Starbucks is one of the most recognized coffee brands in the world. Founded in 1971, the company has grown into a global powerhouse in the coffee industry. But who owns Starbucks?

The company is publicly traded, with various institutional and retail investors holding shares. The largest shareholder plays a significant role in decision-making, influencing the company’s direction and growth.

History of Starbucks

Starbucks was founded in 1971 in Seattle, Washington, by Jerry Baldwin, Gordon Bowker, and Zev Siegl. Initially, it sold only coffee beans and equipment. In 1982, Howard Schultz joined the company and introduced the idea of selling espresso-based drinks.

Schultz later acquired the company in 1987 and expanded it into a global coffee chain.

Starbucks has grown rapidly, entering international markets and acquiring various coffee-related brands.

Who Owns Starbucks?

Starbucks is a publicly traded company listed on the NASDAQ under the ticker symbol SBUX. Its ownership is distributed among institutional investors, mutual funds, and retail investors. The largest shareholder is Vanguard Group, one of the world’s leading investment firms.

List of Starbucks Shareholders

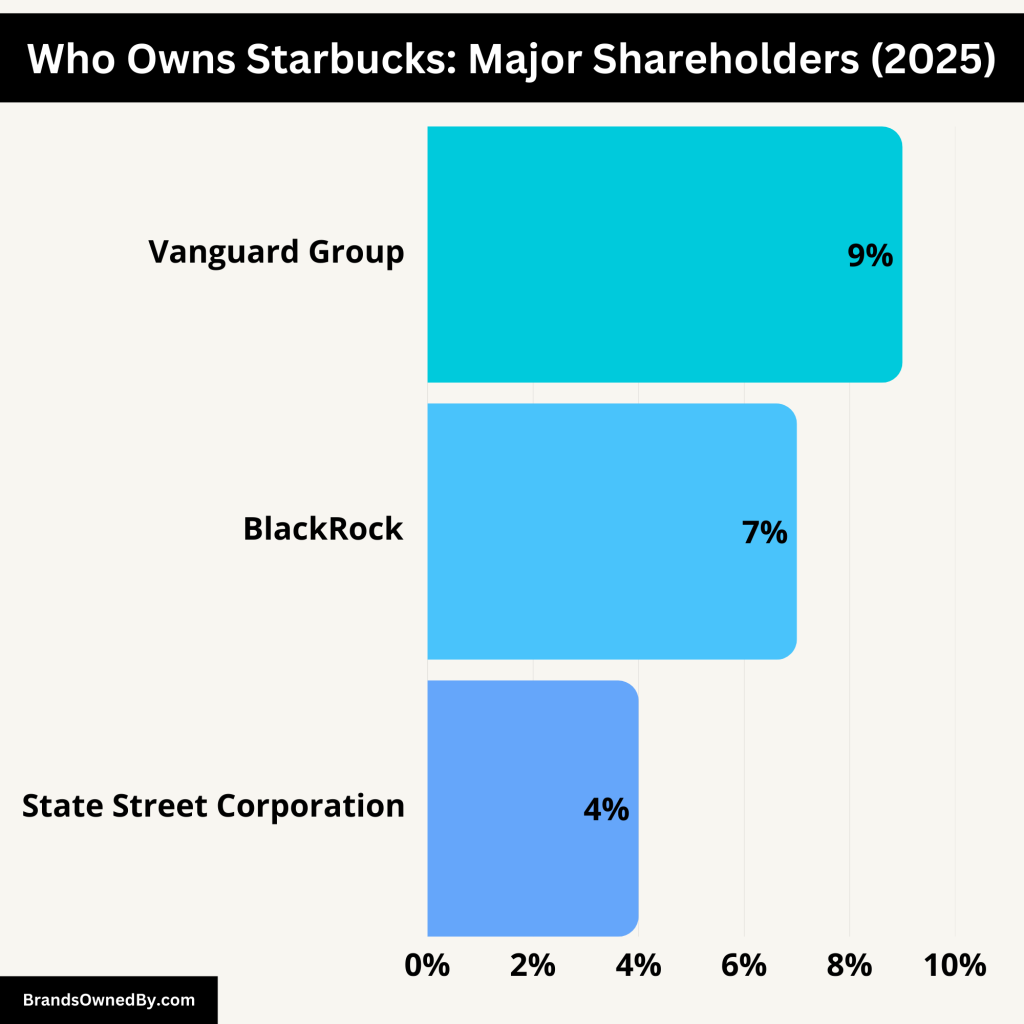

Here’s a list of the major shareholders of Starbucks:

