Kenvue is one of the most recognized names in consumer health. Many people want to know who owns Kenvue, especially after its separation from Johnson & Johnson. The company now operates as an independent business, but ownership details, leadership, revenue, and brand portfolio remain key to understanding its position in the global healthcare market.

Key Takeaways

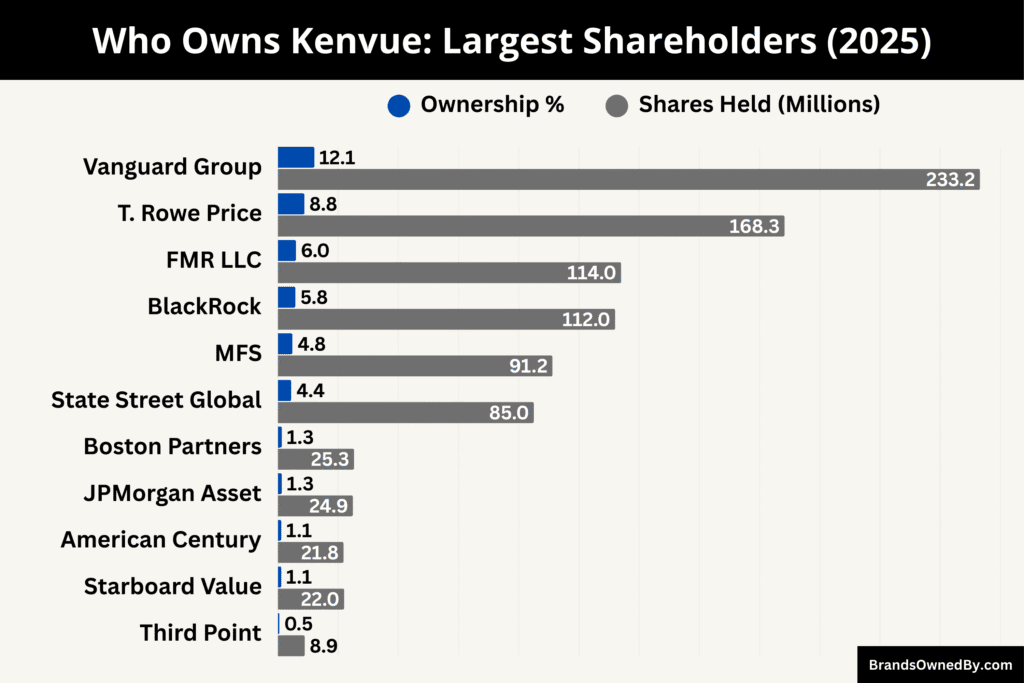

- Kenvue is a publicly traded company with no single majority owner, and its shares are primarily held by institutional investors.

- Vanguard, T. Rowe Price, Fidelity, BlackRock, and MFS are the largest shareholders, collectively controlling a significant portion of the voting power.

- Activist investors like Starboard Value and Third Point hold smaller stakes but have influence through board representation and strategic engagement.

- Johnson & Johnson, the original parent, has fully exited its ownership, leaving Kenvue as an independent consumer health company governed by institutional and activist shareholders.

Kenvue Company Profile

Kenvue is incorporated in Delaware and headquartered in the Skillman section of Montgomery Township, New Jersey, with plans to relocate its global headquarters to Summit, New Jersey. It employs over 20,000 people globally. Its operations span three main segments: Self Care, Skin Health & Beauty, and Essential Health.

In 2024, approximately half of its sales came from outside North America, indicating its strong international footprint.

Kenvue’s name is a portmanteau: “ken” (meaning knowledge) plus “vue” (a view or insight), reflecting its emphasis on science, consumer insight, and care. The company emphasizes values such as putting people first, earning trust through science, empathy, and innovation.

