Who owns Peloton is a question many fitness enthusiasts and investors ask. Peloton is a well-known name in connected fitness, offering bikes, treadmills, and interactive classes to a global audience. Since going public, it has attracted a diverse group of institutional, insider, and retail shareholders. Understanding who owns the company helps explain its strategic decisions and future direction.

Peloton Company Profile

Peloton Interactive, Inc. is a technology-driven fitness and wellness company based in New York City. It offers connected exercise equipment—such as stationary bikes (Peloton Bike, Bike+), treadmills (Tread, Tread+), the rowing machine (Peloton Row), and the strength-training device (Guide)—all paired with an immersive software platform.

This platform streams live and on-demand classes and uses built-in sensors for real-time feedback. Peloton serves both hardware buyers and digital-only customers through subscription services like Peloton App and Strength+ memberships. The company is traded on NASDAQ under the ticker PTON.

Founders

Peloton was founded in January 2012 (though some records cite 2011) by a team of five innovators: John Foley, Tom Cortese, Hisao Kushi, Yony Feng, and Graham Stanton.

Inspired by the challenge of fitting high-quality boutique fitness into a hectic lifestyle, they devised a solution combining hardware, content, and connectivity. John Foley—drawing from his background leading Barnes & Noble’s e-commerce—helped shape the vision and pitched Peloton relentlessly until funding came through.

Major Milestones

Peloton’s journey is marked by bold moves and innovation:

- 2013: Launched via a Kickstarter campaign.

- 2014: Opened its first showroom and began shipping the Peloton Bike.

- 2018: Introduced the Peloton Tread.

- September 2019: Completed its IPO, raising over $1.16 billion at $29 per share.

- 2020: Released the more affordable Bike+ during peak demand amid the pandemic.

- 2021: Launched the Guide for camera-based strength training and acquired commercial fitness firm Precor.

- 2022: Debuted the Peloton Row and saw leadership changes with Barry McCarthy taking over as CEO.

- 2025 (Q4): Announced a strategic pivot toward holistic wellness—expanding into strength training, stress management, sleep, nutrition, and AI-enhanced personalization. Reported $607 million in revenue, 2.8 million connected fitness subscribers, and 552,000 app users while undergoing cost restructuring and its sixth round of layoffs.

Who Owns Peloton: Top Shareholders

Peloton is a publicly traded company listed on the Nasdaq under the ticker PTON. Its ownership is widely distributed among large institutional investors, mutual funds, exchange-traded funds (ETFs), company insiders, and retail shareholders. Institutional investors hold the largest share of power, often influencing strategic decisions through their voting rights and board-level relationships.

While insiders still maintain stakes, no single individual or entity has outright control of the company. This diversified structure means Peloton’s future is shaped by a combination of market sentiment, institutional priorities, and management vision.