| Shareholder | Ownership Percentage | Role & Influence |

|---|

| Vanguard Group | ~9% | Largest shareholder, invests through index funds, influences corporate decisions via shareholder votes. |

| BlackRock | ~7% | Global asset manager, influences governance policies and long-term business strategy. |

| State Street Corporation | ~4% | Major institutional investor, advocates for corporate governance and sustainability. |

| Howard Schultz | Varies (individual stake) | Former CEO and chairman, influential in Starbucks’ culture and business strategy. |

| Fidelity Investments | Significant (various funds) | Major mutual fund investor, holds Starbucks stock across multiple funds. |

| Geode Capital Management | Not publicly disclosed | Passive investment firm, holds shares through index funds. |

| Morgan Stanley | Not publicly disclosed | Owns shares through wealth management and investment funds. |

| Other Institutional & Retail Investors | Remaining shares | Mix of pension funds, hedge funds, and individual investors who trade Starbucks stock. |

Vanguard Group

Vanguard Group is the largest institutional shareholder of Starbucks, owning approximately 9% of the company’s outstanding shares. Vanguard is one of the world’s largest asset management firms, overseeing trillions of dollars in global investments. It primarily invests in Starbucks through its index funds, which track the performance of the stock market. Because Vanguard represents the interests of millions of investors, including individuals and pension funds, it does not actively participate in day-to-day operations but exerts influence through shareholder votes on key corporate decisions.

BlackRock

BlackRock, another leading asset management company, holds around 7% of Starbucks shares. Known as the world’s largest investment manager, BlackRock has a strong presence in global financial markets. Like Vanguard, BlackRock owns Starbucks stock mainly through index and mutual funds. The company advocates for corporate governance practices that align with long-term shareholder interests. While it does not directly control Starbucks’ operations, BlackRock’s voting power in shareholder meetings gives it a say in executive compensation, environmental policies, and corporate strategy.

State Street Corporation

State Street Corporation owns roughly 4% of Starbucks’ outstanding shares. As one of the “Big Three” investment firms alongside Vanguard and BlackRock, State Street manages assets for institutional investors, including pension funds and government agencies. The firm invests in Starbucks through its ETFs and index funds. Though State Street does not directly influence Starbucks’ business decisions, it actively participates in corporate governance discussions, including sustainability and diversity initiatives.

Howard Schultz

Howard Schultz, the former CEO and chairman of Starbucks, played a crucial role in transforming the company into a global coffee empire. While he no longer holds a controlling stake, Schultz remains a significant individual shareholder. Over the years, he has sold portions of his stock but retains a vested interest in the company’s future. His influence extends beyond ownership, as he has returned multiple times to lead Starbucks through pivotal periods, most recently in 2022 as interim CEO. Despite stepping down, his legacy and business philosophy continue to shape Starbucks’ direction.

Fidelity Investments

Fidelity Investments is a major mutual fund manager that holds a significant stake in Starbucks. With various funds investing in Starbucks stock, Fidelity plays a role in shaping shareholder decisions through its voting power. The firm manages retirement and investment accounts for millions of clients, indirectly giving them ownership in Starbucks. Fidelity’s investment in Starbucks is primarily driven by the company’s strong financial performance and brand loyalty.

Geode Capital Management

Geode Capital Management, an institutional investment firm, owns a notable percentage of Starbucks shares. The firm specializes in passive investments, meaning its stake in Starbucks is held through index funds that track the stock market. Geode does not directly influence Starbucks’ business strategy but participates in shareholder voting.

Morgan Stanley

Morgan Stanley is another major shareholder in Starbucks, holding shares through its wealth management and investment funds. The firm provides financial services to high-net-worth individuals and institutions that invest in Starbucks. While Morgan Stanley does not play an active role in Starbucks’ management, its analysts closely monitor the company’s stock and provide investment recommendations to clients.

Other Institutional and Retail Investors

Aside from these major shareholders, Starbucks is also owned by a mix of institutional and retail investors. These include mutual funds, pension funds, hedge funds, and individual investors who buy and trade Starbucks stock on the NASDAQ. While retail investors have limited direct influence, institutional investors collectively shape Starbucks’ governance through shareholder meetings and proxy votes.

Who Controls Starbucks?

