SHEIN is one of the fastest-growing fashion retailers in the world. Known for ultra-affordable clothing, it dominates the fast fashion e-commerce space. If you’ve ever wondered who owns SHEIN, this article explains the company’s ownership, investors, leadership, and financial scale in detail.

SHEIN Company Profile

SHEIN is a global online fast fashion retailer known for its low-cost, trend-driven clothing and digital-first business model. Founded in 2008, it has transformed from a small wedding dress e-commerce startup into a fashion juggernaut serving over 150 countries.

The company was launched by Chris Xu (also known as Xu Yangtian), a Chinese-American entrepreneur with a background in SEO and cross-border e-commerce. Originally named SheInside, the company rebranded to SHEIN in 2015 to streamline its global identity and expand beyond bridalwear.

SHEIN does not own factories in the traditional sense. Instead, it operates through a tech-enabled on-demand production model. It works with hundreds of third-party manufacturers, mainly in Guangzhou, China, using real-time data analytics to produce small batches of fashion items. Based on consumer response, the company rapidly scales production or discontinues items. This method helps minimize inventory waste and keeps costs low.

In 2022, SHEIN moved parts of its operational headquarters to Singapore, officially designating it as its global headquarters by 2023. This move allowed the company to strengthen its legal, financial, and international business capabilities while navigating geopolitical tensions and regulatory scrutiny.

Major Milestones

2008 – Founded as SheInside in Nanjing, China, selling wedding dresses online.

2012–2014 – Expanded into general women’s fashion and began targeting overseas customers in the U.S. and Europe.

2015 – Rebranded to SHEIN. Started building a supply chain ecosystem in Guangzhou to speed up design-to-delivery timelines.

2018–2020 – Launched mobile-first platform and scaled influencer marketing. App downloads surged globally, especially among Gen Z.

2020 – The COVID-19 pandemic accelerated growth. SHEIN became one of the most downloaded fashion apps globally.

2021 – SHEIN surpassed Zara and H&M in the U.S. online fast fashion market share.

2022 – Valued at over $100 billion in a private fundraising round, briefly making it the most valuable fashion startup globally.

2023 – Announced Singapore as the official headquarters. Began testing resale and circular fashion initiatives.

2024 – Increased investment in local warehouses in the U.S., Mexico, Brazil, and Europe for faster delivery.

2025 – Reports $35+ billion in revenue, with expansion into categories like home goods, beauty (via SHEGLAM), and premium fashion (via MOTF). Positioned for a potential IPO or SPAC deal in the near future.

SHEIN’s journey from a niche Chinese e-commerce site to a global retail empire highlights the power of agile manufacturing, digital marketing, and direct-to-consumer innovation.

