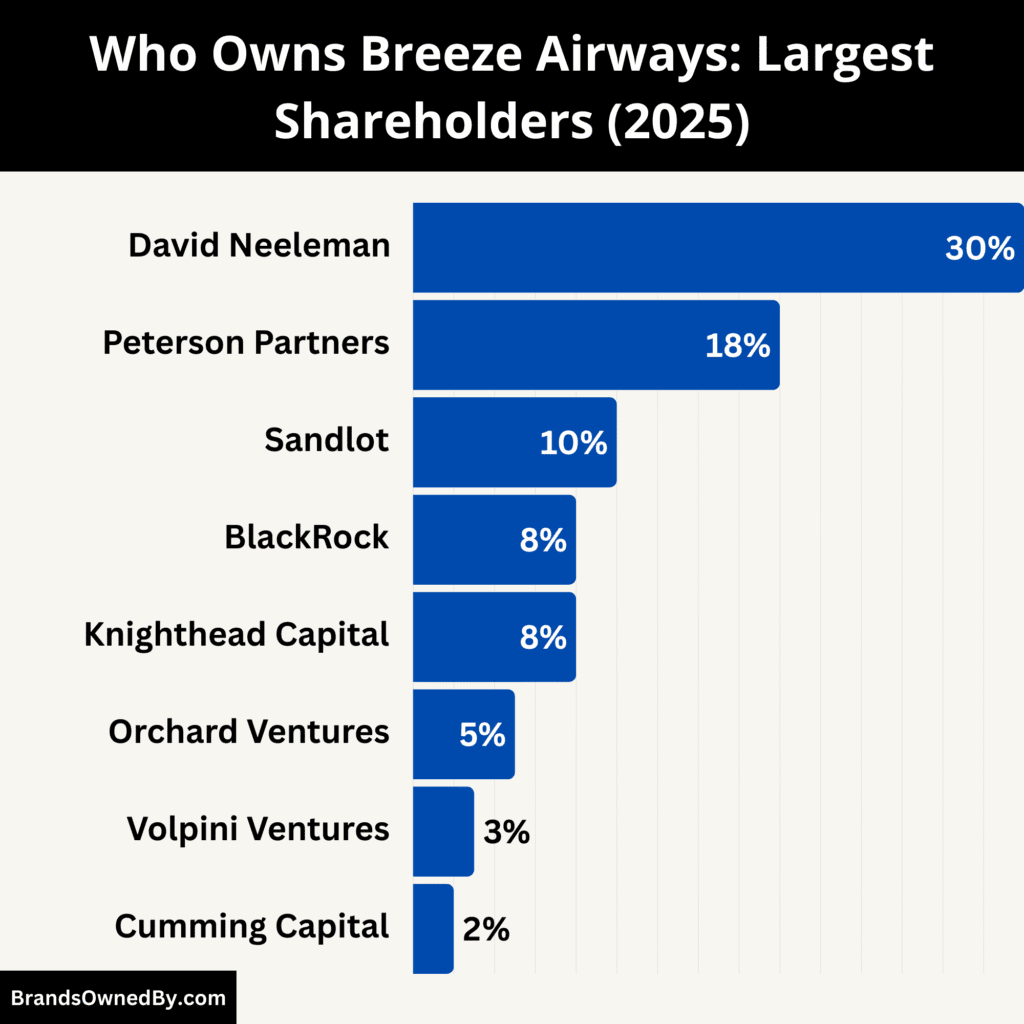

Who Owns Breeze Airways: Major Shareholders

Breeze Airways is a privately held company. Its ownership is divided among its founder, institutional backers, and smaller investors such as employees and executives. No public trading exists, so all equity is held in private hands.

As of its initial regulatory filings, a few key shareholders held more than 10 % of the voting stock; the remaining shares are distributed among officers, employees, and other investors.

Since then, later rounds of funding brought in new institutional investors (e.g., BlackRock, Knighthead, Orchard Ventures, Volpini Ventures), though their exact ownership percentages are less publicly documented.

