Who owns Snowflake is a question that often comes up among investors, tech enthusiasts, and customers. As one of the fastest-growing cloud data companies, Snowflake has attracted significant attention since its IPO. This article explores Snowflake’s ownership structure, major shareholders, leadership, financial standing, and subsidiaries, giving a clear picture of who truly holds stakes in the company.

Snowflake Company Profile

Snowflake Inc. is a publicly traded leader in cloud-based data warehousing and analytics. It operates on AWS, Azure, and Google Cloud. As of early 2025, the company employed approximately 7,834 people globally and served over 10,618 customers, including more than 800 from the Forbes Global 2000. It processes around 4.2 billion queries per day, a testament to its scalable platform and wide usage.

Founders and Early Years

Founded on July 23, 2012, in San Mateo, California, Snowflake emerged from the vision of three data-vaulting experts: Benoît Dageville, Thierry Cruanes, and Marcin Żukowski. Dageville and Cruanes had backgrounds as data architects at Oracle, and Żukowski co-founded Vectorwise. Mike Speiser, from Sutter Hill Ventures, became Snowflake’s first CEO.

Major Milestones

- 2014: Snowflake launched its cloud data platform and exited stealth mode, rapidly gaining traction.

- 2018–2019: Expanded to Microsoft Azure (2018) and Google Cloud Platform (2019), becoming a multi-cloud solution.

- 2020: Held a landmark IPO, raising over $3.4 billion in one of the largest software IPOs ever.

- 2023–2024: Launched Cortex, its generative AI platform for large language models, embedding advanced AI capabilities into its Data Cloud.

- June 2025: Acquired Crunchy Data for about $250 million to expand enterprise PostgreSQL support and AI infrastructure.

- Snowflake Summit 2025: Unveiled Adaptive Compute, Generation 2 Warehouses, Snowflake Intelligence (secure AI agents), and key partnerships with OpenAI and the LA28 Olympics.