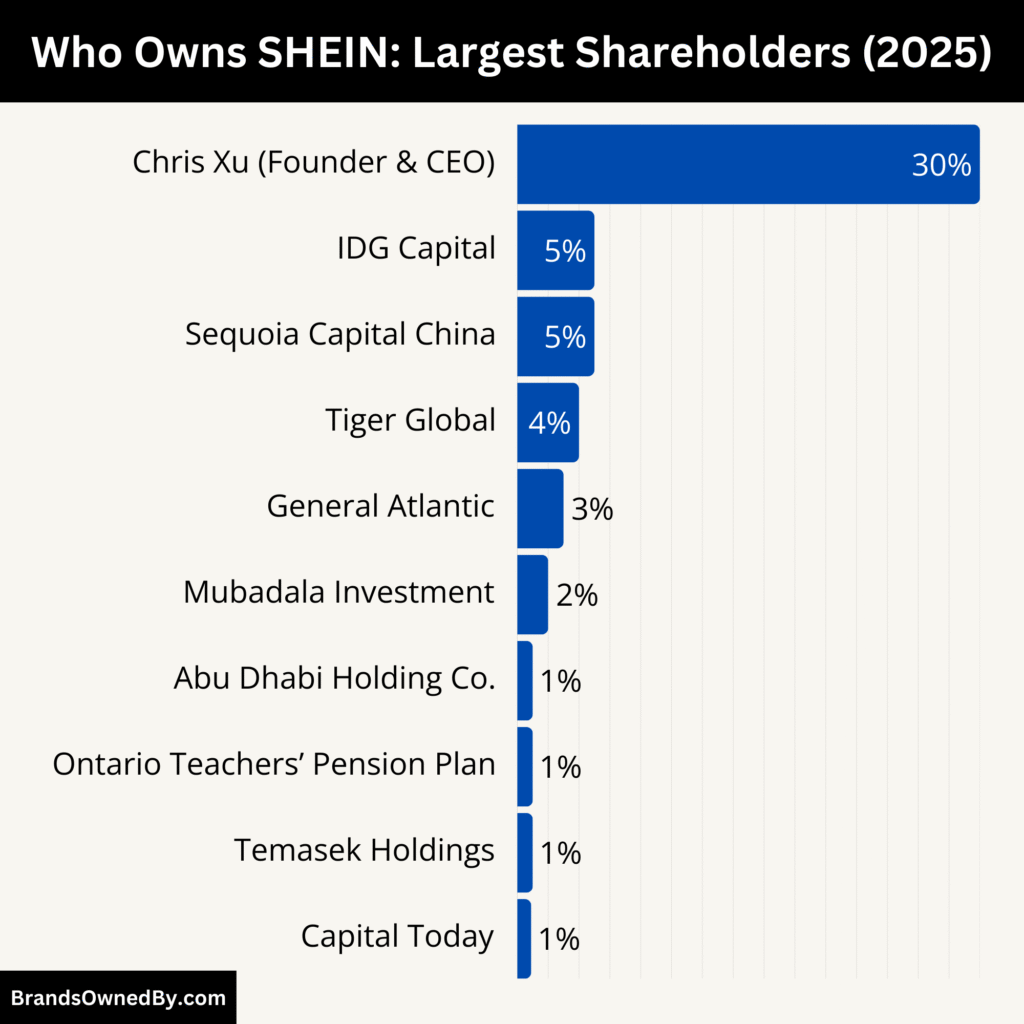

Who Owns SHEIN: Top Shareholders

SHEIN is a privately held company with a concentrated ownership structure. The majority of control remains with its founder, Chris Xu, while several institutional investors hold minority stakes. In recent years, especially from 2022 to 2025, additional international investors joined, including sovereign wealth funds and private equity firms, to support global expansion.

Below is a detailed breakdown of SHEIN’s major shareholders in 2025:

| Shareholder | Estimated Ownership (2025) | Country/Region | Year of Investment | Role/Influence in SHEIN |

|---|---|---|---|---|

| Chris Xu (Founder & CEO) | 30–35% | China / USA | 2008 (Founder) | Strategic leadership, full control of operations, innovation, and global direction |

| IDG Capital | 5–8% | China / Global | ~2014 | Early-stage VC support, helped expand SHEIN’s manufacturing and export logistics |

| Sequoia Capital China | 5–7% | China | ~2018 | Strengthened tech systems, retail analytics, and investor visibility |

| Tiger Global Management | 4–6% | United States | ~2020 | Enhanced credibility with U.S. financial markets, helped plan future IPO roadmap |

| General Atlantic | 3–5% | United States | 2021 | Supported global expansion, particularly in Latin America and Europe |

| Mubadala Investment Company | 2–4% | United Arab Emirates | 2023 | Facilitated MENA growth, logistics investment, regulatory partnerships in the Gulf region |

| ADQ (Abu Dhabi Holding Co.) | <2% | United Arab Emirates | 2024 | Co-invested in regional warehousing, customer service operations, and last-mile delivery network |

| Ontario Teachers’ Pension Plan | 1–2% | Canada | 2024 | Added institutional stability, long-term financial backing, and pension-grade investor oversight |

| Temasek Holdings | 1–2% | Singapore | 2024 | Strengthened SHEIN’s presence in Southeast Asia and solidified Singapore HQ status |

| Capital Today | <1.5% | China | ~2013 | Early investor, supported early SEO-focused e-commerce model, reduced influence over time |

| Employees & Early Executives | 5–7% | Global | Ongoing (ESOP) | Equity granted to top management and founding team, incentivizing innovation and retention |

| Unknown Middle East Consortiums | 1–2% (combined) | Gulf Region | 2023–2025 | Private consortiums investing for geopolitical alliances, regional e-commerce, and local economic alignment |

| Private Equity Firms (undisclosed) | ~2–3% (combined) | Global | 2022–2025 | Provided growth capital for logistics, AI-backed fashion prediction tools, and app development |

Chris Xu – Founder and Largest Shareholder

Chris Xu (also known as Xu Yangtian) is the founder, CEO, and largest shareholder of SHEIN. He is believed to hold more than 30% ownership in the company. As the original founder, his equity position gives him voting control and strategic authority over major business decisions.