While Starbucks is owned by various institutional and retail investors, the company’s control lies in the hands of its executive leadership and board of directors. These key decision-makers shape Starbucks’ business strategy, expansion plans, and overall corporate governance.

Board of Directors – The Governing Body

Starbucks is governed by a board of directors that oversees major business decisions, including mergers, acquisitions, executive appointments, and shareholder interests. The board is composed of independent directors and company executives who guide Starbucks’ long-term vision. The chairman of the board leads governance discussions and ensures the company operates in shareholders’ best interests.

Laxman Narasimhan – The CEO of Starbucks

Laxman Narasimhan is the current Chief Executive Officer (CEO) of Starbucks, having taken over the role in March 2023. He succeeded Howard Schultz, who briefly returned as interim CEO before stepping down.

Narasimhan has an extensive background in business leadership. Before joining Starbucks, he served as the CEO of Reckitt, a multinational consumer goods company. He also held executive positions at PepsiCo, focusing on global business operations.

As Starbucks’ CEO, he is responsible for daily operations, strategic growth, and international expansion. Under his leadership, Starbucks continues to focus on digital innovation, sustainability, and customer experience.

Howard Schultz – The Visionary Founder

Howard Schultz is widely regarded as the driving force behind Starbucks’ global success. Although he did not originally found Starbucks, he played a pivotal role in transforming it into a global coffee empire.

Starbucks was founded in 1971 by Jerry Baldwin, Gordon Bowker, and Zev Siegl in Seattle, Washington. Initially, it sold only coffee beans and equipment. However, Schultz, who joined the company in 1982 as Director of Retail Operations, saw the potential of selling handcrafted espresso beverages. After acquiring Starbucks in 1987, he expanded it into a global brand inspired by Italian coffee culture.

Schultz served as CEO multiple times, leading the company through crucial periods of expansion and reinvention. Even though he is no longer the CEO, his legacy and influence continue to shape Starbucks’ values, innovation, and customer experience.

Executive Leadership – Managing Daily Operations

Apart from the CEO, Starbucks’ executive team includes key figures responsible for different areas of the business, including finance, marketing, operations, and global strategy. Some of the most critical roles include:

- Chief Financial Officer (CFO): Manages Starbucks’ financial performance, investor relations, and revenue growth strategies.

- Chief Operating Officer (COO): Oversees the company’s supply chain, retail operations, and customer service.

- Chief Marketing Officer (CMO): Leads branding, digital innovation, and customer engagement initiatives.

Institutional Investors – Indirect Control Through Shareholder Influence

Although Starbucks’ daily operations are controlled by executives and the board, institutional investors like Vanguard Group, BlackRock, and State Street Corporation influence decision-making through shareholder voting rights. These investors advocate for business strategies that enhance profitability and shareholder value.

Annual Revenue and Net Worth of Starbucks

Starbucks Annual Revenue

In fiscal year 2024, Starbucks faced financial challenges, reporting a 1% decline in annual revenue to $36.2 billion. This downturn was attributed to decreased customer traffic and increased competition.

From 2015 to 2019, Starbucks experienced consistent revenue growth, peaking at $26.51 billion in 2019. However, in 2020, the company faced an 11.3% decline in revenue, likely due to global disruptions. A significant rebound occurred in 2021 with a 23.5% increase, followed by steady growth through 2023. In 2024, revenue growth plateaued at 0.6%, indicating potential market saturation or increased competition.

The revenue of Starbucks for the last 10 years with YoY% is listed below:

| Fiscal Year | Annual Revenue (in billions) | YoY Growth (%) |

|---|

| 2015 | $19.16 | — |

| 2016 | $21.32 | +11.3% |

| 2017 | $22.39 | +5.0% |

| 2018 | $24.72 | +10.4% |

| 2019 | $26.51 | +7.2% |

| 2020 | $23.52 | -11.3% |

| 2021 | $29.06 | +23.5% |

| 2022 | $32.25 | +10.9% |

| 2023 | $35.98 | +11.6% |

| 2024 | $36.18 | +0.6% |

Starbucks Net Worth

As of March 2025, Starbucks’ market capitalization is approximately $112.28 billion. Market capitalization, calculated by multiplying the current stock price by the total number of outstanding shares, reflects the company’s net worth. This valuation indicates a modest recovery from the previous year’s financial struggles.

The company’s market capitalization mirrored its revenue trends, with notable growth from 2015 to 2021. The peak in 2021 at $132.59 billion was followed by declines in 2022 and 2023. By the end of 2024, market capitalization showed a modest recovery to $114.25 billion, reflecting investor confidence despite recent revenue stagnation.