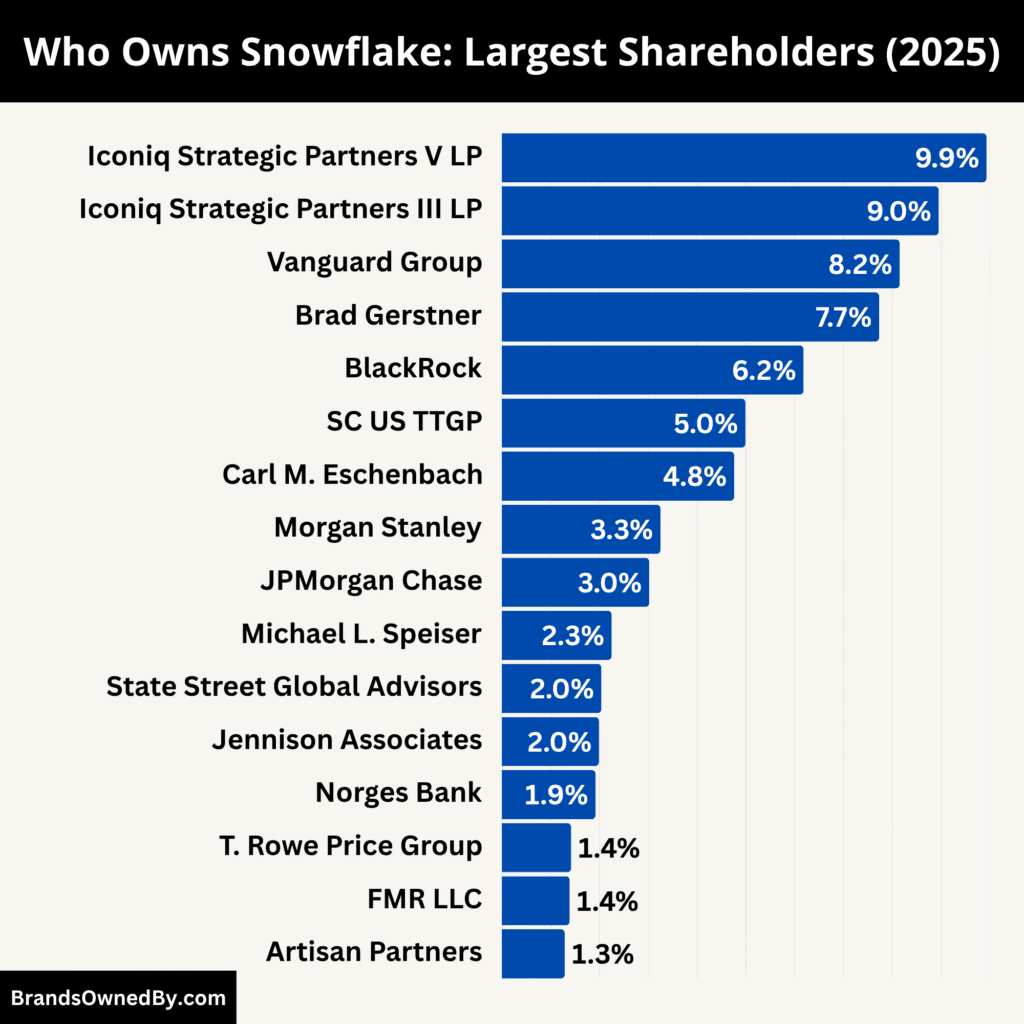

Who Owns Snowflake: Top Shareholders

Snowflake Inc. is a publicly traded company, meaning it does not have a single private owner but is collectively owned by its shareholders. The largest shareholder is Vanguard Group, followed by Morgan Stanley, T. Rowe Price, and BlackRock, along with other institutional investors and individual stakeholders.

Snowflake’s capital structure combines broad institutional ownership with a large block of insider holdings. Institutions own the majority of publicly traded shares, while founders, early backers, and current executives retain material stakes through insider entities.

This mix gives the company stable, long-term financial backing from major funds, while keeping strategic influence concentrated among a relatively small group of insiders and founders.

Because Snowflake has both Class A and Class B shares and founder-aligned vehicles, voting power and control are not directly proportional to economic ownership. The proxy and 10-K filings show the exact split of Class A and Class B shares and the governance provisions that govern conversion and transfer of restricted founder shares.

This legal framework matters for how much influence each holder can exercise at the board and shareholder meeting level.

Below is a list of the major shareholders of Snowflake as of August 2025:

| Shareholder | Type | Estimated ownership % (2025) | Role / influence | Notes |

|---|---|---|---|---|

| Iconiq Strategic Partners V LP | Insider-aligned fund | 9.93% | Largest single block; high voting influence | Holds shares from late-stage/private transactions. Coordinates with founder vehicles on governance and board matters. |

| Iconiq Strategic Partners III LP | Insider-aligned fund | 8.95% | Major concentrated holder within the Iconiq group | Originated from earlier allocations and secondaries. Adds to Iconiq’s coordinated voting clout. |

| The Vanguard Group, Inc. | Institutional investor | 8.15% | Large passive institutional holder; major vote bloc | Holds shares across index and active funds. Provides stable, long-term backing and governance engagement. |

| Brad Gerstner | Individual / early investor | 7.73% | Influential insider investor and vocal supporter | Early backer with both personal and fund-level positions. Engages with leadership and investors on strategy. |

| BlackRock, Inc. | Institutional investor | 6.18% | Significant ETF/mutual-fund holder; governance participant | Broad portfolio exposure; participates in stewardship and proxy voting. Periodically rebalances tech allocations. |

| SC US TTGP Ltd | Insider-aligned entity | 4.99% | Founder/partner-aligned vehicle with meaningful voice | Likely represents an affiliated LP or strategic partner. Holds shares subject to conversion/transfer rules. |

| Carl M. Eschenbach | Individual / board member | 4.76% | Board director with sizeable insider stake | Active in board deliberations on hiring, strategy, and capital allocation. Interests align with long-term shareholder value. |

| Morgan Stanley | Institutional investor | 3.25% | Institutional holder; advisory/underwriting history possible | Holds through asset-management arms and client portfolios. Influence via voting and occasional engagement. |

| JPMorgan Chase & Co. | Institutional investor | 3.02% | Institutional holder with market-making/client links | Participates in governance votes and provides liquidity services. Position held across bank-managed funds. |

| Michael L. Speiser | Individual / early investor | 2.25% | Early CEO/investor with historical influence | Early-stage leader and VC backer. Holdings often reflect long-term commitment and legacy influence. |

| State Street Global Advisors | Institutional investor | 2.04% | Index/ETF manager; stewardship participant | Typical passive holder in major indices and funds. Votes on compensation, board elections, ESG. |