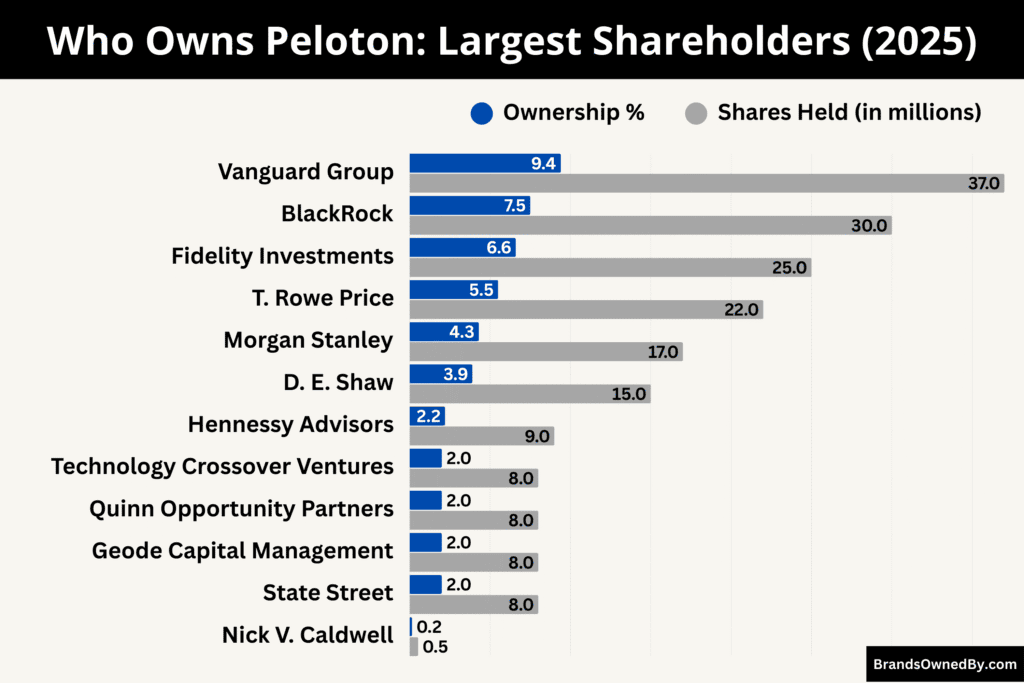

Here’s a list of the largest shareholders of Peloton as of August 2025:

| Shareholder / Group | Estimated Ownership (%) | Shares (Approx.) | Notes / Influence |

|---|---|---|---|

| Vanguard Group | 9.3–9.4% | ~37 million | Largest shareholder, long-term passive investor with strong governance influence |

| BlackRock | ~7.5% | ~30 million | World’s largest asset manager, advocates operational efficiency |

| FMR LLC (Fidelity Investments) | 6.3–6.6% | ~25 million | Active institutional investor, engages on growth strategy |

| T. Rowe Price | ~5.5% | ~22 million | Active portfolio manager, board engagement |

| Morgan Stanley | ~4.3% | ~17 million | Investment bank and asset manager, capital markets expertise |

| D. E. Shaw | ~3.9% | ~15 million | Data-driven hedge fund, opportunistic investor |

| Hennessy Advisors | ~2.2% | ~9 million | Actively managed mutual funds, niche strategy |

| Technology Crossover Ventures | 2–3% | ~8–12 million | Growth equity investor |

| Quinn Opportunity Partners | 2–3% | ~8–12 million | Event-driven hedge fund |

| Geode Capital Management | 2–3% | ~8–12 million | Quantitative investment manager |

| State Street | 2–3% | ~8–12 million | Large asset manager, governance influence |

| Mutual Funds & ETFs (incl. Vanguard Total Stock Market ETF, Fidelity Blue Chip Growth Fund, iShares Russell 2000 ETF, Vanguard Extended Market ETF) | Over 40% combined | N/A | Indirect ownership by millions of individual investors |

| Insiders (Nick Caldwell, Elizabeth F. Coddington, Jay C. Hoag, others) | 8–8.5% | N/A | Direct operational influence, board-level control |

| Retail Shareholders | 4–6% | N/A | Market sentiment impact |

| Government & Other Institutional Entities (Swiss National Bank, Banco Bilbao Vizcaya Argentaria, Corebridge Financial, etc.) | 1–2% | N/A | Diversified, non-activist holdings |

Vanguard Group

Vanguard Group is Peloton’s largest shareholder, owning approximately 9.3–9.4% of the company, which equals over 37 million shares. Vanguard’s size and long-term investment strategy give it considerable sway over corporate governance. As a passive investment giant, it typically supports stability in leadership and focuses on sustainable growth rather than aggressive restructuring.

BlackRock

BlackRock holds about 7.5% of Peloton’s outstanding shares, or roughly 30 million shares. Known as the world’s largest asset manager, BlackRock often advocates for operational efficiency and shareholder value. Its influence is felt through voting on key corporate proposals and long-term sustainability policies.

FMR LLC (Fidelity Investments)

Fidelity, operating through FMR LLC, owns about 6.3–6.6% of Peloton. This position reflects a strong belief in Peloton’s brand value and digital subscription potential. Fidelity is an active institutional investor, often engaging with management to discuss performance and growth strategies.

T. Rowe Price

T. Rowe Price holds approximately 5.5% of Peloton. As a global investment manager, the firm is known for active portfolio oversight and engagement with company boards. T. Rowe Price’s stake positions it as a meaningful voice in shareholder votes and strategic discussions.

Morgan Stanley

Morgan Stanley owns around 4.3% of Peloton’s stock. While smaller than the top four investors, its role as a leading investment bank and asset manager gives it insight into capital markets, potentially influencing Peloton’s financing and strategic direction.

D. E. Shaw

D. E. Shaw holds about 3.9% of Peloton shares. As a prominent hedge fund, it is known for its data-driven and opportunistic investment approach. Its presence in the shareholder base suggests interest in both near-term market performance and potential turnaround opportunities.

Hennessy Advisors

Hennessy Advisors owns roughly 2.2% of Peloton, often investing through actively managed mutual funds. While not among the very largest holders, its influence lies in its niche portfolio management approach.