Founders and Origins

Kenvue does not have “founders” in the traditional sense (i.e., individuals who started it from scratch). Rather, it emerged via corporate restructuring. In November 2021, Johnson & Johnson announced plans to spin off its consumer health division to allow each business to focus more sharply on its core strengths.

In February 2022, the new company was registered (initially under a placeholder name) in Delaware. In September 2022, the brand name “Kenvue” was unveiled. In May 2023, it launched its initial public offering (IPO), listing shares on the New York Stock Exchange under the ticker “KVUE.”

At that time, Johnson & Johnson retained a majority of shares (over 90 %) before ultimately fully separating via a share exchange in mid-2023.

Thus, Kenvue’s creation was the result of a corporate spin-off rather than an entrepreneurial founding by individuals.

Major Milestones

- 1886 – Johnson & Johnson is founded, creating the foundation for consumer health brands later owned by Kenvue.

- 1950s–1960s – Expansion of consumer brands such as Tylenol, Band-Aid, Johnson’s Baby, and Listerine.

- 1980s–1990s – Johnson & Johnson grows its consumer health portfolio globally through acquisitions and expansions.

- 2006 – Johnson & Johnson acquires Pfizer Consumer Healthcare for $16.6 billion, adding brands like Nicorette and Zyrtec.

- 2010s – Strategic restructuring begins, focusing operations on pharmaceuticals, medical devices, and consumer health.

- 2021 – Johnson & Johnson announces the plan to spin off its consumer health division as a standalone company.

- 2022 – Kenvue is incorporated in Delaware, and the new name is revealed.

- 2023 – Kenvue completes its IPO on the New York Stock Exchange, raising $3.8 billion at a $41 billion valuation.

- 2023 – Johnson & Johnson completes the share exchange, and Kenvue becomes fully independent.

- 2023 – Kenvue is added to major stock indices, including the S&P 500.

- 2024 – Reports $15.5 billion in revenue in its first full year as an independent company.

- 2024 – Declares a dividend, showing financial stability and long-term shareholder commitment.

- 2025 – Debuts on the Fortune 500 at rank 281.

- 2025 – Completes transition services agreements with Johnson & Johnson, ending reliance on the parent company.

- 2025 – Announces a portfolio review, with potential sales of underperforming brands.

- 2025 – CEO Thibaut Mongon steps down; Kirk Perry becomes interim CEO.

Who Owns Kenvue: Major Shareholders

Kenvue is a publicly traded company, so its ownership is distributed broadly among institutional investors, mutual funds, and other entities. After the spin-off from Johnson & Johnson, J&J initially held a large controlling stake. Over time, that stake has been reduced and eventually exited.

Today, no single party holds full control. Instead, major institutional shareholders exert influence through board representation, proxy votes, and strategic engagement.

In 2025, institutional ownership accounts for the vast majority of the shares, and a small number of funds and former parent J&J (until its exit) stand out as key shareholders.

Below is a list of the top shareholders of Kenvue as of September 2025:

| Shareholder | Shares Held (Millions) | Ownership % | Role & Influence |

|---|---|---|---|

| Vanguard Group, Inc. | 233.2 | 12.1% | Largest shareholder, strong influence on governance and ESG policies, passive but powerful index fund manager. |

| T. Rowe Price Associates, Inc. | 168.3 | 8.8% | Actively managed fund, engages directly with companies, influential on long-term growth and capital allocation. |

| FMR LLC (Fidelity) | 114.0 | 6.0% | Major mutual fund operator, represents retail and retirement investors, supports stability but critical if results lag. |

| BlackRock, Inc. | 112.0 | 5.8% | Passive + active stewardship, highly influential on ESG, climate disclosure, and shareholder proposals. |

| Massachusetts Financial Services (MFS) | 91.2 | 4.8% | Focuses on consistent returns and dividends, constructive dialogue with management, supports brand stability. |

| State Street Global Advisors | 85.0 | 4.4% | Emphasizes board independence, transparency, and governance best practices; aligns votes with other index giants. |

| Boston Partners | 25.3 | 1.3% | Long-term institutional holder, supports financial discipline. |

| JPMorgan Asset Management | 24.9 | 1.3% | Institutional investor, adds stability, typically supportive of management. |

| American Century Investments | 21.8 | 1.1% | Steady holder, participates in governance through proxy voting. |

| Starboard Value | 22.0 | 1.1% | Activist investor, secured 3 board seats in 2025, pushing for profitability and strategic changes. |

| Third Point LLC | 8.9 | 0.5% | Activist hedge fund, advocates for portfolio optimization and capital allocation reviews. |