| Jennison Associates LLC | Active asset manager | 1.99% | Concentrated active investor; research-driven | Likely engages on growth, profitability, and capital-allocation discussions. |

| Norges Bank Investment Management | Sovereign wealth fund | 1.92% | Long-term, disciplined investor | Patient capital with strong governance/ESG focus. Signals stable, long-horizon support. |

| T. Rowe Price Group | Institutional investor | 1.42% | Long-term active manager | Holds diversified position; supports long-term growth initiatives. |

| FMR LLC (Fidelity) | Institutional investor | 1.39% | Active/passive exposure via mutual funds | Participates in proxy voting and engagement through fund channels. |

| Artisan Partners | Active asset manager | 1.29% | Specialist manager with targeted exposure | Smaller concentrated stake; offers active oversight and feedback. |

Iconiq Strategic Partners V LP

Iconiq Strategic Partners V is the single largest listed holder of Snowflake equity. Iconiq’s stakes in later-stage tech companies typically come from early secondary transactions and allocations made to private wealth clients who backed the company in venture rounds.

Because Iconiq is closely connected to Snowflake’s early leadership and other founder-aligned vehicles, its position functions almost like an insider block: it holds concentrated voting power and coordinates with other founder vehicles during governance votes. Iconiq’s holdings are large enough to make it a key audience for management’s strategic messaging, and it is often consulted on board composition and compensation matters.

Iconiq Strategic Partners III LP

Iconiq Strategic Partners III is another sibling vehicle in the Iconiq family. Its stake originated from earlier funding rounds and secondary transactions before and around the IPO. While Iconiq V is the largest single fund, Iconiq III’s near-9% stake means the Iconiq group, taken together, is one of the most powerful concentrated shareholders.

The group’s influence is exercised through coordinated proxy votes and by maintaining active dialogue with management about long-term product and M&A strategy. Because Iconiq holds shares across multiple classes and affiliated funds, its economic exposure and voting clout are tracked closely by the proxy statement.

Vanguard Group, Inc.

Vanguard is Snowflake’s largest pure institutional investor by typical share count. Vanguard’s accumulation has been driven largely by passive and index strategies, plus certain active funds that added exposure as Snowflake grew into major index benchmarks. Vanguard does not run the company day-to-day; instead, it exerts influence primarily through stewardship — voting at annual meetings and engaging on governance or sustainability matters.

Vanguard’s stake provides long-term stability: it tends not to trade rapidly and often supports steady corporate policies that favor durable growth. (Recent 13F/filing activity shows some changes in position size during 2025.)

Brad Gerstner

Brad Gerstner is an early backer and prominent insider investor. He led important ventures and later private rounds for Snowflake and has historically held a large personal stake through both direct and fund-level positions.

Gerstner’s ownership is more than financial: he is an active voice in strategic discussions and has served as a visible liaison between the founder group and institutional investors.

His trades and portfolio allocations can be material for market watchers because he is both a believer in the company’s long-term story and a sophisticated allocator across high-growth software names.

BlackRock, Inc.

BlackRock’s holding is sizable and typical of large asset managers that own stakes across most major growth names. BlackRock brings voting clout, stewardship programs, and access to corporate governance resources, but the firm’s portfolio is broad, so its approach tends to be oversight and engagement rather than hands-on intervention.

BlackRock has adjusted its stake periodically in 2025 as it rebalanced technology allocations; such moves are normal for a diversified institution with active/passive fund mixes.

SC US TTGP Ltd

SC US TTGP Ltd is a name that appears in Snowflake’s ownership tables as an insider-aligned entity. Entities like this are usually limited-partnership vehicles that represent early institutional backers, strategic partners, or affiliated venture funds. Its near-5% holding gives it a meaningful voice in coordination with the founder block.

These vehicles often hold shares subject to transfer and conversion rules, meaning their influence can be amplified during certain governance events.

Carl M. Eschenbach

Carl Eschenbach is a long-standing director and former executive in Silicon Valley. His nearly 5% stake makes him one of the larger insiders by share count. Eschenbach’s role is governance-focused: he participates in board deliberations on executive hiring, strategy, risk oversight, and capital allocation.

He holds both shares and a board seat; his interests align closely with long-term shareholder value and sound corporate governance.

