The New York Times is one of the most influential newspapers in the world. Many people wonder who owns The New York Times and how it operates behind the scenes. This article explores the newspaper’s ownership, control, financials, and more in detail.

History of The New York Times

The New York Times was founded on September 18, 1851, by journalist and politician Henry Jarvis Raymond and former banker George Jones. Originally called the New York Daily Times, it aimed to report the news honestly and without sensationalism. The publication grew steadily in readership and influence.

By the late 19th century, it was already one of the top newspapers in the United States. Adolph Ochs, a newspaper publisher from Tennessee, bought the paper in 1896. He reshaped its editorial tone, introducing the famous motto, “All the News That’s Fit to Print.” Under his leadership, The Times became a symbol of journalistic integrity and global reporting.

The Ochs-Sulzberger family has maintained control ever since. Their legacy in journalism spans over a century, with the paper becoming a staple in U.S. media history.

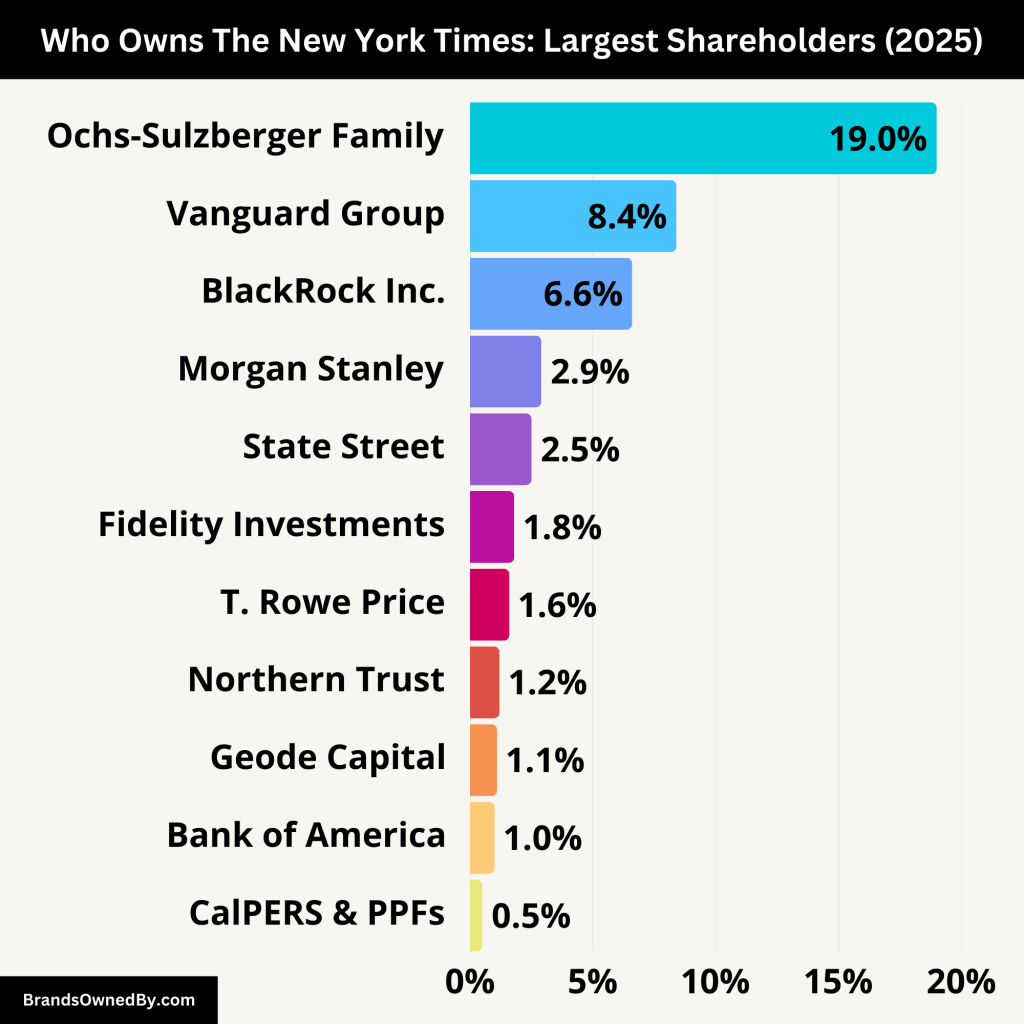

Who Owns The New York Times: Major Shareholders

The New York Times Company is a publicly traded media organization listed on the New York Stock Exchange (NYSE) under the ticker symbol NYT. However, ownership is structured in a way that allows one family — the Ochs-Sulzberger family — to retain control. While public shareholders own the majority of economic shares, the Ochs-Sulzberger family holds a special class of shares with superior voting power.

These Class B shares ensure the family has control over strategic decisions and board appointments, even if they don’t own most of the company’s equity.

The most prominent shareholders of The New York Times include:

| Shareholder | Estimated Ownership | Share Class | Type of Investor | Control / Influence |

|---|---|---|---|---|

| Ochs-Sulzberger Family | ~19% equity, 90% voting | Class B | Founding Family | Full control via Class B shares and board appointments |

| Vanguard Group | ~8.4% | Class A | Institutional (Passive) | Large economic stake, limited voting rights |

| BlackRock Inc. | ~6.6% | Class A | Institutional (Passive) | Financial interest only, no strategic influence |

| Morgan Stanley | ~2.9% | Class A | Institutional (Mixed) | Financial stakeholder, minimal governance role |

| State Street Corporation | ~2.5% | Class A | Institutional (Passive) | Index fund exposure, no control |