Vanguard Group, Inc.

Vanguard owns about 233.2 million shares, equal to roughly 12.1% of Kenvue. This makes it the largest single shareholder. Vanguard’s influence lies in its ability to sway director elections and approve or reject executive pay packages.

While it remains a passive index investor, its weight ensures the board must consider Vanguard’s governance standards, particularly around accountability, shareholder rights, and ESG practices.

T. Rowe Price Associates, Inc.

T. Rowe Price holds approximately 168.3 million shares, or 8.8% of Kenvue. Known for its active fund management style, T. Rowe’s ownership carries a strong reputation in pushing for consistent long-term performance. Its investment analysts often engage directly with companies on financial strategies, giving it leverage in discussions about growth, innovation, and capital allocation.

FMR LLC (Fidelity)

Fidelity controls around 114.0 million shares, representing 6.0% of Kenvue’s outstanding stock. Fidelity is one of the top U.S. mutual fund operators, meaning its stake is held on behalf of millions of retail and retirement account holders. Its voting record typically supports board stability but can turn critical if financial results lag. Fidelity’s involvement provides broad investor representation within Kenvue’s governance structure.

Massachusetts Financial Services (MFS)

MFS owns about 91.2 million shares, equating to 4.8% ownership. MFS has a long history of influencing portfolio companies through constructive dialogue rather than confrontation. With Kenvue, its priority is consistent cash generation, reliable dividends, and maintaining the strong brand equity inherited from Johnson & Johnson. Its weight makes it a dependable ally for management in most governance matters.

State Street Global Advisors

State Street holds roughly 85 million shares, or about 4.4% of Kenvue. As a major index fund manager, it focuses heavily on corporate governance best practices. State Street often emphasizes board independence, transparency in executive compensation, and alignment with shareholder interests. Its vote is particularly influential when combined with Vanguard and BlackRock in shareholder proposals.

BlackRock, Inc.

BlackRock owns about 112 million shares, equivalent to 5.8% of the company. BlackRock’s approach combines passive index strategies with active stewardship. It often engages boards directly on climate disclosure, product safety, and corporate responsibility.

In Kenvue’s case, BlackRock’s stake ensures it can shape long-term ESG initiatives while keeping management focused on financial results.

Starboard Value

Starboard Value holds roughly 22 million shares, equal to 1.1% of Kenvue. Despite its smaller stake, Starboard has been highly active, pushing for strategic changes in 2025.

It secured three board seats through a proxy settlement, giving it direct influence on company direction. Starboard has focused on improving profitability, streamlining underperforming brands, and considering divestitures.

Third Point

Third Point owns about 8.9 million shares, or 0.5% of Kenvue. While relatively small, Third Point is known for activist campaigns that target undervalued companies.

At Kenvue, its role has been to push management toward portfolio optimization and to review capital allocation. Even with under 1% ownership, Third Point’s reputation makes management attentive to its critiques.

Boston Partners, JPMorgan, and American Century

Boston Partners owns around 25.3 million shares (1.3%), JPMorgan holds about 24.9 million shares (1.3%), and American Century has roughly 21.8 million shares (1.1%). Collectively, these institutions contribute to Kenvue’s stability by acting as long-term holders.

While none individually wields outsized influence, their combined holdings reinforce institutional oversight and voting power.

Who is the CEO of Kenvue?