Below is a list of the top shareholders of Breeze Airways as of September 2025:

| Shareholder / Group | Ownership % (2020 Filing) | Estimated Ownership % (2025) | Role & Influence |

|---|---|---|---|

| David Neeleman (Founder & CEO) | 35.8% | ~30% | Largest single shareholder; still controlling figure due to governance rights and CEO role. |

| Peterson Partners (via multiple funds) | 23.9% | ~18% | Remains a major institutional backer; board influence and long-term capital provider. |

| Sandlot (Sandlot LLC / Sandlot Investments) | 14.1% | ~10% | Early investor; diluted but continues to hold significant voting block. |

| BlackRock | N/A | ~8% | Entered in 2021 $200M round; large institutional investor with financial oversight. |

| Knighthead Capital Management | N/A | ~8% | Co-led 2021 round; minority stake with focus on growth and return. |

| Orchard Ventures | N/A | ~5% | Smaller institutional investor; financial support in later rounds. |

| Volpini Ventures | N/A | ~3% | Niche investor; part of funding syndicate; limited but notable stake. |

| Cumming Capital Management | N/A | ~2% | Minor private capital stake; complements larger institutional investors. |

| Officers, Employees & Other Investors | 26.2% | ~16% | Includes management, staff equity incentives, and smaller private investors; collectively meaningful but fragmented control. |

David Neeleman – ~30%

David Neeleman is the founder and CEO of Breeze Airways. He holds the largest individual stake, estimated at around 30% of the company. Although his percentage has declined slightly due to dilution from new funding rounds, he retains effective control thanks to his dual role as both majority shareholder and chief executive.

His aviation track record with JetBlue, Azul, WestJet, and Morris Air strengthens investor confidence. At Breeze, he sets the strategic vision, shapes its growth into underserved markets, and guides long-term expansion into international routes.

Peterson Partners – ~18%

Peterson Partners, a Utah-based investment firm, has been one of Breeze Airways’ earliest and most important institutional backers. Initially owning close to 24% of the airline, its stake has been diluted over time but remains significant at an estimated 18%.

Peterson Partners provides long-term investment stability and likely maintains board representation. The firm’s influence ensures financial discipline and governance, balancing founder-led leadership with institutional oversight.

Sandlot Investments – ~10%

Sandlot, an early-stage investor, originally owned around 14.1% of Breeze. As new investors joined, its estimated stake has decreased to roughly 10%. Despite this reduction, Sandlot remains a substantial shareholder.

The firm’s early support was crucial to launching Breeze Airways. Its continued ownership provides voting power and alignment with other major shareholders on key decisions.

BlackRock – ~8%

BlackRock, one of the world’s largest asset managers, joined Breeze Airways in the $200 million funding round of 2021. As of September 2025, its stake is estimated at around 8%.

BlackRock brings not only capital but also credibility and visibility in the broader investment market. As an institutional investor, its role is primarily financial, though its presence adds weight to governance and future funding opportunities.

Knighthead Capital Management – ~8%

Knighthead Capital co-led the 2021 funding round alongside BlackRock. Its estimated ownership in Breeze Airways is also around 8%.

As a hedge fund and private equity player, Knighthead focuses on financial returns and growth potential. Its involvement signals investor confidence in Breeze’s ability to scale in the competitive airline industry.

Orchard Ventures – ~5%

Orchard Ventures entered in later investment rounds. While smaller than the leading institutional players, its estimated 5% stake gives it influence as part of the broader shareholder group.

The firm supports Breeze’s expansion with capital and maintains alignment with larger investors through governance participation.

Volpini Ventures – ~3%

Volpini Ventures holds an estimated 3% stake in Breeze Airways. Though relatively small, its contribution demonstrates the diversified base of private investors who see long-term potential in the airline.

Its role is primarily financial, offering backing during Breeze’s growth phase.

Cumming Capital Management – ~2%

Cumming Capital Management owns an estimated 2% of Breeze. As a minor investor, its influence is limited, but it contributes to the broader institutional funding that enabled the airline to expand its fleet and network.

Even though its stake is smaller, it adds another layer of investor diversity.

Officers, Employees, and Other Investors – ~16%

A significant portion of Breeze Airways’ ownership—around 16%—is held collectively by its officers, employees, and smaller private investors. This group includes equity incentives, stock options, and early private backers.

While no single individual in this group holds a controlling stake, collectively they play an important role in aligning employee interests with the success of the airline. Offering stock options also helps Breeze attract and retain talent in the competitive aviation market.

Who is the CEO of Breeze Airways?

Breeze Airways is led by David Neeleman, a veteran airline entrepreneur who has founded multiple successful carriers across the Americas. His leadership defines the airline’s strategy and its focus on serving underserved markets with affordable flights.

David Neeleman’s Role as CEO

As of September 2025, David Neeleman continues to serve as the Chief Executive Officer of Breeze Airways. He is also the company’s largest shareholder, holding an estimated 30% stake. This dual role gives him strong control over the airline’s direction.

