There’s a lot of debate and concern on the internet as to who owns TikTok.

TikTok is owned by ByteDance, a Chinese tech giant founded by Zhang Yiming. Launched globally in 2016, TikTok has become a cultural phenomenon with over 1.5 billion users.

Despite its success, its ownership structure has sparked geopolitical debates, particularly regarding data privacy and ties to China.

Let’s dig deep and figure out the ownership structure of TikTok and the list of major shareholders.

TikTok History

TikTok originated from ByteDance’s 2016 launch of Douyin, a Chinese app tailored for short videos. Recognizing global potential, ByteDance expanded internationally by merging Douyin with Musical.ly, a lip-syncing app acquired in 2017.

This rebranding effort propelled TikTok to dominate global app stores leveraging AI-driven content recommendations to engage users worldwide.

2014–2016: The Birth of ByteDance and Douyin

- 2014: ByteDance, the parent company of TikTok, is founded by Zhang Yiming in Beijing, China. The company initially focuses on AI-driven content platforms, including Toutiao, a news aggregation app.

- September 2016: ByteDance launches Douyin, a short-form video app tailored for the Chinese market. Douyin quickly gains traction, leveraging ByteDance’s AI algorithms to personalize content for users.

2017: The Global Expansion Begins

- February 2017: ByteDance launches TikTok for international markets, initially targeting Southeast Asia. The app is a rebranded version of Douyin but faces stiff competition from existing platforms like Instagram and Snapchat.

- November 2017: ByteDance acquires Musical.ly, a popular lip-syncing app with over 100 million users, primarily in the U.S. and Europe. This acquisition is a turning point, as ByteDance merges Musical.ly’s user base with TikTok, creating a unified platform.

2018: TikTok Goes Viral

- August 2018: TikTok officially merges with Musical.ly, rebranding all Musical.ly accounts under TikTok. This move consolidates its user base and accelerates growth in Western markets.

- 2018 Milestones: TikTok becomes the most downloaded app in the U.S. and tops app store charts in over 150 countries. Its user-friendly interface, creative tools, and viral challenges attract millions of young users.

2019: TikTok Becomes a Cultural Phenomenon

- 2019 Growth: TikTok surpasses 1 billion downloads globally, cementing its status as a cultural force. The app becomes a hub for memes, dance challenges, and influencer content.

- Regulatory Scrutiny: TikTok faces its first major controversy as U.S. lawmakers raise concerns over data privacy and its ties to China. Despite this, its user base continues to grow rapidly.

2020: Geopolitical Tensions and Record Growth

- March 2020: The COVID-19 pandemic drives a surge in TikTok usage as people turn to the app for entertainment during lockdowns. TikTok becomes a platform for creativity, education, and social connection.

- August 2020: Former U.S. President Donald Trump issues an executive order to ban TikTok unless it is sold to a U.S. company. Microsoft and Oracle express interest, but no deal materializes.

- 2020 Milestones: TikTok surpasses 2 billion downloads and becomes one of the most valuable social media platforms globally.

2021: Leadership Changes and Monetization

- May 2021: ByteDance founder Zhang Yiming steps down as CEO, handing over the reins to co-founder Liang Rubo. This move is seen as an effort to distance the company from geopolitical tensions.

- 2021 Growth: TikTok introduces new monetization features, including TikTok Shop, enabling e-commerce integrations, and expands its advertising platform to compete with Facebook and Google.

2022: Dominance and Diversification

- 2022 Milestones: TikTok reaches 1.5 billion monthly active users, solidifying its position as the fastest-growing social media platform. It also diversifies its offerings with tools like TikTok Music and TikTok Live.

- Regulatory Challenges: The app faces bans in India (since 2020) and increased scrutiny in the U.S. and EU over data privacy concerns. ByteDance partners with Oracle to store U.S. user data locally.

2023-24: TikTok’s Global Influence

- 2023 Growth: TikTok becomes a key player in the entertainment industry, with users spending an average of 95 minutes per day on the app. It also expands its e-commerce capabilities with TikTok Shop in Southeast Asia and the U.S.

- Revenue: TikTok generates an estimated $80 billion revenue in 2023.

- Challenges: TikTok faces potential bans in the U.S. due to national security concerns, prompting ByteDance to explore restructuring options.

Who Owns TikTok?