Morgan Stanley

Morgan Stanley holds Snowflake shares primarily through institutional asset management and investment banking channels. Its stake reflects both passive fund inclusion and allocations from client portfolios. Morgan Stanley may also have been involved in underwriting or advisory work for Snowflake in past financing or strategic transactions, which helps explain a durable institutional holding and a continued interest in company performance.

As with most large banks, its influence is exercised through proxy voting and occasional engagement.

JPMorgan Chase & Co.

JPMorgan’s position comes from investment management arms and client portfolios that include Snowflake. The bank’s exposure is similar to other large institutions: it delivers governance engagement, custodian relationships, and liquidity for the stock via market-making and client services. JPMorgan’s ownership size positions it to participate meaningfully in major votes, but not to unilaterally determine outcomes.

Michael L. Speiser

Michael Speiser was an early CEO and remains an insider investor. His stake is smaller than some of the institutional blocks, but his historical role and early contributions give him standing in founder and investor discussions. Speiser’s holdings often come with vesting or transfer conditions that reflect his long-term commitment to the company’s mission and governance stability.

State Street Global Advisors

State Street is another large index and asset-management firm with an allocation to Snowflake. Its holding is typical of large ETFs and institutional funds that track major indices or hold active growth strategies. State Street participates in stewardship and votes on executive compensation, board elections, and governance proposals. Its presence helps ensure wide institutional oversight of corporate policy.

Jennison Associates LLC

Jennison is an active asset manager that takes concentrated positions in growth companies. Its near-2% stake indicates an active research-driven allocation rather than purely passive indexing. Active managers like Jennison sometimes engage directly with company management on topics like capital allocation, margin profiles, and growth strategy.

Norges Bank Investment Management

Norges (the Norwegian sovereign wealth fund) invests with a long-term horizon. Its roughly 2% stake in Snowflake reflects disciplined, benchmarked exposure to global tech growth. Norges’ ownership signals patient capital that generally supports sustainable growth while scrutinizing governance and ESG issues.

T. Rowe Price Group

These managers represent a mix of active mutual funds and specialty managers that collectively add meaningful diversification to Snowflake’s investor base. Their presence contributes to a healthy mix of short- and long-term perspectives at shareholder meetings. Active investors typically provide targeted feedback to management and vote in line with long-term value creation objectives.

Who is the CEO of Snowflake?

Snowflake is led by Sridhar Ramaswamy, who took over as CEO in February 2024. His appointment marked a major shift for the company, bringing in a leader with deep expertise in search, AI, and cloud innovation. Ramaswamy succeeded Frank Slootman, a renowned tech executive who had guided Snowflake through its record-breaking IPO in 2020.

Background of Sridhar Ramaswamy

Before joining Snowflake, Sridhar Ramaswamy served as the head of Google’s advertising business, overseeing one of the most profitable divisions in the tech world. He later co-founded and became CEO of Neeva, a privacy-focused search engine acquired by Snowflake in 2023. His career reflects a strong blend of engineering expertise and business leadership, making him well-suited to lead Snowflake into the era of AI-driven data platforms.

Vision and Strategic Direction

Under Ramaswamy’s leadership, Snowflake has intensified its focus on AI integration, aiming to make advanced analytics more accessible to enterprises. His strategy revolves around expanding Snowflake’s platform capabilities beyond data warehousing, tapping into data science, machine learning, and AI-powered applications. This vision aims to position Snowflake not only as a cloud data leader but also as a central player in enterprise AI transformation.

Leadership and Decision-Making Structure

Snowflake operates under a top-down leadership model with significant input from its executive team and board of directors. The CEO works closely with key executives like the Chief Product Officer, Chief Revenue Officer, and Chief Financial Officer to drive product innovation and market expansion. Strategic decisions are typically made in collaboration with senior leadership and approved by the board, where major shareholders also have influence.

Past CEOs of Snowflake

Sridhar Ramaswamy is Snowflake’s third CEO. The company was initially led by co-founder Benoit Dageville, who focused on engineering and product development in its early years. Frank Slootman then took over in 2019, steering Snowflake through rapid growth, its 2020 IPO, and international expansion. With Ramaswamy at the helm since 2024, Snowflake is entering a new phase centered on AI and long-term platform diversification.

