Zoom Video Communications, widely recognized simply as Zoom, became a household name during the pandemic. The question “who owns Zoom” has intrigued many, given the company’s massive success and global impact. Let’s explore Zoom’s background, ownership structure, leadership, financial strength, and the brands it holds under its umbrella.

Zoom Company Profile

Zoom Communications, Inc. is a leading global platform for online collaboration. In 2025, it stands as an AI-driven work ecosystem. This overview looks at the company background, founders, and major milestones using current data.

Company Profile

Zoom Communications, Inc. (formerly Zoom Video Communications, Inc.) was incorporated in April 2011. It is headquartered in San Jose, California. The company originally focused on cloud‑based videoconferencing. By 2025, it has grown into a full AI‑first productivity platform.

In November 2024, Zoom dropped “Video” from its legal name to reflect its broader scope beyond meetings. It serves individuals, enterprises, education, government, healthcare, and more, offering products such as Zoom Meetings, Zoom Phone, Zoom Chat, Zoom Docs, Zoom Contact Center, and AI Companion services.

By fiscal year‑end January 2025, the company had revenue of around $4.5 billion, net income of over $1 billion, assets near $11 billion, and equity of roughly $21 billion. It employed around 7,400 people.

Zoom earned recognition on Fast Company’s list of the World’s Most Innovative Companies for 2025, its second consecutive year on that list, highlighting its evolution into an AI‑first open work platform.

Founders and Leadership

Eric Yuan, a former Cisco/WebEx engineering leader, founded the company in 2011. He left Cisco after proposing a modern smartphone‑friendly conferencing system. He then set up Zoom with a team of around 40 engineers, many former WebEx colleagues.

Yuan serves as chairman and chief executive officer. Other key executives include CTO Xuedong Huang and CFO (as of mid‑2025) Michelle Chang.

Eric Yuan owns approximately 22 % of Zoom and retains large voting control. He recently sold some Class A shares in early March 2025 under a trading plan, but still holds the bulk of his ownership through Class B shares with superior voting power.

Major Milestones

- 2011: Founded as Saasbee, Inc. in April; rebranded to Zoom in mid‑2012.

- 2013: Launch of beta and public release; one million users by May 2013.

- 2015: Raised Series C funding ($30 M); hit 40 M users and crossed one billion meeting minutes.

- 2019: IPO on Nasdaq (ticker ZM) at $36 per share; shares jumped 72 % first day; first profitable year.

- 2020: Massive pandemic growth—from 10 M daily meeting participants in December 2019 to over 300 M by April 2020; acquisition of Keybase for E2E encryption; data center in Singapore opens.

- 2021–2023: Acquired Kites for real‑time translation (2021); attempted merger with Five9 failed (2021); acquired Workvivo (2023); later dropped from Nasdaq‑100 index; layoffs in early 2023.

- Late 2024: Name change to Zoom Communications, Inc. to signal shift toward AI‑first work platform.

- 2025: Roll‑out of Zoom AI Companion across platform; launch of Zoom Docs and Zoom Clips; strong enterprise contact center deals; revenue guidance for FY 2026 issued; forecast modest growth as demand normalizes.

Who Owns Zoom: List of Shareholders

Zoom Video Communications remains a publicly traded company on NASDAQ under the ticker ZM. Its ownership is shared among its founder, top executives, institutional investors, and thousands of individual shareholders worldwide. As of mid-2025, let’s look deeper into who owns Zoom by exploring the major shareholders, their stake percentages, and how they influence the company.

