Delta Air Lines is one of the most recognized airlines in the world, known for its extensive flight network and reliable services. Over nearly a century, it has grown from a small crop-dusting operation into a global aviation leader. Travelers and investors alike often wonder about the ownership of this aviation giant. Understanding who owns Delta Air Lines provides insight into its corporate structure, major stakeholders, and decision-making power.

Delta Air Lines Company Profile

Delta Air Lines is a major American airline headquartered in Atlanta, Georgia. As of 2025, it operates a fleet of approximately 1,000 aircraft, serving over 350 destinations across more than 50 countries. The airline is recognized for its extensive domestic and international network, connecting millions of passengers annually. Delta’s commitment to innovation, customer service, and sustainability has solidified its position as one of the leading carriers in the global aviation industry.

Founders and Early History

The origins of Delta Air Lines trace back to March 2, 1925, when Huff Daland Dusters was established in Macon, Georgia, as the world’s first aerial crop-dusting operation. This initiative aimed to combat the boll weevil infestation affecting cotton crops in the region.

In 1928, the company was renamed Delta Air Service, reflecting its new focus on passenger services. The name “Delta” was chosen to honor the Mississippi Delta region, where the airline initially operated.

Passenger operations commenced on June 17, 1929, marking the beginning of Delta’s transformation into a commercial airline. Over the following decades, the airline expanded its services, fleet, and routes, adapting to the evolving demands of air travel.

Major Milestones

- 1925 – Founding as Huff Daland Dusters: Delta was established in Macon, Georgia, as the world’s first aerial crop-dusting company, aimed at protecting cotton crops from the boll weevil infestation.

- 1928 – Renamed Delta Air Service: Transitioned focus from crop-dusting to passenger flights. The name “Delta” was chosen after the Mississippi Delta region.

- 1929 – First Passenger Flight: Delta Air Service launched its first passenger service, connecting Dallas, Texas, to Jackson, Mississippi, marking the airline’s entry into commercial aviation.

- 1930s – Expansion into Mail and Passenger Service: Delta became one of the first airlines to operate scheduled air mail along with passenger flights, boosting operational revenue and reliability.

- 1940s – Post-War Fleet Growth: After World War II, Delta modernized its fleet with surplus military aircraft, expanding domestic routes and adding more cities to its network.

- 1953 – First Weather-Avoidance Radar: Introduced advanced radar technology to improve flight safety, setting new standards in aviation operations.

- 1955 – First Airport Lounge: Delta opened its first airport lounge, offering premium passengers exclusive services, a concept later adopted by other airlines.

- 1960s – Branding and Technology: Introduced the iconic “widget” logo, which became a symbol of Delta’s brand. Electronic reservations systems were implemented to streamline ticketing and improve operational efficiency.

- 1970 – In-Flight Entertainment: Audio in-flight entertainment systems were installed, enhancing passenger experience and comfort.

- 1973 – Recognition for Customer Service: Delta earned accolades as the top U.S. airline for customer service, reflecting its commitment to passenger satisfaction.

- 1980s – Expansion and Hub Development: Delta developed major hubs in Atlanta, Detroit, and Minneapolis, establishing itself as a dominant airline in domestic and international markets.

- 1990s – International Growth: Expanded international operations to Europe, Asia, and Latin America, increasing its global footprint and partnerships with foreign carriers.

- 2008 – Merger with Northwest Airlines: Combined with Northwest Airlines, creating one of the world’s largest airline networks. This merger significantly increased Delta’s international routes and fleet size.

- 2010s – Technological Innovation and Modern Fleet: Introduced fuel-efficient aircraft, implemented mobile check-in apps, and enhanced operational efficiency through digital solutions.

- 2020 – Pandemic Response: Navigated the COVID-19 pandemic with health protocols, fleet management adjustments, and financial strategies to stabilize the company.

- 2025 – Centennial Celebrations: Delta celebrated 100 years of operations with:

- CES 2025 Keynote showcasing future innovations like AI-powered passenger experiences.

- Special Centennial Livery on the Airbus A321neo.

- Trading Card Collection highlighting historical aircraft and milestones.

- Flight Museum Renovations to commemorate Delta’s history.