Neeleman is deeply involved in strategic decisions, including fleet expansion, route selection, and customer service innovations. His hands-on leadership style ensures that Breeze maintains the agility of a startup while scaling like a major airline.

Neeleman’s Aviation Background

David Neeleman is one of the most recognized figures in the global airline industry. Before Breeze, he successfully founded and co-founded several airlines:

- Morris Air (1984): His first airline, later sold to Southwest Airlines.

- WestJet (1996): A Canadian low-cost airline that became one of North America’s largest carriers.

- JetBlue Airways (1999): A U.S.-based airline known for its customer experience and competitive fares.

- Azul Brazilian Airlines (2008): One of the largest airlines in Brazil, serving over 100 destinations.

Breeze Airways is his fifth airline venture, built on decades of industry experience.

Leadership Style and Vision

David Neeleman’s leadership at Breeze Airways reflects his long-held philosophy of making air travel affordable, accessible, and comfortable. His style combines entrepreneurial boldness with a relentless focus on customer experience. Unlike traditional airline executives who often prioritize hub expansion, Neeleman emphasizes point-to-point travel between secondary airports. This model reduces costs and attracts travelers who would otherwise drive long distances or pay higher fares on connecting routes.

He also leverages technology as a competitive advantage. Breeze’s mobile-first booking system, self-service features, and real-time flexibility options are a direct result of Neeleman’s vision for frictionless air travel. This approach not only appeals to younger travelers but also reduces operating expenses by limiting dependency on call centers and legacy systems.

Past and Potential Leadership Changes

Since Breeze Airways’ launch, David Neeleman has remained at the helm, but he has not led the airline alone. In 2023, he appointed Tom Doxey as President, a move designed to strengthen operations as the airline scaled rapidly. Doxey, with his experience from Allegiant Air, oversees network planning, cost control, and fleet management, giving Breeze the operational depth it needs for long-term stability.

While no CEO transition has occurred, industry analysts note that Breeze’s growing institutional investor base may eventually encourage a succession plan. Potential leadership shifts could see Neeleman stepping back into a chairman role, with operational leadership handed to seasoned executives like Doxey or other rising leaders within the company. Such a move would ensure continuity while allowing investors more direct oversight of management.

Decision-Making Structure

The governance of Breeze Airways balances founder-driven strategy with institutional accountability. Neeleman retains significant influence as both CEO and largest shareholder, giving him authority over the airline’s strategic direction. However, Breeze’s board includes representatives from major investors such as Peterson Partners, BlackRock, and Knighthead Capital. This mix ensures that decisions are not made unilaterally but rather shaped by both entrepreneurial vision and financial prudence.

Strategic choices, such as aircraft acquisitions and international route launches, typically require board approval, aligning expansion with investor expectations. At the same time, tactical decisions around customer service, marketing, and day-to-day operations remain under Neeleman and his executive team’s control. This dual framework of visionary leadership backed by structured governance positions Breeze Airways to scale while minimizing the risks often associated with founder-led startups.

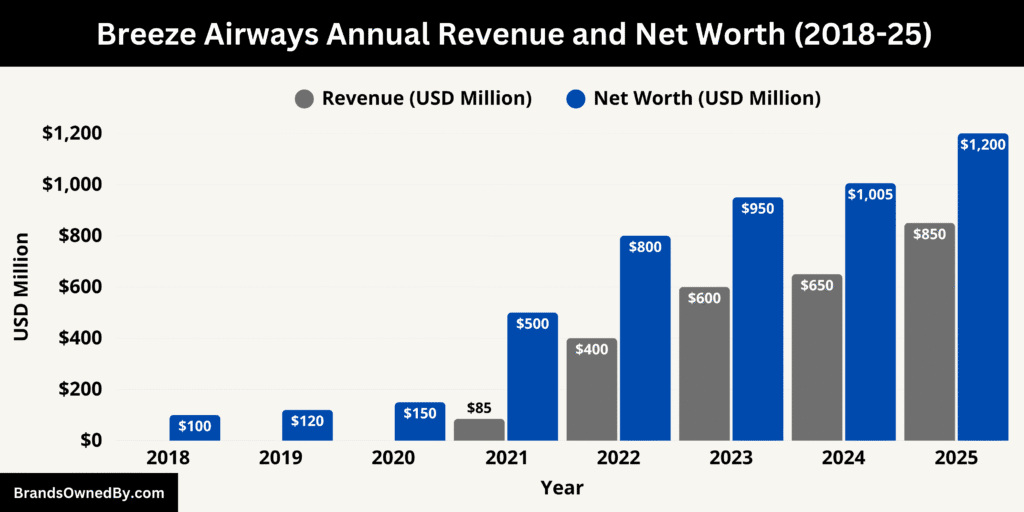

Breeze Airways Annual Revenue and Net Worth

As of September 2025, Breeze Airways is estimated to generate $850 million in annual revenue, reflecting its growing network and expanded fleet. The company’s estimated net worth stands around $1.2 billion, driven by continued investor support and increasing passenger demand. This marks significant progress for the airline, which only began operations in 2021.