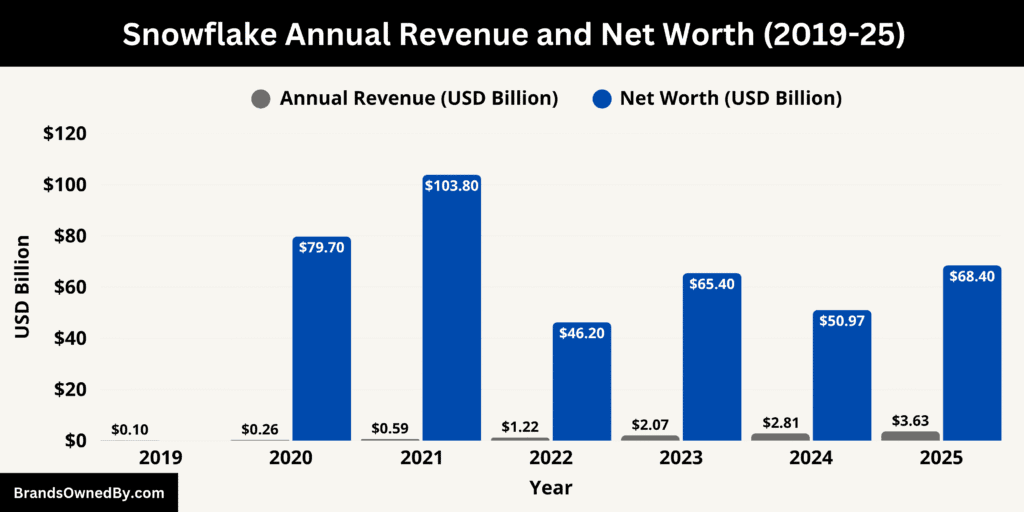

Snowflake Annual Revenue and Net Worth

In 2025, Snowflake achieved impressive financial growth, generating $3.63 billion in annual revenue, marking a continued upward trajectory in its cloud data platform dominance. The company’s market capitalization reached $68.4 billion by year-end, reflecting strong investor confidence and Snowflake’s expanding role in enterprise data solutions worldwide.

Annual Revenue 2025

In the fiscal year ending January 31, 2025, Snowflake achieved annual revenue of approximately $3.63 billion, representing nearly 29% growth compared to the prior year. This strong performance underscores continued enterprise demand for its AI Data Cloud platform and reflects rising adoption across existing and new customers.

Snowflake posted revenue of roughly $986.8 million in the fourth quarter alone, a 27% year-over-year increase. Product revenue for that quarter was approximately $943.3 million, up 28% from the same period last year. On a trailing-twelve-month basis through April 2025, total revenue exceeded $3.84 billion, illustrating steady momentum.

Operating Income and Free Cash Flow

Despite a net operating loss under GAAP, Snowflake delivered strong cash flow metrics. For fiscal 2025, it reported an operating loss of approximately $1.46 billion, yet generated nearly $960 million in operating cash flow. Free cash flow reached about $884 million, reflecting a solid 24% free cash flow margin.

Snowflake’s net loss for the full year 2025 widened to $1.286 billion, marking a 54% increase compared to the prior year’s loss. On a trailing twelve-month basis ending April 2025, net losses stood at approximately $1.399 billion, up by about 51% year-over-year.

Snowflake Net Worth

As of early August 2025, Snowflake’s market capitalization stands at approximately $69.6 billion. This figure reflects a significant increase—over 50% growth year-over-year, highlighting renewed investor optimism and confidence in the company’s AI expansion efforts.

The company’s net worth has experienced considerable fluctuation over recent years. At the start of 2025, Snowflake’s market value was roughly $57.3 billion, representing a mild decline compared to the prior year.

By mid-2025, the figure had climbed to approximately $70.8 billion, underscoring an inflection point driven by strong product adoption and momentum in AI offerings.

Monthly market cap estimates during early 2025 varied notably. In January, the value hovered around $50–$53 billion, before rebounding steadily in subsequent months. By mid-year, it climbed into the $60–$70 billion range, reflecting a vigorous recovery and growth trajectory.

Companies Owned by Snowflake

Here’s a list of the major brands and companies owned by Snowflake as of 2025:

Snowflake Computing India LLP

Snowflake Computing India LLP operates as a key subsidiary focused on supporting engineering and regional operations across the Indian subcontinent. It plays a critical role in the company’s global development strategy by tapping into local technical talent, driving product innovation and localization efforts, and managing regional partnerships and customer success in one of the world’s fastest-growing tech markets.