Who Owns Delta Air Lines: Major Shareholders

Delta Air Lines is a publicly traded company listed on the New York Stock Exchange under the ticker symbol DAL. It does not have a single owner. Instead, ownership is divided among institutional investors, mutual funds, and individual shareholders. The largest shareholders are investment management firms and pension funds, which hold significant stakes in the company.

Delta Air Lines is a publicly traded company listed on the New York Stock Exchange under the ticker symbol DAL. It has a complex ownership structure that reflects its size and global influence.

Its shares are primarily held by institutional investors, mutual funds, individual insiders, and retail shareholders. Institutional investors hold the majority of shares, giving them significant influence over corporate decisions, governance, and strategic direction.

As of 2025, institutional investors own approximately 80.38%, insiders hold around 0.42%, and retail investors control about 19.20% of the company.

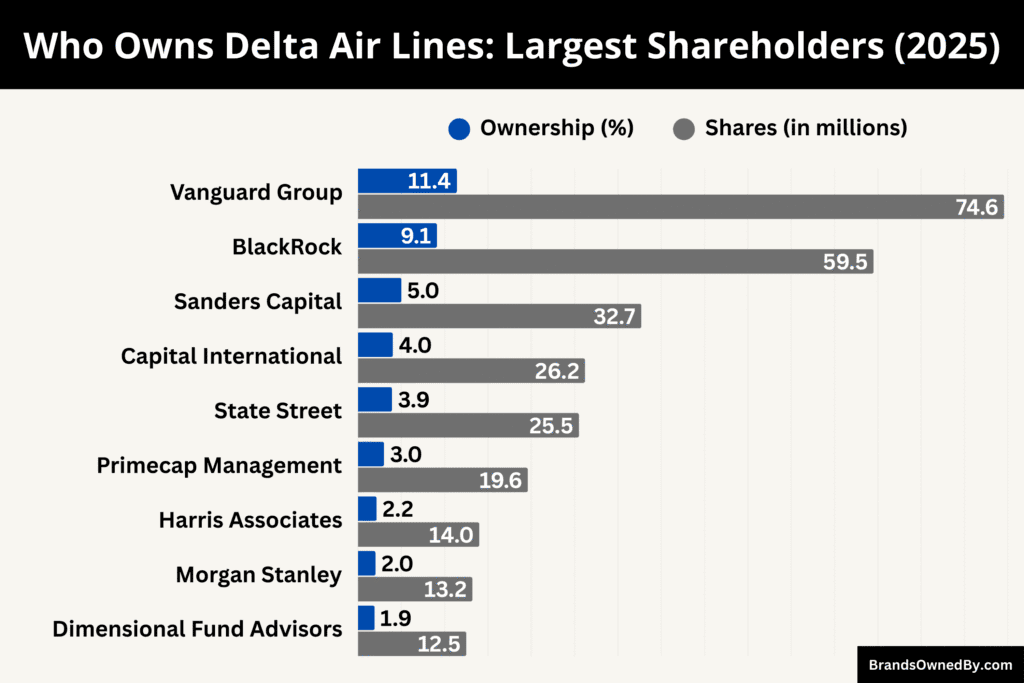

Below is a list of the top shareholders of Delta Air Lines as of August 2025:

| Shareholder | Ownership % | Approx. Number of Shares | Influence/Role |

|---|---|---|---|

| Vanguard Group Inc. | 11.42% | 74.57 million | Largest shareholder; significant voting power in corporate governance; long-term strategic influence on board decisions and policies |

| BlackRock Inc. | 9.12% | 59.5 million | Major influence on shareholder votes and strategic direction; advocates for ESG initiatives and long-term growth |

| Sanders Capital LLC | 5.01% | 32.7 million | Significant stakeholder; influences board elections and corporate strategy; focuses on long-term value creation |

| Capital International Investors | 4.02% | 26.2 million | Provides guidance on capital allocation, dividends, and operational strategy; emphasizes stability and disciplined growth |

| State Street Corporation | 3.92% | 25.5 million | Participates in corporate governance and policy decisions; collaborates with other institutional investors on strategic matters |

| Primecap Management Co. | 3.01% | 19.6 million | Votes on executive leadership and corporate policies; advocates for efficiency and prudent financial practices |

