Stitch Fix has reshaped the way people shop for clothes by combining human stylists with advanced algorithms. Since its launch, it has attracted millions of customers who enjoy personalized fashion recommendations delivered right to their doorstep. As the company continues to evolve, many investors, customers, and industry watchers are curious about who owns Stitch Fix and how its leadership is steering the business through a competitive retail landscape. This article explores its ownership, leadership, and financial standing in detail.

Stitch Fix Company Profile

Stitch Fix is a technology-powered personal styling service in the United States. It combines data science and a team of stylists to curate personalized clothing “Fixes” for customers based on their style preferences, size, and budget. The service launched in 2011 and quickly gained popularity for simplifying and personalizing shopping. The company remains listed publicly and led by Claire-driven leadership as of 2025.

Company Details

Stitch Fix, Inc. was founded in 2011 in Cambridge, Massachusetts, originally named “Rack Habit,” and later rebranded. Its headquarters are now at One Montgomery Tower, San Francisco, California. As of mid-2025, the company employs approximately 4,570 people. It is publicly traded (Class A shares), part of the Russell 2000 index, and has an ISS Governance QualityScore of 10, indicating relatively high governance risk compared to peers.

By 2024, the company’s annual revenue stood at around $1.34 billion. Its algorithm-guided styling model remains a key differentiator, offering both one-off and auto-ship options.

Founders

Stitch Fix was co-founded by Katrina Lake and Erin Morrison Flynn in 2011 while Lake was pursuing her MBA at Harvard Business School. The idea began as a class project. Founded in Lake’s Cambridge apartment, the concept combined machine learning with human styling. Later, Netflix executive Eric Colson joined as “chief algorithms officer,” strengthening the company’s data-driven approach.

Katrina Lake later became the youngest woman to take a company public when Stitch Fix IPO’d in 2017.

Major Milestones

- 2011 – Stitch Fix is founded (initially Rack Habit), from a Harvard project to a data-style startup.

- 2014–2017 – The company achieves profitability and hits around $730 million in sales by mid-2016.

- November 2017 – IPO on NASDAQ, raising ~$120 million. Katrina Lake becomes the youngest woman to IPO a tech company.

- 2018–2020 – Expansion into men’s wear, plus-size, maternity, and kids categories. The company gains wider visibility.

- 2020 – In response to the pandemic, Stitch Fix laid off 18% of its staff in California but hired stylists in lower-cost cities to cut expenses.

- August 2021 – Founder Katrina Lake steps down as CEO and becomes Executive Chairperson; Elizabeth Spaulding succeeds her.

- June 2022 – About 15% of the salaried workforce is laid off due to declining growth.

- January 2023 – Elizabeth Spaulding steps down; Lake returns as interim CEO.

- June 2023 – Matt Baer (formerly of Macy’s) is appointed CEO.

- 2024 – Recorded revenue ~$1.34 billion; continues navigating a turnaround in a challenging retail environment.

- 2025 – Under Matt Baer, focus shifts to revitalizing customer-stylist relationships, improving product trends, and rebuilding growth.