As of September 2025, Kenvue’s Board appointed Kirk Perry as Interim Chief Executive Officer, effective immediately.

The Board made the appointment on July 14, 2025, as part of a package of actions aimed at unlocking shareholder value. The move followed a Board-led strategic review and leadership changes. Thibaut Mongon stepped down and left the Board.

Interim Mandate and Priorities

Perry’s immediate mandate is to stabilize operations and accelerate profitable growth while the Board advances a comprehensive review of strategic alternatives. The Board charged a Strategic Review Committee to consider a broad set of options, including portfolio simplification and operational improvements. Perry is expected to work with that committee to sharpen execution and move toward “top-tier financial performance.”

Background and Qualifications

Kirk Perry is a seasoned consumer-products and technology executive with more than 30 years of experience. Immediately before joining Kenvue’s Board in December 2024, he served as President and CEO of Circana (the data and analytics firm formed from IRI and The NPD Group).

He previously led global client and agency solutions at Google and spent 23 years at Procter & Gamble in senior general-management and marketing roles. He also serves on the board of The J.M. Smucker Company. These roles give him deep experience at the intersection of brands, data, and retail.

The Board emphasized it is pleased to have Perry step in and has engaged Heidrick & Struggles to assist in the search for a permanent CEO. The Strategic Review Committee is being advised by Centerview Partners and McKinsey & Company as the Board evaluates strategic alternatives.

Financial Context

The Board announced the CEO transition alongside preliminary second-quarter 2025 results: reported net sales were down about 4.0% and organic sales down about 4.2%.

The company provided adjusted diluted EPS guidance of approximately $0.28–$0.29 for the quarter and said it will publish full Q2 results and a revised full-year outlook on August 7, 2025.

These metrics frame Perry’s short-term priorities: arrest declines, improve execution, and support the strategic review.

Perry’s appointment signals a board focus on commercialization, data-driven growth, and potential portfolio moves. Given his background in analytics and retail insights, expect a sharper emphasis on pricing, channel performance, and brand rationalization while strategic alternatives are evaluated. The Board has explicitly framed these steps as aimed at unlocking shareholder value.

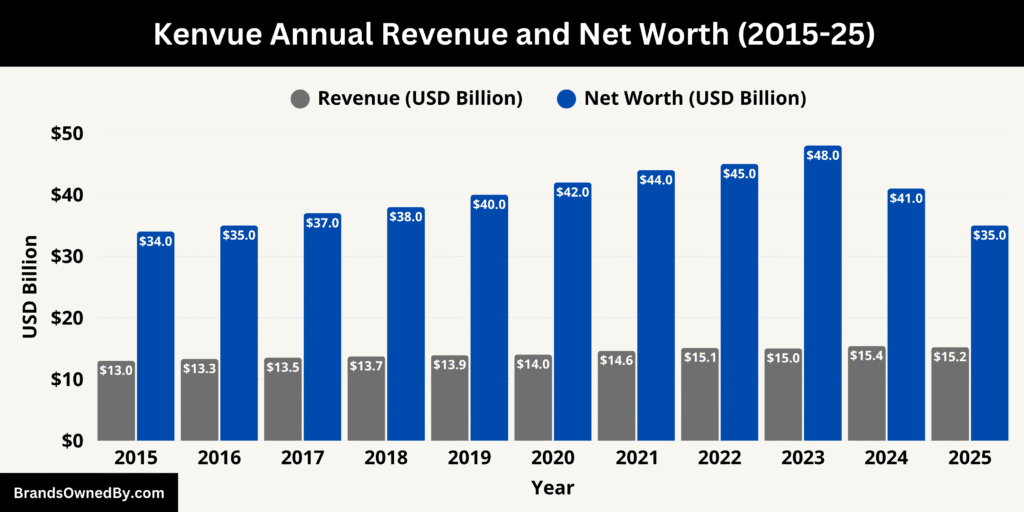

Kenvue Annual Revenue and Net Worth

As of September 2025, Kenvue has reported an estimated annual revenue of around $15.2 billion and a net worth of approximately $35 billion based on its market capitalization. These figures reflect the company’s position as one of the largest pure-play consumer health firms in the world, with a portfolio spanning pain relief, oral care, wound care, and wellness brands.