| Fidelity Investments | ~1.8% | Class A | Mutual Fund (Active/Passive) | Long-term investor, no editorial or board-level power |

| T. Rowe Price | ~1.6% | Class A | Institutional (Active) | Long-term economic holder, low governance impact |

| Northern Trust | ~1.2% | Class A | Institutional (Passive) | Minor shareholder, financial interest only |

| Geode Capital Management | ~1.1% | Class A | Index Fund Manager | Sub-advisor to Fidelity, no direct influence |

| Bank of America | <1% | Class A | Institutional/Private Wealth | Minimal role, manages investments on behalf of clients |

| CalPERS & Public Pension Funds | <0.5% | Class A | Public Pension Funds | Minority shareholders, sometimes active in policy issues |

| Public & Retail Investors | ~20–25% | Class A | Individual Investors | Economic interest, no control due to lack of voting power |

Ochs-Sulzberger Family – Controlling Shareholder

The Ochs-Sulzberger family remains the single most powerful force behind The New York Times. Though they own around 19% of the total equity, their control comes from owning over 90% of the Class B shares — which have enhanced voting rights. These shares are held in The 1997 Trust, a private family trust that ensures the company stays under family leadership and maintains editorial independence.

A.G. Sulzberger, the fifth-generation heir of the family legacy, serves as chairman and publisher, overseeing the company’s editorial direction, corporate mission, and strategic decisions. This structure enables the family to appoint the majority of the board and block any external takeover attempts.

The Vanguard Group – Largest Institutional Shareholder

The Vanguard Group is the largest institutional holder of Class A shares, owning approximately 8.4% of the company. As a passive investment manager, Vanguard’s interest is primarily financial.

Although Vanguard can vote on shareholder proposals, it cannot influence company strategy due to its lack of Class B shares. Vanguard’s role is representative of large institutional capital backing The Times for its long-term performance, especially in digital subscription growth.

BlackRock Inc. – Second-Largest Institutional Shareholder

BlackRock Inc. holds about 6.6% of the Class A shares. It is a major global investment firm and one of the largest holders of media and tech stocks across the market. Like Vanguard, BlackRock’s stake is passive, and its voting power is restricted to the Class A shareholder pool.

BlackRock benefits financially from The New York Times’ revenue and profit growth but has no editorial or governance control.