Despite multiple funding rounds, Xu has avoided excessive dilution, ensuring he maintains dominant influence. As of 2025, he chairs the company’s internal executive board and continues to lead innovation, technology, and international expansion.

IDG Capital – Early Institutional Backer

IDG Capital is one of SHEIN’s earliest institutional investors. The firm, known for investing in Chinese startups, helped fund SHEIN’s initial global scale-up efforts around 2014–2016.

IDG holds an estimated 5–8% minority stake as of 2025. Though it does not have board control, it played a pivotal role during the brand’s early stages, especially in building the cross-border e-commerce supply chain.

Sequoia Capital China – Key Growth-Stage Investor

Sequoia Capital China joined during SHEIN’s growth rounds, around 2018–2020. It helped expand the company’s technological infrastructure, logistics, and data systems.

Sequoia’s current ownership is estimated at 5–7%. The firm offers strategic guidance and has representation in internal advisory committees. Although not involved in daily operations, Sequoia supports scaling and investor relations, especially in Asia and the U.S.

Tiger Global Management – U.S. Tech Investor

Tiger Global Management, a New York–based hedge fund, invested in SHEIN during its pre-2021 valuation surge. Known for betting on high-growth internet businesses, Tiger saw SHEIN as a digital-first disruptor in global retail.

As of 2025, Tiger holds an estimated 4–6% stake. While it has no operational control, Tiger has helped guide capital structuring and international partnerships, especially in North America.

General Atlantic – Strategic Growth Partner

General Atlantic, a U.S.-based private equity firm, became a shareholder in late 2021, during a funding round aimed at expansion in Latin America, MENA, and Europe.

Its estimated stake in 2025 is around 3–5%. General Atlantic plays a strategic role in guiding regional expansion, global logistics optimization, and compliance, particularly after SHEIN’s headquarters move to Singapore.

Mubadala Investment Company – UAE Sovereign Wealth Fund

In 2023, Mubadala Investment Company, based in Abu Dhabi, invested in SHEIN as part of its Middle East expansion. This was aligned with SHEIN’s growth in the MENA region and interest in regional supply chain investments.

Mubadala’s shareholding is estimated at 2–4%, providing capital and diplomatic channels in the Gulf Cooperation Council (GCC) countries. Its investment also contributes to SHEIN’s future IPO readiness and geopolitical diversification.

ADQ (Abu Dhabi Developmental Holding Company)

ADQ, another UAE sovereign fund, participated in a 2024 investment round. It aimed to co-invest in logistics centers, local operations, and brand partnerships across the MENA region.

ADQ’s stake is smaller, likely under 2%, but strategically valuable. It also aids SHEIN in local talent hiring and regional localization.

Ontario Teachers’ Pension Plan (OTPP) – Canadian Institutional Investor

OTPP joined SHEIN’s investor pool in 2024 as a late-stage investor. This move was part of a broader strategy to align with stable, high-growth global retailers.

Its estimated stake is 1–2%, with no operational involvement but a long-term growth interest. OTPP’s involvement signals investor confidence and adds legitimacy ahead of any potential IPO.

Capital Today – Chinese Venture Capital Firm

Capital Today, a Chinese VC firm, was an early-stage investor in SHEIN. It invested before the company’s major global breakout.

By 2025, Capital Today’s holdings have been diluted to an estimated under 1.5%, but it remains part of the cap table with historic ties to the brand.

Temasek Holdings – Singapore Government-Linked Investor

After SHEIN moved its global HQ to Singapore, Temasek Holdings entered discussions and acquired a small strategic stake in 2024. This move helped solidify local regulatory and banking relationships.

Temasek’s ownership is modest, likely 1–2%, but highly strategic for SHEIN’s Asia-Pacific future, fintech integration, and possible IPO plans in Singapore.