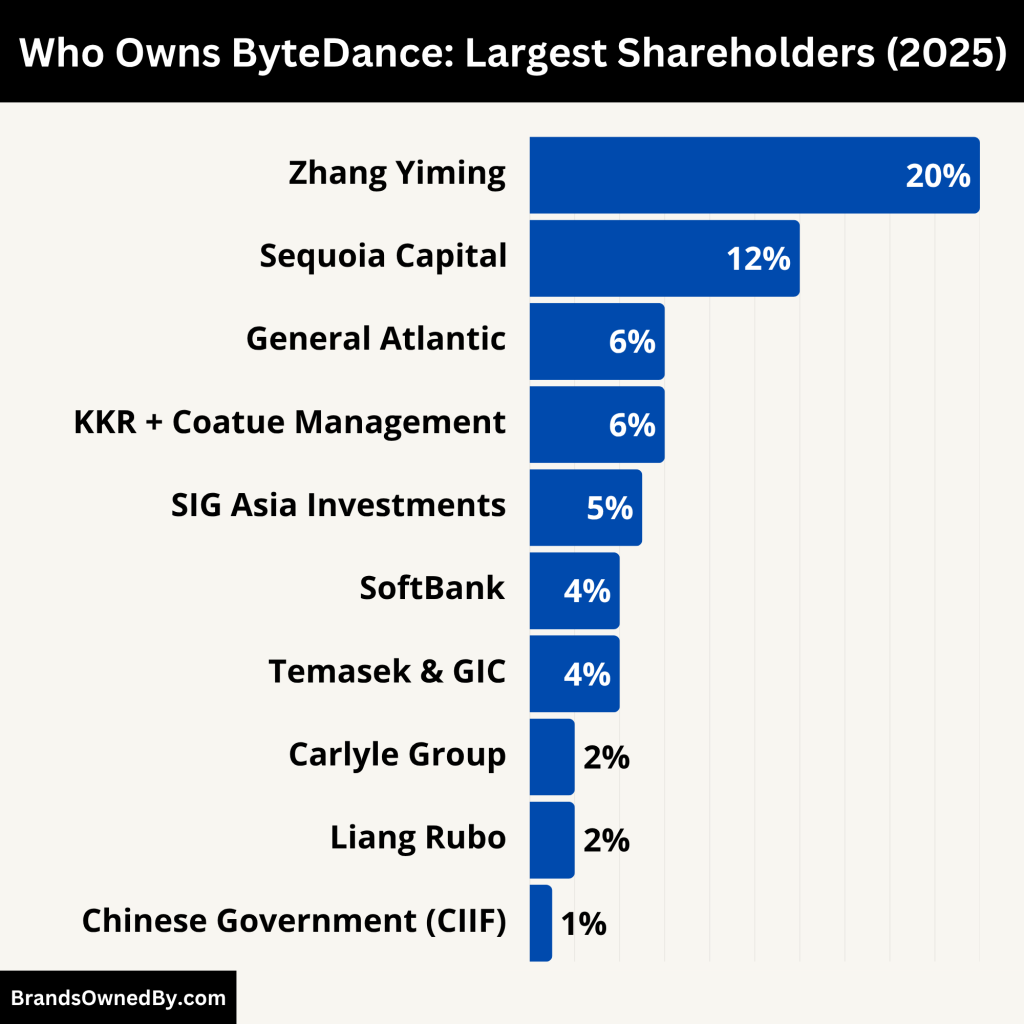

TikTok is wholly owned by ByteDance, a privately held company headquartered in Beijing.

While founder Zhang Yiming remains the largest individual shareholder, institutional investors like Sequoia Capital, General Atlantic, and Susquehanna International Group hold significant stakes.

The Chinese government does not directly own ByteDance, but national security laws require companies to share data if requested.

Here’s a list of the people and entities who own TikTok, (via its parent company ByteDance) along with their responsibilities and roles:

| Shareholder | Stake (%) | Role | Responsibilities | Control |

|---|---|---|---|---|

| Zhang Yiming | 20–25% | Founder and largest individual shareholder | Guides long-term strategy, innovation, and global vision; navigates regulatory challenges. | Significant voting power; influences major decisions despite stepping down as CEO. |

| Sequoia Capital China | 15–20% | Early institutional investor | Provides strategic advice, supports global expansion, and assists with funding and acquisitions. | Holds a board seat; influences key decisions like funding rounds and market strategies. |

| General Atlantic | 10–15% | Global growth equity firm | Focuses on monetization, advertising, and e-commerce growth; helps navigate Western regulatory issues. | Participates in board discussions; influences revenue growth strategies. |