Below is the historical overview of revenue and net worth of Kenvue from 2015 to 2025:

| Year | Revenue (USD Billions) | Net Worth / Market Value (USD Billions) | Notes |

|---|---|---|---|

| 2015 | 13.0 | ~34.0 (division est.) | Early baseline under Johnson & Johnson Consumer Health. |

| 2016 | 13.3 | ~35.0 (division est.) | Stable global sales, brand trust maintained. |

| 2017 | 13.5 | ~37.0 (division est.) | Incremental growth, strength in OTC products. |

| 2018 | 13.7 | ~38.0 (division est.) | Emerging markets contributed to growth. |

| 2019 | 13.9 | ~40.0 (division est.) | Expansion in wound care and wellness categories. |

| 2020 | 14.0 | ~42.0 (division est.) | Pandemic boosted demand for pain relief and hygiene products. |

| 2021 | 14.6 | ~44.0 (division est.) | Post-pandemic recovery, strong oral care sales. |

| 2022 | 15.1 | ~45.0 (division est.) | Final year under J&J Consumer Health, stable revenues. |

| 2023 | 15.0 | 48.0 (IPO value) | Official spin-off and IPO, largest U.S. IPO since 2021. |

| 2024 | 15.4 | 41.0 | First full independent year, market value adjusted downward. |

| 2025 | 15.2 | 35.0 | Sales down by ~4%, market cap ~$35B amid strategic review. |

Revenue Performance in 2025

Kenvue’s revenue in 2025 has faced challenges due to declining organic sales in the second quarter, which dropped by about 4.2%. Reported sales were down by roughly 4.0%, reflecting weaker consumer demand in some categories and supply chain adjustments.

Despite these declines, the company continues to generate multi-billion-dollar sales annually, driven by powerhouse brands such as Tylenol, Listerine, Neutrogena, and Band-Aid. Its revenues remain resilient compared to competitors, thanks to global market penetration and strong consumer trust.

For the second quarter of 2025, Kenvue projected adjusted diluted earnings per share (EPS) in the range of $0.28 to $0.29.

While this shows short-term margin pressure, management has stated its commitment to restoring profitability through cost efficiencies, pricing strategies, and portfolio optimization. The company’s financial focus is shifting toward improving operating margins and aligning investment with high-growth segments of consumer health.

Market Capitalization and Net Worth

By September 2025, Kenvue’s market capitalization placed its net worth at approximately $35 billion. This valuation reflects investor confidence in its globally recognized consumer brands, even amid revenue softness. The net worth is shaped not only by sales but also by shareholder sentiment, activist involvement, and strategic reviews announced by the Board to unlock further value. If Kenvue successfully improves performance and executes on its restructuring and portfolio review, its valuation has room to expand.

Financial Outlook

Kenvue’s financial trajectory for the remainder of 2025 will depend on execution under interim CEO Kirk Perry and the outcomes of the strategic review. The company is expected to release updated full-year guidance in August 2025, which may include revisions to its revenue and earnings outlook. Long-term, the focus on leveraging data-driven insights, strengthening brand equity, and improving efficiency is designed to restore top-tier financial performance and enhance net worth growth.

Brands Owned by Kenvue

Kenvue operates as a pure-play consumer health company, managing a broad portfolio of well-known healthcare, wellness, and self-care brands. The company’s strategy focuses on leveraging heritage brands, expanding global reach, and innovating in consumer health.