| Year | Revenue (Estimated) | Net Worth (Estimated) | Key Notes |

|---|---|---|---|

| 2018 | $0 | $100M | Company founded by David Neeleman, early planning phase |

| 2019 | $0 | $120M | Early private funding, aircraft orders placed |

| 2020 | $0 | $150M | Pre-launch stage, investor capital increased |

| 2021 | $85M | $500M | Launch year, $200M funding round led by BlackRock & Knighthead |

| 2022 | $400M | $800M | Expansion of routes and fleet, rapid passenger growth |

| 2023 | $600M | $950M | Scaling operations, higher load factors |

| 2024 | $650M | $1.05B | Continued growth, approaching profitability |

| 2025 | $850M | $1.2B | Strong performance, valuation boosted by investor confidence |

Revenue Growth Over the Years

Breeze Airways’ revenue trajectory has been rapid. In 2021, during its first year of operations, revenue was modest as routes and brand recognition were just developing. By 2022, revenue grew to an estimated $400 million, supported by a larger fleet of Airbus A220 aircraft and expansion into new U.S. cities.

The upward trend continued into 2023 and 2024, with revenue climbing past $650 million, aided by higher passenger traffic and a steady rise in load factors. By 2025, the airline has reached approximately $850 million, closing the gap with established low-cost competitors. This pace highlights Breeze’s ability to convert its underserved-market strategy into sustainable income.

Net Worth and Valuation

Breeze Airways’ net worth, estimated at $1.2 billion in 2025, reflects not only its revenue generation but also strong backing from institutional investors. Capital injections from firms like BlackRock, Peterson Partners, and Knighthead Capital have consistently raised the airline’s valuation since its founding.

The net worth also takes into account Breeze’s growing fleet of Airbus A220 and Embraer E190/E195 aircraft, which represent both assets and long-term growth tools. Additionally, the company’s digital-first platform, which reduces operational costs compared to legacy carriers, enhances its valuation by making the business model more scalable.

Future Financial Outlook

Looking ahead, Breeze Airways aims to surpass the $1 billion annual revenue mark by 2026, supported by new domestic routes and possible international expansion. The net worth is also expected to grow as the airline prepares for a potential public offering within the next few years. Institutional investors are likely to play a central role in shaping this financial future, ensuring capital availability for expansion while keeping profitability in focus.

Brands Owned by Breeze Airways

Breeze Airways has focused on building a strong identity under its own name while also creating operational entities to manage services, technology, and fleet strategy. As of September 2025, the airline operates under a unified brand but controls several internal divisions and initiatives that strengthen its low-cost business model.

| Company/Brand/Entity | Type | Purpose/Details | Year Established/Introduced | Role in Breeze Airways’ Business |

|---|---|---|---|---|

| Breeze Airways Passenger Airline | Core Airline | Operates commercial flights with Airbus A220-300 and Embraer E190/E195 aircraft | 2021 | Main revenue driver, passenger operations |

| Breeze eCommerce and Digital Platform | Digital Entity | Direct booking via website and app; manages sales, trip changes, and ancillary purchases | 2021 | Reduces dependency on third-party systems, increases margins |

| Breeze Travel Extras | Ancillary Brand | Handles baggage, seat upgrades, bundles, and in-flight extras | 2022 | Boosts ancillary revenue and supports low-cost fare structure |

| Breeze Thru | Operational Initiative | Streamlined check-in and boarding system with mobile-first solutions | 2022 | Enhances customer experience and efficiency |

| Breeze Training & Operations Center | Internal Entity | Provides pilot and crew training, operational planning, and safety programs | 2023 | Reduces outsourcing costs and ensures operational consistency |

| Breeze Loyalty Program | Loyalty Brand | Rewards program with simple, flexible benefits | 2023 | Builds customer loyalty and retention |

| Fleet Acquisition and Leasing Subsidiaries | Subsidiary Entities | Manage aircraft financing, acquisition, and leasing arrangements | 2021–2024 | Ensures favorable fleet management and financing terms |

Breeze Airways Passenger Airline

The primary entity is Breeze Airways, the commercial passenger airline itself. It operates a fleet of Airbus A220-300s and Embraer E190/E195 aircraft, serving more than 40 U.S. destinations. Breeze focuses on connecting underserved secondary airports with affordable nonstop flights, positioning itself as a flexible and traveler-friendly option. The passenger airline is the core revenue driver of the company.