Employees and Founding Team

A portion of SHEIN’s equity is allocated to senior employees, founding team members, and early executives through Employee Stock Ownership Plans (ESOPs).

Combined, these stakeholders hold an estimated 5–7%. While they may not influence board-level decisions, they contribute to long-term growth and innovation through operational leadership.

Who is the CEO of SHEIN?

SHEIN’s success in global fashion e-commerce is deeply connected to its low-profile yet visionary leader, Chris Xu. As of 2025, he remains the company’s CEO, largest shareholder, and strategic architect, overseeing all key aspects of the brand’s global expansion, digital innovation, and manufacturing ecosystem.

Chris Xu: Background and Profile

Chris Xu (also known by his Chinese name Xu Yangtian) is a Chinese-American entrepreneur with a background in search engine optimization (SEO) and cross-border e-commerce. He graduated from Qingdao University of Science and Technology and initially worked in online marketing and website operations.

He founded SHEIN (originally SheInside) in 2008, targeting the niche market of bridal and formal dresses online. By 2014, he shifted the company’s focus toward fast fashion. His early understanding of Google marketing and global shipping helped SHEIN scale in overseas markets, particularly the United States, Europe, and the Middle East.

Despite leading one of the world’s largest fashion platforms, Xu is known for his intensely private nature, rarely giving interviews or making public appearances. Internally, he is described as data-obsessed, frugal, and fiercely product-driven.

Leadership Style and Decision-Making

As CEO, Chris Xu maintains a tight, centralized decision-making structure. He is personally involved in product strategy, logistics, and technology infrastructure. While SHEIN has grown into a global enterprise, its operational control still revolves around Xu and a small group of founding executives and trusted lieutenants.

He reportedly holds regular meetings with internal teams that handle algorithm-based product testing, supply chain management, and app development. Key product launches, market entries, and acquisitions go through his approval.

Even with international investors and new regional offices, strategic vision and corporate governance remain firmly founder-led.

Key Achievements Under Chris Xu

- Built one of the fastest design-to-manufacture supply chains in the world, capable of releasing new items within 7–10 days.

- Led SHEIN’s shift from China-based operations to Singapore as global headquarters in 2023, reducing political and regulatory risks.

- Expanded SHEIN’s presence in the U.S., Latin America, Europe, and the Middle East, turning it into a top fashion destination for Gen Z and millennial consumers.

- Oversaw the launch of SHEGLAM, MOTF, and DAZY, transforming SHEIN into a multi-brand fashion and beauty ecosystem.

- Drove the company’s revenue to $35+ billion by 2025, making SHEIN one of the world’s most profitable private e-commerce firms.

Past and Potential Leadership Changes

Since its founding in 2008, SHEIN has never appointed a CEO other than Chris Xu. No co-founder or public executive has shared equal leadership visibility. However, as the company prepares for a potential IPO or strategic listing, investors have speculated about appointing regional CEOs or a global board of directors to support governance transparency.

As of mid-2025, Chris Xu has not indicated any intention to step down or dilute control. Insiders suggest that any leadership restructuring, if it happens, would be symbolic or post-IPO.

Future Role and Influence

Chris Xu is expected to remain CEO through SHEIN’s next growth phase, which includes building localized supply hubs, entering sustainable fashion segments, and expanding SHEGLAM into a standalone beauty powerhouse.

Industry watchers expect him to take on a tech-founder role similar to Jeff Bezos or Mark Zuckerberg, retaining long-term control even if SHEIN becomes a public company.