Below are the key brands and entities Kenvue owns and operates as of 2025:

| Brand / Entity | Product Focus / Segment | Market Position / Details |

|---|---|---|

| Tylenol | Pain relief, fever reduction | Global leader in acetaminophen-based OTC pain management; flagship brand |

| Band-Aid | Adhesive bandages, wound care | Leading wound care brand; offers waterproof, sensitive-skin, and advanced healing options |

| Johnson’s Baby (Consumer Division) | Infant skincare and hygiene | Trusted global brand for mild, hypoallergenic baby care products |

| Listerine | Mouthwash, oral hygiene | Clinically recognized, strong global brand in oral care |

| Neutrogena | Skincare, facial care, sunscreens | Science-backed, dermatologist-recommended brand; profitable portfolio asset |

| Aveeno | Natural skincare, body care | Botanical-focused formulations; emphasizes efficacy and environmental responsibility |

| Zyrtec (Consumer Health Segment) | Allergy relief (cetirizine tablets, liquids) | Widely recognized OTC allergy brand; global distribution |

| Nicorette | Smoking cessation (gum, lozenges, patches) | Supports wellness and self-care; educational campaigns on quitting |

| Bengay | Topical analgesics for muscle/joint pain | Complementary to Tylenol in pain relief portfolio |

| Motrin | NSAID pain relief (tablets, gels, liquids) | Global presence for mild to moderate pain management |

| Kenvue Consumer Health LLC | Corporate entity (U.S.) | Oversees U.S. operations including manufacturing, distribution, and marketing |

| Kenvue Europe GmbH | Regional corporate entity (Europe) | Handles European regulatory compliance, marketing, and supply chain |

| Local Affiliates / Regional Entities | Manufacturing, distribution, marketing | Operate in Asia-Pacific, Latin America, and other regions; support localized operations |

| Digital Health & Innovation Platforms | Direct-to-consumer health and wellness platforms | Supports personalized engagement, online sales, and consumer insights |

Tylenol

Tylenol is one of Kenvue’s flagship over-the-counter pain relief brands. It includes a range of acetaminophen-based products for adults and children. Tylenol has maintained strong market leadership in pain management and fever reduction globally. Kenvue oversees manufacturing, distribution, and marketing, emphasizing safety, reliability, and brand trust.

Band-Aid

Band-Aid is Kenvue’s leading wound care and adhesive bandage brand. The brand includes traditional bandages, waterproof designs, and advanced healing strips. Kenvue has expanded Band-Aid with skin-sensitive options and educational campaigns on first aid, strengthening its position as a global market leader.

Johnson’s Baby (Kenvue Consumer Division)

Under Kenvue, the Johnson’s Baby line remains a key portfolio asset, covering shampoos, lotions, wipes, and skincare products for infants and children. The brand is recognized for safety, mild formulations, and decades of consumer trust. Kenvue continues to innovate in hypoallergenic and natural ingredient products.

Listerine

Listerine, Kenvue’s oral care brand, includes mouthwashes, rinses, and dental hygiene products. Kenvue manages global marketing campaigns promoting oral health and disease prevention. Listerine is positioned as a clinical-strength, trusted solution for everyday oral care.

Neutrogena

Neutrogena is a leading skincare brand under Kenvue, covering facial cleansers, moisturizers, sunscreens, and cosmetic products. Kenvue focuses on science-backed formulations, dermatologist recommendations, and global availability. It is one of the company’s most profitable consumer health brands.

Aveeno

Aveeno is a natural-focused skincare brand specializing in moisturizers, cleansers, and body care products made with botanical ingredients. Kenvue operates Aveeno globally, emphasizing product safety, clinical efficacy, and environmentally conscious formulations.

Zyrtec (Consumer Health Segment)

Zyrtec is Kenvue’s allergy relief product line, providing tablets, liquids, and dissolvable forms of cetirizine. The brand has strong consumer awareness in allergy relief and continues to be marketed globally under Kenvue’s consumer-focused strategy.