The historical net worth of Starbucks from 2015-24 is as below:

| Year-End | Market Capitalization (in billions) | YoY Change (%) |

|---|---|---|

| 2015 | $61.36 | +48.2% |

| 2016 | $57.60 | -6.1% |

| 2017 | $60.69 | +5.4% |

| 2018 | $69.63 | +14.7% |

| 2019 | $96.84 | +39.1% |

| 2020 | $120.27 | +24.2% |

| 2021 | $132.59 | +10.2% |

| 2022 | $112.44 | -15.2% |

| 2023 | $108.83 | -3.2% |

| 2024 | $114.25 | +5.0% |

Starbucks Market Share and Competitors

Starbucks holds a significant position in the global coffee industry. In the United States, it commands approximately 40% of the coffee shop market. Globally, Starbucks operates over 39,477 stores across more than 80 countries, making it the largest coffeehouse chain worldwide.

Starbucks Competitors

The major competitors of Starbucks are listed below:

Dunkin’

Dunkin’ is one of Starbucks’ primary competitors, particularly in the United States. With over 12,000 locations, Dunkin’ holds a 26% share of the U.S. coffee shop market. Originally known for its doughnuts, Dunkin’ has shifted focus towards coffee, offering a range of beverages that rival Starbucks’ menu. Its value-oriented pricing and strong rewards program have contributed to its substantial market presence.

McDonald’s McCafé

McDonald’s, through its McCafé line, has become a formidable competitor in the coffee segment. Leveraging its extensive global presence of over 41,000 restaurants, McDonald’s offers a variety of coffee drinks at competitive prices. The convenience of McCafé within existing McDonald’s locations appeals to customers seeking quick service.

Tim Hortons

Tim Hortons is a Canadian-based coffee and fast-food chain with over 4,500 locations as of June 2024. While its primary market is Canada, Tim Hortons has expanded into the U.S. and other countries, offering a menu that includes coffee, baked goods, and breakfast items. Its strong brand loyalty in Canada and growing international presence make it a notable competitor.

Dutch Bros

Dutch Bros is an Oregon-based coffee chain rapidly expanding across the United States. Known for its drive-through service and a diverse menu of iced and espresso-based drinks, Dutch Bros has nearly 1,000 locations. Its focus on customer service and unique offerings has garnered a loyal customer base, posing a growing challenge to established coffee chains.

Luckin Coffee

Luckin Coffee, a Chinese coffee chain, has experienced rapid growth, expanding from 10,000 to 22,340 stores in just two years, surpassing Starbucks in China. Offering competitively priced coffee and a mobile-first ordering system, Luckin plans to enter the U.S. market, starting with New York City. Its aggressive expansion strategy and affordability present a competitive threat to Starbucks.

Chagee

Chagee, founded in 2017, is a prominent Chinese coffee chain planning to open its first U.S. location in Los Angeles. With nearly 6,400 locations across China, Malaysia, Singapore, and Thailand, Chagee aims to expand into 100 countries. Its entry into the U.S. market introduces another competitor in the specialty coffee segment.

Brands Owned by Starbucks

Starbucks has acquired several brands to expand its market presence.

Starbucks has expanded its influence beyond its core coffee business by acquiring and developing various brands. These brands cater to different customer preferences, from premium tea to bottled water and fresh juices. Each acquisition has played a role in strengthening Starbucks’ presence in the beverage and food industries.

Teavana

Starbucks acquired Teavana in 2012 for $620 million to enter the premium tea market. Teavana specialized in loose-leaf teas, herbal infusions, and high-end tea accessories. The acquisition aimed to diversify Starbucks’ offerings, capitalizing on the growing global tea market.

Starbucks initially expanded Teavana by integrating its products into stores and opening dedicated Teavana retail locations. However, in 2017, Starbucks announced the closure of all standalone Teavana stores due to underperformance. Despite this, Teavana-branded teas remain available in Starbucks locations, grocery stores, and online, maintaining its presence as Starbucks’ premium tea brand.

Seattle’s Best Coffee

Seattle’s Best Coffee was acquired by Starbucks in 2003 to compete in the lower-priced coffee segment. Originally founded in 1970, Seattle’s Best Coffee focused on providing smooth, mild coffee blends at a more affordable price than Starbucks’ premium offerings.