Who Owns Stitch Fix: Top Shareholders

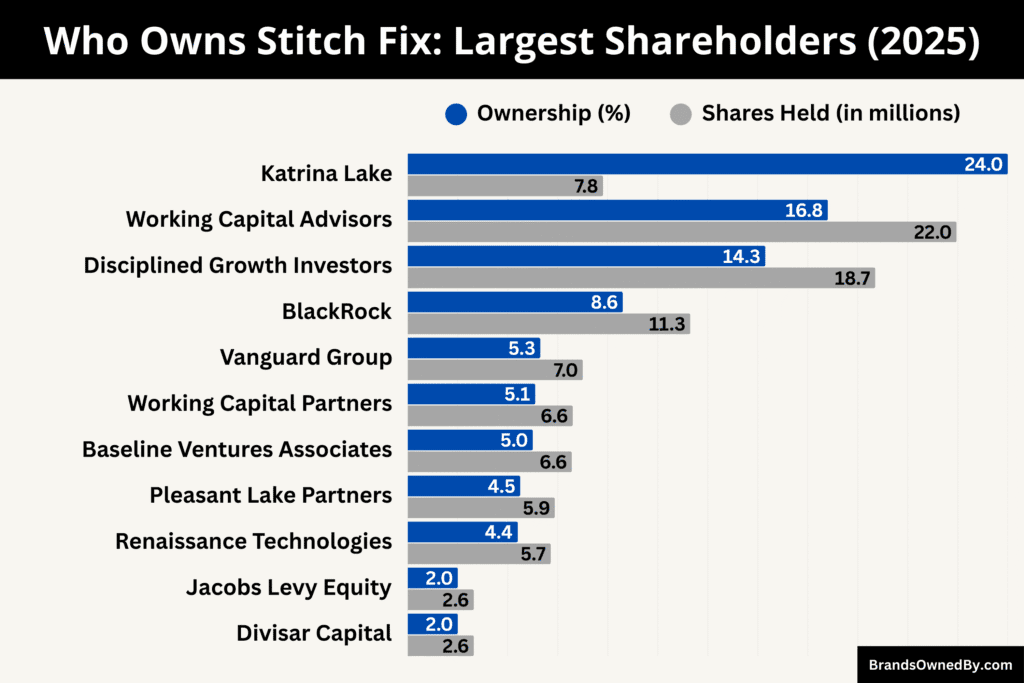

Stitch Fix’s ownership in 2025 is a mix of founder control and strong institutional backing. It is a publicly traded company listed on the NASDAQ under the ticker symbol SFIX.

Katrina Lake, through her Class B shares, maintains significant voting power despite reducing her public Class A holdings. Major institutional investors such as Working Capital Advisors (UK) Ltd., Disciplined Growth Investors, BlackRock, and Vanguard hold substantial stakes, influencing strategic decisions.

Smaller but notable positions from firms like Baseline Ventures, Pleasant Lake Partners, and Renaissance Technologies round out a diverse shareholder base that blends long-term vision with market-driven oversight.

Below is a list of the top shareholders of Stitch Fix as of August 2025:

| Shareholder | Approx. % Ownership | Approx. Shares Held | Role / Influence |

|---|---|---|---|

| Katrina Lake (via trusts – Class B + Class A) | Large voting control | ~200,000 Class A + ~7.81 M Class B | Founder, Executive Chairperson; retains strong governance influence |

| Working Capital Advisors (UK) Ltd. | 16.8 % | ~21.95 M | Major insider investor; significant sway in governance |

| Disciplined Growth Investors, Inc. | 14.3 % | ~18.7 M | Leading institutional holder; long-term strategic investor |

| BlackRock, Inc. | 8.6 % | ~11.3 M | Global asset manager; passive yet influential voting power |

| Vanguard Group, Inc. | 5.3 % | ~7 M | Long-term institutional holder; stable governance presence |

| Working Capital Partners, Ltd. | 5.1 % | ~6.6 M | Related insider entity; aligned with Working Capital Advisors |

| Baseline Ventures Associates, LLC | 5.0 % | ~6.56 M | Early investor; historic supporter of company’s vision |

| Pleasant Lake Partners LLC | 4.5 % | ~5.88 M | Institutional backer; ongoing confidence in turnaround |

| Renaissance Technologies LLC | 4.4 % | ~5.72 M | Quantitative investment firm; data-driven position |

| JPMorgan Chase & Co. | 0.32 % | ~402,328 | Recently expanded stake; emerging institutional interest |

| Jacobs Levy Equity Management Inc. | 2.0 % | ~2.64 M | Institutional investor; diversified equity strategy |

| Divisar Capital Management LLC | 2.0 % | ~2.64 M | Institutional investor; focused on mid-cap growth |

| State Street Corp | <2 % | N/A | Large custodian bank; smaller but notable stake |

| Geode Capital Management | <2 % | N/A | Quantitative index fund manager; passive stake |

| Hodges Capital Management | <2 % | N/A | Boutique investment firm; niche portfolio position |

Katrina Lake – Founder and Chairperson

Katrina Lake remains the company’s most influential individual, though her direct holdings have shifted over time. In mid-2025, she sold a large portion of her Class A shares—about 600,000 shares—at ~$5.10 each. She now directly owns around 200,000 Class A shares, and still holds approximately 7.81 million Class B shares via trusts. These B shares preserve her significant voting power and influence over company direction despite trimming her public-facing stakes.