| Harris Associates L.P. | 2.15% | 14.0 million | Engages in governance discussions and strategic decision-making; emphasizes research-driven investment and active shareholder engagement |

| Morgan Stanley | 2.02% | 13.2 million | Influences board elections and corporate governance; focuses on maximizing shareholder value and sustainable growth |

| Dimensional Fund Advisors LP | 1.92% | 12.5 million | Participates in shareholder votes and strategic guidance; supports efficiency, profitability, and shareholder value |

| Retail Investors | 19.20% | ~125 million | Collective voting power in shareholder meetings; broad public influence on company policies and governance |

| Insiders (Executives & Directors) | 0.42% | ~2.7 million | Small direct stake but involved in day-to-day management and executive decisions |

Vanguard Group Inc.

Vanguard Group Inc. is the largest institutional shareholder of Delta Air Lines, owning roughly 11.42% of the company’s outstanding shares. This amounts to over 74 million shares, valued at several billion dollars. Vanguard manages investments on behalf of millions of clients worldwide, making it a long-term strategic shareholder.

Its ownership gives it significant voting power at shareholder meetings, enabling it to influence decisions on board appointments, corporate policies, and strategic initiatives. Vanguard’s focus tends to be on long-term growth, stability, and shareholder value, which aligns with Delta’s continued expansion and operational efficiency goals.

BlackRock Inc.

BlackRock Inc. holds about 9.12% of Delta Air Lines, making it another powerful institutional shareholder. BlackRock’s holdings allow it to participate actively in shareholder votes and corporate governance. As a global asset manager, BlackRock emphasizes both financial returns and sustainable corporate practices, often promoting environmental, social, and governance (ESG) initiatives.

Its involvement in Delta gives it the ability to influence key strategic decisions, such as fleet expansion, international partnerships, and investment priorities.

Sanders Capital LLC

Sanders Capital LLC owns approximately 5.01% of Delta, representing roughly 32.7 million shares. As a smaller but significant institutional investor, Sanders Capital focuses on long-term value creation.

Its stake provides the firm with the ability to voice opinions on major company straegies and participate in voting on board members and corporate policies. Sanders Capital’s influence is strategic, often pushing for efficiency and profitability in line with shareholder interests.

Capital International Investors

Capital International Investors holds around 4.02% of Delta Air Lines. The firm is known for long-term investment strategies, emphasizing stable growth and disciplined corporate governance.

Its ownership allows it to influence decisions such as capital allocation, dividend policies, and operational strategies. Capital International Investors contributes to Delta’s stability by advocating for structured, risk-aware growth initiatives.

State Street Corporation

State Street Corporation owns roughly 3.92% of Delta Air Lines. As a major institutional shareholder, State Street exerts influence in shareholder meetings, particularly in corporate governance and strategic oversight. Its investment is focused on long-term returns, and it often collaborates with other institutional investors to guide major company policies and decisions.

Primecap Management Co.

Primecap Management Co. holds approximately 3.01% of Delta’s outstanding shares. Primecap’s investment approach focuses on long-term growth opportunities.

Its ownership grants the firm the ability to participate in votes regarding executive leadership, corporate governance, and key strategic initiatives. Primecap has historically advocated for efficient management and prudent financial practices, aligning with Delta’s operational goals.

Harris Associates L.P.

Harris Associates L.P. owns around 2.15% of Delta Air Lines. With its stake, Harris Associates can engage in governance discussions, vote on corporate policy, and influence strategic decisions. The firm emphasizes research-driven investment and active shareholder engagement, which often supports Delta in maintaining operational discipline and long-term growth.

Morgan Stanley

Morgan Stanley holds approximately 2.02% of Delta Air Lines. As a leading financial institution, Morgan Stanley’s involvement allows it to influence corporate governance decisions, including board elections and major policy implementations. The firm’s investment strategy focuses on maximizing shareholder value while ensuring sustainable growth, giving it a voice in Delta’s strategic planning.

Dimensional Fund Advisors LP

Dimensional Fund Advisors LP owns about 1.92% of Delta Air Lines. Its holdings provide the firm with participation in shareholder votes and influence over the company’s strategic direction. Dimensional Fund emphasizes a systematic, data-driven approach to investments and governance, supporting Delta’s focus on efficiency, profitability, and shareholder value.