Other Significant Institutional Holders

Additional major shareholders include Technology Crossover Ventures, Quinn Opportunity Partners, Geode Capital Management, and State Street, each holding between 2–3% of Peloton. These firms collectively add to the institutional weight shaping company policy.

Mutual Funds and ETFs

A significant portion of Peloton shares—over 40%—is held through mutual funds and ETFs. Notable funds include the Vanguard Total Stock Market ETF (about 3%) and the Fidelity Blue Chip Growth Fund (around 3%). Other holders such as the iShares Russell 2000 ETF and the Vanguard Extended Market ETF each hold between 1–2%. These funds cater to a broad base of individual investors, indirectly giving retail holders a voice.

Nick V. Caldwell – Chief Product Officer

Caldwell is one of Peloton’s largest insiders. As of mid-2025, he holds approximately 526,853 shares—worth several million dollars. In May alone, he sold 66,712 shares to cover tax liabilities, and earlier in the year, another 68,727 shares were sold following RSU settlements. Despite these sales, his continued sizable stake reflects both his executive involvement and alignment with the company’s product strategy.

Elizabeth F. Coddington – Chief Financial Officer

Coddington holds around 311,231 shares as of mid-2025. She has been actively managing her tax obligations and RSU grants, selling 185,661 shares in a recent filing. Her stake represents her financial stewardship and long-term connection to Peloton’s fiscal oversight.

Jennifer Cunningham Cotter – Chief Content Officer

Cotter currently owns approximately 235,439 shares. Earlier in the year, she sold about 145,622 shares to meet stock-related tax requirements. Her holdings illustrate her commitment to the creative and media components of Peloton’s offerings.

Saqib Baig – Chief Accounting Officer

Baig maintains roughly 169,048 shares. He too divested shares—about 23,520—to manage tax liabilities tied to RSU vesting. His holding reflects his key role in maintaining Peloton’s financial integrity.

Dion C. Sanders – Chief Commercial Officer

Sanders now owns about 114,318 shares, following the sale of 122,036 shares earlier in 2025. His remaining stake underscores his ongoing role in Peloton’s commercial operations, distribution, and revenue strategy.

Charles Peter Kirol – Chief Operating Officer

As of July 2025, Kirol holds around 35,877 shares. He reduced his stake by 20,633 shares in a recent transaction, down 36.5%. Though smaller than others, his remaining position ties him directly to operational leadership.

Retail Shareholders

Retail investors hold an estimated 4–6% of Peloton stock. These individual investors may not have the same voting power as large institutions, but their sentiment can significantly affect the share price and market perception.

Government and Other Institutional Entities

A small percentage, roughly 1–2%, is owned by government-linked institutions and international financial entities, including the Swiss National Bank, Banco Bilbao Vizcaya Argentaria, and Corebridge Financial. Their stakes are often part of diversified investment portfolios.

Who is the CEO of Peloton?

Peloton’s executive leadership is now headed by a seasoned strategist with deep experience in subscription services and tech-driven innovation – Peter Stern. Since January 1, 2025, the company has been led by Peter Stern, who brings a unique blend of industry insight and personal connection to Peloton.

| Aspect | Details |

|---|---|

| Name & Title | Peter Stern — CEO & President |

| Start Date | January 1, 2025 |

| Previous Roles | Ford Integrated Services, Apple VP Services (incl. Fitness+), Time Warner Cable executive |

| Member Status | Peloton Member since 2016 |

| Strategic Focus | Return to profitability, cost restructuring, wellness expansion (sleep, nutrition, AI personalization) |

| Transition | Interim leadership by Karen Boone and Chris Bruzzo until Stern’s start date |

| Board Role | Expected appointment to Peloton’s Board to drive long-term strategy |

Peter Stern — Chief Executive Officer & President

Peter Stern assumed the role of CEO and President on January 1, 2025. He joined Peloton after leading Ford’s Integrated Services, where he oversaw subscription-based initiatives like BlueCruise. Prior to that, he held senior roles at Apple—helping shape services such as Apple TV+, iCloud, and co-founding Apple Fitness+—and at Time Warner Cable. His background in hardware, software, content, and services positions him well to guide Peloton’s evolution as both a fitness and technology company.

Stern has been a Peloton Member since 2016, making him not just a leader but also a user deeply familiar with the brand’s offerings and community. His approach blends data-driven decision-making with product empathy, reflecting both strategic and personal alignment with Peloton’s mission.