Working Capital Advisors (UK) Ltd. – Prominent Insider Investor

Working Capital Advisors (UK) Ltd. stands out as one of the largest shareholders. As of mid-2025, it controls roughly 16.8 % of the company, holding approximately 21.95 million shares. This sizeable stake gives them considerable sway in corporate governance, especially when aligned with other major investors.

Disciplined Growth Investors, Inc. – Institutional Powerhouse

This firm remains one of Stitch Fix’s largest institutional holders. As of early 2025, it owns about 14.3 % of the company—around 18.7 million shares. Its active, long-term investment strategy and consistent ownership reflect strong confidence in the company’s recovery and future trajectory.

BlackRock, Inc. – Global Asset Management Giant

BlackRock holds an estimated 8.6 % of Stitch Fix—about 11.3 million shares. As a leading institutional investor, BlackRock brings passive yet influential voting power, contributing to governance decisions.

Vanguard Group, Inc. – Steady Institutional Holder

Vanguard owns approximately 5.3 % of the company, equating to nearly 7 million shares. They are another key institutional voice in the shareholder ecosystem, often taking a long-term passive approach.

Working Capital Partners, Ltd. – Related Insider Entity

Operating alongside its UK counterpart, Working Capital Partners Ltd. controls about 5.1 % of shares, or roughly 6.6 million shares. It appears closely connected to the Working Capital Advisors group, reinforcing their collective influence.

Baseline Ventures Associates, LLC – Early Backer

Holding around 5.0 % (approximately 6.56 million shares), Baseline Ventures has maintained a strong stake since the early rounds. Their position reflects historical support and alignment with the founding strategy.

Pleasant Lake Partners LLC – Active Institutional Supporter

They hold about 4.5 % of the company—c. 5.88 million shares. Their role underscores ongoing institutional confidence in Stitch Fix’s strategic initiatives.

Renaissance Technologies LLC – Quantitative Investor

Renaissance Technolgies owns roughly 4.4 % (around 5.72 million shares). As a well-known quant fund, their ownership often tracks systematic confidence and can influence sentiment among technical investors.

JPMorgan Chase & Co. – Recent Gain, Emerging Stake

JPMorgan elevated its position significantly in Q4 2024, adding ~241,000 shares to reach about 402,328 total, equating to about 0.32 % of the company. Though not among the largest holders, the notable increase signals renewed interest.

Additional Noteworthy Holders

- Jacobs Levy Equity Management Inc.: Owns about 2.0 % (~2.64 million shares).

- Divisar Capital Management LLC: Holds around 2.0 % (~2.64 million shares).

- State Street Corp, Geode Capital Management, Hodges Capital Management, and others also hold smaller, yet meaningful fractional stakes.

Who is the CEO of Stitch Fix?

As of August 2025, Stitch Fix is led by Matt Baer, a seasoned retail and digital commerce executive whose leadership has been instrumental in steering the company’s turnaround. Since taking over in June 2023, Baer has combined his e-commerce expertise with strategic cost optimization and innovation, positioning Stitch Fix for renewed growth in a competitive market.

| Category | Details |

|---|---|

| Role | CEO and Board Director of Stitch Fix (since June 2023) |

| Previous Experience | Macy’s (Chief Customer & Digital Officer); Walmart.com (VP eCommerce); co-founded a digital marketplace; legal background |

| Education | BBA (University of Michigan – Ross); JD (Cardozo School of Law) |

| Board Position | Member of La-Z-Boy Incorporated Board (since Jan 2025) |

| Strategic Focus | Transformation Office, cost optimization, core styling experience |

| Results | Return to revenue growth; improved forecasts; stock response positive |

Matt Baer – CEO and Director

Matt Baer has led Stitch Fix as its Chief Executive Officer since June 26, 2023. He also serves on the company’s board of directors, bringing deep experience in retail, digital transformation, and customer engagement.

Baer possesses a diverse and robust retail leadership résumé:

- Macy’s: Served most recently as Chief Customer & Digital Officer, where he oversaw Macy’s and Bloomingdale’s digital businesses. His achievements include launching third-party marketplaces, a media network, livestream shopping, as well as enhancements to mobile and app platforms.