Morgan Stanley – Institutional Shareholder

Morgan Stanley owns roughly 2.9% of the Class A shares through its wealth management and institutional investment vehicles. The firm includes The Times in its client portfolios for long-term stability and digital media exposure.

Its stake provides economic benefit but does not allow for strategic influence within the company.

State Street Corporation – Passive Investor

State Street holds about 2.5% of Class A shares. Like Vanguard and BlackRock, State Street is a large index and mutual fund provider, holding shares in thousands of companies across the globe.

While State Street votes on shareholder issues, it holds no Class B shares and thus has no influence over board structure or top-level strategy.

Fidelity Investments – Active Mutual Fund Participant

Fidelity, through its mutual funds and actively managed accounts, owns around 1.8% of The New York Times Company. It is among the top ten institutional investors and is known for taking both long-term and opportunistic positions in media companies.

Fidelity’s role is financial, and while it may express opinions through shareholder proposals, it does not participate in company governance.

T. Rowe Price – Long-Term Institutional Holder

T. Rowe Price owns approximately 1.6% of the Class A shares. As an asset manager with a reputation for holding companies long-term, T. Rowe Price includes The Times in many of its core equity portfolios.

It benefits from dividend growth and share price appreciation but has no strategic control or voting clout beyond that of any regular Class A shareholder.

Northern Trust – Minority Shareholder

Northern Trust, another prominent asset manager, holds close to 1.2% of Class A shares. Its stake is relatively small but reflects institutional confidence in The Times’ financial health.

Northern Trust does not engage in management decisions and is classified as a passive investor.

Geode Capital Management – Index Fund Manager

Geode Capital, a lesser-known but significant index fund manager (and sub-advisor to Fidelity), owns about 1.1% of the company. Geode’s investments track indices and rely on long-term appreciation.

Its position reflects broader market participation but comes without any influence on company policy or leadership.

Bank of America – Investment Management Arm

Bank of America, through Merrill Lynch and its private wealth division, holds under 1% of the Class A shares. It invests on behalf of institutional clients and high-net-worth individuals. While its stake is small, it adds to the collective power of institutional investors backing The Times’ business model.

Public and Retail Investors – Collective Shareholders

Together, public and retail investors hold around 20–25% of the Class A shares. These include individual investors, small fund managers, and private portfolios. Shares can be bought and sold on the New York Stock Exchange under the ticker NYT.

These investors have no special voting rights, and their voice is largely symbolic in shareholder meetings. However, their interest supports market liquidity and overall valuation.

CalPERS and Public Pension Funds – Minority but Influential

CalPERS (California Public Employees’ Retirement System) and other public pension funds often hold fractional shares of The New York Times in their diversified portfolios. While their holdings are small — often less than 0.5% — they may engage in governance issues, particularly those related to corporate responsibility, diversity, or executive pay.

Public and Retail Investors – Broad Market Participants

Individual investors and smaller institutions collectively own about 20–25% of the Class A shares. These shares are traded on the NYSE and are accessible to any retail investor.

Although they do not have much voting power, retail investors benefit from the company’s financial performance through capital gains and dividends. Their investment is purely economic with no direct input in corporate governance.

Who Controls The New York Times?

Despite being a publicly traded company, The New York Times Company is effectively controlled by the Ochs-Sulzberger family through its unique dual-class share structure. The real power lies not just in ownership but in voting rights, board influence, and leadership roles.

The Ochs-Sulzberger Family Trust – Ultimate Decision-Maker

At the core of control is The 1997 Trust, a private family trust established to safeguard the mission, independence, and direction of the company. This trust holds all Class B shares, which carry enhanced voting power — each Class B share is worth one vote, whereas each Class A share only counts as one vote per 10 shares when it comes to key decisions such as board appointments.

This gives the family the power to elect 70% of the company’s board of directors, allowing them to effectively steer corporate governance. While their economic stake is under 20%, they wield over 90% of the company’s voting power, insulating them from market pressure or activist investor campaigns.