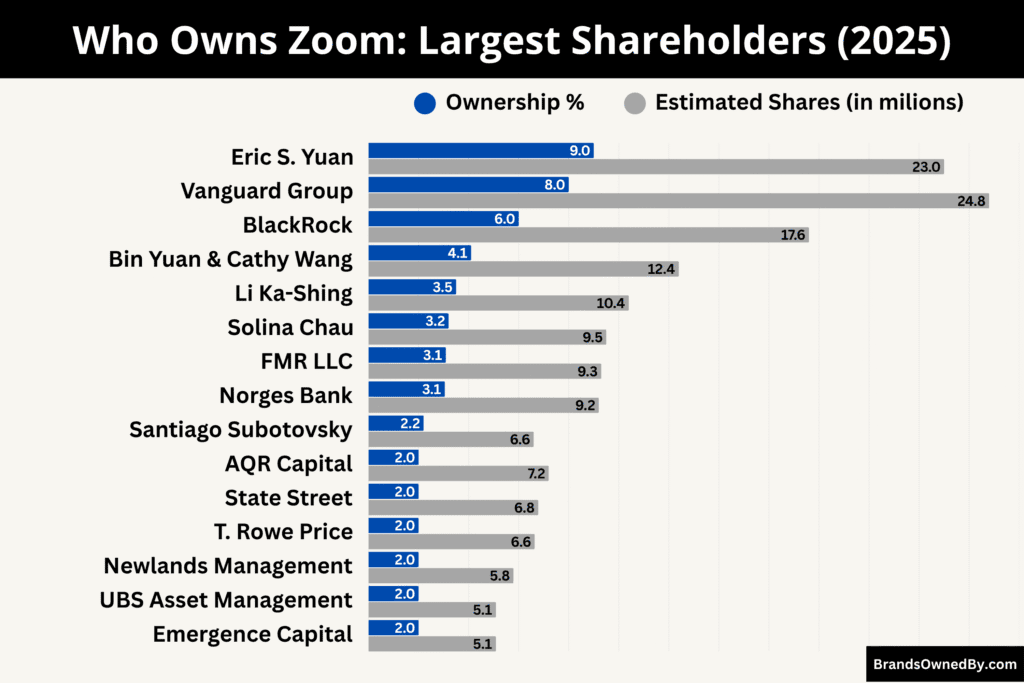

Here’s a list of the major shareholders of Zoom as of August 2025:

| Shareholder Name | Ownership % | Estimated Shares | Share Class | Notes / Influence |

|---|---|---|---|---|

| Eric S. Yuan | 7–9% | 21–23 million | Mostly Class B | Founder & CEO; controls 30%+ of total voting power |

| Vanguard Group | 8.2% | ~24.8 million | Class A | Largest institutional investor; passive but influential in governance |

| BlackRock, Inc. | 5.82% | ~17.6 million | Class A | Large index investor; votes on key governance issues |

| FMR LLC (Fidelity) | 3.09% | ~9.3 million | Class A | Long-term tech investor; active via mutual funds |

| Norges Bank | 3.05% | ~9.2 million | Class A | Sovereign fund; focuses on ESG, governance |

| AQR Capital | 2.39% | ~7.2 million | Class A | Hedge fund investor; algorithmic, growth exposure |

| State Street | 2.24% | ~6.78 million | Class A | Index fund manager; passive influence |

| T. Rowe Price | 2.20% | ~6.64 million | Class A | Actively managed funds; strong position in growth tech |

| Newlands Management | 1.91% | ~5.79 million | Class A | Hedge fund with increasing position since 2024 |

| UBS Asset Management | 1.68% | ~5.09 million | Class A | Swiss investment bank; diversified institutional holding |

| Emergence Capital | 1.68% | ~5.09 million | Class B & A | Early-stage investor; Santiago Subotovsky on board |

| Santiago Subotovsky | ~2.2% | ~6.6 million | Mostly Class B | Board member; personal & fund-based holdings |

| Solina Chau | ~3.2% | ~9.5 million | Primarily Class B | Early investor via Horizon Ventures; controls ~13% of voting power |

| Li Ka-Shing | ~3.5% | ~10.4 million | Class B & A | Backed Zoom in early stage; maintains quiet but strategic role |

| Kelly Steckelberg (CFO) | ~0.3% | ~944,000 | Class A | Insider holding; incentive-aligned executive |

| Bin Yuan & Cathy Wang | ~4.1% | ~12.4 million | Family Trust (Class B) | Likely relatives of Eric Yuan; used to preserve founder control |

| Retail Investors | 30–38% | ~91–115 million | Class A | Individual shareholders; little direct control unless organized |

Eric S. Yuan

Eric Yuan is the largest individual shareholder of Zoom and the most powerful person in the company. As of 2025, he owns between 7% and 9% of the company’s outstanding shares, totaling around 21 to 23 million shares. The majority of his holdings are Class B shares, which carry 10 votes per share, compared to Class A shares, which have only 1 vote each.