SHEIN Annual Revenue and Net Worth

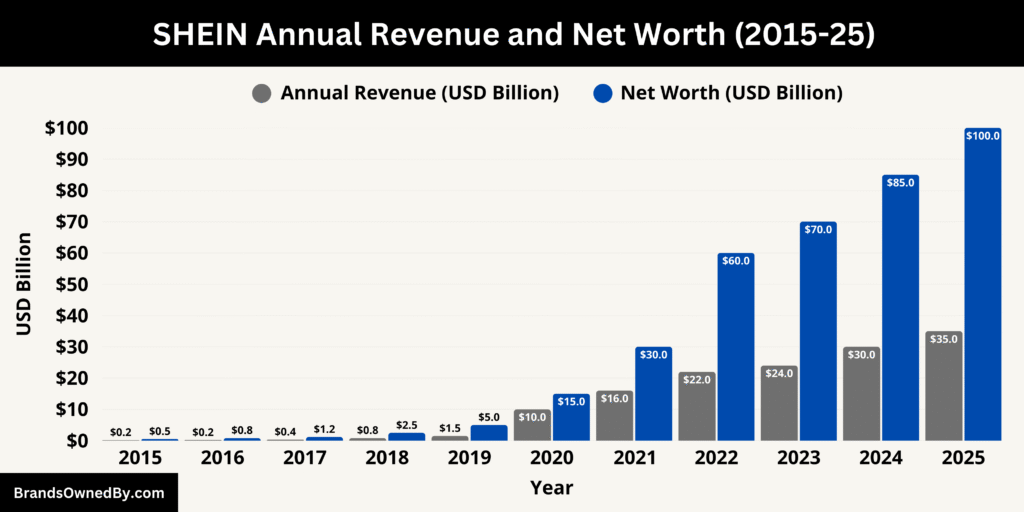

In 2025, SHEIN has solidified its position as one of the largest fashion retailers in the world—not just in e-commerce, but across all retail channels. With over $35 billion in annual revenue and a net worth approaching $100 billion, SHEIN stands among the most financially powerful private companies in the global fashion and retail sector. Its annual revenue and net worth reflect a decade of exponential growth powered by digital innovation, global supply chain mastery, and strong consumer demand for affordable fashion.

2025 Revenue Growth and Performance

SHEIN’s estimated annual revenue for 2025 is over $35 billion, marking a significant jump from previous years. In 2020, the company reported around $10 billion in sales. That figure tripled by 2022 as SHEIN expanded into new markets and broadened its product categories. By 2023, revenue reached approximately $24 billion, and continued aggressive growth has pushed it beyond $35 billion by mid-2025.

A major contributor to this surge is SHEIN’s expansion beyond fashion. The company has grown into beauty, home décor, electronics accessories, and even sustainable product lines. Its beauty brand, SHEGLAM, now rivals traditional cosmetics players in price-sensitive markets. Sub-brands like MOTF and DAZY have helped the company cater to broader demographics, including premium shoppers and urban youth markets.

In addition, SHEIN has made significant investments in local warehousing, regional fulfillment centers, and ultra-fast delivery systems in the United States, Europe, Mexico, and the Middle East. These investments have reduced shipping time and increased customer retention, contributing directly to revenue growth. Seasonal sales events like SHEIN Black Friday, Birthday Bash, and region-specific promotions have become major revenue drivers.

SHEIN’s mobile app continues to be one of the most downloaded fashion apps globally in 2025, with high conversion rates driven by social commerce, influencer engagement, and algorithmic product curation.

Net Worth and Market Valuation in 2025

As of 2025, SHEIN’s estimated net worth is between $90 billion and $100 billion, based on internal financial metrics, investor interest, and recent private fundraising rounds. Although the company is still privately held, investor activity in late 2024 and early 2025 suggests a valuation just shy of the $100 billion mark. Some analysts believe it may surpass that figure if the company proceeds with a public listing in the near future.

The company’s net worth is derived from several key factors: its enormous customer base, intellectual property in logistics and data modeling, global warehouse and distribution infrastructure, app technology, and brand value across multiple markets. SHEIN also benefits from a highly scalable cost structure and low overhead, as it does not maintain traditional brick-and-mortar retail locations.

The valuation also reflects SHEIN’s potential IPO ambitions. The company has reportedly been working on regulatory approvals and legal restructuring to meet listing standards in either Singapore, the United States, or both. If listed publicly, it would instantly become one of the most valuable fashion companies in the world, alongside Inditex (Zara’s parent company), LVMH, and H&M.

Despite occasional scrutiny over environmental and labor practices, SHEIN’s financial performance continues to attract interest from sovereign wealth funds, pension investors, and global equity partners, further supporting its high net worth in 2025.