The brand allowed Starbucks to target budget-conscious consumers while maintaining a presence in fast-food chains, convenience stores, and grocery retailers. Despite its strong distribution network, Starbucks announced in 2022 that it would sell the Seattle’s Best Coffee brand to Nestlé as part of a broader corporate strategy to streamline its portfolio.

Evolution Fresh

Starbucks acquired Evolution Fresh in 2011 for $30 million to enter the premium cold-pressed juice market. Evolution Fresh specialized in nutritious, preservative-free juices, aligning with growing consumer demand for healthy beverages.

Initially, Starbucks integrated Evolution Fresh juices into its stores and even launched standalone juice bars. However, in 2022, Starbucks sold Evolution Fresh to Bolthouse Farms while retaining the brand’s distribution in Starbucks locations. The brand continues to be recognized for its high-quality, cold-pressed juices available in grocery stores across the U.S.

Ethos Water

Ethos Water, acquired by Starbucks in 2005, is a bottled water brand with a social mission. Starbucks purchased the brand to promote its commitment to corporate social responsibility, pledging a portion of Ethos Water sales to fund clean water projects worldwide.

Each bottle of Ethos Water contributes to funding water access initiatives in developing countries. Through this program, Starbucks has helped raise millions of dollars to support clean drinking water efforts globally. Ethos Water remains a staple in Starbucks locations, reinforcing the company’s socially responsible brand image.

Princi

Princi is an upscale Italian bakery brand that Starbucks partnered with in 2016 and later fully integrated into its business model. Founded by Rocco Princi in Milan, the bakery is known for its high-quality artisanal bread, pastries, and premium food offerings.

Princi serves as the exclusive food supplier for Starbucks Reserve Roasteries, providing freshly baked goods that complement the premium coffee experience. Although standalone Princi locations are limited, Starbucks has incorporated its artisanal food offerings into select high-end locations, elevating its premium customer experience.

La Boulange

Starbucks acquired La Boulange, a San Francisco-based bakery chain, in 2012 for $100 million. The goal was to improve Starbucks’ food offerings by incorporating high-quality pastries, sandwiches, and baked goods.

While Starbucks successfully integrated La Boulange’s recipes and food innovations into its stores, it shut down standalone La Boulange locations in 2015. The brand itself no longer operates as an independent entity, but its influence is evident in Starbucks’ expanded food menu, which now features high-quality bakery-style items inspired by La Boulange’s recipes.

Conclusion

Starbucks is a publicly traded company with a diverse ownership structure. The largest shareholders, including Vanguard Group and BlackRock, hold significant influence. While shareholders own the company, the board of directors and executive team control its daily operations. With billions in revenue and a dominant market share, Starbucks continues to lead the global coffee industry. Its expansion strategy and brand acquisitions strengthen its position against competitors.

FAQs

Who is the largest shareholder of Starbucks?

The largest shareholder of Starbucks is Vanguard Group, holding approximately 9% of the company’s shares.

Does Howard Schultz still own Starbucks?

Howard Schultz no longer owns a majority stake in Starbucks, but he remains influential due to his past leadership and legacy.

Is Starbucks owned by Nestlé?

No, Starbucks is not owned by Nestlé. However, Nestlé has a licensing agreement to sell Starbucks coffee products in retail stores.

How much is Starbucks worth?

Starbucks’ market capitalization is around $100 billion, though it fluctuates based on stock performance.

Who controls Starbucks’ decisions?

Starbucks’ board of directors and executive leadership, including the CEO, control the company’s decisions and strategy.

Is Starbucks owned by Tata?

No, Starbucks is not owned by Tata. However, Tata Starbucks Private Limited is a joint venture between Starbucks and Tata Consumer Products, operating Starbucks stores in India. Starbucks owns 50% of the joint venture.

Starbucks is owned by which country?

Starbucks is owned by shareholders and is an American company headquartered in Seattle, Washington, USA.

Who owns Starbucks in the United States?

Starbucks in the U.S. is publicly traded on the NASDAQ stock exchange under the ticker SBUX. It is owned by institutional and retail investors, with Vanguard Group being the largest shareholder.

Who is the CEO of Starbucks?

As of 2024, Laxman Narasimhan is the CEO of Starbucks. He took over the role in 2023, succeeding Howard Schultz.

Who owns Starbucks Israel?

Starbucks does not operate in Israel. It attempted to enter the Israeli market in 2001 through a partnership with Delek Group, but exited in 2003 due to low profitability. Currently, Starbucks has no ownership or presence in Israel.