Because of this dual-class structure, Yuan controls over 30% of the company’s total voting power, despite owning a smaller economic share. This gives him the final say on key strategic decisions, board appointments, and corporate direction. Yuan has been reducing his Class A shareholding slowly since 2023 through 10b5-1 trading plans, but retains the bulk of his influence through Class B shares.

Yuan founded Zoom in 2011 after leaving Cisco WebEx and has served as CEO ever since. His leadership and voting control mean he plays both the role of visionary and gatekeeper at Zoom.

Vanguard Group

The Vanguard Group is the largest institutional shareholder of Zoom, owning approximately 8.2% of the company, which translates to about 24.8 million Class A shares. As a passive investment manager, Vanguard holds shares across various ETFs and mutual funds, especially those tracking the Nasdaq and tech-focused indices.

Vanguard does not participate in daily management, but its large stake gives it considerable influence over shareholder proposals and board elections. While it does not have the controlling power of Eric Yuan, Vanguard often votes on issues that impact governance and compensation and sometimes joins forces with other institutions to push for transparency and shareholder rights.

BlackRock

BlackRock, the world’s largest asset manager, owns about 5.82% of Zoom’s outstanding shares, totaling nearly 17.6 million shares. Like Vanguard, BlackRock is a passive investor with shares held through index funds and iShares ETFs.

Though not directly involved in Zoom’s strategy, BlackRock’s influence shows through shareholder votes. Its voting policy usually supports long-term growth, ESG compliance, and board accountability. BlackRock is one of the most consistent top holders in large-cap tech companies and plays a significant governance role across the industry.

FMR LLC (Fidelity Investments)

Fidelity Investments, operating through FMR LLC, owns roughly 3.09% of Zoom shares, or about 9.3 million shares. Fidelity is an active investor and is known to hold large stakes in growth-stage tech companies. It was among the institutional buyers during Zoom’s IPO in 2019.

Fidelity’s influence is financial rather than managerial. However, as an early and consistent supporter, it represents the interests of millions of retail investors who invest through its mutual funds and retirement plans.

Norges Bank Investment Management

Norges Bank, which manages Norway’s sovereign wealth fund, holds about 3.05% of Zoom as of 2025, approximately 9.2 million shares. Norges Bank is a long-term investor with a focus on ethical investing and sustainability. It often engages in policy discussions around executive pay, board structure, and environmental impact.

Although it doesn’t hold board seats or exercise operational control, Norges Bank’s reputation as a globally respected institutional investor means its involvement adds credibility to Zoom’s investor base.

AQR Capital Management

AQR Capital Management, a quantitative hedge fund, owns about 2.39%, or roughly 7.2 million shares of Zoom. AQR’s stake may fluctuate regularly due to its algorithmic trading model, but its current holdings suggest confidence in Zoom’s medium-term growth potential.

AQR rarely engages in activist activity, but its presence shows that Zoom appeals not only to passive institutions but also to sophisticated hedge funds.

State Street Global Advisors

State Street owns approximately 2.24%, or 6.78 million shares of Zoom. It is one of the “Big Three” index fund managers alongside Vanguard and BlackRock. Its voting behavior is closely watched and often aligns with broader institutional sentiment.

State Street focuses on long-term stability and governance. It does not intervene in daily operations but can influence proxy outcomes and corporate governance trends.

T. Rowe Price Group

T. Rowe Price holds about 2.20% of Zoom, amounting to 6.64 million shares. It is a growth-focused fund manager known for strategic positions in tech and biotech firms. T. Rowe may influence strategic direction indirectly through investor calls, board recommendations, or exit timing.