Here is a detailed 10-year revenue and net worth history of SHEIN from 2015 to 2025:

| Year | Estimated Annual Revenue (USD) | Estimated Company Net Worth (USD) | Key Highlights |

|---|---|---|---|

| 2015 | $150 million | $500 million | Rebranded from SheInside to SHEIN; focused on women’s fashion |

| 2016 | $220 million | $800 million | Began expanding globally, especially in the U.S. and Middle East |

| 2017 | $350 million | $1.2 billion | Launched influencer marketing and mobile app optimization |

| 2018 | $800 million | $2.5 billion | Rapid global growth; began scaling supply chain in Guangzhou |

| 2019 | $1.5 billion | $5 billion | Entered new markets in Europe and Latin America |

| 2020 | $10 billion | $15 billion | Explosive growth during COVID-19; surged in U.S. market |

| 2021 | $16 billion | $30 billion | Surpassed H&M and Zara in U.S. online sales |

| 2022 | $22 billion | $60 billion | Attracted large investors; valuation hit record highs |

| 2023 | $24 billion | $70 billion | Shifted global HQ to Singapore; invested in regional logistics |

| 2024 | $30 billion | $85 billion | Expanded product categories and regional fulfillment centers |

| 2025 | $35+ billion | $90–100 billion | Preparing for IPO; operates in 150+ countries with multiple in-house brands |

Companies Owned by SHEIN

As of 2025, SHEIN operates a growing portfolio of in-house brands, subsidiaries, and digital commerce entities that serve diverse fashion, beauty, and lifestyle segments. These brands are developed, managed, and fully controlled by SHEIN. Rather than acquiring legacy fashion labels, SHEIN has focused on building its own ecosystem of vertically integrated, data-driven brands optimized for speed, affordability, and digital marketing.

Here’s a list of the top brands and companies owned by SHEIN as of July 2025:

| Brand/Entity | Launch Year | Category/Focus | Target Audience | Operational Status & Notes |

|---|---|---|---|---|

| SHEIN (Main Brand) | 2008 | Fast fashion, general apparel | Global (Gen Z, Millennials) | Flagship brand; core driver of SHEIN’s business and global identity |

| ROMWE | ~2014 | Streetwear, casual fashion | Gen Z, college youth | Operates with distinct branding but shares backend with SHEIN |

| DAZY | ~2021 | Korean/Japanese-style streetwear | Gen Z, urban youth | Popular in Asia and Western fashion circles, known for minimalist designs |

| EMERY ROSE | ~2021 | Boho, soft casualwear | Women 25–40 | Offers flowy, floral, and earth-toned fashion; slower product churn |

| MOTF | 2020 | Premium basics, minimalist apparel | Professionals, style-conscious | Premium materials; higher quality, still affordably priced |

| SHEGLAM | 2020 | Cosmetics and skincare | Global beauty consumers | Fast-growing beauty line; offers full makeup collections and skincare routines |

| LUVLETTE | ~2021 | Lingerie, shapewear, sleepwear | Women, inclusive sizing | Body-positive branding; comfort-focused with seasonal drops |

| PETSIN | ~2022 | Pet fashion and accessories | Pet owners, Gen Z & Millennials | Niche brand gaining popularity; affordable and playful designs |

| GLOWMODE | ~2021 | Activewear and athleisure | Fitness and casualwear shoppers | Trendy, functional workout wear; positioned as budget-friendly alternative |

| CUCCOO | ~2020 | Footwear (heels, boots, sneakers) | Global female consumers | Trend-based shoe collections; rapidly updated based on fashion cycles |

| Auri | 2024 | Luxury-inspired accessories | Fashion-forward, minimalist users | New brand focused on affordable elegance in jewelry and bags |

| S-HEIN Studios | ~2022 | Experimental design incubator | Trend testers, niche audiences | Used for testing new designs, collaborations, and sustainability trials |

| SHEIN Marketplace | 2023 | Third-party seller platform | Broader e-commerce market | Enables external brands and small businesses to sell through SHEIN’s platform |

| SHEIN Exchange | 2022 (pilot) | Resale & secondhand platform | Eco-conscious consumers | Focused on circular fashion; peer-to-peer resale of SHEIN products |

SHEIN (Core Brand)

The flagship brand, SHEIN, is the primary identity of the company and represents the bulk of its sales. It offers ultra-fast fashion for women, men, and children. Its product range includes apparel, footwear, accessories, bags, lingerie, and now even small electronics and home décor.