- Walmart.com: Previously held the position of Vice President of eCommerce, where he played a key role in scaling up Walmart’s digital infrastructure.

- Startups & Early Career: Co-founded a digital marketplace and held executive roles at e-commerce startups like Fab.com and Quirky. He began his professional journey in law, practicing complex commercial litigation.

Academic & Board Engagements

Matt earned a Bachelor’s degree in Business Administration from the University of Michigan’s Ross School of Business and a Juris Doctor from the Cardozo School of Law.

In early 2025, he joined the board of directors at La-Z-Boy Incorporated, further extending his executive influence beyond Stitch Fix.

Baer has steered significant transformational efforts at Stitch Fix:

- He established a dedicated Transformation Office to drive long-term growth initiatives and enhance organizational agility.

- He has prioritized streamlining operations, including cost reductions through consolidating fulfillment centers and exiting less profitable markets while doubling down on the core styling experience.

Performance Under His Leadership

Under Baer’s guidance, Stitch Fix has seen encouraging improvements despite broader economic challenges:

- In early 2025, Stitch Fix reported its return to year-over-year revenue growth for the first time in a while.

- In Q2 of fiscal 2025, revenue surpassed expectations at $312.1 million, losses per share narrowed to 5 cents, and the full-year sales forecast was raised—boosting investor confidence.

- For Q3, the company delivered better-than-expected results again, projecting full-year revenue between $1.254 and $1.259 billion and reaffirming its position as a leading personalized apparel retailer.

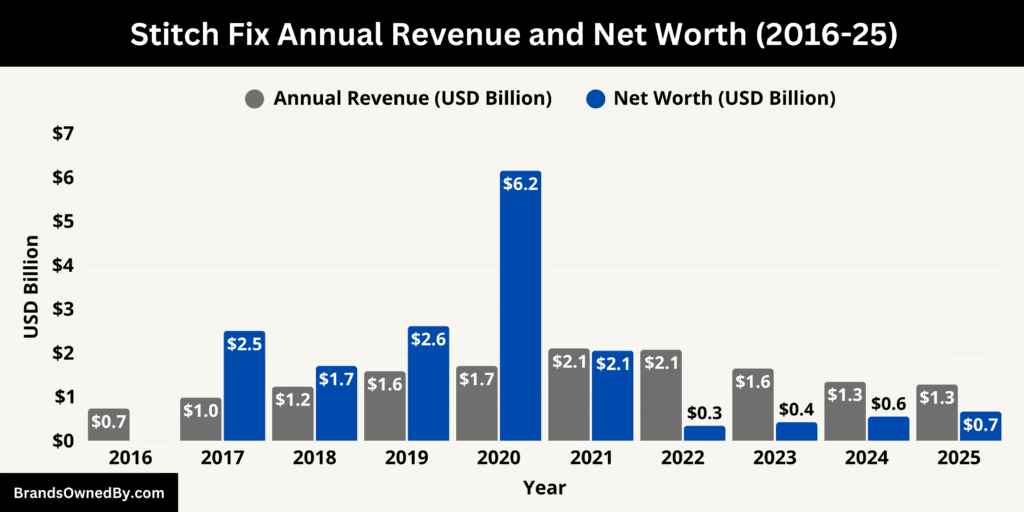

Stitch Fix Annual Revenue and Net Worth

In 2025, Stitch Fix finds itself in a phase of cautious recovery. The company’s annual revenue is projected to close the fiscal year at roughly $1.28 billion, reflecting a smaller decline compared to the steeper drop seen in 2024. Stitch Fix’s market capitalization — a measure of its net worth — has rebounded to between $580 million and $600 million, marking a notable improvement in investor confidence compared to the prior year’s valuation lows.

Annual Revenue

In the fiscal year ending August 3, 2024, Stitch Fix generated approximately $1.34 billion in net revenue. This represented a notable 16% decline compared to the previous year, reflecting ongoing challenges in client engagement and purchasing patterns.

Moving into 2025, the company’s trailing twelve-month (TTM) revenue stood at around $1.28 billion, reflecting a further year-over-year decline of approximately 7.8%.