Newlands Management Operations

Newlands Management, an emerging hedge fund, owns around 1.91%, or 5.79 million shares. Though smaller in size than other institutions, Newlands has been increasing its stake since 2024, likely in response to Zoom’s expansion into AI tools and enterprise services. Their presence reflects confidence in the company’s post-pandemic transformation.

UBS Asset Management

UBS owns approximately 1.68% of Zoom, which equals 5.09 million shares. As a global financial firm, UBS invests in Zoom through various active and passive strategies. It typically maintains a diversified portfolio and represents both retail and institutional interests.

Emergence Capital & Santiago Subotovsky

Emergence Capital, an early investor in Zoom, holds about 1.68% of shares through its funds. Santiago Subotovsky, Emergence’s partner, also personally holds shares and sits on Zoom’s board of directors.

Subotovsky’s combined personal and firm ownership gives him a unique role among institutional investors—he offers strategic advice, supports governance, and maintains close ties with Eric Yuan. Emergence was one of the earliest believers in Zoom’s vision, joining its Series A round.

Solina Chau

Solina Chau, through her investment vehicle linked to billionaire Li Ka-Shing, holds around 3.2% of Zoom. She invested early through Horizon Ventures and received Class B shares, which carry higher voting rights. In 2025, her voting power accounts for roughly 13% of total control.

Though she is not involved in daily operations, her influence remains significant through the voting structure. Chau’s support was key to Zoom’s early expansion in Asia-Pacific markets.

Li Ka-Shing

Hong Kong billionaire Li Ka-Shing was an early backer of Zoom via Horizon Ventures. He holds approximately 3.5% of the company, partly through Class B shares. Li’s strategic support gave Zoom a credibility boost in the early 2010s and helped it penetrate markets in Hong Kong, Singapore, and China before scaling globally.

Even in 2025, Li Ka-Shing remains a quiet but powerful shareholder with a long-term interest in Zoom’s innovation-led growth.

Kelly Steckelberg (CFO)

Kelly Steckelberg, Zoom’s Chief Financial Officer, holds about 0.3% of the company—around 944,000 shares. While she doesn’t control voting blocks, her insider ownership aligns her financially with the company’s performance. She also has influence over investor relations and long-term fiscal planning.

Bin Yuan & Cathy Wang (Family Trust)

Bin Yuan and Cathy Wang, believed to be close relatives of Eric Yuan, manage a trust that holds 4.1% of Zoom’s stock. This family trust is structured to preserve voting control within Eric Yuan’s circle and may be used to ensure intergenerational control.

Retail Investors

Retail investors make up the remaining 30–38% of total shares. These include individual traders and long-term investors who purchase Zoom through apps like Robinhood, Fidelity, or Charles Schwab. While collectively large, they lack coordination and typically don’t participate in governance unless organized through proxy campaigns.

Who is the CEO of Zoom?

Eric Yuan has been the CEO of Zoom since founding the company in 2011. As of 2025, he remains at the helm and continues to actively shape Zoom’s strategy and growth. Yuan’s leadership reflects his origins as an engineer and his commitment to delivering a seamless user experience. He oversees product direction, international expansion, and AI integration across Zoom’s suite of services.

Leadership Style and Decision‑Making Structure

Yuan champions a transparent, customer-first ethos. He regularly engages in open forums with employees and users to gather feedback directly. Under his structure, a cohesive executive team handles major functional areas—product, engineering, finance, sales and marketing—with Yuan collaborating closely on strategic priorities.

Final decisions on acquisitions, budgets, and organizational changes are made collaboratively, with Yuan holding ultimate veto power.

In 2025, Yuan leads Zoom’s transformation into an AI-first work platform. He has emphasized integrating AI into every product—from Meetings and Phone to Contact Center and Docs.

Yuan also pioneered the use of his AI avatar during an earnings call, using Zoom’s own Clips tool—making him one of the first CEOs to adopt avatar-led investor communication.

Compensation and Financial Alignment

For fiscal year 2025, Yuan’s total compensation dropped sharply—down roughly 88% to $3.4 million, due to the absence of a new equity “refresh” award compared with prior years.