| Susquehanna International Group (SIG) | 10–12% | Early financial backer | Provides financial expertise; supports scaling operations and exploring new revenue streams. | Holds a board seat; involved in strategic decisions and partnerships. |

| Employees (ESOP) | 15–20% | Workforce with stock ownership | Drives innovation, product development, and operational execution. | Limited individual voting power; collectively holds significant influence. |

| Other Institutional Investors (e.g., Coatue, KKR, SoftBank) | 10–15% | Later-stage investors | Provides financial backing and strategic advice for scaling and market expansion. | Collectively influences funding and expansion decisions. |

| Chinese Government | Indirect | Regulatory body | Ensures compliance with Chinese laws; can request data under national security laws. | Indirect control through regulations; no direct ownership stake. |

1. Zhang Yiming (20–25%)

Role: Founder of ByteDance and the visionary behind TikTok. Although he stepped down as CEO in 2021, Zhang remains the largest individual shareholder and holds significant influence over the company’s strategic direction.

Control: Zhang’s stake grants him substantial voting power, allowing him to shape major decisions, including product development, global expansion, and partnerships.

Responsibilities: While no longer involved in day-to-day operations, Zhang focuses on long-term innovation and ByteDance’s global vision. He also plays a key role in navigating regulatory challenges, particularly in Western markets.

2. Sequoia Capital China (15–20%)

Role: One of ByteDance’s earliest and most influential investors. Sequoia Capital China, led by Neil Shen, has been instrumental in guiding ByteDance’s growth strategy.

Control: As a major institutional investor, Sequoia holds a seat on ByteDance’s board and influences key decisions, including funding rounds, acquisitions, and market expansion.

Responsibilities: Sequoia provides strategic advice, helps secure additional funding, and supports ByteDance’s efforts to scale globally. It also plays a role in managing relationships with other investors.

3. General Atlantic (10–15%)

Role: A leading global growth equity firm, General Atlantic invested in ByteDance during its early stages and has been a key supporter of TikTok’s monetization efforts.

Control: General Atlantic holds significant voting rights and participates in board discussions, particularly on matters related to revenue growth and market expansion.

Responsibilities: The firm focuses on helping ByteDance optimize its advertising platform, expand TikTok’s e-commerce capabilities, and navigate regulatory challenges in Western markets.

4. Susquehanna International Group (SIG) (10–12%)

Role: SIG is a global financial services firm and one of ByteDance’s earliest backers, having invested in the company since its inception in 2012.

Control: SIG’s stake gives it a voice in major decisions, including funding rounds and strategic partnerships. It also holds a seat on ByteDance’s board.

Responsibilities: SIG provides financial expertise and supports ByteDance’s efforts to scale its operations and explore new revenue streams.

5. Employees (15–20%)

Role: ByteDance has a robust employee stock ownership program (ESOP), which grants shares to its workforce as part of their compensation.

Control: While individual employees have limited voting power, collectively, they hold a significant stake in the company.

Responsibilities: Employees drive innovation and operational execution, ensuring TikTok remains competitive in the fast-paced social media landscape. The ESOP aligns their interests with the company’s long-term success.

6. Other Institutional Investors (10–15%)

Role: This group includes firms like Coatue Management, KKR, and SoftBank Vision Fund, which have invested in ByteDance during later funding rounds.

Control: These investors hold smaller stakes but collectively influence major decisions, particularly around funding and global expansion.

Responsibilities: They provide financial backing and strategic advice, helping ByteDance scale its operations and explore new markets.

7. Chinese Government (Indirect Influence)

Role: While the Chinese government does not own a direct stake in ByteDance, it exerts influence through national security laws and regulations.

Control: Under Chinese law, companies like ByteDance are required to share data with the government if requested. This has raised concerns in Western markets about TikTok’s data privacy practices.

Responsibilities: The government’s role is primarily regulatory, ensuring ByteDance complies with local laws and policies.

TikTok Annual Revenue and Earnings

As of 2025, TikTok’s revenue for 2024 is estimated to be $25+ billion. This is mostly driven by increased advertising, e-commerce integrations (like TikTok Shop), and premium subscription services.