Under his leadership in 2025, Peloton reported improved financial performance. In Q4, the company returned to profitability with US $0.05 earnings per share, outpacing analyst expectations. Stern also spearheaded restructuring efforts—including a 6% workforce reduction and cost-saving measures targeting US $100 million in annual savings—that helped shrink operating expenses significantly. He further drove a strategic pivot toward broader wellness offerings, expanding Peloton’s focus beyond fitness to include strength training, sleep, nutrition, stress management, and AI personalization.

Interim Leadership — Bridging the Transition

Before Stern took over, Peloton was guided through a transitional period by Interim Co-CEOs. Karen Boone served as the sole Interim CEO from November through year-end 2024, while Chris Bruzzo stepped down as co-CEO in early November but remained on the board. Their stewardship ensured stability during the leadership transition.

Leadership Style & Board Involvement

As CEO, Stern is also expected to join Peloton’s Board, reinforcing his strategic role in shaping the company’s direction and governance. He is known for his decisive, innovation-driven management style—combining results-oriented strategy with a modern understanding of digital fitness platforms. Peloton’s Chairperson and board expressed confidence in his ability to guide the company through this critical period.

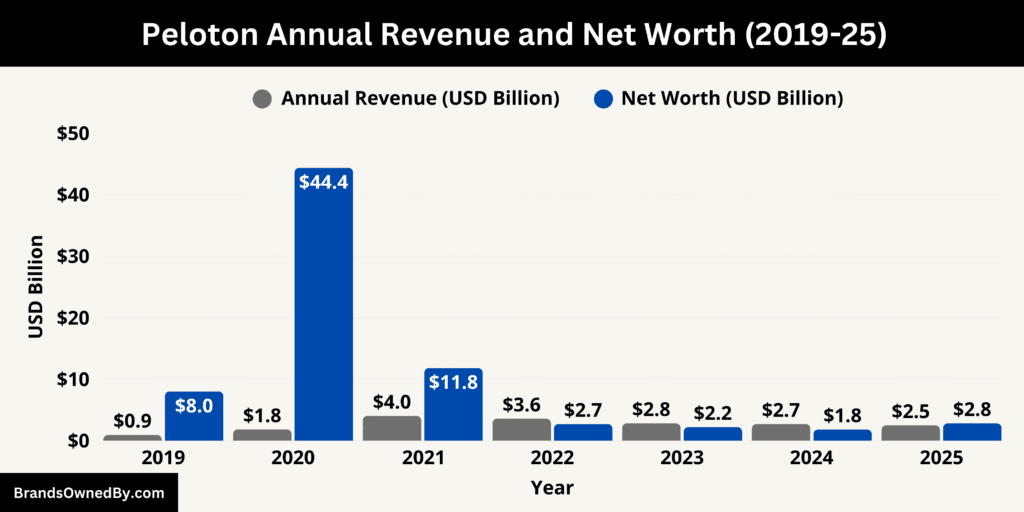

Peloton Annual Revenue and Net Worth

Peloton generated around $2.5 billion in revenue during fiscal 2025, achieving a slim net quarterly profit after a year marked by transformation. The company fortified its cash flow, benefiting from aggressive cost-cutting measures. Its net worth of approximately $2.8 billion as of August 2025 suggests cautious investor optimism as Peloton pivots toward long-term, sustainable growth.

Annual Revenue in 2025

In the fiscal year ending June 30, 2025, Peloton reported annual revenue of approximately $2.49 billion, reflecting a decline of around 7.8% from the prior year. This downturn underscores challenges in core product demand and subscriber retention.

On a trailing twelve-month basis, the company’s revenue stood at about $2.53 billion, reinforcing the trend of gradual decline amid post-pandemic normalization.

Despite this, quarterly performance showed moments of resilience, with fiscal Q4 revenue of $606.9 million, slightly above Wall Street expectations, demonstrating the ability to stabilize topline in a tough market environment.

Net Income and Profitability

Peloton swung back into profitable territory in fiscal Q4 2025, delivering a GAAP net income of $21.6 million, or $0.05 per share. This marked a notable turnaround from the prior year’s quarter, when the company posted a loss of $31.9 million. However, the full fiscal year still ended in the red, reflecting the high costs and operational drag Peloton has been methodically addressing.

Cash Flow and Operating Efficiency

Operationally, Peloton delivered over $320 million in net cash from operations in FY 2025. The company also achieved non-GAAP free cash flow, driven by a substantial 25% reduction in operating expenses year-over-year. These improvements reflect sharper cost control strategies and efficiency gains implemented under the current leadership.