His base salary remained modest, with most of his income tied to performance vesting and long-term alignment with shareholders.

Key Initiatives and Strategic Priorities

In 2025, Eric Yuan has focused on accelerating Zoom’s transformation from a video communications provider to a broader AI-powered collaboration platform. Under his guidance, Zoom has rolled out features like real-time AI transcripts, automated meeting summaries, and integration of AI plug-ins.

He has also prioritized growth in the enterprise segment and the hybrid events market. Strategic investments in AI and security reinforce Yuan’s pledge to elevate Zoom’s technological edge.

Board and Governance Role

As Chairman of the Board, Eric Yuan helps shape major decisions regarding strategy, board composition, and corporate governance. His Class B shares—carrying ten votes each—give him control of over 30% of total voting rights. This ensures that while Zoom is publicly traded, Yuan retains ultimate authority on strategic matters.

Legacy and Leadership Continuity

Zoom has had only one CEO—Eric Yuan—since its founding. His long tenure stands out in modern tech leadership. He built the company from 40 engineers in 2011 to over 7,400 employees worldwide by 2025, maintaining consistent leadership through Zoom’s IPO, explosive pandemic growth, and evolution into a multi-product AI-driven company

Zoom Annual Revenue and Net Worth

Zoom’s fiscal 2025 results show modest revenue growth of just over 3%, with enterprise customers paying off in stronger performance in that segment. Profit margins improved significantly, particularly in operating and cash flow measures.

It generated over $1 billion in GAAP profits and nearly $1.75 billion in adjusted net income. Its strong free cash flow and high margin performance gave Zoom a stable valuation of around $22 billion in market value in August 2025.

Annual Revenue (Fiscal Year 2025)

Zoom Communications generated $4.6654 billion in total revenue for the fiscal year ending January 31, 2025. This represented a 3.1% year-over-year increase compared to fiscal 2024, and about 3.3% growth in constant currency terms.

The enterprise segment continued to be the primary driver with $2.7542 billion, growing 5.2% year over year, while the online or “self-service” segment contributed $1.9112 billion, up 0.2%.

Fourth‑Quarter Performance

For the fourth quarter alone, Zoom reported total revenue of $1.1841 billion, a 3.3% increase year over year (or 3.6% in constant currency). Enterprise revenue for the quarter reached $706.8 million, growing 5.9%, while online revenue dipped slightly by 0.4% year over year.

Profitability and Operating Results

Zoom delivered GAAP operating income of $813.3 million for the full fiscal year, up sharply from the prior year, which translated into a GAAP operating margin of 17.4%, an expansion of 580 basis points.

Adjusted (non‑GAAP) operating income was approximately $1.8379 billion, yielding a 39.4% operating margin. For Q4, the GAAP operating margin rose to 19.0%, and the non‑GAAP margin edged up to 39.5%, reflecting improved cost management and disciplined investment choices.

Net Income and Earnings per Share

Zoom achieved GAAP net income of $1.0102 billion for fiscal 2025, or $3.21 per diluted share, compared to $637.5 million or $2.07 in fiscal 2024.

On a non‑GAAP basis, net income totaled $1.7448 billion, with earnings per share of approximately $5.54, reflecting strong performance after adjusting for stock‑based compensation and other non‑cash charges.

Cash Flow Highlights

Operating cash flow for the year reached $1.9453 billion, a 21.7% increase year over year, while free cash flow—after capital expenditures—was about $1.8087 billion, up 22.9%. This translated into a robust operating cash flow margin of 41.7%, indicating exceptional efficiency and capital discipline.

| Metric | Fiscal Year 2025 (Ended Jan 31, 2025) |

|---|---|

| Total Annual Revenue | $4.665 billion |

| Year-over-Year Revenue Growth | +3.1 % |

| GAAP Net Income | $1.010 billion |

| Non-GAAP Net Income | $1.745 billion |

| Operating Cash Flow | $1.945 billion |

| Operating Cash Flow Margin | 41.7 % |

| Free Cash Flow | $1.809 billion |

| Market Capitalization (Net Worth) | ~$22.6 billion |

Zoom Net Worth

By August 2025, Zoom’s market capitalization—or corporate “net worth” in equity markets—was estimated between $21.47 billion and $22.64 billion, depending on the data source and exact date. Most reports converged around $22 billion, placing Zoom among the top 1,000 global companies by valuation.