Below is a detailed breakdown of TikTok’s annual revenue from 2016 to 2023, including year-over-year (YoY) growth percentages:

| Year | Revenue (USD) | YoY Growth (%) | Key Drivers |

|---|---|---|---|

| 2016 | $10 million | – | Launch of Douyin in China; limited monetization efforts. |

| 2017 | $50 million | 400% | Global launch of TikTok; acquisition of Musical.ly. |

| 2018 | $200 million | 300% | Rapid user growth; introduction of in-app advertising. |

| 2019 | $1 billion | 400% | Viral popularity; expansion of ad platform and influencer partnerships. |

| 2020 | $2.5 billion | 150% | COVID-19 surge in usage; increased ad spending by brands. |

| 2021 | $4.6 billion | 84% | Launch of TikTok Shop and e-commerce features; growth in premium ads. |

| 2022 | $12 billion | 161% | Expansion of TikTok Shop in Southeast Asia; increased ad revenue from SMEs. |

| 2023 | $20 billion | 67% | Monetization of TikTok Live, TikTok Music, and global e-commerce integrations. |

TikTok Market Share and Competitors

TikTok commands 22% of the global social media market leading the short-form video sector.

TikTok’s Market Share

- Global Social Media Market: TikTok holds approximately 22% of the global social media market share as of 2023, making it the third-largest platform after Facebook and Instagram.

- Short-Form Video Market: TikTok dominates the short-form video sector with a 60% market share, far ahead of competitors like Instagram Reels and YouTube Shorts.

- User Demographics: TikTok is particularly popular among Gen Z and Millennials, who account for over 60% of its user base. It has also seen significant growth among older demographics in recent years.

- Regional Dominance: TikTok is the most downloaded app in over 150 countries, with strongholds in the U.S., Europe, Southeast Asia, and Latin America.

Top Competitors of TikTok

| Platform | Market Share (Short-Form Video) | Key Differentiator |

|---|---|---|

| TikTok | 60% | Advanced AI-driven content discovery; viral challenges and trends. |

| Instagram Reels | 18% | Integration with Instagram’s photo and story features; Meta’s ad platform. |

| YouTube Shorts | 15% | Access to YouTube’s creator ecosystem and monetization tools. |

| Snapchat | 8% | Focus on AR and ephemeral content; high engagement among Gen Z. |

| Triller | 2% | Music-centric platform with celebrity partnerships. |

| Likee | 3% | Strong presence in emerging markets; innovative video editing tools. |

1. Instagram Reels (Meta)

Market Share: 18% (short-form video segment)

Launched in 2020, Instagram Reels is Meta’s direct response to TikTok. It integrates seamlessly with Instagram’s existing ecosystem, leveraging its 2 billion active users.

Strengths

- Strong integration with Instagram’s photo and story features.

- Advanced ad targeting through Meta’s advertising platform.

Weaknesses

- Perceived as a “copycat” of TikTok, lacking originality.

- Algorithm not as refined as TikTok’s for content discovery.

2. YouTube Shorts (Alphabet)

Market Share: 15% (short-form video segment)

YouTube Shorts was launched in 2021 to compete with TikTok. It benefits from YouTube’s massive creator ecosystem and 2.5 billion logged-in monthly users.

Strengths

- Integration with YouTube’s monetization tools (e.g., ads, memberships).

- Access to a vast library of music and content.

Weaknesses

- Less intuitive user interface compared to TikTok.

- Slower adoption among younger audiences.

3. Snapchat

Market Share: 8% (short-form video segment)

Snapchat pioneered ephemeral content and remains popular among Gen Z users. Its Spotlight feature directly competes with TikTok.

Strengths

- Strong focus on augmented reality (AR) and filters.

- High engagement rates among younger users.

Weaknesses

- Smaller user base compared to TikTok and Instagram.

- Limited monetization options for creators.

4. Triller

Market Share: 2% (short-form video segment)

Triller is a TikTok alternative that emphasizes music and AI-driven video editing. It has gained traction among musicians and celebrities.

Strengths

- Strong focus on music and entertainment.

- Partnerships with major artists and labels.

Weaknesses

- Limited global reach compared to TikTok.

- Less sophisticated content discovery algorithm.

5. Likee (Bigo)

Market Share: 3% (short-form video segment)

Likee, developed by Singapore-based Bigo, is popular in emerging markets like India, Southeast Asia, and the Middle East.

Strengths

- Strong presence in regions where TikTok faces bans or restrictions.

- Innovative video editing tools and effects.

Weaknesses

- Limited brand recognition in Western markets.

- Smaller creator ecosystem compared to TikTok.

Brands Owned by ByteDance

Below is a detailed overview of other major brands and companies owned by ByteDance:

1. Douyin (抖音)

Douyin is the Chinese version of TikTok and was launched in 2016 before TikTok’s global release. It is tailored specifically for the Chinese market, with features and content that comply with local regulations.