The core brand is designed using consumer browsing data, trend forecasting algorithms, and rapid design-to-production cycles. It is SHEIN’s most recognized label and drives massive global engagement via influencer campaigns, app-first promotions, and limited-time drops.

ROMWE

ROMWE is a sister brand to SHEIN and operates under the same supply chain and logistics infrastructure. It was originally a separate entity but is now fully controlled by SHEIN.

ROMWE offers casual streetwear and alternative fashion aimed at Gen Z audiences. The brand uses a playful tone, edgier designs, and trend-heavy visuals. ROMWE operates with its own branding and web platform but shares inventory systems with SHEIN.

DAZY

DAZY is SHEIN’s in-house brand focused on Korean and Japanese-inspired fashion, emphasizing minimalist streetwear aesthetics with soft color palettes and modern silhouettes.

Targeted primarily at urban millennials and younger Gen Z consumers, DAZY has become one of the most followed sub-brands within the SHEIN ecosystem. The brand features its own campaigns, styling lookbooks, and trend pages, all hosted within the SHEIN app.

EMERY ROSE

EMERY ROSE targets boho-chic and relaxed feminine fashion, with flowy dresses, soft textures, floral prints, and earth-toned palettes.

It appeals to women aged 25–40 who prefer a casual yet stylish wardrobe. Unlike SHEIN’s ultra-fast product churn, EMERY ROSE focuses on slightly more consistent capsule collections while maintaining affordability.

MOTF

MOTF (pronounced “motif”) is SHEIN’s entry into the premium basics and elevated essentials space. It offers higher-quality materials such as silk, linen, and organic cotton at competitive prices.

The brand targets working professionals and consumers who want quality without the luxury markup. MOTF is styled as an upscale alternative to SHEIN, marketed through lifestyle campaigns and polished, minimalist visuals.

SHEGLAM

SHEGLAM is SHEIN’s cosmetics and beauty brand, launched to compete with mass-market beauty retailers. It includes makeup, skincare, tools, and beauty accessories.

By 2025, SHEGLAM is one of the fastest-growing global beauty brands. It offers a full range of foundation, lipsticks, eyeshadow palettes, and skincare products. It is priced affordably and launched in themed collections in collaboration with influencers and cultural events.

SHEGLAM operates across multiple geographies and has even begun retail testing in international pop-up events, though it remains primarily e-commerce based.

LUVLETTE

LUVLETTE is SHEIN’s in-house lingerie and intimate wear brand. It features bras, shapewear, bodysuits, and sleepwear.

With a focus on body positivity, LUVLETTE offers inclusive sizing and comfort-focused designs. Campaigns focus on empowerment and affordability. The brand is fully integrated into SHEIN’s marketing engine, with seasonal collections and try-on haul trends on platforms like TikTok and Instagram.

PETSIN

PETSIN is SHEIN’s niche brand for pet fashion and accessories. It offers affordable clothing, collars, toys, and home products for dogs and cats.

The brand caters to the growing market of pet-loving millennials and Gen Z consumers. PETSIN is still emerging but gaining traction as a lifestyle brand extension of SHEIN.

GLOWMODE

GLOWMODE is SHEIN’s activewear and athleisure brand. It offers sports bras, leggings, workout sets, and performance wear at highly competitive prices.

With bold colorways and trendy designs, GLOWMODE competes with brands like Gymshark and Lululemon in the budget segment. It emphasizes functionality with breathable fabrics and high-stretch comfort.

CUCCOO

CUCCOO is SHEIN’s dedicated footwear brand, offering fashion sneakers, sandals, boots, and heels. It operates within the main SHEIN app but maintains distinct branding and product storytelling.

CUCCOO blends trend-based designs with comfort and affordability, catering to both fast-moving fashion and everyday essentials.

Auri

Auri is a recently launched luxury-inspired accessories brand. It offers bags, jewelry, sunglasses, and belts that replicate designer aesthetics without the price tag.

While still scaling, Auri is positioned as an affordable luxury extension of the SHEIN universe, appealing to fashion-forward consumers looking for elegant, minimalist accessories.

S-HEIN Studios (Experimental Design Unit)

S-HEIN Studios is not a brand in the traditional sense, but rather an internal design incubator within SHEIN. It is used to test new concepts, designer collaborations, eco-conscious collections, and limited edition product lines.