Snowflake Computing Netherlands BV

Based in Europe, Snowflake Computing Netherlands BV serves as a regional base for Snowflake’s operations in the Netherlands and neighboring countries. This entity manages local sales, customer support, compliance, and strategic collaborations, helping Snowflake expand its footprint across the EU while meeting regional regulatory requirements and fostering business development in European markets.

Snowflake Computing U.K. Ltd.

Snowflake Computing U.K. Ltd. anchors the company’s presence in the United Kingdom. Established to oversee commercial, technical, and support functions, it enables Snowflake to engage closely with U.K. enterprises, adapt solutions to meet local industry standards, and collaborate with the robust British data and AI ecosystem.

Snowflake Computing Pty Ltd.

This subsidiary covers Snowflake’s operational and customer outreach activities in Australia and the broader Oceania region. Snowflake Computing Pty Ltd. ensures that organizations across this area can access localized support, compliance guidance, and integration services tailored to regional cloud adoption trends and enterprise use cases.

Crunchy Data

In June 2025, Snowflake acquired Crunchy Data—an enterprise-grade provider of PostgreSQL-based database solutions—for approximately $250 million. This strategic move enabled the launch of Snowflake Postgres, delivering a seamless, AI-ready PostgreSQL interface within Snowflake’s AI Data Cloud. Crunchy Data’s robust, secure, and compliance-driven technology integrates natively with Snowflake’s platform, empowering developers to build, deploy, and scale production-ready AI agents and applications using familiar PostgreSQL tools and syntax.

Final Thoughts

Understanding who owns Snowflake gives valuable insight into the company’s direction and influence. With major stakes held by institutional investors like Vanguard, BlackRock, and Iconiq, as well as key insiders, ownership is widely distributed. This balanced structure supports long-term growth, innovation, and stability. As Snowflake continues expanding its cloud and AI capabilities worldwide, its ownership profile will remain a crucial factor in shaping its future.

FAQs

Who owns Snowflake data warehouse?

Snowflake Inc., a publicly traded company listed on the New York Stock Exchange under the ticker symbol SNOW, owns and operates the Snowflake Data Cloud platform, which includes its data warehouse services. The company is owned by its public shareholders, including institutional investors, mutual funds, and individual stakeholders.

Who owns Snowflake cloud?

The Snowflake Cloud is owned and managed by Snowflake Inc. itself. While Snowflake’s infrastructure runs on major public cloud providers like AWS, Microsoft Azure, and Google Cloud, the platform, its intellectual property, and its services remain fully under Snowflake Inc.’s control.

Who owns Snowflake software?

Snowflake Inc. owns the proprietary software behind its data platform, including the Snowflake Data Cloud, Snowpark, and Cortex AI. The company develops, maintains, and licenses this software to its customers worldwide.

Who owns Snowflake technology?

All patents, designs, and core technology of Snowflake belong to Snowflake Inc. This includes the architecture that separates compute and storage, multi-cloud capabilities, and integrated AI tools.

Who created Snowflake?

Snowflake was founded in 2012 by Benoît Dageville and Thierry Cruanes, both former Oracle engineers, along with Marcin Żukowski, a Dutch entrepreneur known for his work on database technology.

Is Snowflake owned by Salesforce?

No. Snowflake is not owned by Salesforce, but Salesforce Ventures was an early investor in Snowflake and still holds a minority stake.

Is Snowflake owned by AWS?

No. Snowflake is independent and not owned by Amazon Web Services (AWS). However, AWS is one of the primary cloud platforms Snowflake uses to host and deliver its services.

Who is the largest shareholder of Snowflake?

As of 2025, the largest shareholder of Snowflake is The Vanguard Group, one of the world’s biggest asset management firms, with a significant institutional stake.

Does Warren Buffett still own Snowflake?

Yes. Through Berkshire Hathaway, Warren Buffett continues to hold a sizable investment in Snowflake. Berkshire was an early backer during Snowflake’s IPO in 2020 and has retained its shares.

Is Snowflake belong to Microsoft?

No. Snowflake is not owned by Microsoft, though it operates on Microsoft Azure as one of its supported cloud platforms.

How many employees are at Snowflake?

As of 2025, Snowflake employs over 7,200 people worldwide, spanning engineering, sales, customer support, product development, and operations.

Is Snowflake a ServiceNow?

No. Snowflake and ServiceNow are two separate companies. Snowflake focuses on cloud-based data warehousing and analytics, while ServiceNow provides digital workflow and IT service management solutions.