Peloton Net Worth 2025

Peloton’s net worth, expressed through its market capitalization, stood at approximately $2.8 billion as of early August 2025. Different financial trackers place the value between $2.4 billion and $3.1 billion, reflecting the fluid nature of stock prices and investor sentiment during that period.

Throughout 2025, Peloton’s valuation showed signs of recovery and genuine momentum. In July, one data source estimated a mid-year valuation near $2.5 billion, with values gradually climbing toward the $3 billion mark by August.

The company’s 12-month market cap gain ranged from 80% to 110%, underscoring renewed investor interest and confidence in leadership strategies.

Historical Perspective

Peloton’s market cap trajectory illustrates dramatic shifts over recent years. At its zenith in 2021, the company reached levels well above US $30 billion. Since then, however, it faced steep declines. By the end of 2024, market value had tumbled closer to $3–3.3 billion, before gradually stabilizing in 2025 at its current levels.

This shift reflects Peloton’s transition from rapid pandemic-era growth to a phase of disciplined restructuring and recalibration.

Drivers of Valuation Change

Several factors have influenced this market cap pattern. The return to profitability in Q4 2025, a renewed focus on managing cost structure, and the expansion into broader wellness services all helped rebuild investor trust.

Concurrently, investors appear cautiously optimistic, rewarding progress but still acknowledging that full recovery from prior highs may take sustained execution.

Brands Owned by Peloton

Peloton owns a wide range of brands and companies. Below is a list of the major brands owned by Peloton as of August 2025:

| Brand/Entity | Year Launched/Acquired | Type | Key Details |

|---|---|---|---|

| Peloton Bike | 2014 | Fitness Equipment | Original flagship stationary bike with integrated touchscreen for streaming live and on-demand cycling classes. Major revenue driver and brand icon. |

| Peloton Bike+ | 2020 | Fitness Equipment | Upgraded version of the Peloton Bike with rotating HD screen, improved audio, and automatic resistance adjustment for seamless cardio-to-strength transitions. |

| Peloton Tread | 2018 (updated models in 2021) | Fitness Equipment | Premium treadmill offering running, walking, and bootcamp classes with advanced safety features and immersive workout experience. |

| Peloton Row | 2022 | Fitness Equipment | High-end rowing machine with real-time form feedback, performance tracking, and integration into Peloton’s training ecosystem. |

| Peloton Guide | 2021 | Strength Training Device | AI-powered device that uses computer vision to track form, count reps, and provide personalized training recommendations. |

| Precor | 2021 (Acquisition) | Commercial Fitness Equipment | Established U.S.-based manufacturer supplying gyms, hotels, and corporate fitness centers. Acquisition expanded Peloton’s manufacturing capacity. |

| Peloton Interactive Platform | 2014 | Digital Platform | Central hub for Peloton’s live and on-demand classes across cycling, running, yoga, pilates, meditation, and strength training. |

| Peloton Digital Membership | 2018 | Subscription Service | Standalone access to Peloton’s library of workouts without requiring Peloton hardware, available on mobile, smart TV, and third-party devices. |

| Peloton Apparel | 2014 | Apparel & Accessories | Branded fitness clothing and accessories designed for performance and style, including collaborations with fashion designers and influencers. |

Peloton Bike

The Peloton Bike is the original flagship product that revolutionized the home fitness market. Launched in 2014, it features a stationary bike with an integrated touchscreen for streaming live and on-demand cycling classes. It remains Peloton’s best-selling product and a major driver of subscriber growth, attracting a global community of dedicated users.

Peloton Bike+

Introduced in 2020, the Peloton Bike+ builds on the success of the original bike with upgraded hardware, including a rotating HD screen, improved audio, and automatic resistance adjustment. The Bike+ is designed to make switching between cycling and floor workouts seamless, increasing its appeal to users who want more versatility from a single machine.

Precor

Peloton acquired Precor in 2021 to expand its manufacturing capabilities and strengthen its commercial fitness presence. Precor is a leading fitness equipment manufacturer that supplies gyms, hotels, and health clubs worldwide. This acquisition allowed Peloton to bring more production in-house, reduce supply chain challenges, and diversify into the commercial fitness space.

Peloton Interactive Platform

The Peloton Interactive Platform is the company’s flagship subscription service, offering live and on-demand classes across cycling, running, strength training, yoga, meditation, and more. It is available on Peloton’s own hardware, mobile apps, and web. This platform is the core of Peloton’s recurring revenue model.