User Base: Over 700 million active users in China.

Key Features

- Advanced e-commerce integrations, including live-stream shopping.

- Stricter content moderation aligned with Chinese laws.

Revenue: Douyin contributes significantly to ByteDance’s overall revenue, with a large portion coming from advertising and e-commerce.

2. Toutiao (今日头条)

Toutiao, meaning “Today’s Headlines,” is an AI-powered news aggregator launched in 2012. It uses machine learning to curate personalized news feeds for users.

User Base: Over 250 million active users.

Key Features

- Aggregates content from thousands of publishers and creators.

- Offers video, articles, and short-form content.

Revenue: Primarily generated through advertising and partnerships with content creators.

3. CapCut

CapCut is a free video editing app designed to complement TikTok and Douyin. It allows users to create professional-quality videos with ease.

User Base: Over 500 million downloads globally.

Key Features

- Intuitive editing tools, including transitions, filters, and effects.

- Seamless integration with TikTok for direct uploads.

Revenue: CapCut is free to use but drives value by enhancing TikTok’s creator ecosystem, indirectly boosting TikTok’s ad revenue.

4. Lark (飞书)

Lark is a cloud-based collaboration platform designed for businesses, offering tools for communication, project management, and productivity.

User Base: Primarily used by enterprises in Asia, with growing adoption in other regions.

Key Features

- Combines messaging, video conferencing, and document collaboration.

- Integrates with third-party apps like Google Workspace and Microsoft Office.

Revenue: Generates income through subscription plans for businesses.

5. Resso

Resso is a music streaming app launched in 2020, targeting markets like India, Indonesia, and Brazil. It integrates social features, allowing users to share music and comments.

User Base: Over 50 million active users.

Key Features

- Synchronized lyrics and user-generated content.

- Social feed for discovering music trends.

Revenue: Earns through premium subscriptions and ad-supported free tiers.

6. Xigua Video (西瓜视频)

Xigua Video is a long-form video platform that competes with platforms like YouTube. It offers a mix of user-generated content, movies, and TV shows.

User Base: Over 200 million active users.

Key Features

- Focus on high-quality, long-form content.

- Monetization options for creators through ads and subscriptions.

Revenue: Generates income through advertising and premium subscriptions.

7. Nuverse (朝夕光年)

Nuverse is ByteDance’s gaming division, focused on developing and publishing mobile and PC games. It aims to leverage ByteDance’s expertise in AI and content recommendation.

Key Titles:

- Mobile Legends: Bang Bang (publishing rights in select regions).

- Marvel Snap (a popular digital card game).

Revenue: Earns through in-app purchases, ads, and game sales.

8. Pico

Pico is a virtual reality (VR) hardware and software company acquired by ByteDance in 2021. It focuses on developing VR headsets and immersive content.

Key Products

- Pico Neo 3 and Pico 4 VR headsets.

- VR content platform with games, videos, and educational apps.

Revenue: Generates income through hardware sales and content partnerships.

9. Lemon8

Lemon8 is a lifestyle and community app that combines elements of Instagram and Pinterest. It focuses on fashion, beauty, travel, and food content.

User Base: Popular in Japan and Southeast Asia, with growing adoption in other regions.

Key Features

- Photo and video sharing with a focus on aesthetics.

- Content discovery through personalized feeds.

Revenue: Earns through advertising and partnerships with brands.

10. BytePlus

BytePlus is ByteDance’s enterprise software division, offering AI-powered solutions like recommendation engines, data analytics, and cloud services.

Key Clients

- Companies in e-commerce, media, and entertainment.

Revenue: Generates income through subscription-based services and enterprise contracts.

Conclusion

TikTok’s ownership under ByteDance reflects a blend of entrepreneurial vision and global investor support.

Despite regulatory challenges, its innovative platform continues to dominate social media, reshaping digital culture.

However, geopolitical tensions and competition pose ongoing risks to its growth.

FAQs

Is TikTok owned by China?

Yes, through ByteDance, but it operates globally with localized data policies.

Who is TikTok’s largest shareholder?

Zhang Yiming, with 20–25%, followed by Sequoia Capital.

How does TikTok make money?

Through ads, in-app purchases, and e-commerce integrations like TikTok Shop.

Is TikTok banned in any country?

Yes, in India (2020) and partially restricted in the U.S. and EU over security concerns.

Does Microsoft own TikTok?

No—a 2020 acquisition attempt failed; TikTok remains under ByteDance.