Market cap had declined from pandemic-era peaks (when it exceeded $50 billion). However, it showed a year-over-year rebound of roughly 20–28% in 2025.

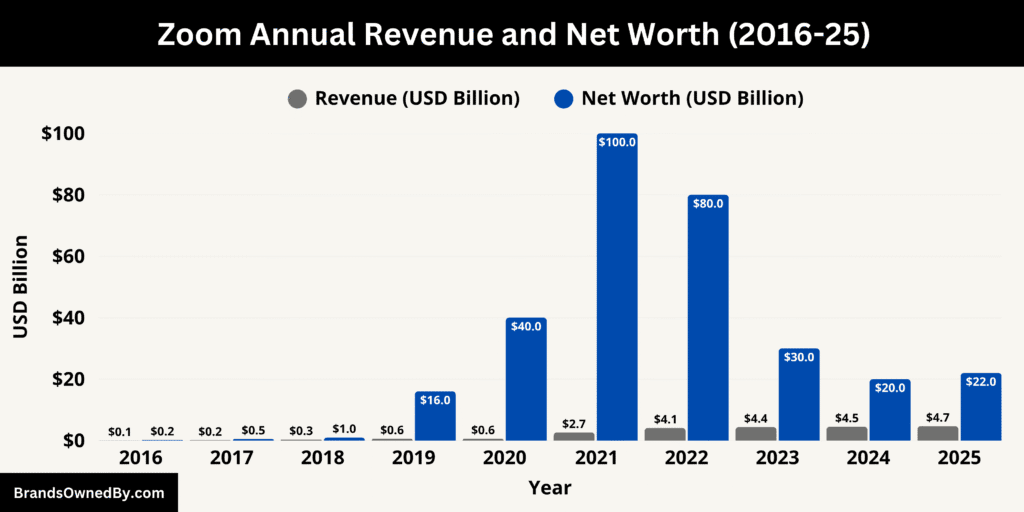

Here’s the historical overview of annual revenue and net worth for Zoom from 2016 to 2025:

| Fiscal Year | Revenue (USD Billion) | Market Cap / Net Worth (USD Billion) |

|---|---|---|

| 2016 | 0.061 | 0.2 (pre-IPO private valuation) |

| 2017 | 0.151 | 0.5 (estimated pre-IPO) |

| 2018 | 0.330 | 1.0 (late-stage private valuation) |

| 2019 | 0.622 | 16.0 (IPO market cap in April 2019) |

| 2020 | 0.622 | 40.0 (mid-2020 pandemic surge) |

| 2021 | 2.651 | 100.0+ (peak during pandemic) |

| 2022 | 4.099 | 70.0–80.0 (post-peak decline begins) |

| 2023 | 4.393 | 24.0–30.0 (volatility continues) |

| 2024 | 4.524 | 17.0–20.0 (stabilization phase) |

| 2025 | 4.665 | 21.5–22.6 (recovery in progress) |

Brands and Companies Owned by Zoom

Zoom Video Communications, Inc. has grown beyond its original meetings platform into a broader suite of brands and acquired entities. Each plays a strategic role in Zoom’s product ecosystem, helping the company stay competitive in the evolving collaboration and communications market.