Retail Investors

Retail investors collectively hold approximately 19.20% of Delta Air Lines. While individual ownership stakes are smaller, their combined holdings represent a significant portion of the company.

Retail investors participate in shareholder votes and can influence company policies through proxy voting. Their presence ensures broader public engagement with the airline’s performance and corporate governance.

Who is the CEO of Delta Air Lines?

As of 2025, Ed Bastian serves as the Chief Executive Officer of Delta Air Lines. He has been at the helm of the company since 2016, guiding it through significant industry challenges and positioning it as a leader in global aviation.

Under his leadership, Delta has focused on enhancing customer experience, expanding international partnerships, and embracing technological innovations.

Ed Bastian’s tenure has been marked by a commitment to operational excellence and customer satisfaction. He has emphasized the importance of a people-driven, customer-focused culture, aiming to provide welcoming, elevated, and caring service to passengers.

This approach has been central to Delta’s strategy of maintaining high levels of customer loyalty and satisfaction.

Financial Performance and Corporate Growth

Under Bastian’s leadership, Delta has achieved significant financial milestones. In the second quarter of 2025, the airline reported record revenue of $15.5 billion, with a non-GAAP operating income of $2 billion and an operating margin of 13.2%. These results reflect the airline’s strong performance and effective management strategies.

In 2025, Delta celebrated its 100th anniversary, marking a century of aviation excellence. The company showcased its vision for the future of air travel at CES 2025 in Las Vegas, highlighting innovations in artificial intelligence, sustainable technology, and digital transformation.

Bastian’s keynote address emphasized the role of technology in enhancing human experiences, reinforcing Delta’s commitment to innovation.

Challenges and Crisis Management

Throughout his tenure, Bastian has navigated Delta through various challenges, including economic downturns and industry disruptions. In response to a significant IT outage in 2024, Delta took legal action against CrowdStrike, the cybersecurity firm responsible for the faulty software update that led to widespread disruptions. Bastian’s decisive leadership during such crises has been instrumental in maintaining the airline’s operational resilience.

Succession Planning and Future Outlook

As of 2025, Bastian has not indicated plans to step down, signaling his continued commitment to Delta’s growth and strategic direction.

However, he has hinted at the development of a succession plan to ensure the company’s leadership remains strong in the future. This forward-thinking approach underscores Delta’s focus on long-term stability and success.

Delta Air Lines Annual Revenue and Net Worth

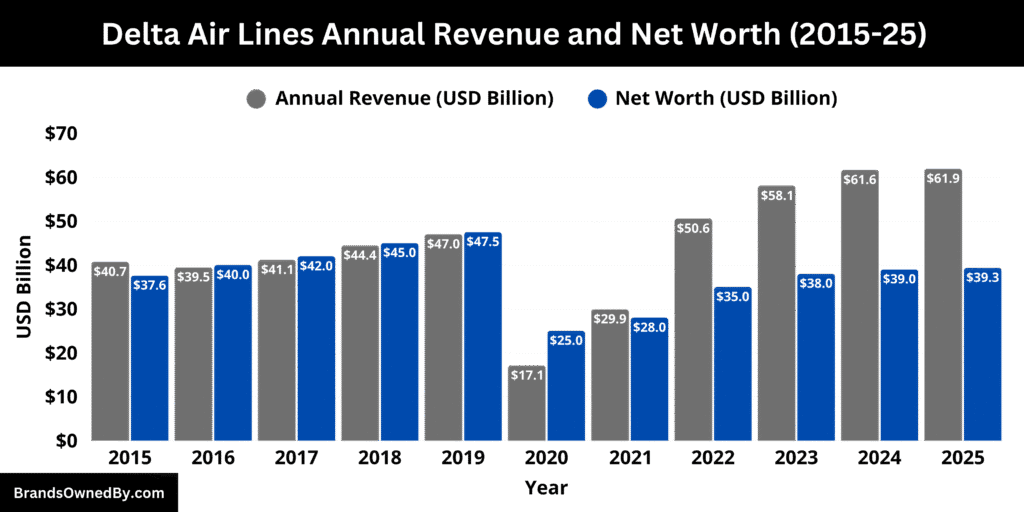

In 2025, Delta Air Lines continues to demonstrate strong financial performance, generating total annual revenue of $61.92 billion and maintaining a net worth of approximately $39.33 billion as of August 2025.