Some capsule drops and sustainability trials are launched under this label to test consumer response before full-scale integration into the main brand.

SHEIN Marketplace

Launched in select markets, the SHEIN Marketplace allows third-party brands and sellers to offer products on SHEIN’s platform. This move transforms SHEIN from a pure DTC retailer to a hybrid platform.

While not a separate brand, this marketplace structure is a new revenue stream that also supports localized sellers and manufacturers in markets like Brazil, the U.S., and the Middle East.

SHEIN Exchange (Resale Platform)

SHEIN Exchange is SHEIN’s pre-owned and resale initiative, launched in response to sustainability concerns. It allows consumers to resell SHEIN clothing in peer-to-peer fashion.

Although still in early stages, it reflects SHEIN’s attempt to enter the circular economy, offering both resale options and incentives for eco-conscious buyers.

Final Thoughts

SHEIN remains privately held and is led by its founder, Chris Xu, who holds significant ownership and decision-making power. The company’s unique e-commerce strategy and data-driven model have made it a global fashion powerhouse. While several investors hold minority shares, SHEIN’s core leadership remains in control. With billions in annual revenue and a valuation close to $100 billion, it is one of the most influential brands in modern retail.

FAQs

Who is Shein’s owner?

As of 2025, SHEIN is owned and led by Chris Xu, also known as Xu Yangtian. He is the company’s founder, CEO, and largest shareholder. Xu owns the largest equity stake and has maintained majority control through all funding rounds, making him the ultimate decision-maker within the company.

Who owns Shein clothing?

SHEIN owns and designs its own clothing, operating as a vertically integrated fast fashion brand. The company does not resell other brands but instead produces and distributes its own products using a data-driven on-demand model. All clothing under the SHEIN name, and its sub-brands like DAZY, MOTF, and GLOWMODE, are wholly owned by SHEIN.

Is Shein owned by China?

SHEIN was founded in China in 2008, but as of 2025, the company is legally headquartered in Singapore. It has global operations, with logistics hubs and warehouses in the U.S., Europe, Mexico, and the Middle East. While its supply chain is still heavily based in China, SHEIN is not state-owned and operates as a private global company.

Who is the largest shareholder of Shein?

The largest shareholder of SHEIN is Chris Xu. He is estimated to own 30–35% of the company, giving him dominant control over major business decisions and corporate strategy. No institutional investor holds more shares than Xu.

Is it Chris Xu or Sky Xu?

The correct name is Chris Xu, although he is sometimes mistakenly referred to as Sky Xu in media reports. His full Chinese name is Xu Yangtian, and Chris Xu is the name he uses professionally as CEO and founder of SHEIN.

Who is the biggest buyer of Shein?

The United States is currently the biggest market for SHEIN, accounting for a significant share of its annual sales. Within the U.S., Gen Z and millennial women are the primary buyers. Globally, SHEIN’s biggest buyers include young consumers from Europe, the Middle East, Latin America, and Southeast Asia, with a strong presence across social media-driven fashion communities.

What is Chris Xu’s net worth?

As of July 2025, Chris Xu’s estimated net worth is between $20 billion and $30 billion, based on his equity ownership in SHEIN. His wealth fluctuates with SHEIN’s valuation, which is estimated to be between $90 billion and $100 billion. Xu remains one of the richest private tech and retail entrepreneurs in Asia.

Who owns SHEIN in 2025?

Chris Xu, the founder and CEO, is the largest shareholder. The company is privately held with several minority investors.

Is SHEIN a Chinese company?

SHEIN was founded in China, but it has since relocated major parts of its operation abroad, especially to Singapore and the Middle East.

Is SHEIN publicly traded?

No, SHEIN is a private company. It has not gone public as of 2025.

Who invested in SHEIN?

Investors include IDG Capital, Sequoia Capital China, Tiger Global, General Atlantic, and Abu Dhabi-based investment groups.

Who is the founder of SHEIN?

SHEIN was founded in 2008 by Chris Xu (Xu Yangtian). He started the company in Nanjing, China, originally focusing on bridal wear before expanding into fast fashion. Xu’s background in SEO and cross-border e-commerce helped him build a global fashion empire from the ground up.