Although this indicates continued pressure on top-line growth, it also underscores the effectiveness of early stabilization efforts.

Stitch Fix delivered $325 million in net revenue for the quarter ending May 3, 2025 — marking its return to year-over-year growth with a modest 0.7% increase. This rebound signals positive momentum under the current turnaround strategy.

In the second quarter of fiscal 2025, the company posted $312.1 million in net revenue, which, although a 5.5% drop from the prior year, still surpassed analyst expectations.

This performance helped buoy investor sentiment and reinforced the potential for recovery despite persistent macroeconomic headwinds.

Financial Outlook for Full-Year 2025

Stitch Fix raised its full-year projection during Q3, expecting revenue in the range of $1.254 billion to $1.259 billion. This was an upgrade from an earlier forecast of $1.225 billion to $1.24 billion. The improved outlook reflects growing confidence in the company’s strategic shift and operational resilience.

Stitch Fix Net Worth

As of August 2025, Stitch Fix’s net worth, measured by market capitalization, hovers between $580 million and $600 million, peaking briefly at $602.85 million during early August trading sessions. This represents a double-digit percentage increase from its 2024 market value, when the company was trading closer to the mid-$500 million range.

The recovery in market cap reflects a shift in investor sentiment. Analysts attribute the uptick to stronger-than-expected quarterly results, narrowed losses, and improved revenue forecasts for the fiscal year. This signals that, while Stitch Fix is still well below its 2018–2019 valuation highs (when the company’s market cap exceeded $3 billion), investors see potential for a gradual rebound.

Historical Comparison and Growth Potential

The current valuation is a fraction of its peak, underscoring both the volatility of its business model and the potential upside if its turnaround strategy succeeds. In the early post-IPO period, Stitch Fix was valued as a high-growth disruptor in fashion retail, but macroeconomic pressures, customer churn, and operational shifts eroded much of that value.

Now, as the company focuses on personalization technology, improved inventory management, and retaining active clients, market watchers are beginning to price in the possibility of sustainable recovery.

Several key factors have contributed to the increase in net worth this year:

- Stabilized Customer Metrics – A smaller-than-expected decline in active clients has reduced revenue erosion.

- Cost Optimization – Lower operational expenses have improved margins, even amid flat sales.

- Raised Revenue Guidance – Updated 2025 forecasts have positioned the company as a potential comeback story in the retail-tech sector.

Outlook for Valuation

If Stitch Fix maintains quarterly growth and strengthens client engagement, analysts suggest that its net worth could push past the $700 million mark in the next 12–18 months. However, this will require both revenue stabilization and a visible improvement in profitability, as investors remain cautious in an uncertain retail environment.

Brands Owned by Stitch Fix

Here’s a list of the major brands and companies owned by Stitch Fix as of August 2025:

| Brand / Entity | Category | Year Launched / Acquired | Target Market | Key Products / Focus | Notes |

|---|---|---|---|---|---|

| 41 Hawthorn | Women’s Private Label | 2012 | Women | Everyday versatile tops, dresses, work-to-weekend layers | Core private label with consistent fit and quality |

| Mix by 41 Hawthorn | Women’s Private Label | 2016 | Women | Affordable basics and wardrobe staples | Budget-friendly sister line to 41 Hawthorn |

| Market & Spruce | Women’s Private Label | 2013 | Women | Casual essentials, cardigans, denim-friendly staples | Americana-inspired casualwear |

| Pixley | Women’s Private Label | 2014 | Women | Print-focused tops, skirts, and dresses | Seasonal color stories and approachable trends |

| Fortune + Ivy | Women’s Private Label | 2018 | Women | Desk-to-dinner dresses, blouses, versatile pieces | Trend-aware yet timeless designs |

| Pink Clover | Women’s Private Label | 2017 | Women | Cozy knits, lounge-friendly tops, casual staples | Comfort-first focus |

| Nine Britton | Women’s Private Label | 2015 | Women | Jersey dresses, midi skirts, modern basics | Feminine, casual silhouettes |

| Goldray | Women’s Private Label | 2019 | Women | Statement prints, textures, bold color pieces | Small capsule drops |