A.G. Sulzberger – Chairman and Publisher

Arthur Gregg (A.G.) Sulzberger is the current chairman of the board and publisher of The New York Times. A fifth-generation member of the Ochs-Sulzberger family, he was appointed publisher in 2018, succeeding his father Arthur O. Sulzberger Jr., and later became chairman in 2021.

A.G. Sulzberger is responsible for upholding the editorial values of the newspaper and ensuring its independence and credibility. He also oversees long-term strategic direction, digital innovation, and journalistic integrity. His leadership reflects both family legacy and a commitment to transformation in the digital era.

Meredith Kopit Levien – President and Chief Executive Officer (CEO)

Meredith Kopit Levien has served as the President and CEO of The New York Times Company since September 2020. She joined the company in 2013 and previously held roles as Chief Operating Officer and Chief Revenue Officer.

As CEO, she is responsible for the company’s business operations, financial strategy, technology development, and overall growth. Levien has been a major force in the company’s successful transition to a digital-first, subscription-based model, which has become the foundation of its revenue growth.

Her leadership has helped expand the company’s product portfolio, including The Athletic and Wordle, while focusing on subscriber growth and profitability.

Board of Directors – Largely Appointed by the Family

The company’s board of directors consists of a mix of independent members and family representatives, most of whom are appointed via Class B voting rights held by the family trust.

While independent directors provide oversight, the majority are aligned with or directly chosen by the Ochs-Sulzberger family. This ensures the board remains aligned with the long-term vision of preserving journalistic integrity over short-term market demands.

Executive Leadership Team – Operational Control

Alongside the CEO, The New York Times is run by a senior executive leadership team that includes:

- Roland A. Caputo – Executive Vice President and Chief Financial Officer

- Diane Brayton – Executive Vice President, General Counsel & Secretary

- Joseph Kahn – Executive Editor of The New York Times newsroom

- Hannah Yang – Chief Growth Officer.

This team is responsible for executing the company’s digital strategy, managing day-to-day operations, overseeing editorial independence, and ensuring consistent financial performance.

Editorial Independence – Protected by Structure

Even though it is a for-profit public company, editorial independence is carefully protected through the family’s continued control. The Class B voting rights and board structure were intentionally designed to shield the newsroom from commercial or political influence.

Decisions around hiring senior editors, approving major coverage, and setting editorial standards rest with the publisher and executive editor, not external shareholders or advertisers.

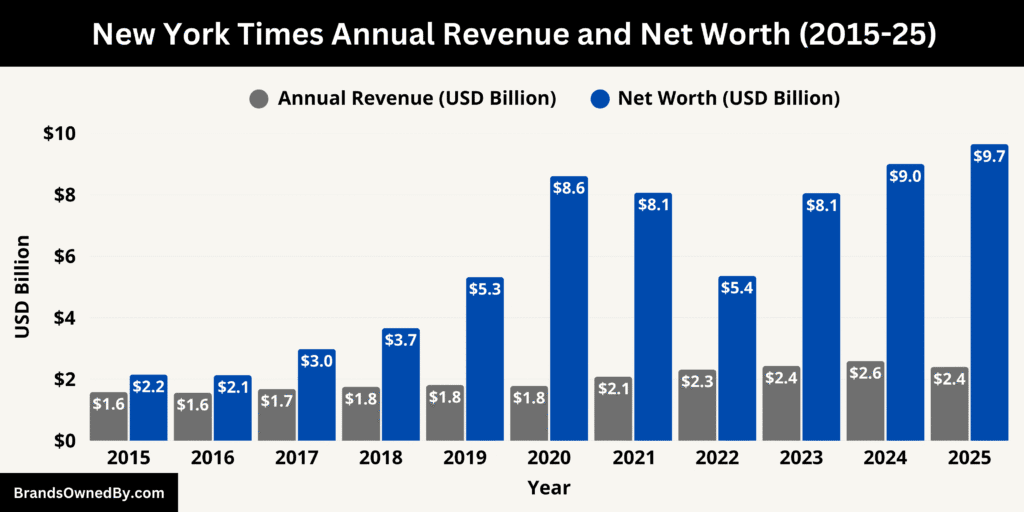

Annual Revenue and Net Worth of The New York Times

The New York Times Company is one of the most financially successful media organizations in the world. In 2025, it generated around $2.4 billion in annual revenue, largely driven by digital subscriptions and advertising. As of September 2025, the company’s net worth stands at $9.65 billion, making it one of the most valuable journalism brands globally.