Peloton Apparel

Peloton operates its own apparel line, featuring workout gear, accessories, and lifestyle clothing. The brand focuses on high-quality, performance-oriented fabrics and collaborates with popular designers for limited edition collections. The apparel business has become an important extension of Peloton’s brand identity.

Guide

Peloton Guide is an AI-powered strength training device that uses computer vision to track movements and help users improve their form. It was launched to expand Peloton’s offerings beyond cardio into strength training, which is one of the fastest-growing segments in home fitness.

Peloton Tread

Peloton Tread is the company’s treadmill product line, designed for running and walking workouts both live and on-demand. It features a large HD touchscreen and advanced safety features. Tread classes have grown to become a significant part of Peloton’s fitness ecosystem.

Peloton Row

Peloton Row is the rowing machine launched in 2022, marking Peloton’s entry into the rowing segment. It offers form guidance, personalized feedback, and integration with the Peloton training platform. The Row targets both strength and cardio training markets.

Peloton Digital Membership

Peloton’s Digital Membership is a standalone subscription for users who don’t own Peloton hardware but still want access to its workouts. It is compatible with smartphones, tablets, smart TVs, and non-Peloton fitness equipment. This service expands Peloton’s reach to a global audience.

Final Thoughts

Peloton’s ownership is spread across powerful institutional investors, committed insiders, and individual shareholders, ensuring no single entity controls the company. With Peter Stern at the helm, Peloton is pushing for a stronger market position and a return to growth. The company remains focused on delivering premium fitness experiences rather than diversifying through acquisitions, keeping its brand and mission at the center of its strategy.

FAQs

Who owns Peloton company?

Peloton Interactive, Inc. is a publicly traded company listed on NASDAQ under the ticker symbol PTON. It is owned by a mix of institutional investors, mutual funds, and individual shareholders. The largest shareholders in 2025 include The Vanguard Group, BlackRock, and various top mutual fund holdings, alongside major insider shareholders such as co-founders and key executives.

Who owns Peloton Bike?

The Peloton Bike is owned and manufactured by Peloton Interactive, Inc. It is the company’s flagship product, launched in 2014, and is part of Peloton’s proprietary line of connected fitness equipment. The design, patents, and technology are owned by Peloton.

Is Peloton still in business?

Yes, Peloton is still in business as of 2025. The company continues to operate globally, selling fitness equipment, offering subscription-based workout classes, and expanding its product line. While it faced financial and leadership challenges in recent years, Peloton has restructured operations to remain competitive.

Who is the Peloton founder?

Peloton was founded in 2012 by John Foley, along with co-founders Tom Cortese, Graham Stanton, Hisao Kushi, and Yony Feng. Foley served as CEO until 2022.

What is John Foley’s net worth?

John Foley’s net worth peaked at over $1 billion during Peloton’s early 2021 stock surge but has significantly dropped since. As of 2025, his estimated net worth is around $150–200 million, largely from his retained Peloton shares, past stock sales, and new ventures.

Who is the largest shareholder of Peloton?

The largest shareholder of Peloton in 2025 is The Vanguard Group, an investment management firm, holding a substantial institutional stake in the company.

Why was Peloton’s CEO fired?

Former CEO John Foley stepped down in 2022 amid declining sales, supply chain issues, and a sharp drop in Peloton’s stock value. The move was part of a broader restructuring to stabilize the company’s financial performance.

Did Lululemon acquire Peloton?

No, Lululemon did not acquire Peloton. However, in 2023, Peloton entered into a strategic partnership with Lululemon to end apparel competition and collaborate on fitness content.

Is Peloton American-owned?

Yes, Peloton is an American-owned company headquartered in New York City, United States. While it has global investors, its primary ownership and operations are U.S.-based.

Why is Kendall Toole done with Peloton?

Kendall Toole, a popular Peloton instructor, announced her departure in late 2023, citing a desire to focus on personal projects, mental health advocacy, and opportunities outside Peloton’s platform.

Who is the former billionaire of Peloton?

John Foley, Peloton’s co-founder and former CEO, was once a billionaire during Peloton’s market peak in 2021 but lost billionaire status after the stock price decline.

Who is the highest-paid Peloton trainer?

While exact salaries are confidential, industry reports suggest Cody Rigsby is among the highest-paid Peloton trainers, earning millions annually through salary, bonuses, and brand partnerships.

Who is the current CEO of Peloton?

As of January 1, 2025, Peter Stern is the CEO.

Did Peloton ever have a controlling owner?

No. Even co-founder John Foley held significant voting power but not full control before stepping down in 2022.