Below are the major brands and acquisitions that Zoom owns and operates as of 2025:

| Name | Type | Launch/Acquisition Year | Description |

|---|---|---|---|

| Zoom Meetings | Core Product | 2013 | Zoom’s original and most widely used video conferencing service, enabling virtual meetings, webinars, and group collaboration. |

| Zoom Phone | Product (VoIP/Telephony) | 2019 | Cloud-based business phone system offering voice calling, call routing, and integration with Meetings and Chat. |

| Zoom Chat | Product (Messaging) | 2019 | Messaging platform integrated with Zoom ecosystem, enabling real-time chat, file sharing, and transitions to meetings. |

| Zoom Contact Center | Product (CCaaS) | 2022 | A cloud contact center solution with AI-powered routing, analytics, and customer engagement tools. |

| Zoom One | Product Suite/Bundling | 2022 | A bundled offering combining Meetings, Chat, Phone, Whiteboard, and Contact Center for unified communications. |

| Zoom Apps & Marketplace | Platform Ecosystem | 2021 | Embedded app platform allowing third-party developers to integrate tools into Zoom Meetings and Chat. |

| Zoom Docs | Product (Docs Platform) | 2024 | Collaborative document editing tool integrated with Zoom Chat, Whiteboard, and AI features. |

| Zoom Clips | Product (AI Video Tool) | 2024 | Tool for creating AI-generated video summaries, shareable clips, and asynchronous video communications. |

| Kites GmbH | Acquisition (AI Translation) | 2021 | German-based AI translation company acquired to power Zoom’s multilingual transcription and live translation. |

| Workvivo | Acquisition (Employee Engagement) | 2023 | Platform focused on internal communications, engagement, and employee experience in enterprise settings. |

Zoom Meetings

Zoom Meetings is the flagship video conferencing service that launched in 2013. It supports virtual meetings, webinars, and large-scale events. Over time it has become feature-rich with enhanced security, live transcription, polling, and customizable backgrounds. Though no longer the only focus, Meetings remains the core use case around which Zoom builds integrations and APIs for third-party developers.

Zoom Phone

Zoom Phone is the company’s cloud‑based telephony system. It offers voice over IP calling, call routing, auto attendants, and integration with Zoom Meetings and Chat. The product scaled rapidly during and after the pandemic. It positions Zoom as a unified communications provider rather than just a video tool. It has been a key driver of recurring enterprise revenue.

Zoom Chat (Team Chat)

Zoom Chat is Zoom’s internal messaging and collaboration platform. It allows threaded conversations, file sharing, group channels, and app integrations. Chat is deeply embedded into the Zoom ecosystem, enabling seamless transitions between text, voice, and video interactions. It is Zoom’s answer to collaboration services like Slack or Microsoft Teams.

Zoom Contact Center

Zoom Contact Center is Zoom’s entry into customer service and support technology. Built from the failed attempt to acquire Five9, Zoom rolled out its own cloud contact center in early 2022. It includes omnichannel routing, AI assistants, customer journey analytics, agent dashboards, and AI Companion–powered features. It reflects Zoom’s broader ambition in customer experience and CCaaS.

Zoom One

Zoom One is an integrated bundle launched in mid‑2022 that packages Meetings, Phone, Chat, Whiteboard, and Team Room into a unified offering. It simplifies licensing for customers and showcases Zoom’s move toward a comprehensive communications platform built around user convenience and cross‑product integration.

Zoom Apps & Marketplace

Zoom Apps is an embedded app ecosystem within Meeting and Chat. Launched in 2021, it allows third-party developers to build interactive add-ons—such as polls, whiteboards, productivity tools, and CRM integrations. The SDK and marketplace further position Zoom as a platform rather than just a point solution.

Zoom Docs

Zoom Docs, introduced in 2024, is a collaborative document creation tool integrated into Zoom’s workspace suite. It allows multiple users to edit documents in real time, link to Zoom Chat conversations, and embed media and meeting content. It is part of Zoom’s effort to support synchronous and asynchronous work in one shared environment.

Zoom Clips

Zoom Clips, launched in late 2024, enables users to create short, AI‑enabled video summaries and avatars from longer interactive sessions. Clips can auto‑summarize meetings, extract key moments, and produce shareable snippets. It is tightly integrated with AI Companion and used for asynchronous communication and knowledge sharing.