Here’s an overview of the historical revenue and net worth of The New York Times:

| Year | Annual Revenue (USD billions) | Market Cap / Net Worth (USD billions) | Notes on Revenue Growth |

|---|---|---|---|

| 2015 | $1.579 | $2.15 | Relatively flat, transition toward digital just beginning |

| 2016 | $1.555 | $2.13 | Slow growth, still heavily reliant on print |

| 2017 | $1.676 | $2.98 | Substantial gains from early digital subscription push |

| 2018 | $1.749 | $3.66 | Growth fueled by steady subscription increases |

| 2019 | $1.812 | $5.32 | Modest growth over previous years |

| 2020 | $1.784 | $8.61 | Slight decline, impacted by pandemic and advertising slowdown |

| 2021 | $2.075 | $8.07 | Jump from 2020 due to post-pandemic recovery and digital push |

| 2022 | $2.308 | $5.36 | Continued growth in subscriptions and digital products |

| 2023 | $2.426 | $8.05 | Strong digital expansion, including The Athletic |

| 2024 | $2.586 | $9 | Growth of ~6.6% over 2023, driven by subscription bundles |

| 2025 | $2.4 | $9.65 | Stable compared to 2024, with growth in digital subscriptions and lifestyle products |

Annual Revenue of The New York Times

The New York Times Company, publisher of The New York Times, continues to thrive as a leading global media organization. Its business model is now driven largely by digital subscriptions, advertising, and premium products, making it one of the strongest examples of a successful digital transformation in the journalism industry.

In 2025, the company reported annual revenue of about $2.4 billion. The majority came from digital subscriptions, which include core news products, The Athletic, NYT Cooking, and puzzle subscriptions. Digital revenue now accounts for more than two-thirds of the company’s total, marking a decisive shift away from reliance on print.

The New York Times earns revenue from several major streams:

- Subscriptions – the largest contributor, including both print and digital.

- Advertising – digital ads showing steady growth alongside legacy print advertising.

- Licensing and syndication – distribution of NYT content to partners worldwide.

- Other products and acquisitions – such as games, lifestyle products, and specialty subscriptions.

Net Worth of The New York Times Company

As of September 2025, the net worth of The New York Times Company, measured by its market capitalization, is approximately $9.65 billion. This valuation underscores the company’s strong financial health, brand power, and consistent profitability.

The company’s subscriber base of more than 10 million paying users, combined with its diverse revenue streams, ensures long-term sustainability. Unlike many legacy newspapers, The New York Times has successfully positioned itself as a dominant force in the digital media landscape.

Financial Growth Outlook

Looking forward, the company expects further growth from:

- Expanding its global digital subscriber base.

- Scaling sports and lifestyle verticals like The Athletic and Cooking.

- Investing in podcasts, newsletters, and audio journalism.

These strategies will likely allow the company to maintain revenue stability and potentially grow its market capitalization beyond $10 billion in the coming years.

Companies Owned by The New York Times

The New York Times Company has expanded its portfolio in recent years. It owns a range of media and digital assets:

| Company / Brand | Type | Details |

|---|---|---|

| The New York Times | Core news brand | Flagship publication, both print and digital editions |

| The Athletic | Sports media | Acquired in 2022 for $550 million |

| Wordle | Puzzle game | Acquired in early 2022 for low seven-figure sum |

| NYT Games | Digital games platform | Includes Crossword, Spelling Bee, Wordle, and others |

| NYT Cooking | Digital cooking subscription | Lifestyle platform with 20,000+ recipes |

| Wirecutter | Product recommendation site | Acquired in 2016, earns via affiliate links |

| Serial Productions | Podcast production company | Acquired in 2020, creators of the “Serial” podcast |

| NYT Audio App | Digital audio platform | In-house app launched in 2023 for exclusive audio content |

| The Daily | News podcast | Produced and owned by The New York Times newsroom |

| T Brand Studio | Branded content and ad studio | Internal advertising and storytelling division |

| NYT Live | Events and conferences | Hosts DealBook, Climate Forward, and other live journalism events |