Below is an overview of the annual revenue and net worth of Delta Air Lines from 2015-25:

| Year | Annual Revenue (USD) | Market Capitalization (USD) |

|---|---|---|

| 2015 | $40.70 billion | $37.59 billion |

| 2016 | $39.45 billion | $40.00 billion |

| 2017 | $41.14 billion | $42.00 billion |

| 2018 | $44.44 billion | $45.00 billion |

| 2019 | $47.01 billion | $47.50 billion |

| 2020 | $17.10 billion | $25.00 billion |

| 2021 | $29.90 billion | $28.00 billion |

| 2022 | $50.58 billion | $35.00 billion |

| 2023 | $58.05 billion | $38.00 billion |

| 2024 | $61.64 billion | $39.00 billion |

| 2025 | $61.92 billion | $39.33 billion |

Annual Revenue 2025

For the fiscal year ending June 30, 2025, Delta Air Lines reported total revenue of $61.92 billion. This represents a 3.01% increase compared to the previous year, reflecting steady growth despite global economic fluctuations.

Delta’s revenue comes from multiple streams, including passenger services, cargo operations, and ancillary services such as baggage fees and premium offerings. High demand on both domestic and international routes, particularly in business and premium cabins, has been a significant contributor to revenue expansion. The airline’s strategic partnerships and alliances further enhance its global reach and revenue potential.

During the second quarter of 2025, Delta achieved record quarterly revenue of $15.5 billion, marking a 1% year-over-year increase. This growth was supported by operational efficiency, a well-optimized route network, and continued recovery in international travel.

Seasonal travel surges, along with strong performance in premium services, helped Delta maintain its competitive edge. The airline’s ability to manage costs, invest in technology, and deliver quality customer experiences has reinforced steady quarterly growth.

Net Worth 2025

As of August 2025, Delta Air Lines’ net worth (market capitalization) is approximately $39.33 billion. This figure represents investor confidence in the airline’s long-term profitability and market position.

Market capitalization reflects not only Delta’s current financial performance but also expectations for future growth, operational stability, and resilience against industry challenges. Factors contributing to its valuation include a diversified revenue base, strategic acquisitions, robust shareholder support, and Delta’s strong brand recognition globally.

The net worth also signals the airline’s ability to attract investment, maintain liquidity, and pursue expansion opportunities while ensuring sustainable shareholder value.

Looking forward, Delta projects full-year 2025 earnings per share between $5.25 and $6.25, with free cash flow expected to range from $3 billion to $4 billion.

These projections emphasize the company’s focus on profitable growth, operational efficiency, and shareholder returns. Delta’s strategic initiatives in fleet modernization, technology adoption, and international expansion are expected to further enhance revenue and market value in the coming years.

Companies Owned by Delta Air Lines

Delta Air Lines operates a diverse portfolio of subsidiaries, brands, and specialized entities, reflecting its strategy to integrate operations, enhance customer service, and strengthen its global footprint. From regional airlines and maintenance divisions to private jet services and loyalty programs, these entities allow Delta to maintain operational efficiency, control costs, and expand its service offerings across multiple segments of the aviation industry.

Here’s a list of the top companies and brands owned by Delta Air Lines as of 2025:

| Company/Brand | Ownership Type | Primary Function/Role | Key Details |

|---|---|---|---|

| Endeavor Air | Wholly owned subsidiary | Regional airline (Delta Connection) | Operates CRJ-900 fleet; feeds traffic to Delta hubs; serves 130+ cities across North America |

| Delta TechOps | Wholly owned subsidiary | Maintenance, Repair, and Overhaul (MRO) | Provides engineering and technical services to Delta and third-party airlines; one of North America’s largest MRO providers |

| Monroe Energy | Wholly owned subsidiary | Refinery / Fuel production | Processes crude oil into jet fuel and petroleum products; supports Delta’s fuel needs and supply chain stability |

| Delta Private Jets | Wholly owned subsidiary | Private jet charter services | Offers aircraft management, maintenance, and personalized travel for corporate and high-net-worth clients |