Nicorette

Nicorette is Kenvue’s smoking cessation brand, offering gums, lozenges, and patches. Kenvue has maintained this brand as part of its wellness and self-care portfolio, promoting nicotine replacement therapies with educational campaigns on quitting smoking.

Bengay

Bengay is a topical analgesic brand for muscle and joint pain, managed entirely by Kenvue. It includes creams, gels, and patches. The brand complements Kenvue’s broader pain relief portfolio alongside Tylenol.

Motrin

Motrin, a nonsteroidal anti-inflammatory drug (NSAID), is part of Kenvue’s consumer pain management offerings. The brand includes tablets, gels, and liquid formulations, marketed globally for mild to moderate pain relief.

Acquisitions and Portfolio Expansion

Since the spin-off, Kenvue has focused on expanding through strategic acquisitions and licensing agreements. While Kenvue has not made blockbuster acquisitions on the scale of its former parent, it has invested in smaller wellness brands, digital health initiatives, and niche consumer products. These moves are designed to enhance the company’s presence in natural products, self-care, and direct-to-consumer channels.

Operational Entities

Kenvue operates multiple subsidiaries and regional entities responsible for manufacturing, marketing, and distribution across North America, Europe, Asia-Pacific, and Latin America. These include Kenvue Consumer Health LLC in the U.S., Kenvue Europe GmbH, and various local affiliates responsible for regulatory compliance, supply chain management, and brand activation in their respective territories.

Digital and Innovation Platforms

Kenvue has invested in digital health platforms and direct-to-consumer initiatives, allowing it to collect consumer insights, offer personalized recommendations, and improve online accessibility of its wellness products. These platforms are fully owned and operated by Kenvue, supporting long-term engagement with its brands.

Conclusion

Kenvue stands today as a global leader in consumer health after separating from Johnson & Johnson. Ownership is now distributed among institutional and retail shareholders, though Johnson & Johnson played a major role in its early structure. With strong leadership, multi-billion-dollar revenues, and an iconic portfolio of brands, Kenvue has established itself as a powerful independent company.

FAQs

Who owns the Kenvue company?

Kenvue is a publicly traded company, so it is owned by a combination of institutional investors, mutual funds, and individual shareholders. No single entity holds majority control, giving institutional investors and activist shareholders significant influence.

Who is the largest shareholder of Kenvue?

As of September 2025, Vanguard Group is Kenvue’s largest shareholder, holding approximately 12.1% of the company’s outstanding shares.

Is Kenvue owned by J&J?

No, Kenvue is no longer owned by Johnson & Johnson. J&J spun off its Consumer Health division as Kenvue in 2023 and fully exited its remaining stake by 2024.

When was Kenvue founded?

Kenvue was officially founded in 2023 as a standalone company following its spin-off from Johnson & Johnson.

What brands does Kenvue own?

Kenvue owns a portfolio of consumer health and wellness brands, including Tylenol, Band-Aid, Johnson’s Baby, Listerine, Neutrogena, Aveeno, Zyrtec, Nicorette, Bengay, and Motrin, among others.

Does Johnson & J&J own Kenvue?

No, Johnson & Johnson no longer owns Kenvue. The company is fully independent and publicly traded.

Who owns Kenvue brands?

All Kenvue brands are owned and operated directly by Kenvue, not by any other parent company.

Is Kenvue part of Johnson & Johnson?

No, Kenvue is independent. It was previously part of J&J’s Consumer Health division but became a separate public company in 2023.

Why did Kenvue split from J&J?

Kenvue split from J&J to focus exclusively on consumer health, unlock shareholder value, and operate as a standalone company with greater strategic and operational flexibility.

Does BlackRock own Kenvue?

Yes, BlackRock owns approximately 5.8% of Kenvue’s shares as of September 2025, making it one of the top institutional shareholders.

Is Tylenol owned by Kenvue?

Yes, Tylenol is one of Kenvue’s leading consumer health brands.