The New York Times (Core News Publication)

At the center of the company is The New York Times, its flagship news brand with global reach. It includes both the print edition and the NYTimes.com digital platform, which serves millions of readers daily across the web and mobile.

The Times offers award-winning journalism in politics, global affairs, science, health, business, arts, and opinion. It publishes content in multiple formats including text, audio, video, graphics, and interactive features.

As of 2024, the core news product has over 8 million digital subscribers. It forms the editorial and reputational foundation of the entire company.

The Athletic

Acquired in 2022 for $550 million, The Athletic is a digital sports media company that covers over 200 sports teams globally. It offers detailed game analysis, insider reporting, and deep storytelling across professional and collegiate leagues.

The Athletic brought over 1.2 million paid subscribers to The New York Times ecosystem. It now operates within the Times’ bundle offering, with increased integration across the platform.

While it has yet to turn a profit, The Athletic is central to The Times’ strategy of expanding into verticals that capture passionate audiences.

Wordle

Wordle, the viral word puzzle game, was purchased in early 2022 for a low seven-figure sum. Created by Josh Wardle, it became a global sensation, with millions playing daily.

Since the acquisition, Wordle has been integrated into NYT Games, helping increase user engagement and subscriber retention. It remains free to play but supports the company’s subscription goals by introducing casual users to the NYT digital ecosystem.

NYT Games

NYT Games is one of the company’s top-performing verticals. It includes:

- The Crossword (a legacy favorite since 1942)

- The Mini Crossword

- Spelling Bee

- Letter Boxed

- Wordle

- Tiles

NYT Games has over 1 million paying subscribers and is a leading example of how a news brand can expand into digital entertainment and habitual user engagement. It serves both as a revenue stream and a brand extension.

NYT Cooking

NYT Cooking is a recipe subscription product featuring over 20,000 professionally tested recipes, how-to videos, and culinary guides. It’s one of the Times’ most successful lifestyle offerings, now with over 1 million subscribers.

NYT Cooking appeals to a younger, lifestyle-oriented demographic and includes curated recipe collections, meal-planning tools, and seasonal content. It also generates revenue through branded content and partnerships with cookware and food brands.

Wirecutter

Acquired in 2016, Wirecutter is The Times’ commerce and product recommendation site. It earns revenue through affiliate links and product referral commissions.

Wirecutter covers:

- Consumer tech (laptops, phones)

- Home goods and furniture

- Kitchen tools

- Fitness and sleep products

- Health and personal care

It has maintained editorial independence from advertisers, which has earned it strong reader trust. Wirecutter plays a critical role in diversifying revenue beyond subscriptions.

Serial Productions

Serial Productions, acquired in 2020, is known for the hit investigative podcast “Serial”, which revolutionized narrative audio journalism.

Under Times ownership, Serial Productions continues to create high-quality, episodic content including:

- Serial (Season 1 and sequels)

- Nice White Parents

- The Trojan Horse Affair

- The Coldest Case in Laramie

These shows are distributed through The Times’ audio app and mainstream podcast platforms, driving brand equity and audio revenue.

The New York Times Audio App

Launched in 2023, this is a dedicated app for audio journalism and spoken-word content. It features:

- Narrated articles from Times journalists

- Exclusive audio stories

- The Daily (NYT’s flagship podcast)

- Podcasts from Serial and third-party creators

The audio app is part of the Times’ “subscriber value bundle”, designed to give subscribers access to diverse media formats in one place.