| Delta Global Services | Wholly owned subsidiary | Ground handling and support | Provides ramp, cargo, and customer service operations for Delta and partner airlines |

| Delta Material Services | Wholly owned subsidiary | Procurement and materials management | Manages aircraft parts inventory and supplies components to Delta and other MRO customers |

| SkyMiles IP Ltd. | Wholly owned subsidiary | Loyalty program IP management | Oversees intellectual property and licensing for the SkyMiles frequent flyer program |

| WestJet | 15% equity stake | Strategic airline partnership | Partnered with Korean Air; enhances North American and international connectivity; Onex Partners retains operational control |

| Jazz Aviation | Strategic partnership | Regional airline | Operates flights under Delta Connection in Canada; feeds traffic to Delta hubs |

| Aeromexico | Minority equity stake | Joint operations | Coordinates U.S.-Mexico routes; shares revenue and optimizes route networks |

| Hawaiian Airlines | Codeshare / operational partnership | International flights | Provides extended connectivity and premium services in Pacific routes |

| Virgin Atlantic | Joint venture | Transatlantic routes | Coordinates schedules, shares revenue, and enhances network connectivity |

| Delta Vacations | Wholly owned subsidiary | Travel packages | Packages flights, hotels, and car rentals; captures revenue from leisure travelers |

| Delta Cargo | Wholly owned subsidiary | Freight and logistics | Dedicated air cargo services; optimizes aircraft utilization and diversifies revenue |

Endeavor Air

Endeavor Air is a wholly owned regional airline operating under the Delta Connection brand. It operates the world’s largest fleet of CRJ-900 aircraft, serving over 130 cities across North America. Endeavor plays a crucial role in Delta’s domestic network by providing feeder services to major hubs and maintaining connectivity to Delta’s primary routes.

Delta TechOps

Delta TechOps is Delta’s maintenance, repair, and overhaul (MRO) division. It is one of the largest airline MRO providers in North America, offering services not only to Delta’s fleet but also to third-party customers. Delta TechOps manages a wide range of aircraft types and provides comprehensive engineering, technical, and safety services, ensuring fleet reliability and compliance with aviation regulations.

Monroe Energy

Monroe Energy operates a refinery in Trainer, Pennsylvania. It processes crude oil into jet fuel and other petroleum products, supplying a significant portion of Delta’s fuel needs. This vertical integration allows Delta to manage fuel costs, maintain supply chain stability, and support its sustainability initiatives, including the production of cleaner-burning fuels.

Delta Private Jets

Delta Private Jets provides private jet charter services for corporate clients, high-net-worth individuals, and groups seeking customized travel experiences. The subsidiary operates a fleet of aircraft, offering aircraft management, maintenance, and personalized travel planning services, complementing Delta’s commercial operations with a luxury travel segment.

Delta Global Services

Delta Global Services offers ground handling, ramp operations, cargo handling, and customer service support to Delta and other airlines. This subsidiary ensures smooth operations at airports, enhancing efficiency and maintaining high service standards. Its capabilities extend to international airports, supporting Delta’s global network.

Delta Material Services

Delta Material Services manages the procurement, storage, and distribution of aircraft parts and materials. It ensures the availability of essential components for Delta’s maintenance operations and also supplies parts to other airlines and MRO providers, contributing to operational efficiency and cost control.

SkyMiles IP Ltd.

SkyMiles IP Ltd. manages the intellectual property of Delta’s frequent flyer program, SkyMiles. It oversees licensing, partnerships, and the commercialization of the loyalty brand, allowing Delta to separate the program’s intellectual property from core airline operations while enhancing member engagement and brand value.

WestJet Stake

In May 2025, Delta, in partnership with Korean Air, acquired a combined 25% equity stake in WestJet Airlines. Delta’s investment accounted for a 15% stake, aimed at enhancing North American, European, and Asian connectivity. Onex Partners retains operational control of WestJet, while Delta benefits from expanded network reach and strategic partnership opportunities.

Jazz Aviation Partnership

Delta has a strategic partnership with Jazz Aviation, a Canadian regional carrier. Jazz operates flights under Delta Connection, feeding traffic to Delta’s hubs in North America. This partnership strengthens Delta’s domestic network in Canada and ensures seamless connectivity for passengers.