| We Wander | Women’s Private Label | 2020 | Women | Outdoor-inspired casualwear, utility details | Travel and lifestyle-friendly pieces |

| Mohnton Made | Women’s Private Label | 2018 | Women | Premium tees, sweatshirts, knitwear | Small-batch, quality-first production |

| Truly Poppy | Women’s Private Label | 2021 | Women | Soft blouses, dresses, delicate details | Feminine, event-friendly wear |

| Mauvette | Women’s Private Label | 2022 | Women | Seasonal boutique capsules | Dressy-casual pieces |

| Rumi + Ryder | Kids Private Label | 2018 | Children (2–14) | Playful, durable everyday clothes | School- and play-friendly |

| Alesbury | Men’s Private Label | 2017 | Men | Flannels, jackets, rugged casualwear | Outdoor-inspired staples |

| 01.Algo | Men’s Private Label | 2019 | Men | Commuter pants, polos, performance basics | Mobility and easy-care focus |

| Hawker Rye | Men’s Private Label | 2014 | Men | Chinos, button-downs, sweaters | Versatile work-to-weekend wear |

| The Commons | Men’s Private Label | 2023 | Men | Modern essentials, minimal designs | Newer men’s trend-forward line |

| Stitch Fix Freestyle | Shopping Platform | 2021 | All clients | Direct purchase without Fix scheduling | Owned and operated sales platform |

| Stitch Fix Kids | Styling Program | 2018 | Children | Curated Fix and Freestyle for kids | Includes Rumi + Ryder and other capsules |

| Finery (IP) | Technology Asset | 2019 (Acquired) | Internal | Digital wardrobe & closet organization tech | Supports personalization algorithms |

41 Hawthorn

A flagship women’s private label designed by Stitch Fix. It focuses on polished everyday pieces—tops, dresses, and work-to-weekend layers. The line emphasizes versatile fits, easy-care fabrics, and recurring core silhouettes that get refreshed each season.

Mix by 41 Hawthorn

A lower-priced sister line to 41 Hawthorn. It carries the same clean aesthetic but uses simpler constructions and fabric blends to hit accessible price points without losing day-to-day wearability.

Market & Spruce

Women’s casual essentials with a modern Americana vibe. Expect knit tops, soft cardigans, relaxed shirting, and denim-friendly staples. Fit consistency and repeatable “best sellers” are core to the brand’s appeal inside Fixes and Freestyle.

Pixley

Women’s print-forward styles built around easy tops, skirts, and dresses. Pixley leans on seasonal color stories and approachable details—ruffles, trims, and simple textures—while keeping silhouettes uncomplicated and wearable.

Fortune + Ivy

Women’s desk-to-dinner pieces at sharp price/value. Slip dresses, wrap shapes, blouses, and occasion-ready items are common. It’s aimed at customers wanting trend-aware outfits that still feel timeless.

Pink Clover

Cozy-casual womenswear with an emphasis on soft knits and lounge-friendly tops. Pink Clover often anchors “everyday basics” that stylists use to round out a Fix with comfort-first pieces.

Nine Britton

Women’s modern basics and day dresses with a feminine slant. Known for jersey silhouettes, midi lengths, and easy pull-on fits suited to casual offices and weekend plans.

Goldray

Women’s trend-driven capsules with bolder prints, textures, and color play. Built for clients who like a statement piece in each Fix while keeping the price approachable.

We Wander

Outdoor-inspired women’s casuals designed for off-duty wear—stretch wovens, utility details, and travel-friendly knits. The line balances function with an everyday aesthetic that styles easily with denim and sneakers.

Mohnton Made

A knitwear initiative developed by Stitch Fix with a focus on premium fabrications and small-batch runs. Centered on elevated tees and sweatshirts, it highlights fit, hand feel, and longevity.

Truly Poppy

A feminine micro-brand within Stitch Fix’s private label portfolio. Think soft blouses, tea-length dresses, and delicate detailing intended for brunches, showers, and casual events.

Mauvette

A boutique-style women’s line that rotates in smaller capsules across the year. Skews dressy-casual with seasonal prints, soft tailoring, and versatile layers.