Kites GmbH (Language Translation)

Zoom acquired Kites GmbH in mid‑2021 to enhance real‑time language translation and transcription capabilities. Kites’ AI-driven translation tech now powers Zoom’s multi-language captioning and live translation features in over a dozen languages. This acquisition helps Zoom serve global customers and democratize cross-lingual collaboration.

Workvivo (Employee Experience Platform)

In early 2023, Zoom purchased Workvivo, an employee experience and internal communication platform. Workvivo brings features like company-wide social feeds, internal engagement analytics, event broadcasting, and workplace culture-building. It supplements Zoom’s offerings with tools for internal collaboration and enterprise engagement.

Final Thoughts

When people ask “who owns Zoom,” the simple answer points to its founder Eric Yuan as the largest individual shareholder. Yet, Zoom’s ownership is shared among many institutional investors and thousands of smaller shareholders. With a strong product lineup, steady financial growth, and visionary leadership, Zoom remains a significant force in global communication. Its journey from a startup to a global brand shows how innovative technology and strategic ownership can change the world.

FAQs

Who owns Zoom company?

Zoom Video Communications is a publicly traded company listed on the NASDAQ under the ticker symbol ZM. It is not owned by a single entity but by a mix of institutional investors, retail shareholders, and insiders. The largest individual shareholder is its founder and CEO, Eric Yuan.

Does Microsoft own Zoom?

No, Microsoft does not own Zoom. Microsoft operates its own competing product, Microsoft Teams, which directly rivals Zoom in the collaboration and video conferencing market.

What’s Zoom’s net worth?

As of August 2025, Zoom’s estimated net worth—based on its market capitalization and financials—is around $22 billion. This value fluctuates depending on stock performance and earnings reports.

Is Zoom owned by China?

No, Zoom is not owned by China. It is a U.S.-based company, founded and headquartered in San Jose, California. However, it does have operational ties and employees in China for engineering and development purposes.

Is Zoom owned by Google?

No, Zoom is not owned by Google. Google owns Google Meet, a competing product. Zoom and Google remain separate, rival companies in the video conferencing space.

Is Zoom owned by Meta?

No, Meta (formerly Facebook) does not own Zoom. Meta operates its own communication platforms such as WhatsApp, Messenger, and Workplace.

Is Zoom been bought by Google?

No, Google has not acquired Zoom. Zoom remains an independent publicly traded company as of 2025.

Is Zoom a Chinese app?

No, Zoom is not a Chinese app. It was founded by a Chinese-American entrepreneur but is incorporated and headquartered in the United States.

Is Zoom owned by Cisco?

No, Cisco does not own Zoom. Cisco owns Webex, another video conferencing tool that competes directly with Zoom.

Was Zoom bought by Microsoft?

No, Microsoft has never bought Zoom. The two companies remain competitors.

Does Oracle own Zoom?

No, Oracle does not own Zoom. Zoom partnered with Oracle for cloud infrastructure services during the pandemic, but Oracle has no ownership stake.

Which country owns Zoom app?

Zoom is owned and operated by a U.S.-based company. It is incorporated in Delaware and headquartered in California.

Who owns Zoom China?

Zoom China was operated by local Chinese firms contracted by Zoom to handle engineering and development, but Zoom itself retains ownership. Due to regulatory and political pressures, Zoom reduced its operational presence in China in recent years.

Who founded Zoom?

Zoom was founded by Eric Yuan in 2011. He was previously a lead engineer at Webex and later at Cisco before starting Zoom independently.

Who owns Zoom Workplace?

Zoom Workplace is a suite of Zoom’s enterprise offerings—Meetings, Chat, Phone, Docs, Contact Center, and AI Companion—owned and managed by Zoom Video Communications, Inc., the parent company.

What company is Zoom owned by?

Zoom is not owned by another company. It is an independent, publicly listed corporation on the NASDAQ.

Who is the father of Zoom?

Eric Yuan is considered the “father of Zoom.” He founded the company and currently serves as its CEO.

How much is Eric Yuan worth in billion?

As of August 2025, Eric Yuan’s net worth is estimated to be between $3.5 and $4.2 billion, depending on Zoom’s stock performance and his current holdings.