The Daily (Podcast)

While not a separate company, The Daily is a key audio brand within The Times portfolio. Hosted by Michael Barbaro, it reaches over 4 million listeners per day, making it one of the most listened-to news podcasts in the world.

It drives audience engagement, advertising revenue, and reinforces the brand’s position in modern journalism. The Daily has also spun off other Times shows like:

- The Run-Up

- The Ezra Klein Show

- Hard Fork

These shows are part of the Times’ long-term audio monetization and audience strategy.

NYT Live and Events

NYT Live is the company’s live journalism and event business. It includes conferences, speaker series, and interactive live events such as:

- DealBook Summit

- The New York Times Climate Forward

- Health and Tech Conferences

NYT Live is a growing revenue stream through ticket sales, sponsorships, and brand partnerships, while also building reader loyalty.

T Brand Studio

T Brand Studio is the branded content and advertising division of The Times. It produces high-end native ads, sponsored stories, and immersive content for advertisers. It serves blue-chip clients in industries like tech, finance, luxury, and travel.

The studio blends journalism-inspired storytelling with marketing, contributing to advertising revenue in a way that doesn’t dilute editorial trust.

Times Journeys (Previously Operated)

Times Journeys was a travel brand offering guided tours curated by Times journalists and contributors. While it was paused during the pandemic, it represents a past attempt to extend the brand into experiential media and travel. Its future remains uncertain, but the infrastructure may return in some form as travel rebounds.

Final Thoughts on The New York Times Ownership

So, who owns The New York Times?

Technically, it’s a publicly traded company. But in reality, the Ochs-Sulzberger family controls it through a special voting share structure. This unique setup allows them to guide the paper’s direction while letting the public invest in its financial success.

Over the years, the company has expanded beyond print journalism into digital platforms, games, cooking, and sports. The New York Times remains a vital and evolving institution in the media world.

FAQs

Who is the largest shareholder of The New York Times?

The largest controlling shareholder is the Ochs-Sulzberger family through The 1997 Trust. They hold nearly all Class B shares, giving them over 90% of voting power.

Can I buy shares of The New York Times?

Yes. You can buy Class A shares on the New York Stock Exchange under the ticker symbol NYT. These shares come with limited voting rights.

Is The New York Times privately owned?

No, it is a public company. However, control remains with the founding family due to their ownership of special Class B shares.

Who is the CEO of The New York Times?

The current CEO of The New York Times is Meredith Kopit Levien. She became CEO in 2020 and has overseen the company’s shift to digital media, growing its subscription base significantly.

How much of The New York Times does the Sulzberger family own?

The Sulzberger family, through its holding company Ochs-Sulzberger Family Trust, owns over 90% of the voting shares in The New York Times Company, allowing them to maintain control of the company despite owning a smaller portion of the total equity.

Is The New York Times owned by a billionaire?

While The New York Times is not directly owned by a single billionaire, its largest shareholders include significant institutional investors like The Vanguard Group and BlackRock. The Sulzberger family, which controls the company, has kept its ownership within the family.

How profitable is The New York Times?

The New York Times Company is highly profitable, with an estimated annual revenue of $2.4 billion in 2023. The company has seen steady growth in its digital revenue streams, especially from subscriptions, which now make up a significant portion of its earnings.

Does The New York Times own The Athletic?

Yes, The New York Times acquired The Athletic in January 2022 for $550 million. The Athletic is a sports media company that covers sports teams and leagues worldwide, contributing to The Times’ growing sports content portfolio.

How many subscribers does The New York Times have?

As of 2024, The New York Times has over 10 million total subscribers, with the majority of these being digital subscriptions across various offerings, including news, games, cooking, and sports.

What brands does The New York Times own?

The New York Times owns several brands, including:

- The Athletic (sports media)

- Wordle (puzzle game)

- NYT Games (digital games platform)

- Wirecutter (product review site)

- NYT Cooking (digital cooking subscription)

- Serial Productions (podcast production)

- T Brand Studio (branded content and advertising).