Breeze eCommerce and Digital Platform

Breeze owns and operates its own digital-first booking platform, which functions both as a brand identity and a revenue-generating entity. Unlike legacy carriers that rely heavily on third-party distribution systems, Breeze emphasizes direct online sales through its website and mobile app. The platform supports ticket sales, trip management, loyalty rewards, and ancillary purchases like extra baggage and seat upgrades.

Breeze Travel Extras

This sub-brand manages ancillary revenue streams such as seat selection, baggage fees, in-flight upgrades, and bundled offers. It allows the airline to keep ticket prices low while still generating profit through optional services. By 2025, Breeze Travel Extras accounts for a meaningful share of revenue, aligning with the low-cost carrier model.

Breeze Thru (Operational Initiative)

“Breeze Thru” is an internal operational concept and brand for the airline’s streamlined check-in and boarding system. Focused on efficiency and customer convenience, Breeze Thru emphasizes mobile boarding passes, reduced airport wait times, and digital automation. While not a standalone company, it operates as a branded initiative that differentiates Breeze in customer experience.

Breeze Training & Operations Center

To support its growing fleet and workforce, Breeze owns and manages a training and operations center. This entity handles pilot training, crew certification, and operational planning. By maintaining in-house training capabilities, Breeze reduces costs compared to outsourcing while ensuring consistency in safety and service standards.

Breeze Loyalty Program

Breeze has developed its own loyalty and rewards program, designed around simplicity rather than complex point systems. Though not as large as programs like Delta SkyMiles or American AAdvantage, it serves as both a retention tool and a brand extension. The loyalty program also functions as a separate entity within Breeze, with potential for future partnerships and credit card tie-ins.

Fleet Acquisition and Leasing Subsidiaries

Breeze Airways operates entities that manage fleet acquisition, leasing, and financing for its Airbus and Embraer aircraft. These subsidiaries allow the airline to negotiate favorable terms with manufacturers and leasing companies, while also managing long-term asset strategy. Such entities are standard in the airline industry, and as of 2025, Breeze has developed them into a structured part of its operations.

Final Words

Breeze Airways is a fast-growing U.S. budget airline that focuses on connecting underserved routes. The airline is primarily owned and led by David Neeleman, who is also its CEO and largest shareholder. Institutional investors hold minority stakes, but the founder’s vision continues to guide the company’s growth.

Though still young, Breeze is quickly carving a niche in the airline industry. Its ownership structure ensures that Neeleman remains the driving force, giving Breeze the stability and leadership needed to grow in a competitive market.

FAQs

Does JetBlue own Breeze?

No, JetBlue does not own Breeze Airways. Breeze is an independent airline founded by David Neeleman, who also co-founded JetBlue, but the two airlines operate separately with no ownership connection.

When was Breeze Airways founded?

Breeze Airways was founded in 2018 by David Neeleman. The airline officially launched passenger operations in May 2021.

What is Breeze Airways’ parent company?

Breeze Airways does not have a parent company. It is privately held, with ownership divided among founder David Neeleman, institutional investors such as Peterson Partners, BlackRock, Knighthead Capital, and smaller investors including employees.

Who operates Breeze Airways?

Breeze Airways is operated by its own management team, led by David Neeleman as CEO. The airline has internal divisions for operations, training, fleet management, and digital booking, all under Breeze Airways’ control.

Is David Neeleman a billionaire?

Yes, as of 2025, David Neeleman is considered a billionaire, largely due to his stakes in multiple airlines, including Breeze Airways, Azul Brazilian Airlines, JetBlue, and other aviation ventures.

What is the net worth of David Neeleman?

David Neeleman’s estimated net worth in 2025 is approximately $1.5 billion, reflecting his ownership in Breeze Airways and other airline holdings, along with past entrepreneurial successes.

How much is the Neeleman family worth?

The Neeleman family’s total estimated net worth is around $1.7 billion as of 2025. This includes David Neeleman’s personal net worth, family investments, and stakes in airline ventures co-owned with family members.