Rumi + Ryder (Kids)

Stitch Fix’s kids-exclusive brand offering playful, durable essentials for ages 2–14. It focuses on mix-and-match sets, graphic tees, pull-on bottoms, and school-friendly layers.

Alesbury (Men)

An outdoorsy men’s private brand with flannels, field jackets, work pants, and rugged knits. It’s designed as the go-to for casual layers that handle weekend wear and light adventure.

01.Algo (Men)

Performance-leaning menswear with commuter pants, stretch polos, and moisture-wicking tees. The brand targets comfort, mobility, and easy care for office-to-after hours.

Hawker Rye (Men)

Core menswear staples for work and weekend—button-downs, chinos, sweaters, and casual tailoring. Built around consistent fits and wardrobe building blocks.

The Commons (Men)

A newer men’s line with modern essentials and trend-forward silhouettes. Expect sweater polos, textured knits, and clean, minimalist pieces that elevate everyday outfits.

Stitch Fix Freestyle

Not a brand, but a first-party shopping experience owned and operated by Stitch Fix. It lets clients buy directly—outside a scheduled Fix—while still receiving algorithm- and stylist-guided curation.

Stitch Fix Kids

A dedicated first-party program for children’s styling and direct shopping. It combines the Fix model and Freestyle with youth-specific sizing, fit, and durability requirements, featuring Rumi + Ryder and rotating kids capsules.

Finery (Select IP)

In 2019, Stitch Fix acquired technology and intellectual property from digital wardrobe startup Finery. The IP supports Stitch Fix’s core capabilities in digital styling, closet organization logic, and recommendation features. It is not a consumer brand but remains an owned technology asset.

Final Thoughts

Stitch Fix’s ownership is a balance of founder control and institutional investment. Katrina Lake’s significant stake ensures that the company’s original vision still has influence at the highest level. Meanwhile, large firms like Disciplined Growth Investors, BlackRock, and Vanguard bring financial strength and governance oversight. Under CEO Matt Baer, Stitch Fix is navigating a challenging retail environment with renewed focus and operational discipline.

While profitability remains a work in progress, the company’s commitment to innovation in personalized shopping suggests it will remain a unique player in the fashion industry for years to come.

FAQs

Who owns the company Stitch Fix?

Stitch Fix is a publicly traded company listed on NASDAQ under the ticker symbol SFIX. Its ownership is divided among institutional investors, mutual funds, individual shareholders, and company insiders. As of 2025, the largest shareholders include co-founder Katrina Lake, BlackRock, Vanguard Group, and various investment management firms.

What went wrong with Stitch Fix?

Stitch Fix’s struggles began in the early 2020s due to a mix of slowing client growth, rising customer acquisition costs, and a shift in consumer behavior toward in-person shopping after the pandemic. Its “Freestyle” direct-purchase platform failed to deliver the same growth as its subscription “Fix” model, leading to revenue declines. Supply chain disruptions, inflationary pressures, and increased competition from retail giants like Amazon and Target also hurt profitability.

Where is Stitch Fix located?

Stitch Fix’s operations span the U.S. and the U.K., but its main corporate activities are concentrated in the United States.

Who bought Stitch Fix?

No company has acquired Stitch Fix as of 2025. It remains an independent, publicly traded entity.

Where is Stitch Fix headquarters?

Stitch Fix is headquartered in San Francisco, California, USA.

Is Katrina Lake a billionaire?

As of 2025, Katrina Lake is not a billionaire. While she became a paper billionaire briefly after Stitch Fix’s 2017 IPO, the company’s share price decline over the past few years significantly reduced her net worth.

Is Stitch Fix an American company?

Yes, Stitch Fix is an American company founded in 2011 in San Francisco, California.

Was Stitch Fix on Shark Tank?

No, Stitch Fix never appeared on Shark Tank. Its early funding came from venture capital firms, angel investors, and seed capital rather than reality television pitches.

Is Stitch Fix going out of business?

No, Stitch Fix is not going out of business in 2025. However, the company is in the midst of a turnaround strategy, which includes cost-cutting measures, a more focused product mix, and operational streamlining to return to profitability.

Is Stitch Fix privately owned?

No. It is publicly traded on NASDAQ under the symbol SFIX.