Aeromexico Joint Operations

Delta holds a minority equity stake in Aeromexico and maintains joint venture agreements on routes between the U.S. and Mexico. This collaboration allows Delta to coordinate schedules, share revenue, and optimize route networks, enhancing service efficiency across the region.

Interline and Codeshare Partnerships

Delta owns stakes or maintains long-term partnerships with several smaller carriers, including Hawaiian Airlines (codeshare arrangements) and Virgin Atlantic (joint ventures on transatlantic routes). These relationships allow Delta to extend its network, offer premium services, and optimize international connectivity without direct ownership.

Delta Vacations

Delta Vacations is Delta’s tour and holiday package brand. It packages flights, hotels, and car rentals for travelers, leveraging Delta’s flight network and partnerships. This entity allows Delta to capture additional revenue streams from leisure travelers while promoting brand loyalty.

Delta Cargo

Delta Cargo operates the airline’s dedicated freight and logistics services. It manages air freight, specialized cargo, and shipping solutions for business clients and e-commerce partners. Delta Cargo enhances revenue diversification and optimizes aircraft utilization.

Final Words

Delta Air Lines is owned by a mix of institutional investors, mutual funds, and individual shareholders rather than a single person or entity. The largest shareholders hold significant influence over company decisions and governance, while the board and executive management implement policies and strategies. Understanding who owns Delta Air Lines provides insight into its corporate control, decision-making process, and how shareholder interests guide the company’s operations.

FAQs

Who owns Delta Air Lines stock?

Delta Air Lines stock is owned by institutional investors like Vanguard, BlackRock, and State Street, as well as millions of individual investors.

Who are the largest shareholders in Delta Air Lines?

The largest shareholders of Delta Air Lines are institutional investors. As of 2025, the top shareholders include Vanguard Group Inc. (11.42%), BlackRock Inc. (9.12%), Sanders Capital LLC (5.01%), Capital International Investors (4.02%), and State Street Corporation (3.92%). Retail investors collectively hold about 19.20% of the company, while insiders hold 0.42%.

Who currently owns Delta Air Lines?

Delta Air Lines is a publicly traded company, meaning it is owned collectively by its shareholders, with the largest stakes held by institutional investors such as Vanguard and BlackRock.

Which country owns Delta Air?

Delta Air Lines is an American company and is headquartered in Atlanta, Georgia, United States. It is not owned by any other country.

Who does Delta Air Lines belong to?

Delta Air Lines belongs to its shareholders. The largest influence comes from institutional investors, but the company is publicly traded and does not have a single controlling owner.

Is Delta still using Boeing?

Yes, Delta Air Lines continues to operate Boeing aircraft, including models such as the 737 and 767. Delta also operates Airbus aircraft and is gradually modernizing its fleet with newer, fuel-efficient planes.

What was the old name of Delta Air Lines?

Delta Air Lines was originally founded as the Huff Daland Dusters in 1924. It later became Delta Air Service and eventually adopted the name Delta Air Lines.

Is Delta owned by Virgin?

No, Delta Air Lines is not owned by Virgin. They do have joint ventures and codeshare partnerships with some carriers, including Virgin Atlantic, but ownership remains independent.

Is Delta a Boeing airline?

Delta Air Lines is not exclusively a Boeing airline. While it operates a significant number of Boeing aircraft, it also operates Airbus planes and other models. Delta’s fleet is a mix of Boeing and Airbus aircraft to meet different operational needs.

Is Delta Air Lines owned by the government?

No, Delta Air Lines is a privately owned, publicly traded company. The U.S. government does not own Delta.

Who was the founder of Delta Air Lines?

Delta was originally founded as Huff Daland Dusters in 1925 by B.R. Coad and Collett Everman Woolman, who helped transform it into a passenger airline.

What companies are owned by Delta Air Lines?

Delta owns Delta Connection, Delta Vacations, and Delta TechOps. It also holds equity stakes in airlines such as Aeroméxico, Virgin Atlantic, and LATAM.

Who is the largest shareholder of Delta Air Lines?

The Vanguard Group is the largest shareholder of Delta Air Lines, holding more than 11.42% of its shares as of August 2025.